This is a guest contribution by Nick McCullum from Sure Dividend. Sure Dividend uses The 8 Rules of Dividend Investing to systematically identify high-quality dividend-paying stocks trading at fair or better prices and suitable for long-term investment.

Total returns are the primary goal of most common stock investors. The higher the total returns, the better.

It is important to understand how to use realistic assumptions to estimate the returns that you’ll receive from investing in stocks.

This article will outline how you can calculate the expected return of any stock by using financial metrics and projections about future performance.

Dividend Payments

Dividend payments are the most stable form of total returns.

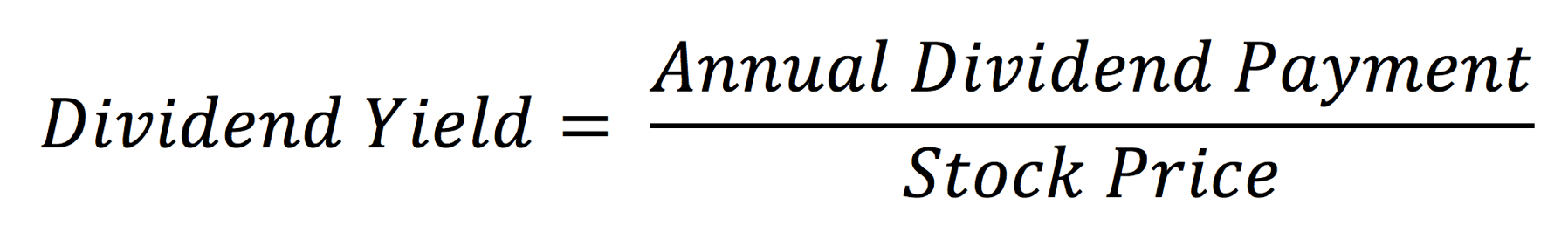

You can calculate your return from dividends alone using the dividend yield, calculated as follows:

The dividend yield tells you how much dividend income you will generate for every dollar invested. For example, a company with a 3% dividend yield will generate $0.03 of annual dividend income for every $1 invested.

Dividends are the easiest component of returns to estimate because they are both (1) easy to quantify and (2) have little uncertainty.

Business Growth

Business growth falls in the middle of total return uncertainty. It is more certain than valuation changes, yet less certain than dividends.

Business growth is usually measured using one of two financial metrics:

- Earnings-per-share growth

- Book-value-per-share growth

Earnings-per-share growth is the most suitable metric for a wide number of businesses. Book value growth is more useful for financial stocks, insurance companies, and other specific sectors.

So how do we estimate the potential growth of publicly-traded businesses?

There are three factors that you should consider.

The first is the company’s historical growth rate. A company with a fantastic history of business expansion is likely to continue this trend. Likewise, a company whose historical growth has been sluggish is a less attractive investment.

Rapid historical growth is a sign of strong management. It also hints at a scalable business model and a durable competitive advantage. These are each factors that you should appreciate as an investor.

Second, you should consider the company’s qualitative growth prospects. These factors are, almost by definition, difficult to assess. Investors can see that companies like McDonald’s (MCD), Walgreens (WBA), or Starbucks (SBUX) can expand their business by opening new stores. Other companies like cigarette maker Philip Morris International (PM) face more broad headwinds.

