It has been a different year compared to the past few that North American investors have seen. For US markets, it has been the first negative year in quite some time and for Canadian investors, it has been a down year in a string of years that have been lackluster. With stocks moving all over the place, and the S&P 500 posting its biggest point gain ever recently (which is less meaningful than percent terms), we wanted to ‘take stock’ of markets in 2018.

As of December 26th, here are some stats for the TSX Composite and S&P 500:

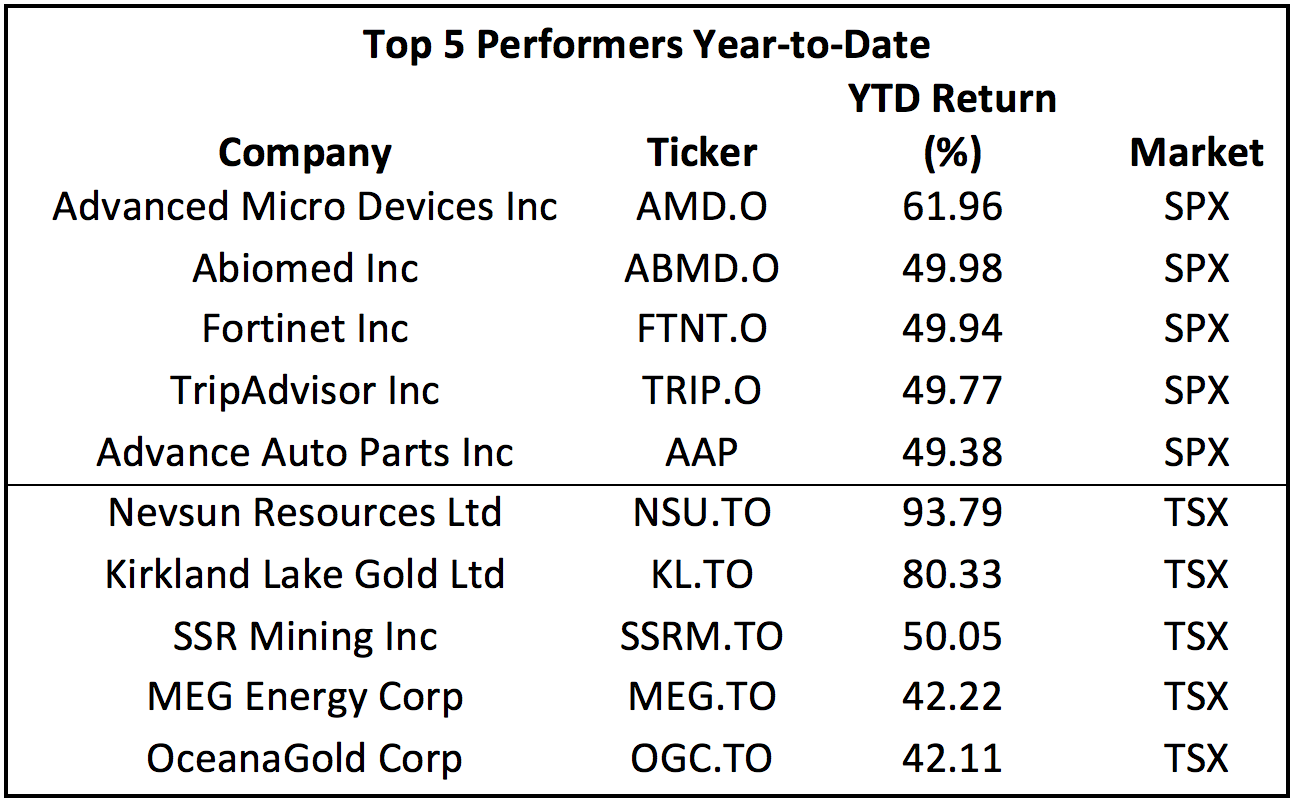

On the US side of things, readers may be very surprised (or not) to see a semiconductor company Advanced Micro Devices (AMD) and an industrial/consumer company Advance Auto Parts (AAP) on the list of the top performers. Let this be a testament that finding the best companies in any sector can lead to investor success, as opposed to trying to time different sectors. Some of the most hated areas in the last six months or so have housed some of the best performers. The other notable area of the top performers is that while there have been some winners that we all would be happy to own, none of the top five names are posting a performance an investor would ‘write home about’.

