5i Research Weekly Rockets and Duds

Welcome to the second half of 2025, and Happy Canada Day!

Here are the Rockets and Duds for last week's stock market action, which included several markets at new all -time highs!

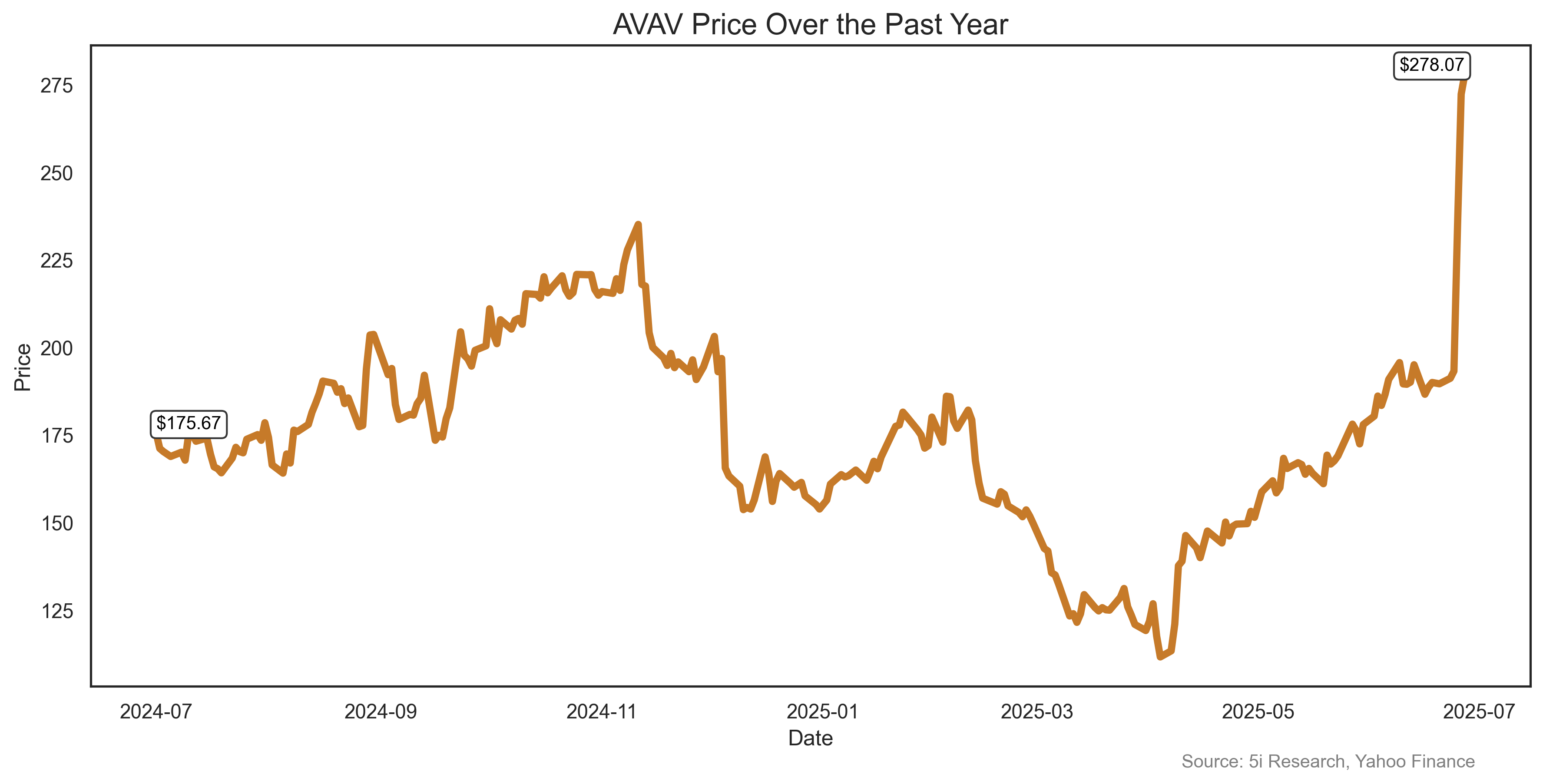

WAR! What is it good for? Absolutely nothing! Unless, of course, you own shares in one of the leading drone manufacturers, and then maybe it's good for making money. We are not condoning war here! Just reporting stock market news! AVAV shares soared 47% last week as it reported strong revenue and EBITDA, helped, of course, by the current global situation with wars pretty much everywhere. AVAV raised guidance and reported an 82% increase in its backlog, which unfortunately is hardly a harbinger to peace this year.

