This is a guest contribution by Nick McCullum from Sure Dividend. Sure Dividend uses The 8 Rules of Dividend Investing to systematically identify high-quality dividend-paying stocks trading at fair or better prices and suitable for long-term investment.

The goal of most investors is to either:

- Maximize returns given a fixed level of risk

- Minimize risk given a certain level of desired return

For either goal, the total return that an investor receives from their investment portfolio is highly important.

There are three main components of total return:

- Valuation changes

- Business growth (usually measured using either earnings-per-share or book value)

- Dividend payments

Not all components of total returns are created equal, however. The three components of total return vary in behaviour and, most importantly, in stability.

This article will compare the three components of total returns and explain why dividends are the most stable form of total returns.

Valuation Changes: The Least Stable Component of Total Returns

Valuation changes occur when a company’s stock price changes without any changes in the underlying value of the business.

In order for a company’s valuation to change, investors must be willing to pay more (or less) for each share of the business. In other words, valuation changes require a change in investor sentiment.

So what makes valuation changes unstable?

Well, it is profoundly difficult for even the best companies to orchestrate a change in investor sentiment. Predicting these changes in sentiment (which is what investors need to do to make money from valuation changes) is even harder.

For these reasons, we recommend that investors avoid using valuation changes as a primary way to make money in the stock market. Instead, we suggest buying great businesses at fair or better prices and allowing the other two components of total returns (business growth and dividend payments) to do the heavy lifting for your portfolio.

So how do we find great businesses at fair or better prices?

There are two components to this statement. The first is finding great businesses. In our opinion, great businesses are those that deliver rising earnings and dividend payments year in and year out. For these reasons, the Dividend Aristocrats (stocks with 25+ years of dividend increases) and the Dividend Achievers (stocks with 10+ years of consecutive dividend increases) are two excellent databases to find high-quality businesses.

The second component of buying great businesses at fair or better prices is assessing the valuation of individual companies. Generally, this is done by comparing a company’s current valuation (using the price-to-earnings, price-to-book, or price-to-free-cash-flow ratio) to its 5 or 10-year average. If a company is trading below its long-term averages, its appeal as an investment increases significantly.

Alternatively, an investor can compare a company’s current valuation to the valuation of the overall stock market (usually measured by the S&P 500). For context, the S&P 500 currently has a price-to-earnings ratio of 25.5. If a company is trading at a price-to-earnings ratio below its 10-year average and below the S&P 500’s average price-to-earnings ratio (25.5), it likely holds appeal from a valuation perspective.

With all this said, valuations are not the best source of returns for dividend growth investors because of the uncertainties it involves. We prefer making money from business growth and dividend payments, which are discussed in detail below.

Business Growth: A Somewhat Predictable Component of Total Returns

Business returns are the ‘middle ground’ of total return certainty.

Business growth is moderately dependable because, all else being equal, fast-growing companies should continue to grow quickly and slow-growing companies should continue to lag the market.

The trouble is that not all else is equal. The business environment changes over time, and many variables (both specific to the business and related to the broader economy) can change a company’s financial performance. These factors include a company’s brand power, management expertise (executive turnover), and changes to the pace of broad-based economic growth.

An investor can account for these differences in their business growth estimates by making upwards or downwards revisions; still, business growth estimates are naturally prone to uncertainty, which prevents them from being the most stable component of total returns.

It should be noted the unpredictability of future business growth is one of the primary reasons why legendary investors like Warren Buffett have made billions of dollars by investing in very simple businesses like Coca-Cola (KO) and Kraft-Heinz (KHC). While Coca-Cola is unlikely to deliver spectacular 50% earnings growth in a single year, it is also unlikely to have an earnings drawdown of 20%. This predictability provides appeal to the more conservative members of the investment community.

Dividend Payments: The Most Stable Component of Total Returns

The last component of total return is dividend payments.

Dividend payments are by far the most reliable form of total returns because for a dividend total return to be realized, all that must occur is for a company to continue paying their current dividend.

Moreover, corporations are highly unlikely to reduce their current dividend payments unless they are forced to. In other words, companies usually only cut their dividends because of a significant decline in profitability – a risk that can be somewhat avoided by investing in high-quality businesses.

Dividends are also attractive because they are highly quantifiable. If a company can just maintain its current dividend payment, then an investor’s future returns are easily calculated using the dividend yield:

For companies that consistently raise their dividends – like the Dividend Aristocrats or Dividend Achievers – dividend-related returns will actually increase over time as the companies continue to reliably increase their dividend payments.

