Before we jump into this post, we are excited to announce that the 5i Research team is growing again. We want to welcome our newest addition to the team, Moez.

Moez comes to us from one of Canada’s largest banks and has completed all three levels of the CFA examinations. To start, he will be focusing on the ETF side of things, providing insights and analysis to the ETF and Mutual Fund Update (ETFMU). While this is where he will start, we have no doubt that his insights and analysis will have an immediate impact on all areas of our research.

Within ETFMU, Moez will be a key part in helping us build some ETF tools for members as well as some asset allocation model portfolios and being a key support in the research function of this service.

5i Research celebrated its seventh anniversary a few months ago and quite frankly we are proud with how this service has developed for our membership both in terms of value and results so far. But we are not done yet and have some really exciting developments in the pipeline. We will provide more details on this when appropriate but exciting changes are planned within six month’s time (if all goes as planned!). In the meantime, we are happy to welcome Moez to the team and are offering a 25% discount to the ETF Update. The post below is a typical example of what can be found within the ETF Update.

You cannot turn on a T.V. or open up a computer without hearing about trade wars or tariffs it seems. The United States has increased pressure on China, sending the Shanghai Composite into bear market territory, down 20% from its high. It has also impacted companies in Canada that are deemed to be susceptible to higher prices from the tariffs and almost ironically, even companies in the US that they are trying to ‘protect’ such as Harley Davidson which has noted it is moving some production to Europe to help combat higher prices from tariffs.

While how this will impact any single economy or company remains uncertain, the common thread here is that it is adding a lot of uncertainty for investors and markets hate uncertainty. For investors looking for ways to stay invested while hopefully avoiding significant trade disruptions, here are a few areas we think that an investor can focus their attention on:

Small and mid-cap ETFs

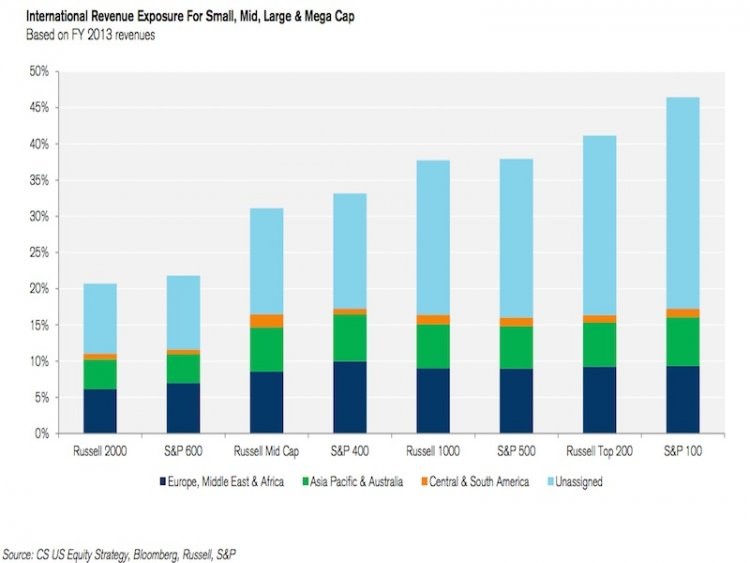

While smaller companies typically do come with more risk in terms of volatility, they can also be sheltered from other risks. Due to their smaller size, small and mid-cap companies generally have more of their business concentrated on domestic customers and in turn are not trading with international partners. Of course, less international trade means less tariffs they have to deal with and less sensitivity to a reduction of international business. In other words, if a large company has ~50% of business coming from international regions, a hit to this revenue source could lead to issues around business sustainability (like paying debt or maintaining market share). If you are a smaller company, on the other hand, and have something at or below 20% international exposure, it is going to be a bit easier to deal with a loss of business from this source. While no impact due to these trade issues would be ideal, the small and mid-cap space is at least better insulated than larger companies.

The above image shows that smaller companies as represented by the Russell 2000 and Russell mid-cap indices have something closer to a 20% to 30% exposure to international markets. Compare this to large and mega-cap names represented by the S&P 500 and S&P 100 and revenues approach something closer to 40% and 45% of revenues coming from international sources. While this chart from Credit Suisse, via Business Insider is a bit long in the tooth being from 2013, we think it is safe to assume that larger companies have only increased their exposure to international markets over the last five years. This is not a perfect answer to trade concerns as rising costs of inputs could still hurt margins at a smaller company but this group should still see less of a direct impact from trade issues.

Three small/mid-cap ETFs to consider:

- iShares Russell 2000 Growth (IWO) – Tracks the Russell 2000 growth ETF and is denominated in US dollars.

- iShares US Small-Cap Index CAD-Hedged (XSU) – Tracks the Russell 2000 index and hedged to Canadian dollars.