WAR! What is it good for? Absolutely nothing! Unless, of course, you own shares in one of the leading drone manufacturers, and then maybe it's good for making money. We are not condoning war here! Just reporting stock market news! AVAV shares soared 47% last week as it reported strong revenue and EBITDA, helped, of course, by the current global situation with wars pretty much everywhere. AVAV raised guidance and reported an 82% increase in its backlog, which unfortunately is hardly a harbinger to peace this year.

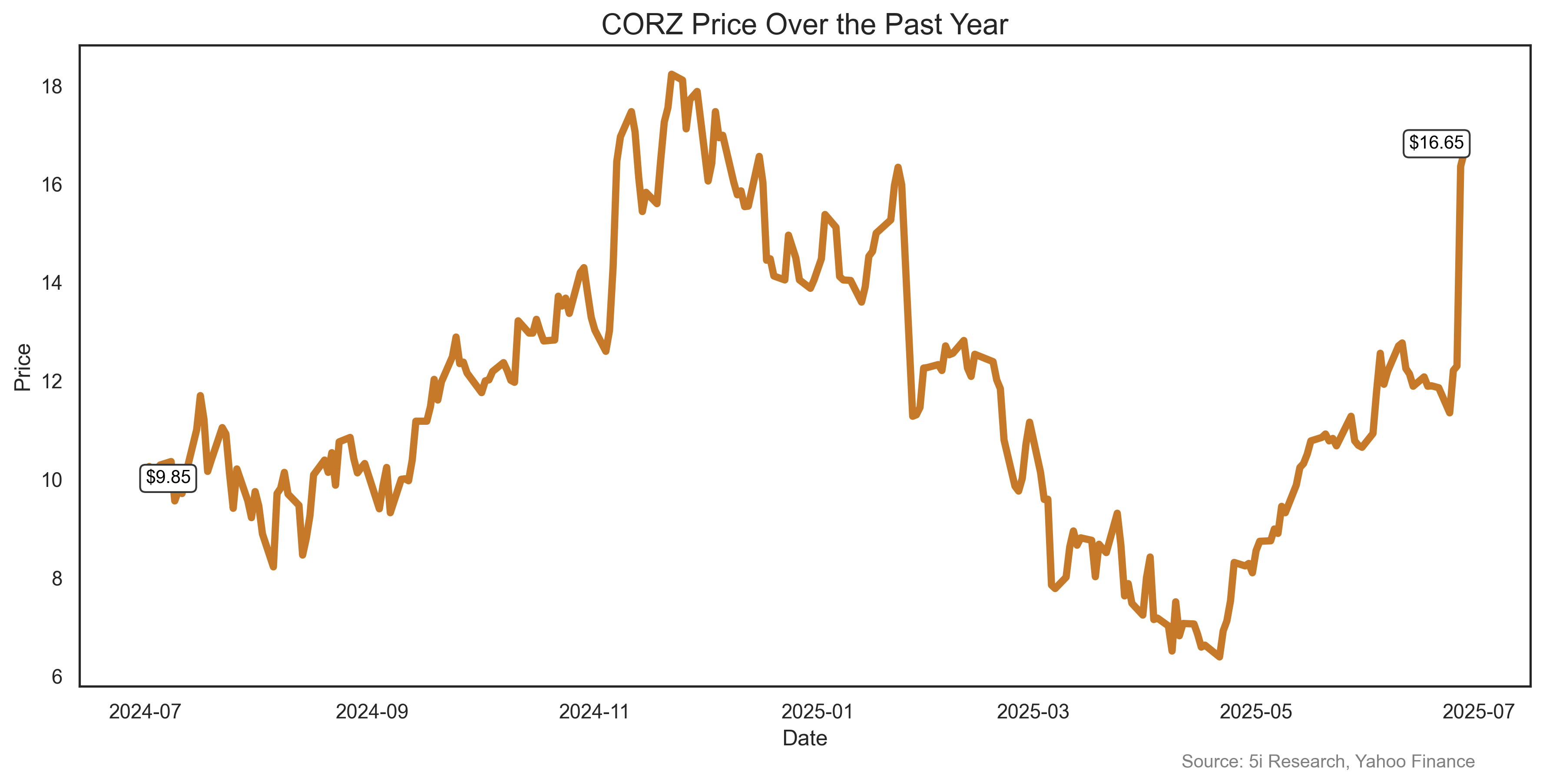

CORZ soared 40% as newly-public Coreweave CRWV was rumoured to have discussed a takeover of the company. CORZ is one of the largest owners and operators of high-powered infrastructure for bitcoin mining and hosting services in North America, CRWV went public in March at $40, and with shares at $160 is using its highly valued stock as currency for deals. Coreweave tried to buy CORZ last year at $5.75 per share before it went public, but the deal was rejected. Maybe with shares at $17 now talks will go better.

CORZ soared 40% as newly-public Coreweave CRWV was rumoured to have discussed a takeover of the company. CORZ is one of the largest owners and operators of high-powered infrastructure for bitcoin mining and hosting services in North America, CRWV went public in March at $40, and with shares at $160 is using its highly valued stock as currency for deals. Coreweave tried to buy CORZ last year at $5.75 per share before it went public, but the deal was rejected. Maybe with shares at $17 now talks will go better.

