This is a guest contribution by Nick McCullum from Sure Dividend

The Canadian banks hold a special part in the portfolios of many investors, both in Canada and the U.S.

By and large, these stocks are known for giving outsized total returns along with exceptionally high dividend yields. This is quite rare – there are not many pockets of the stock market where entire groups of stocks are considered to be quality investments.

Why is this?

Looking at the fundamentals, the Canadian banks have high dividend yields, low price-to-earnings ratios, and conservative payout ratios. These are all characteristics that should be welcome by investors.

The Canadian banks also have long dividend histories.

While none of them are Dividend Aristocrats (stocks with 25+ years of consecutive dividend increases) because they froze their dividends during the 2007-2009 financial crisis, these strong companies continued their steady rate dividend increases shortly after.

In fact, many are on pace to join the Dividend Achievers (stocks with 10+ years of consecutive dividend increases) over the next several years.

Clearly, there is something to be said for investing in the Canadian bank stocks.

This article will show you why the Canadian banks make great dividend stocks, first by discussing quantitative financial metrics and then by discussing qualitative growth prospects.

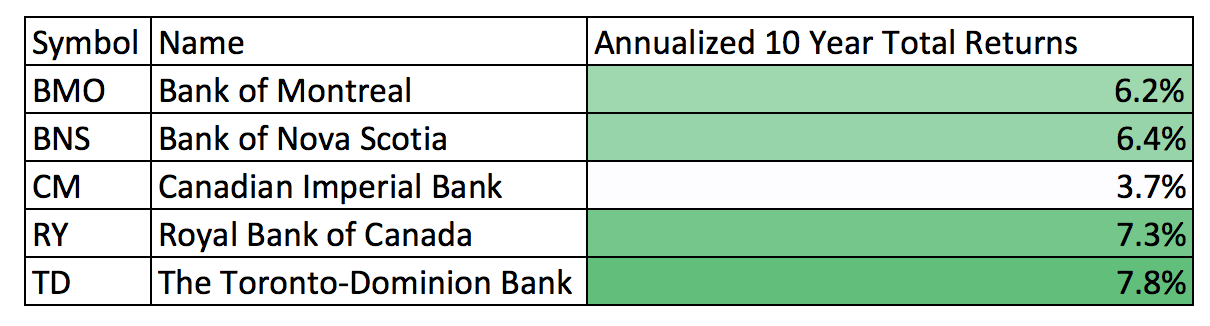

Total Return History

One of the biggest reasons why the Canadian banks are fan favorites among investors is because of their solid track record of delivering outsized total returns.

The banks’ total annualized returns over the past 10 years can be seen below.

Source: YCharts

However, buying the banks ten years ago today (right before the global financial crisis) was a very untimely decision. Canadian bank stock prices were hammered during that time period, although their fundamental business performance was far superior to their U.S. peers. It is certainly possible to achieve double-digit total returns from these stocks by buying them at more opportune times.

Further, the longer-term performance of these stocks (say, over the past 20 years) has been even stronger than the figures above.

While past performance is no guarantee of future results, strong historical total returns can indicate that a company is well-managed. This is particularly important for a financial institution, as aggressive lending practices can quickly erode many years of profits if defaults begin to accumulate.

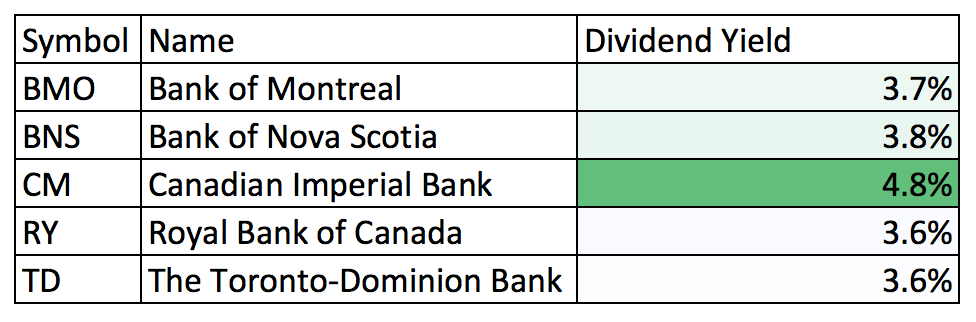

Dividend Yields

The high dividend yields of the Canadian banks are another reason why investors appreciate these stocks.