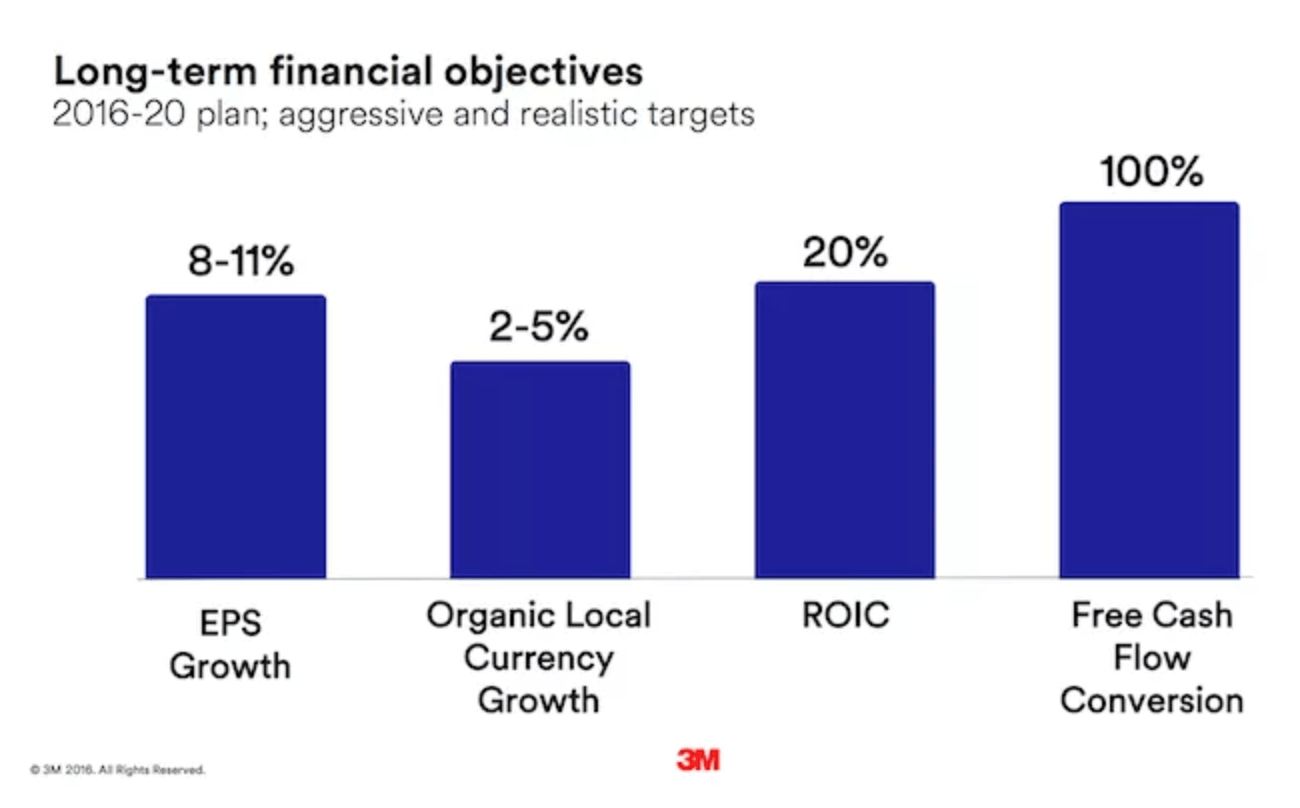

Third, management’s forward guidance provides information about the business’ growth prospects. The following slide from industrial manufacturer 3M (MMM) is an example of this.

Source: 3M Investor Presentation, slide 14

Many companies publish similar guidance. This provides a nice communication of what management expects their corporation to achieve. You should include this information into your expectations about future returns.

Valuation Changes

Valuation changes are the least stable component of total returns. They are also the most powerful in certain situations.

Valuation changes are difficult to predict because the cause of valuation changes are perception changes. In other words, the way that people think about a company will need to change in order for its valuation to change.

With this in mind, how can we determine when a company’s valuation is likely to lead to enhanced total returns?