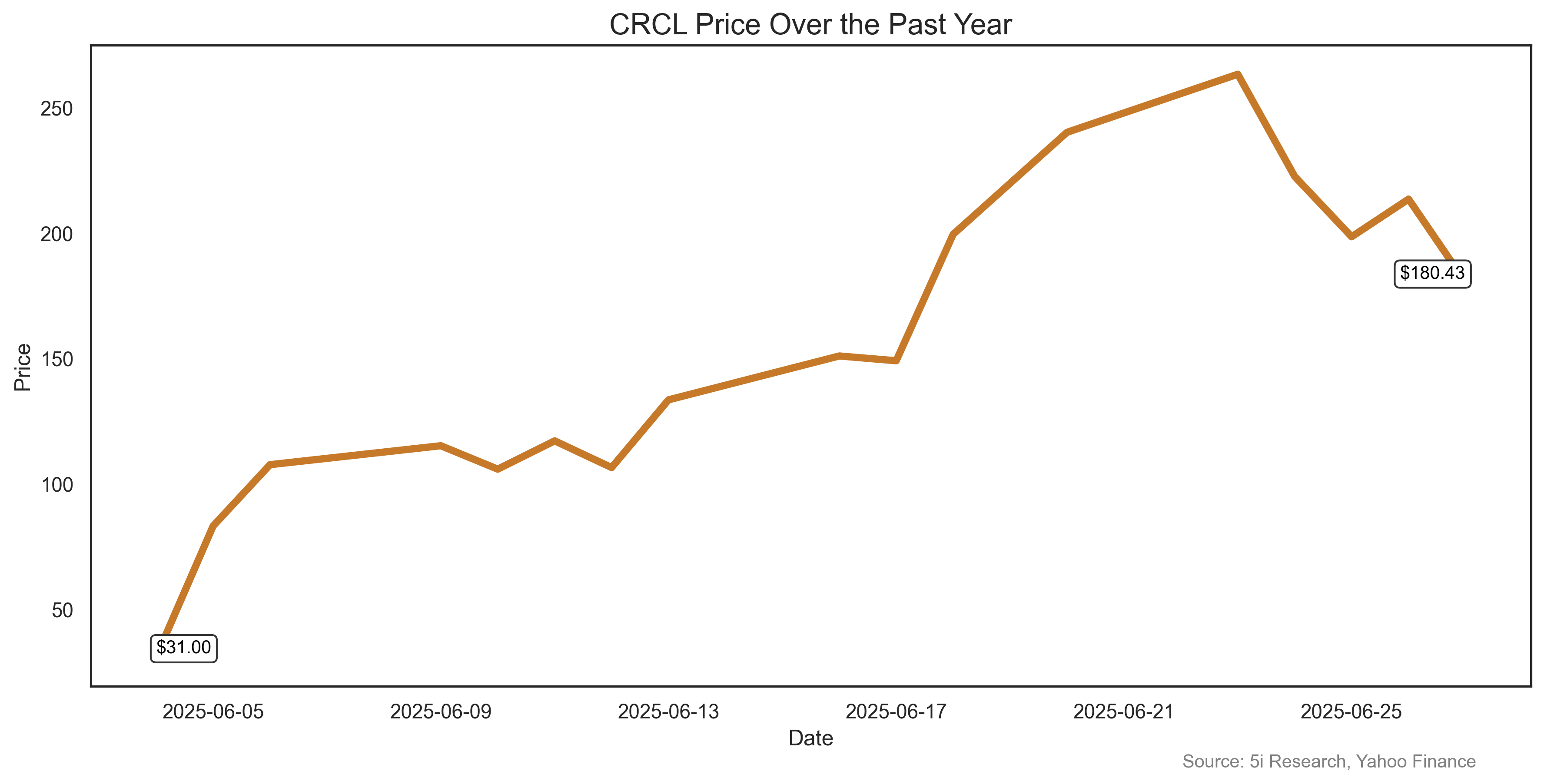

We got questions last week on why Circle shares were down so much. CRCL fell 25% for the week. But it was an easy question to answer. Sometimes, stocks go down. ESPECIALLY after they issue shares in an IPO at $31 each and then shares soar to $299 in less than a month. Even at the 'reduced' price of $180, IPO buyers have seen a six-fold increase in their investment. At some point, reality, and gravity, had to set in. After all, stocks go up, stocks go down. It's the CIRCLE of life. CRCL is the new king of stable coins.

We got questions last week on why Circle shares were down so much. CRCL fell 25% for the week. But it was an easy question to answer. Sometimes, stocks go down. ESPECIALLY after they issue shares in an IPO at $31 each and then shares soar to $299 in less than a month. Even at the 'reduced' price of $180, IPO buyers have seen a six-fold increase in their investment. At some point, reality, and gravity, had to set in. After all, stocks go up, stocks go down. It's the CIRCLE of life. CRCL is the new king of stable coins.

