Looking at the bigger picture allows investors to take advantage of longer-term trends and chart patterns missed by most novice investors. Using weekly charts can help remove intraday noise and volatility that tends to scare short-term focused investors.

Institutional money managers with several million dollar positions use larger time-frames like the weekly chart because they can’t react fast enough to the short-term fluctuations in the market. Since institutional money moves stock prices, it can become very profitable for retail investors if they are able to identify and jump on these larger trends created by this money. Each bar on the weekly chart represents one week of price and volume history.

After breaking out in October to new 28-month highs,

Canadian Pacific Railway (CP-T) spent the next 5-weeks consolidating and came back to successfully retest that breakout. Last week, the price action then went on to make new 30-month highs. With all technical indicators surging higher this price action is very bullish and suggest more new highs to follow. Since it's every fund managers goal to outperform the benchmark, the breakout in relative strength vs. the S&P 500 could accelerate the buying pressure as money begins to chase performance.

View all our answered questions and analysis on Canadian Pacific Railway in the member area here. If you're not currently a member, you can view all the answers and analysis by signing up for a 1 month free trial.

After spending the last year consolidating,

Methanex (MX-T) has just broken out to new 30-month highs. Relative strength vs. the S&P 500 has broken out above its downtrend line and the momentum indicator has begun to accelerate higher. This price action is extremely bullish because stocks that make new highs tend to continue making new highs. This chart also demonstrates a textbook buy signal for momentum based investors.

View all our answered questions and analysis on Methanex in the member area here. If you're not currently a member, you can view all the answers and analysis by signing up for a 1 month free trial.