Dividend yield shows how much income is generated for each dollar of invested capital. The dividend yield is expressed as a percentage.

You can see the current dividend yields of the Canadian banks below.

Source: YCharts

Source: YCharts

The Canadian banks each have a dividend yield that is much higher than the average dividend yield in the S&P 500 (which is about 1.9% right now). CIBC in particular stands out on this metric, as its dividend yield is nearly 5%.

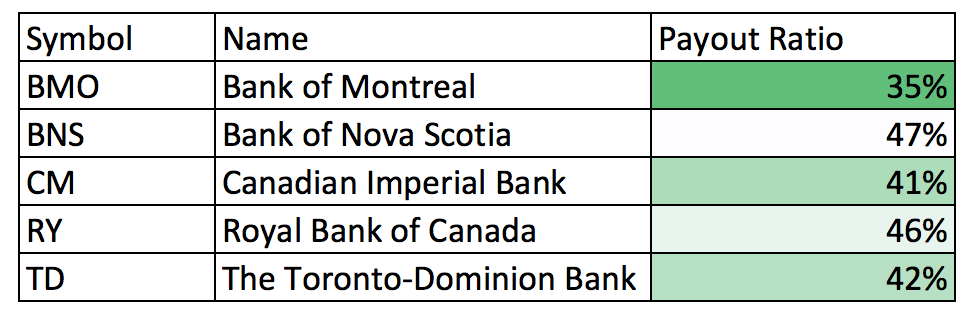

Payout Ratio

A high dividend yield becomes unattractive if the dividend payments are unsustainable. We can measure the safety of a company’s dividend by looking at its dividend payout ratio, which expresses (as a percentage) the proportion of earnings that is delivered to shareholders via dividends.

The payout ratios of the Canadian banks can be seen below.

Source: YCharts

Remarkably, each of these financial institutions has a low payout ratio (below 50%) while still having an exceptionally high dividend yield.

How is this possible?

It is because of their persistently low price-to-earnings ratios, discussed in the next section.

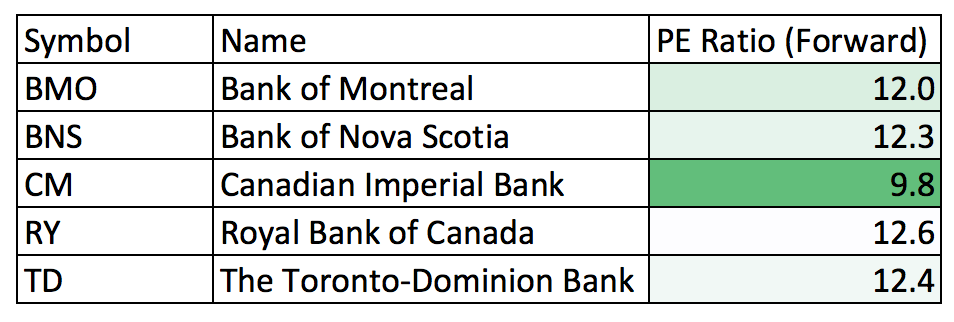

Price-to-Earnings Ratio

The price-to-earnings ratio (or PE ratio) is the most commonly used metric to assess the valuation of a publicly-traded company. It measures how much investors pay for each dollar of underlying earnings.

The Canadian banks each have a price-to-earnings ratio that is less than half of the PE of the broader stock market (as measured by the S&P 500). Their PE ratios can be seen below.

Source: YCharts

The Canadian banks often trade at a PE ratio in the low teens, so their current valuations may not necessarily be a screaming buying opportunity (although a low-teen valuation would be a significant buying opportunity for many other stocks).