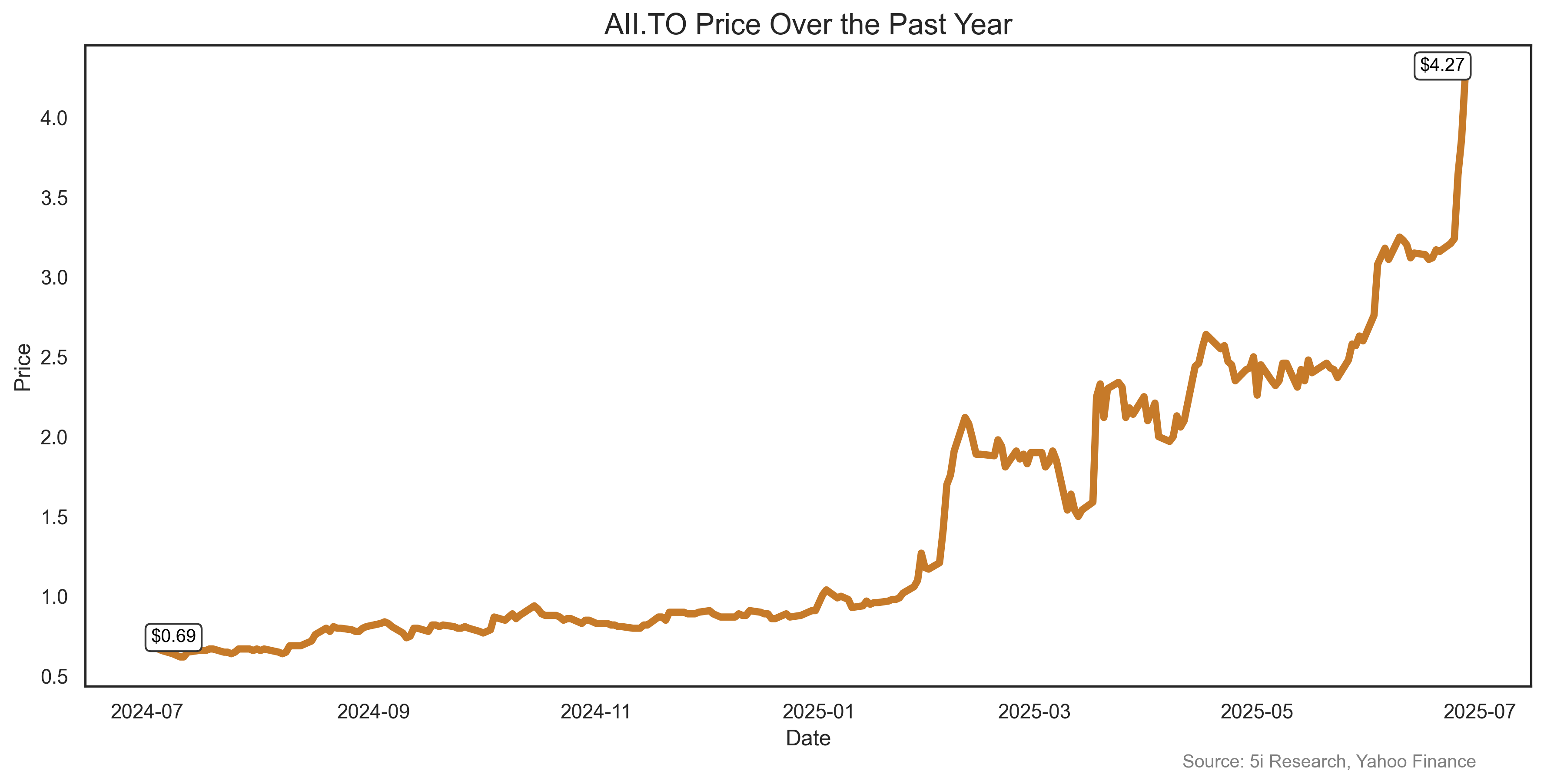

Tungsten has lots of uses, but one high growth use is military. AII shares soared 35% last week as the US House Of Representatives sent a letter to the company outlining the 'strategic importance' of the company and its South Korean tungsten mine, which is now ramping up production. Nothing like having a strategically-important asset during times of war. AII shares are up 612% in the past year even though it has a history of losses. It is expected to break even this year, and be profitable in 2026.

Tungsten has lots of uses, but one high growth use is military. AII shares soared 35% last week as the US House Of Representatives sent a letter to the company outlining the 'strategic importance' of the company and its South Korean tungsten mine, which is now ramping up production. Nothing like having a strategically-important asset during times of war. AII shares are up 612% in the past year even though it has a history of losses. It is expected to break even this year, and be profitable in 2026.

