When talking to someone about investing, the question of ‘what style of investor you are’ often comes up early in the conversation. It gives an individual a bit of a sense of who they are dealing with and the context with which they can talk stocks and investing.

Typically, a response will be either ‘growth’ or ‘value’ and I would bet that a surprising majority of investors would call themselves value investors following the teachings of Ben Graham, Charlie Munger and Warren Buffett. Sometimes you may even have someone say they are a ‘growth at a reasonable price’ or GARP investor at which point you can roll your eyes, because isn’t every investor trying to buy things for a ‘reasonable’ price? Regardless of what any investor defines themselves as, it can be a dangerous and costly decision to define oneself as either a growth or value investor.

Growth versus Value

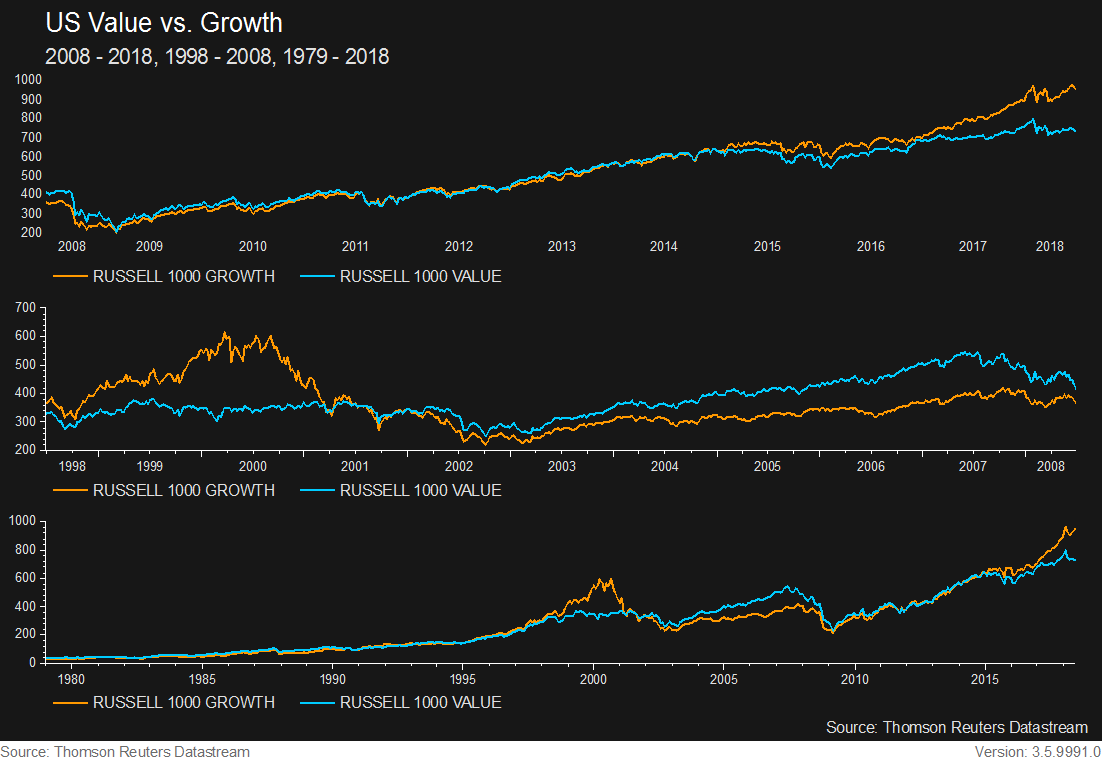

We have seen the data get sliced in varying ways to show which investment strategy outperforms the other. The one thing an investor can be sure of is that any and all strategies will have their time in the sun and outperform only to be a laggard in another time-period.

Currently, value investors are experiencing lagging returns over the last ten years. It has not always been this way and it will not always be this way going forward. Understanding that different styles will perform well in different periods though is a justification in itself for diversifying your investment strategies by style as well as by asset class, geography and sector. Below is a table showing the performance of the Russell 1000 growth and value indices in different time periods.

If there is a takeaway from this point, it is that no single style or strategy will always outperform 100% of the time, so act accordingly. One can still be a value or growth investor but eschewing other investment opportunities and in turn diversification because it does not meet a style definition can harm returns and stability of a portfolio.

Why sticking to one style is dangerous

As a general example, let’s say a market at any given time is comprised of roughly 50% value and 50% growth stocks. If an investor were to only look at one style, they are limiting their opportunity set by a significant degree and this has opportunity costs in terms of foregone returns. Even if an investor did not end up owning the other 50%, should you not still kick the tires on the other opportunities to ensure you are not missing out on something?

If you were a devout value investor for the last ten years, you probably never would have looked at some of the great wealth creators such as Amazon, Facebook, Google, Netflix or Nvidia to name a few. What’s more, is that you did not exactly need to be an overly astute or discerning investor to pick up on any of these names as they have been in our faces for years now. A value investor sticking strictly to value principles has missed out on some great opportunities through these names and will likely miss the next batch of big winners as well. While hindsight makes these names much more obvious investments, not even allowing these stocks to enter ones’ opportunity set would be a mistake.

