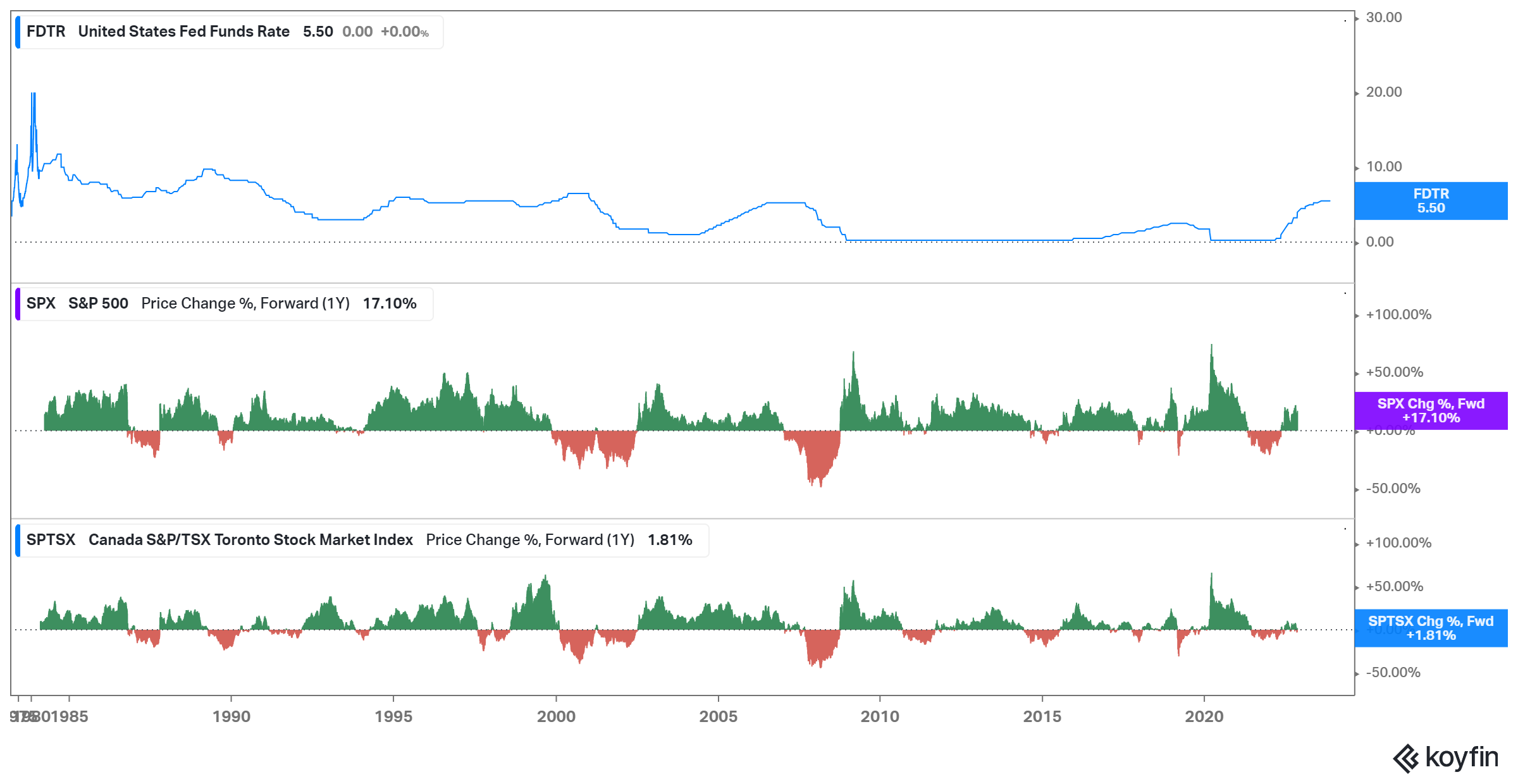

While we do not have the forward 2-year data, we have provided a chart of the Federal Funds Rate since the early 1980s alongside the forward 1-year returns for the S&P 500 and the TSX. We can see that rate cuts are mostly associated with forward 1-year losses in both indices, whereas rate pauses typically see gains in the forward 12-month periods.

Most data shows that rate pauses are positive for equities and typically occur when the economy is beginning to show some signs of weakness, but that rate cuts occur when economic data is in full contraction and there is broad weakness across the economy.