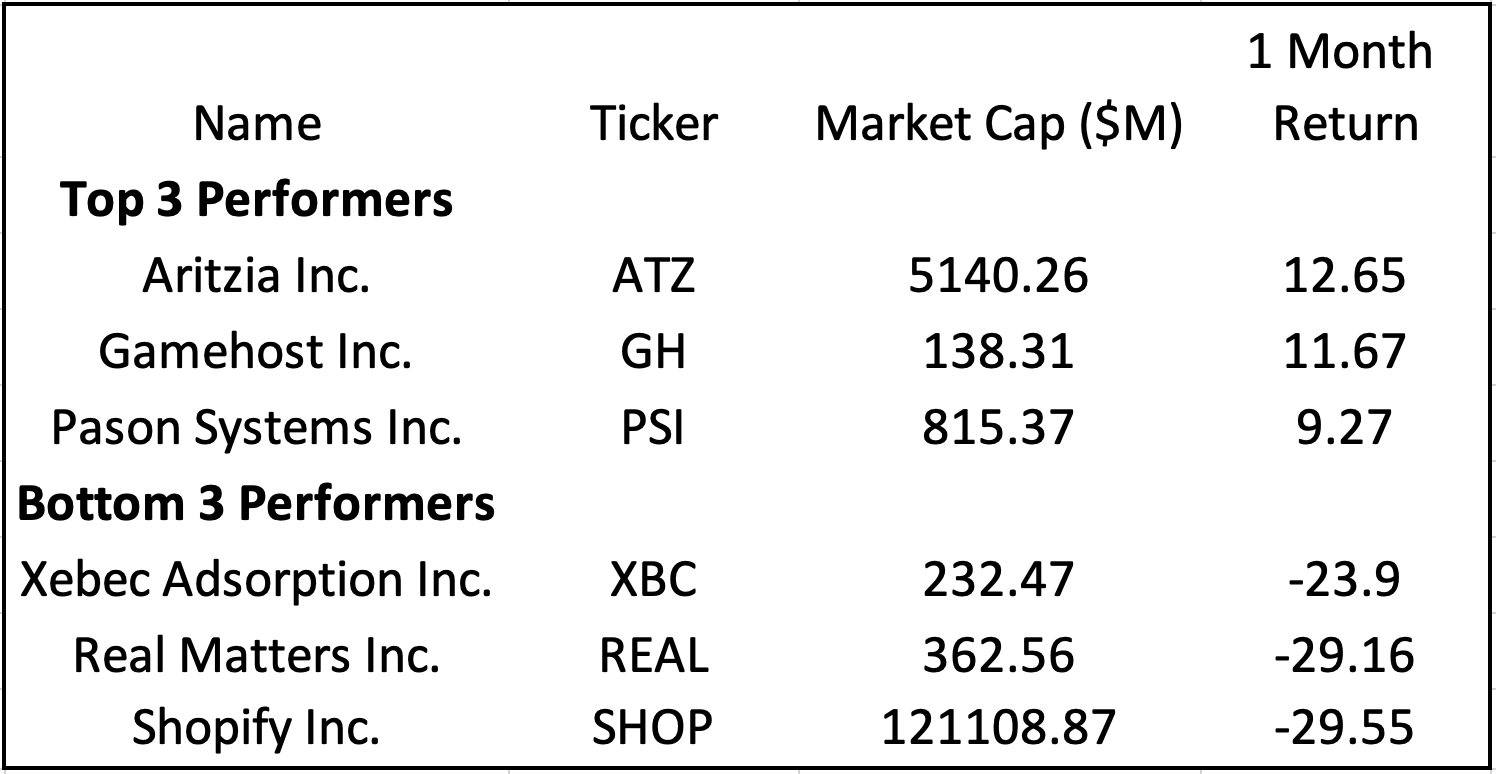

The TSX index enjoyed strong growth of 21.7% in 2021 despite the emergence of the Omicron virus wave in November 2021. In the month of January 2022 the index was characterized by extreme volatility ending down less than 1% as the Omicron virus spread mightily. Geopolitical activity loomed large and concerns around inflation continue. Energy and Financial continued to be positive sectors while Technology and Healthcare were negative. Canadian employment numbers are strong (above pre-pandemic level) which may lead to wage push inflation and the Bank of Canada seems certain to start raising interest rates in the near future. Wages are up and there is a substantial pool of savings to support ongoing consumer spending and corporate profits look to continue their positive trajectory. This piece looks at the top and bottom stock performers of the month in our coverage list as indicated on the table below.