On the Canadian side, commodity names have dominated the top performer list which should not be too surprising given the number of companies in the commodity space on the TSX. This result may be a bit more surprising given the performance of materials, however. What might be the most surprising about this list though is that the one name that looked like it was going to be the darling of the TSX is nowhere to be found in the top performer list: Canada Goose (GOOS). GOOS shares have gone from being up nearly 125% in 2018 to ‘only’ 34% as we write this. What about the worst performers in North America?

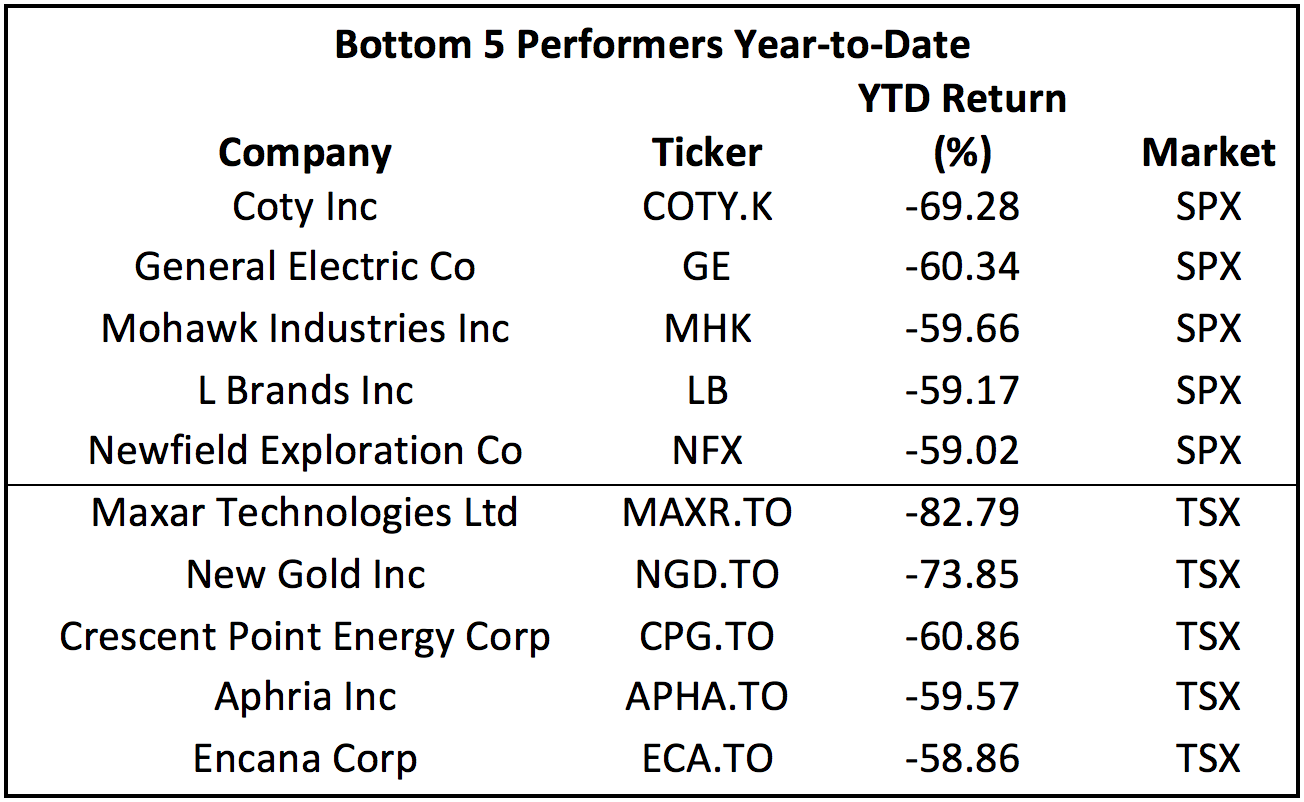

Perhaps one of the most surprising bottom performers in the US is what has been a dividend stalwart General Electric (GE). Other bottom names include consumer companies and industrial names, as one might expect.