However, their low PE ratios still benefit investors.

Given a fixed payout ratio, a lower price-to-earnings ratio creates a higher dividend yield. The Canadian banks’ persistently low price-to-earnings ratios is the ‘secret’ that allows them to have high dividend yields and low payout ratios.

Growth Prospects: International Diversification

One of the most appealing aspects of an investment in the Canadian banks is the amount of international diversification that these institutions provide. Geographic diversification will also be the largest growth driver for each of these companies moving forward.

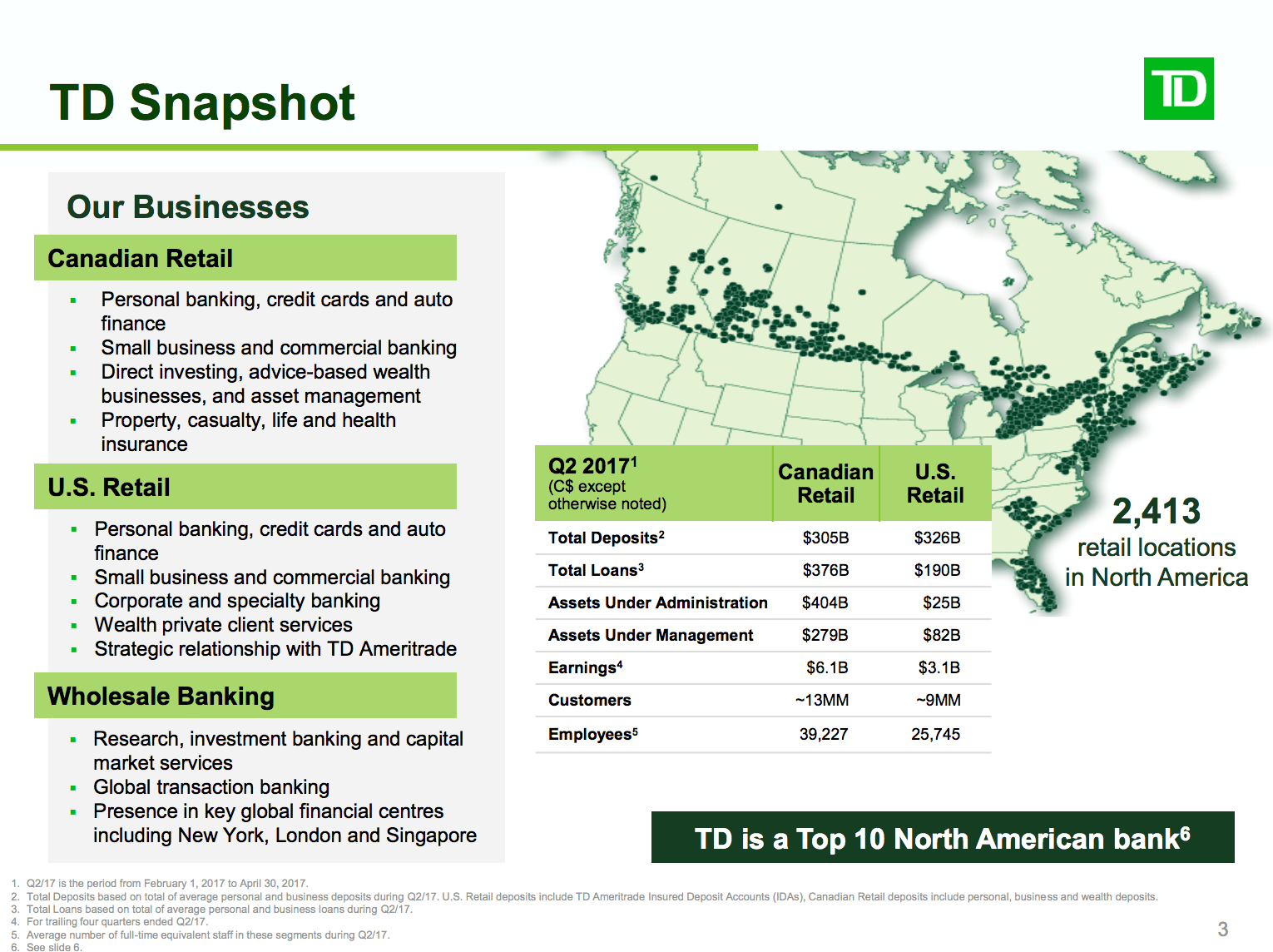

Three of these companies (TD, RBC, and BMO) have had a presence in the United States for some time now. In fact, TD in particular now has more retail branches than its peers and likely has the best international footprint of any of these banks.

TD’s geographically diverse operational footprint can be seen below.

Source: TD Bank Group Second Quarter Earnings Presentation, slide 3

Each of these three U.S.-focused banks (TD, RBC, BMO) has a slightly different geographic footprint, but their growth strategy is the same: acquire smaller, regional financial institutions and integrate them into the parent company’s operating umbrella.