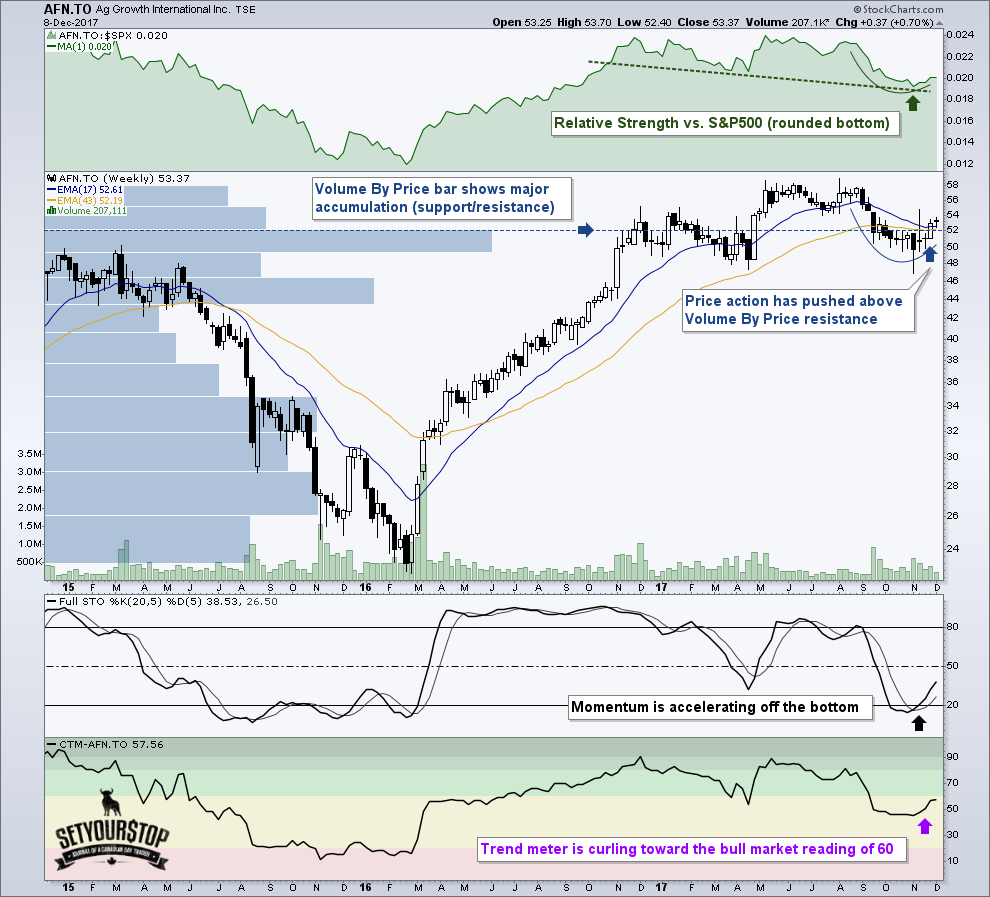

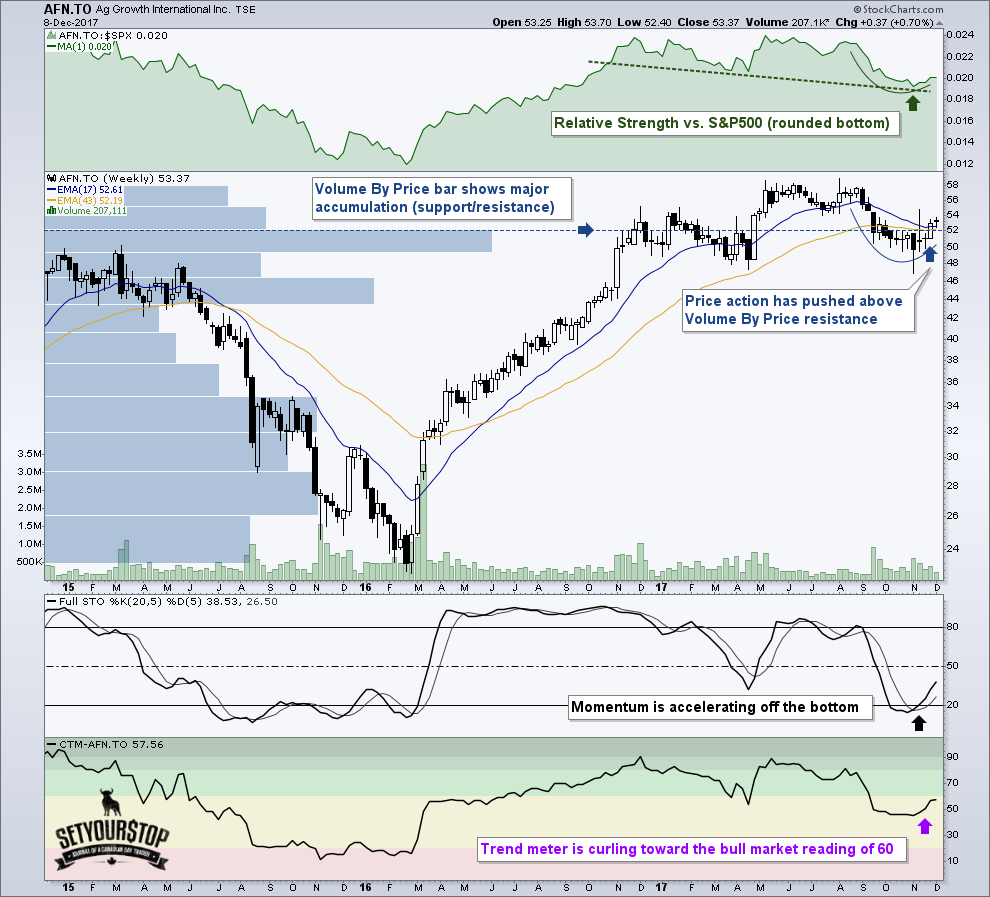

Ag Growth International (AFN-T) has just pushed above volume by price resistance from a rounded bottom pattern. The long volume by price bar on the weekly chart shows where major accumulation (support/resistance) has taken place. The momentum indicator has begun to curl off the bottom and the trend meter is surging toward the bull market reading of 60. This price action is bullish and suggest the bottom is now in place while offering very nice risk/reward.

View our full report on Ag Growth in the member area here. If you're not currently a member, you can view the full report for free, by signing up for a 1 month free trial.