On Canadian stocks, there are some energy names and material names but satellite company Maxar Technologies is by far the worst performer. Formerly MacDonald Dettwiler, the company has seen very poor performance in 2018 post-acquisition of DigitalGlobe in the US. Some also might be surprised to see a marijuana company to be at the bottom of the list as well in the form of Aphria (APHA).

Top and bottom performing stocks only tell a part of the story though. How many companies were positive and negative on the year?

- TSX composite stocks positive year to date: 43 out of 242 or 18% of companies were positive.

- S&P 500 stocks positive year to date: 121 out of 506 or 24% of stocks

- TSX composite stocks negative year to date: 199 stocks negative on the year

- S&P 500 stocks negative year to date: 385 stocks negative on the year

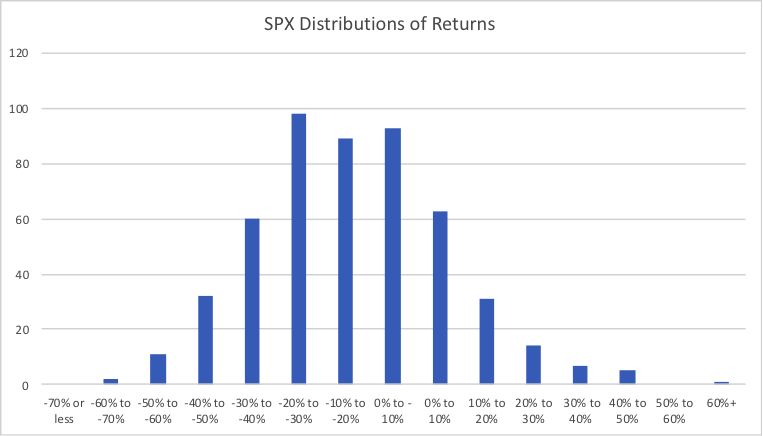

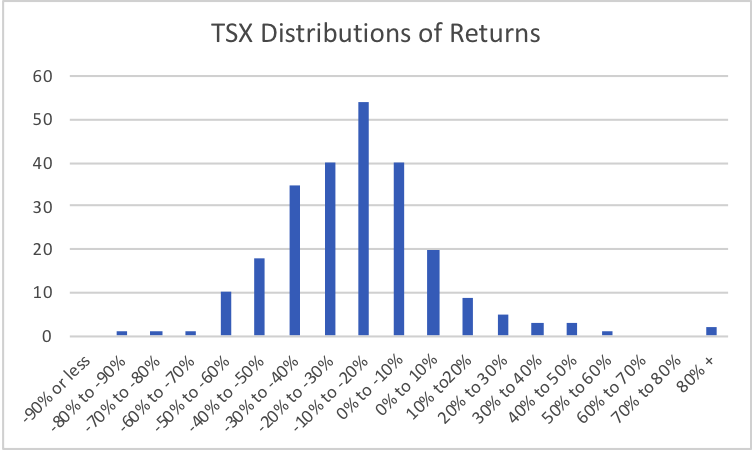

One final interesting data point to look at for the year is the frequency of stocks in different return ranges. Was market performance driven by a few names, or were the majority of publicly traded stocks in the negative in North American markets?

A few takeaways from the above charts would be that the majority of stocks were in a range of being down 40% to down 10%. In other words, most stocks were not just down this year, but down materially. For the S&P 500, 67% of stocks fell within this range. For the TSX, 70% of companies were in this range. While both follow a normal distribution, it is interesting that the constituents in each index had a similar range of returns.

Overall in terms of market performance, the TSX is down 15% on a year-to-date basis with a trailing P/E of 12.9 and a dividend yield of 3.86%. The S&P 500 is down 7.7% with a trailing P/E of 17.5 and a dividend yield of 2.76%. It may not have been a banner year for many investors but the upside is that the downturn creates opportunities for long-term investors.

If you are not yet a member, get your free 1-month access here (no credit card required).

Comments

Login to post a comment.

Invest in US equities and US currency.

Today 28th , my total Portfolio 70% cash, rest equities , all converted to CAD, has suffered -3.8% loss YTD.

Is this a case of not much investor talent just pure currency play?

Art