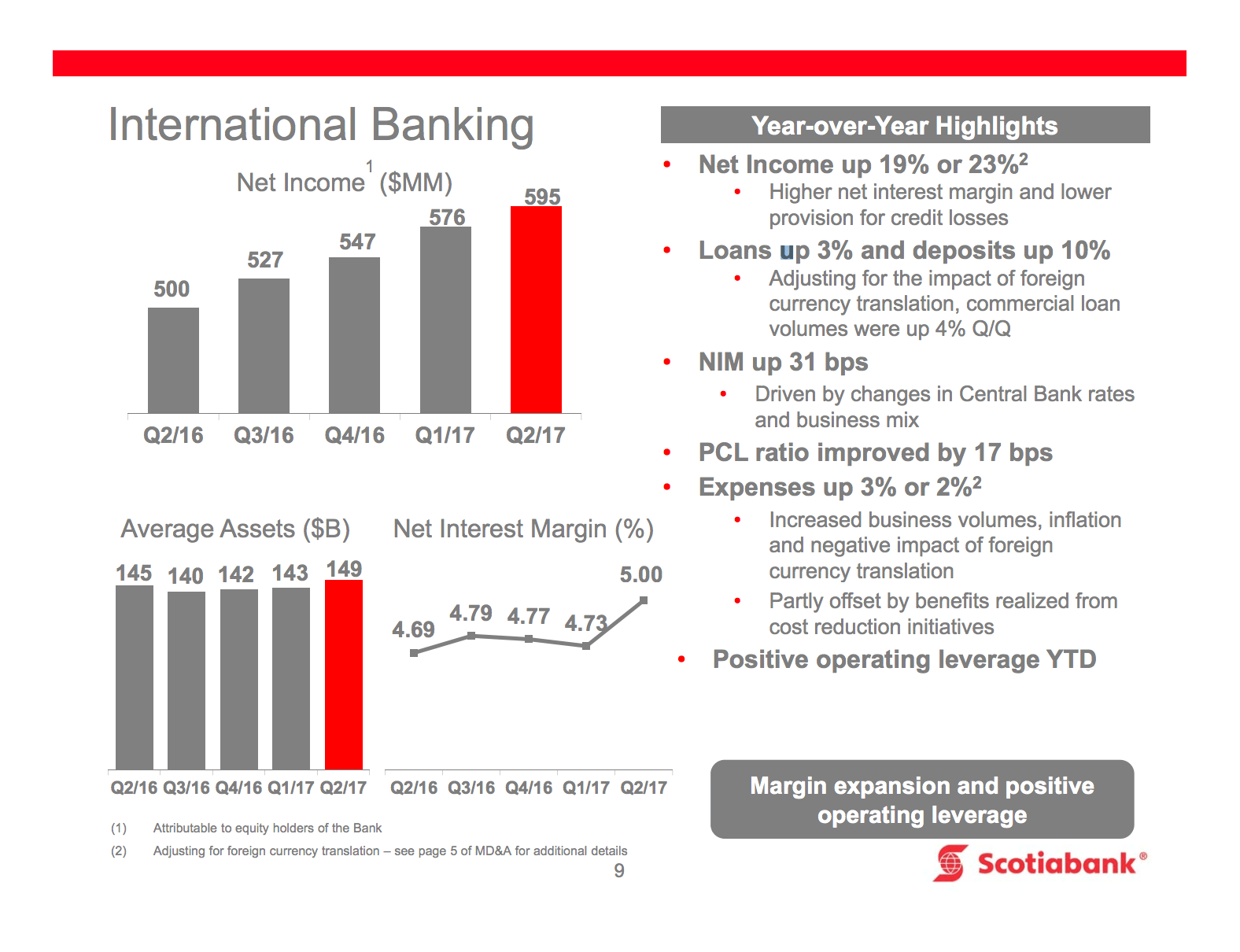

The Bank of Nova Scotia – or Scotiabank - is taking a different approach to expanding geographically.

While TD, RBC, and BMO each have a significant presence in the United States, Scotiabank is focusing on expanding into emerging markets since the bank views the U.S. market as highly competitive.

Scotiabank has been expanding into truly international markets, primarily in Latin America. Some key statistics on Scotiabank’s International Banking segment can be seen below.

Source: Bank of Nova Scotia Second Quarter Earnings Presentation, slide 9

What is remarkable about Scotiabank’s international business is its high levels of profitability. Looking at the company’s net interest margin – which is the difference between its average deposit interest rate and its average loan interest rate – is particularly insightful.

Scotiabank’s international segment posted a 5.00% net interest margin in the most recent quarter while its Canadian Banking segment posted a net interest margin of 2.38%.

So, on the same loan, Scotiabank’s international business generates more than twice as much net interest income.

You may have noticed that I have yet to mention CIBC’s international diversification. There is a reason for this.

Until recently, CIBC had no meaningful geographic diversification and its operations were concentrated primarily in Canada.

To rectify this, the bank announced the acquisition of Chicago-based PrivateBancorp (PVTB) last summer, which has been approved by PVTB’s shareholders as well as the Federal Reserve. It is highly likely that the transaction will close later this summer and PVTB will be de-listed from the stock exchange.

In the past, CIBC’s lack of geographic diversification has been seen as a major negative for this stock’s investment thesis. It has also been a contributor to the stock’s persistently low price-to-earnings ratio (and correspondingly high dividend yield) relative to its peers. If the PVTB acquisition goes according to plan, CIBC’s valuation may be revised upwards by the markets.