- iShares S&P US Mid-Cap Index CAD Hedged (XMH) – Tracks the S&P 400 mid-cap index in the US.

Tech stocks

The idea here is simply that it is difficult to charge a tariff when there are not physical goods crossing a border that can be charged. Technology companies, largely operating in the cloud or online tend to fit this definition. It is not perfect due to some tech companies dealing with hardware but we think it is safe to say that the majority of companies in this industry should be able to mitigate impacts from trade tariffs.

What they are more susceptible to are barriers to investment from foreign capital which we are seeing the US look at with regards to China. So again, even tech companies are not immune from these risks but they have much less direct exposure to these issues and also have much higher margins to adapt and adjust to changes in prices. If you’re a company like Facebook with a net margin in the 30% to 40% range, you can withstand some tariff/investment restriction a lot easier than a Harley Davidson with margins of 10% and who is already looking to move production overseas to adapt to trade tensions.

Three technology ETFs to Consider:

- iShares US Technology ETF (IYW) – The name should be self-explanatory but it holds US tech names such as Apple, Microsoft, Facebook and Google.

- iShares S&P/TSX Tech ETF (XIT) – Don’t look now, but Canadian tech stocks have been on a tear this year, being the best-performing industry in Canada year-to-date, up over 20% year-to-date. The big caveat here is that there is some serious concentration risk in this fund with over 70% of the fund in four stocks. Why they do not do an equal weight version of this is beyond us but is probably the same reason as why the Canadian tech space gets very little attention, regardless of the fact that there are some great companies in this space (that 5i Research also follows).

- KraneShares CSI China Internet ETF (KWEB) – This ETF is a bit of a more aggressive tech suggestion but it holds tech companies in China. This fund could do a bit of a ‘double duty’ on the tariff fear front. Currently, markets in China are hitting bear market territory and the tech stocks are included. So, this could offer an opportunity for a contrarian investor looking for some Chinese tech exposure. The main issue here is that the headline risks are likely not done yet and it is a more volatile space that is not for every investor.

Inflation hedges

One of the more likely outcomes from trade wars is inflation. Tariffs on goods coming into a country mean that costs of goods need to go up to account for it. The obvious hedge to inflation is that of real return bonds and treasury-inflation protected securities. These fixed income products essentially provide a return that is equivalent to inflation so the real value (i.e the buying power of your money after inflation or increased costs remains the same.

Two inflation protection ETFs to consider:

- iShares TIPS Bond ETF (TIP) – This fund offers exposure to inflation protected securities from the US treasury.

- iShares Canadian Real Return Bond ETF (XRB) – For an investor looking more for Canadian dollar exposure, XRB may be the ETF to consider as it is designed to protect against inflation.

Contrarian ETF plays around trade wars

For a more speculative and higher risk investor, we think it is worth considering the possibility that all of this trade war talk is simply posturing. The thesis would be that the various sides are looking for weakness, hoping the other will blink and when they are brought to the edge of the cliff, they invariably pull back and tone down the rhetoric with only minimal and more symbolic actions being left, opposed to anything impactful and material.

Interestingly enough, this seems to have been the trend so far, where decisions seem to be brought to the brink only to be toned done and rationalized when push comes to shove. The risk here is that the parties involved are serious this time and are willing to plunge over the cliff.

Regardless, here are three ETFs to consider for a more contrarian view:

- KraneShares CSI China Internet ETF (KWEB) – We already did mention this one but it gets an honourable mention again, as it applies to the tech side but also the contrarian side, being a China based index that could benefit if all of this trade war talk with China ends up being just that: talk.

- Vanguard FTSE Emerging Markets ETF (VEE) – This fund provides exposure to emerging markets and is having a tough time year-to-date, down roughly 5%.

- BMO Equal Weight Industrials ETF (ZIN) – With industrials largely being the focus of trade wars and tariffs currently, it makes sense that a contrarian might view the industrials sector as a potential buying opportunity. On a year-to-date basis, this fund has actually fared ok, up 4% but is down about 3% from recent highs. For a fund trading at generally cheaper valuations and offering a decent dividend yield, this could be a name to watch if prices slide lower.

We hope you enjoyed this ETF coverage, and got a good sample of the types of research we do in the ETF & Fund Update Letter. While we primarily cover Canadian stocks over at 5i Research, the ETF & Fund Update Letter is our way to help members become properly diversified geographically, by providing research on the best ETFs available to Canadians.

Remember that you can try the ETF & Fund Update Letter risk-free for 60 days to see if it's right for you, while also receiving a 25% discount if you decide to keep it. You'll also have access to all past issues of the ETF Letter. You can claim your discount by clicking here (the discount will appear at the very bottom of the checkout form while signing up).

Comments

Login to post a comment.

-Grant

to write a similar article related stock holdings related to 5i 3 portfolios.

Andrew

Cheers,

Graham