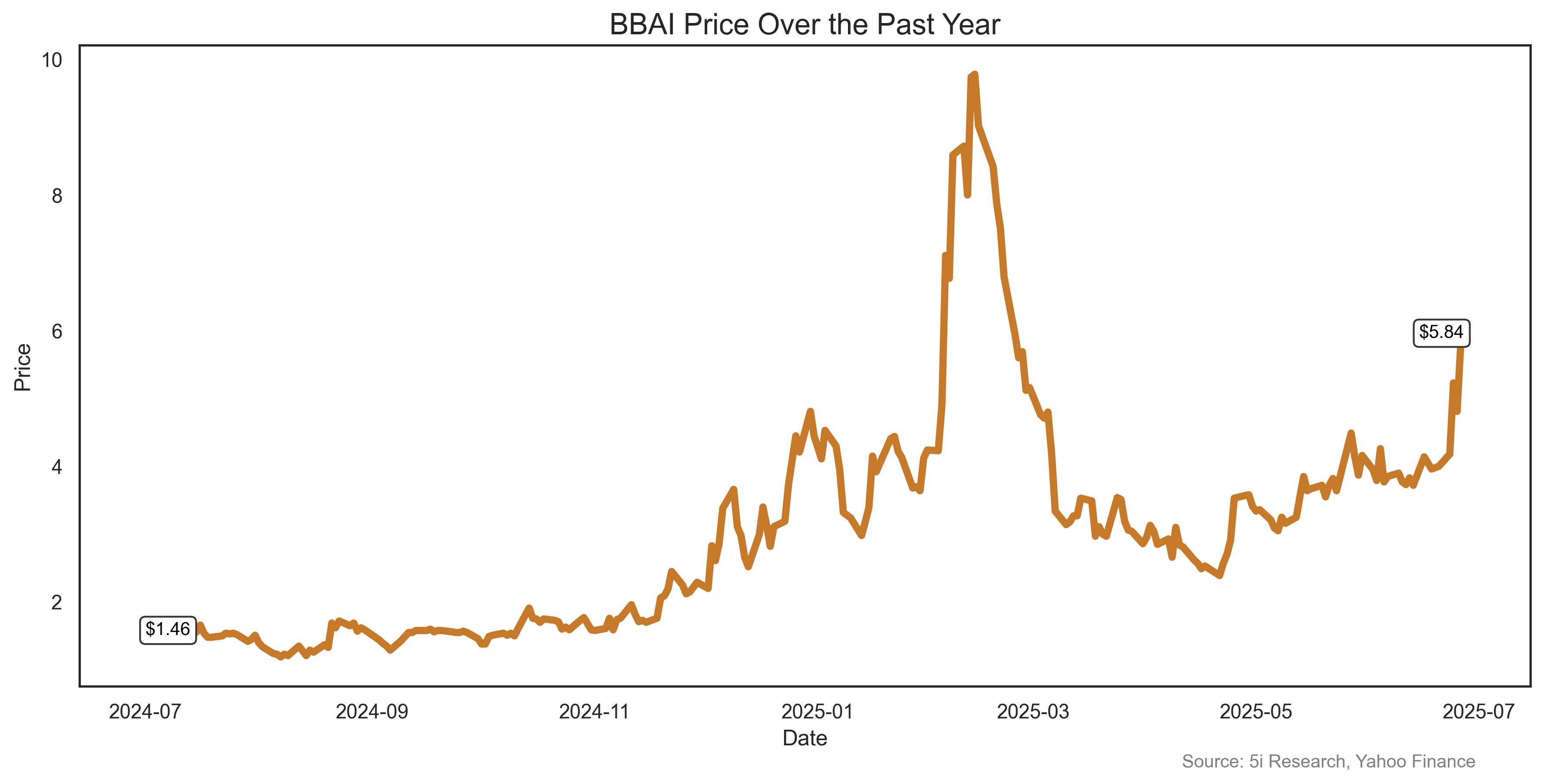

In the stock market, having 'BEAR' right in your corporate name may not always be the best idea. But of course, for BigBear.ai it offsets this risk by also putting 'ai' also right in its corporate name. Artificial intelligence beat out the bear last week as BBAI shares rose 46%. The company announced a series of defense contracts, an airport deployment of its biometric ID software, and some other partnerships. Shares were also no doubt helped by panicked short sellers, as there is still a 27% short interest in the company's shares. Shares are up 287% in the past year.

In the stock market, having 'BEAR' right in your corporate name may not always be the best idea. But of course, for BigBear.ai it offsets this risk by also putting 'ai' also right in its corporate name. Artificial intelligence beat out the bear last week as BBAI shares rose 46%. The company announced a series of defense contracts, an airport deployment of its biometric ID software, and some other partnerships. Shares were also no doubt helped by panicked short sellers, as there is still a 27% short interest in the company's shares. Shares are up 287% in the past year.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Comments

Login to post a comment.