The top performer in January was Aritzia with a return of 12.65% for the month, continuing the results for the last 12 months of some 96%. This is a vertically integrated design house offering everyday luxury clothing online and through some 106 boutiques (38 in US). All boutiques were closed at the end of March, 2020 due to COVID restrictions. These were gradually reopened under occupancy restrictions and reduced hours and were pretty well fully open at beginning of 3rd quarter. Net revenues grew mightily through the third quarter of 2021 led by e-commerce up 88% over the corresponding period in 2020; US revenue was up 115%. Net revenue for the third quarter was up 62.9% leading to net income up some 110%. Management expects to build on this momentum through an emphasis on e-commerce; geographic expansion; product expansion and brand awareness and customer expansion.

Gamehost operates entirely in Alberta with three casinos (Calgary, Fort McMurray, Grand Prairie) and Service Plus Inns and Suites. COVID restrictions imposed by the province basically shut down the casinos for some six months ending at the beginning of the third quarter of 2021 when restrictions were lifted. This enabled the operations to go forward full blast and drove the stock price to $8.80 on July 5th. This came to an end on September 16th as the COVID case surged in Alberta and restrictions were reintroduced. Results for the third quarter were excellent as a consequence with operating revenue up 57% over the prior comparable period and EPS up 91.7%. Subsequently, GH has operated at a somewhat restricted rate. The dividend remains suspended, while GH had some $20 million cash on hand on September 30th 2021 and continues to receive some Government subsidy all of which should support the operation until the Alberta economy returns to more normal times. Two expansion projects have been completed and management is looking for more stable operations and a good runway ahead.

PSI is an energy services company that provides data management systems for drilling rigs and enjoys a significant market share in North America and elsewhere. It was the second-best performer last month and has been carried along by the strong energy market and an increasing rig count to provide a return in excess of 40% for the last 12 months. It has capitalized on the improved activity level of the energy industry leading to strong third quarter results which beat market estimates on all metrics. In mid-December, PSI announced its intention of renewing its normal course issuer bid which seems to underscore its continued good performance. The price of oil (over $90 at the time of writing) continues to support this activity and the rig count has continued to grow.

The worst performer in the month was Shopify down 29.55%. This is a volatile stock with a low for last 12 months at $990 and the high at $2220 in November down to $1227 at end of January 2022. Results for nine months ended September 30, 2021 were outstanding: Revenues at $3.2 billion were up 65.6%; EPS at $9.18 was up from $1.59 in the prior year period. The recent losses in the stock price reflect in part the general malaise afflicting technology stocks and companies with high valuations. SHOP is a leading provider of essential internet infrastructure for commerce, offering tools to start, grow, market, and manage a retail business of any size. It is particularly attractive to small business and occupies a nascent software niche which is growing rapidly. The current share value is probably closer to fair market value and it should grow as SHOP forges ahead.

The second worst performer for the month was Real Matters down 29.16%. The stock price has drifted down from $18 at the end of June to $6.31 on January 31, 2022. REAL provides residential real estate appraisal and title services to mortgage lenders in the United States and Canada as well as insurance inspection services in Canada. Disappointing results and slower growth for periods ending September 30, 2021 and December 31, 2021 contributed to the downward move. REAL is quite dependent on the rate of mortgage originations which in turn is influenced by interest rates. Title and Close revenue were off significantly offset partially by improved appraisal revenue. Revenue for the quarter ended December 31, 2021 was off 10.97% and net income at $2.6 million was off 63%. Given the macro outlook is not favourable and a slowdown in refinancing activity, REAL will be facing ongoing headwinds.

The third-worst performer was Xebec which was down 23.9% this month. This forms a part of a year long decline from $10 a year ago to $1.82 on January 31st 2022, or down 82%. During this period, cash was reduced by more than $100 million ($64 million for acquisitions). XBC is a global provider of clean energy solutions for renewable and low carbon gases used in energy, mobility and industrial applications. It specializes in deploying a portfolio of proprietary technologies for the distributed production of hydrogen, renewable natural gas, oxygen and nitrogen. Results announced in November were disappointing. While revenues were up an impressive 45%, administrative expenses were up more proportionately and the net loss soared to $9.2 million. Order backlog is strong and there is $61.9 million cash on hand and there is growth anticipated from recent acquisitions. Revenue should continue to grow, but adjusted EBITDA will remain negative until management gets expenses under better control.

Disclosure: Analysts of 5i Research and authors responsible for this report do not have a financial or other interest in any of the securities mentioned. The i2i Fund does not have a financial or other interest in any of the securities mentioned.

Comments

Login to post a comment.