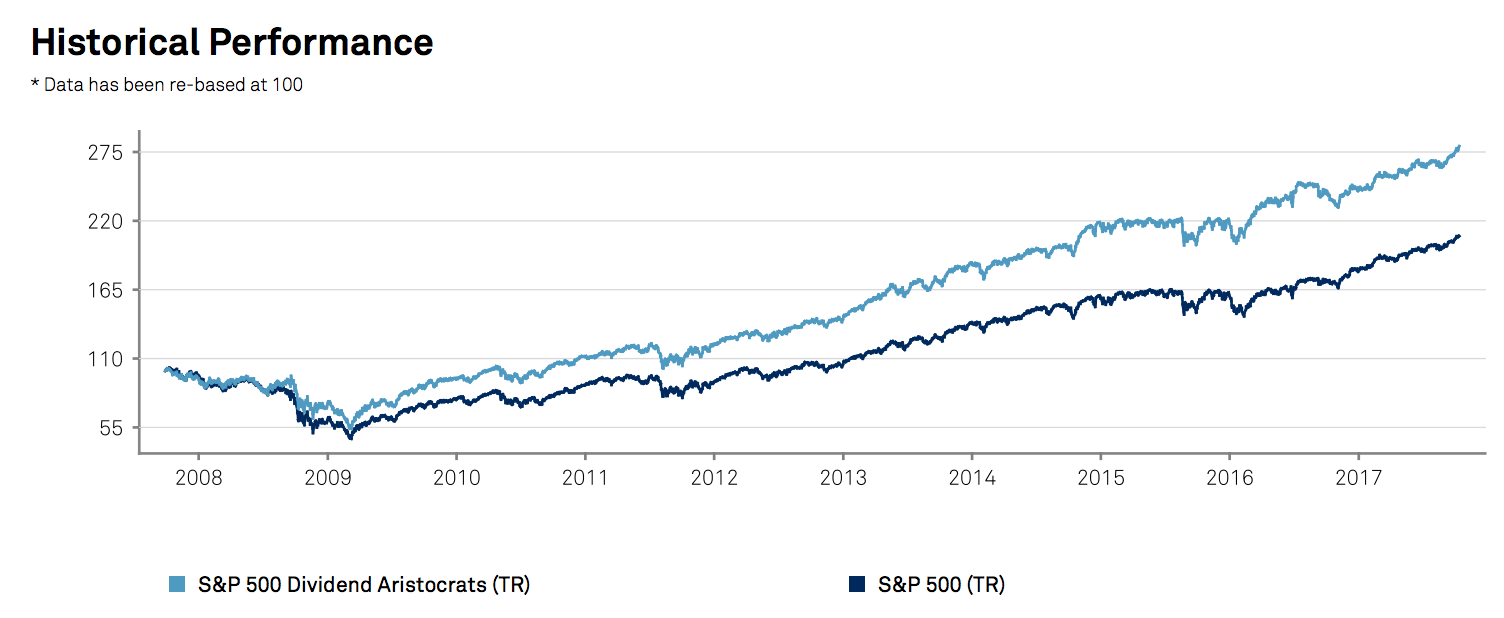

The stability of dividend payments as a component of total returns can be seen by comparing the performance of dividend stocks to non-dividend stocks during periods of economic turmoil. As an example, the performance of the Dividend Aristocrats – S&P 500 stocks with 25+ years of consecutive dividend increase – is compared to the performance of the S&P 500 in the following diagram.

Source: S&P 500 Dividend Aristocrats Fact Sheet

Note that the original divergence between the performance of the Dividend Aristocrats and the performance of the S&P 500 Index was seen during the 2007-2009 financial crisis.

As a last note, the dividend component of total returns is unique because they are the only way for an investor to profit from owning securities without reducing or eliminating their ownership stake. This provides appeal for long-term, buy-and-hold investors who are unwilling to sell securities to generate portfolio income.

Final Thoughts

For dividend investors, the stability of dividend payments as a component of total returns is a significant piece of evidence to support the efficacy of dividend payments. The stability of dividend payments has many attractive benefits, including:

- Downside protection when the overall stock market is falling

- The ability to quantify future returns with ease using the dividend yield

- A method to profit from owning stocks without reducing or eliminating your ownership stake

For these reasons, we maintain that dividend growth investing is a simple and effective investment strategy that appeals to a wide number of self-directed investors.

Access 5i's Model Income Portfolio of the top Canadian dividend companies, by signing up for a free 30-day trial here.

Comments

Login to post a comment.

Thanks for posting it on the blog

Cheers,

Rob