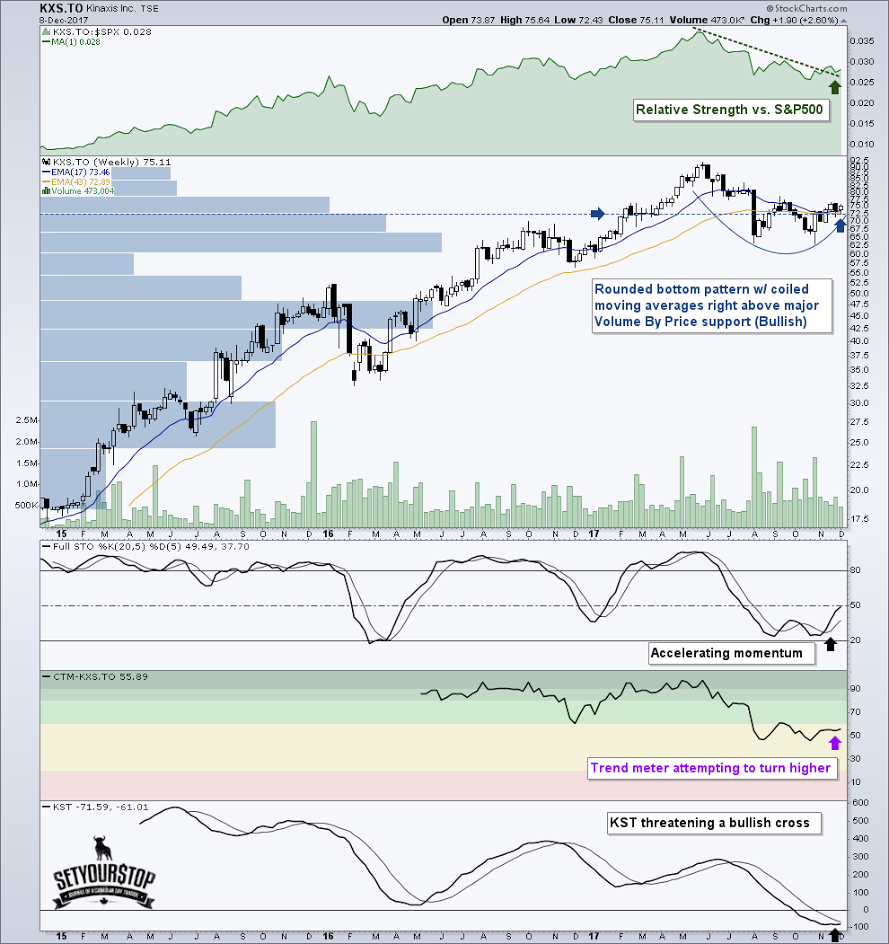

Kinaxis (KXS-T) is a current top pick of 5i Research. Now, the price action suggests the stock could be ready to move. Both the daily and weekly charts resemble a coiled spring (compressed energy ready to explode higher).

The daily chart price action is being compressed as it's pushing up against the underside of major volume by price resistance. The SCTR ranking has made a powerful thrust higher as it begins to breakout from the bottom-performing quartile of the TSX, and the PPO indicator (momentum) attempts a bullish cross. If the market takes the lid off of this consolidation pattern, this price action suggests any move higher could be powerful and fast.

The weekly chart has formed a bullish rounded bottom pattern while the moving averages coil and begin to curl higher. Relative strength vs. the S&P 500 has broken out above its downtrend line. Momentum (full stochastic) has begun to accelerate higher and the KST is threatening a bullish cross. As the chart demonstrates, a bullish KST cross can be the beginning of a massive move. This price action is very bullish and suggests higher prices to come.

View our full report on Kinaxis in the member area here. If you're not currently a member, you can view the full report for free, by signing up for a 1 month free trial.

By Dwigh

Galusha from SetYourStop.com

The author currently does not own any of these three names and does not plan on owning any of those three names within the next 72 hours.

Nothing in this article should be deemed as a recommendation to buy or sell securities and is for informational purposes only. Please do your own due diligence before making an investment decision.

Comments

Login to post a comment.