Final Thoughts

The Canadian banks have many of the characteristics of an attractive dividend investment:

- High dividend yield

- Low payout ratios

- Solid total return histories

These factors help the Canadian banks to rank well using The 8 Rules of Dividend Investing. Clearly, these are high-quality businesses.

So how can an investor know the right time to buy these stocks?

Well, the best time to buy great businesses is when they are trading at discounts to their long-term average price-to-earnings ratios.

In a market like today’s, where stock valuations are elevated across the market, investors might also be willing to settle for buying a great business at ‘fair value’ – or a P/E equal to its long-term average. For businesses like the Canadian banks that persistently trade at low multiples of earnings, this is likely the better approach. Buying great businesses at fair value and holding them for the long run is a fantastic way to build long-term wealth.

The author of this article owns positions in all 5 stocks mentioned.

Please perform your own research before buying or selling any security or consult your financial advisor.

Comments

Login to post a comment.

Question for 5i regarding the quote below:

"So how can an investor know the right time to buy these stocks?

Well, the best time to buy great businesses is when they are trading at discounts to their long-term average price-to-earnings ratios.

Buying great businesses at fair value and holding them for the long run is a fantastic way to build long-term wealth."

Question:

If I am building a new portfolio from your balanced and income portfolios, how can I know if the current prices are fair value? I don't see anywhere in the portfolios the calculated fair value. Many stocks in the portfolios have had a good run and may be presently over-valued and therefore not a good time to invest. Should there be a column added to the portfolios to indicate calculated fair value of the holdings?