To be fair, I am not picking on value here. Apple would be another great ‘obvious’ example in favour of a value investor. Back in March 2016, Apple was trading at roughly 11 times earnings. Yes, growth is slowing but growth tends to slow when you pretty much own the smartphone market and have become something almost like a consumer staple product. Ignoring Apple just because it has value characteristics would also have been a mistake.

Anyone could find a list of stocks that did or did not do well in the past for any style or strategy but the point is that if we know that styles come in and out of favour, often for long periods of time, and that there can be great companies on both sides of the spectrum, why should we limit ourselves to only one investment style?

The only plausible excuse in my view is that of behavioural where an investor makes better decisions because they are more comfortable with a certain style. This is a sound argument but only goes so far, especially if you believe in diversification. If an investor is more comfortable with their home country, should they hold 90% of their portfolio in domestic stocks? If an investor holds a specific knowledge set within an industry or works in an industry, should they hold more stock in that space? The answers here are a clear NO. If this is the case, then just because you are comfortable with a growth or value investment style, why should you be expected to hold 90% or 100% of a portfolio in value or growth stocks only?

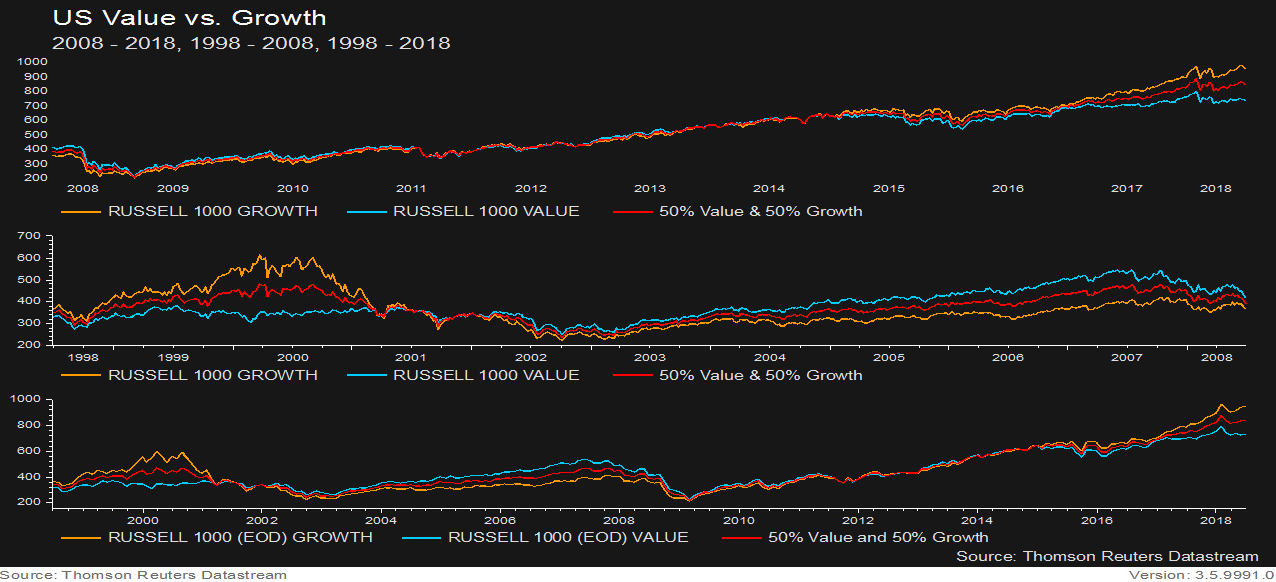

Splitting the difference down the middle, here is what a simple 50/50 growth/value portfolio would look like:

Over the last 20 years, if you were strictly a value investor, having some growth would have benefitted the portfolio. From 1998 to 2008 having some value would have benefitted a growth investor. It also would have made for a far less volatile ride and potentially allowed for some rebalancing opportunities from growth to value. In the more recent period of 2008 to 2018, having some growth once again would have benefitted a value portfolio and looking forward having some value will probably complement a growth portfolio.

Showing that a 50/50 blend of two indices gives returns in the middle is certainly not groundbreaking, but I think it helps paint the picture that a bit of diversification on either side would help to actually boost returns depending on the time period and also help to smooth out the volatility which could perhaps be more important in terms of allowing an investor to stick with their strategy. We imagine the current environment has seen a lot of value types of investors throw in the towel, just like many growth types probably called it a day in 2007.

Putting a pretty bow on this, here is why sticking to one style within a portfolio is dangerous:

- It flies in the face of diversification

- It limits an investors’ potential opportunity set or addressable ‘universe’

- We do not know which areas will outperform but can be confident that no single strategy will outperform all of the time

- It allows an investor more potential to stick with a strategy when it is underperforming while allowing the outperformer to grow to a larger part of the portfolio (maybe a subset of diversification but worth repeating)

Get a free trial to 5i Research here.

If you liked this, you may also like our discussion on defining risk.

Comments

Login to post a comment.

Great article. I do roll my eyes at the GARP guys on BNN. Same as the cautiously optimistic guys, covering all their bases. GARF should be GAHP, but it is not a s catchy – Growth at a High Price. You have to pay up for growth.

Sometimes growth ends up being value, where I think AAPL is today. Is FB headed that way, maybe for awhile. Will it turn on a growth engine again? Probably. Who knows?

A nice blend is good. No need for labels. Whatever works.

dave