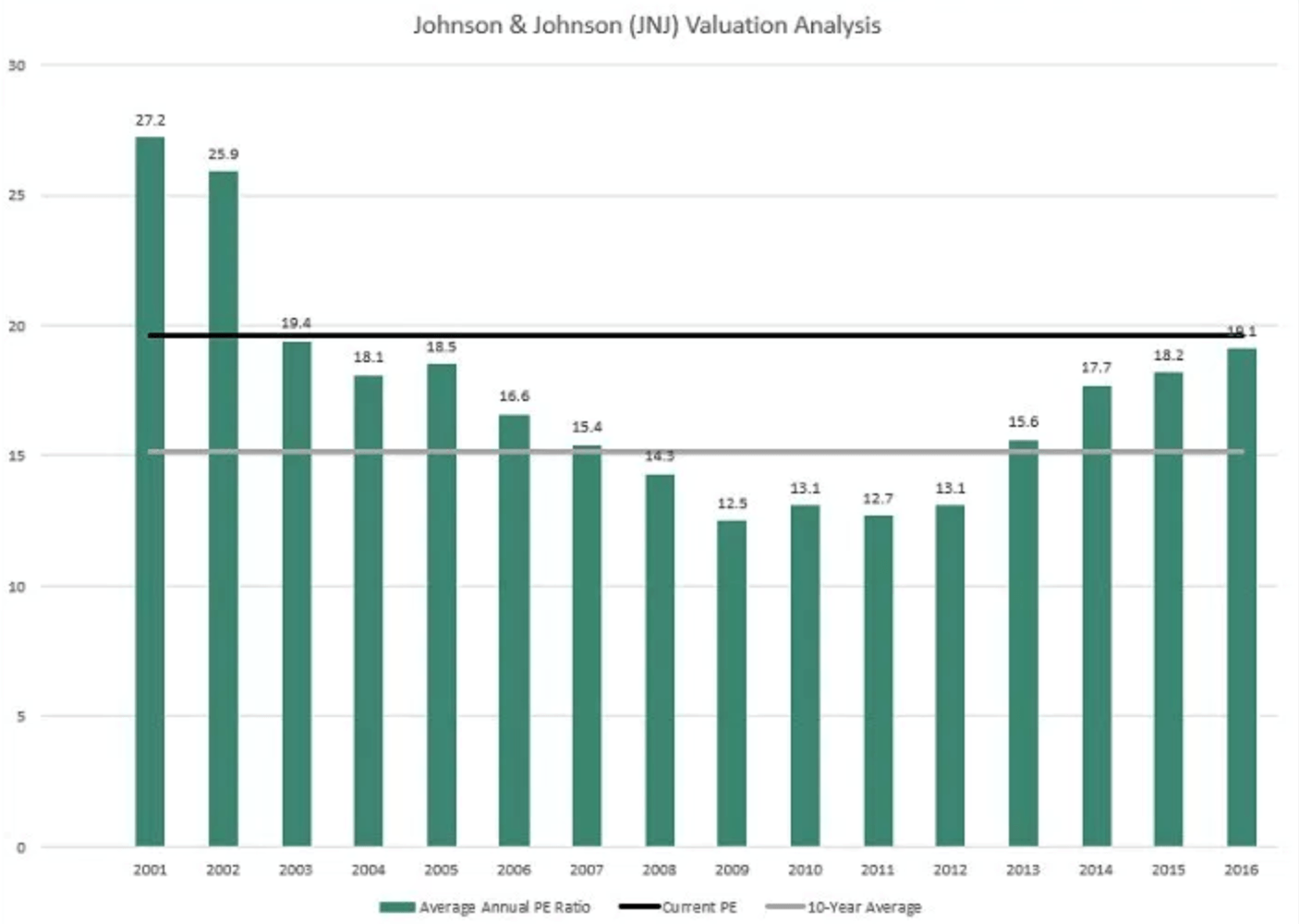

You should compare a company’s current valuation to its long-term historical average. Visualizing this data using a graph like the one shown below is helpful:

Understanding how to interpret this data is important. There are two cases to consider.

In the first case, the company’s valuation is below its long-term average. Valuation expansion should be a positive contributor to future total returns.

In the second case, the company’s valuation is above its long-term average. Valuation contraction will likely be a negative contributor to future total returns.

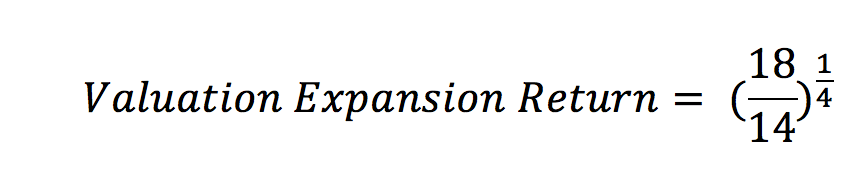

Quantifying these effects requires a “target” valuation multiple. It also requires a time frame over which the valuation mean reversion will occur. The rest of the total return estimation boils down to algebra. Here’s what the mathematics look like:

- A stock is trading at a P/E ratio of 14 and its long-term average P/E ratio is 20.

- You believe a target P/E ratio of 18 is fair for this business.

- You believe a period of 4 years is reasonable for the company’s valuation to revert to 18 times earnings.

- You calculate how this will effect its total returns using the following formula:

You could also calculate this return using Microsoft Excel using the following formula:

![]()

The calculation suggests valuation expansion will boost total returns by 6.5% per year moving forward.

We recommend being very conservative here. This is due to the high degree of uncertainty that is inherent in these calculations. There are two ways to do this.

First, assign a target valuation that is actually lower than the company’s long-term average. This ensures you will achieve an adequate return - even if historical valuations are not again reached. The investment will exceed expectations if complete mean reversion does occur.

Second, always assume that it will take longer than expected for the company’s valuation to normalize. While many undervalued stocks return to fair value in a few months or years, others take several years. You should account for this in your total return calculations.

Final Thoughts

You can calculate the expected total return of any stock by adding the expected returns from the following sources:

- Dividend payments (determined using the dividend yield)

- Business growth (measured by either earnings-per-share growth or book-value-per-share growth). You can estimate this using the company’s track record, growth prospects, and management’s guidance for the future.

- Valuation changes (determined by comparing the company’s current valuation to its long-term historical average)

We recommend being conservative in each one of these estimations. This results in an especially reasonable total return estimate when you combine these factors.

By doing so, this forces you to allocate your capital to only the most appealing investment opportunities, which should enhance your portfolio management decision in the long run.

Have a question? Sign up for free to ask 5i's Research Team your top question, plus get instant access to Canada's top stocks, three model portfolios, and over 62,000 answered investments questions. Get your free 5i Research Trial here.

Related 5i Research articles from Nick:

The Power of Investing in Dividend Growth Stocks

Why Dividends Are The Most Stable Form of Total Returns

Why The Canadian Banks Make Great Dividend Stocks

5i readers interested in Nick's newsletter can also try it free here for 7 days and receive $21 off by using the discount code "21off" (5i is not compensated for this endorsement, we simply like the research and think it's of value to 5i readers).

Comments

Login to post a comment.

What would be the thoughts and formula on a stock which had a P/E above its long term average.

Would we be thinking that the value would contract and be a possibly lesser attractive stock ? Is there a formula for this? This would seem appropriate in today's higher valuations of many company's.

Thanks

Jeff