It is everyone’s favourite time of year again: Tax-loss selling season. Except this year seems to be taking on a bit of a darker tone in that the list of potential tax loss selling candidates has grown as the markets have continued to fall. So, we wanted to look at some stocks that are tax-loss selling candidates but still have a positive outlook going into 2019. Remember, the final day for tax-loss selling in Canada is December 27. The stocks sold cannot be repurchased for 30 calendar days thereafter if the tax-loss is to be realized.

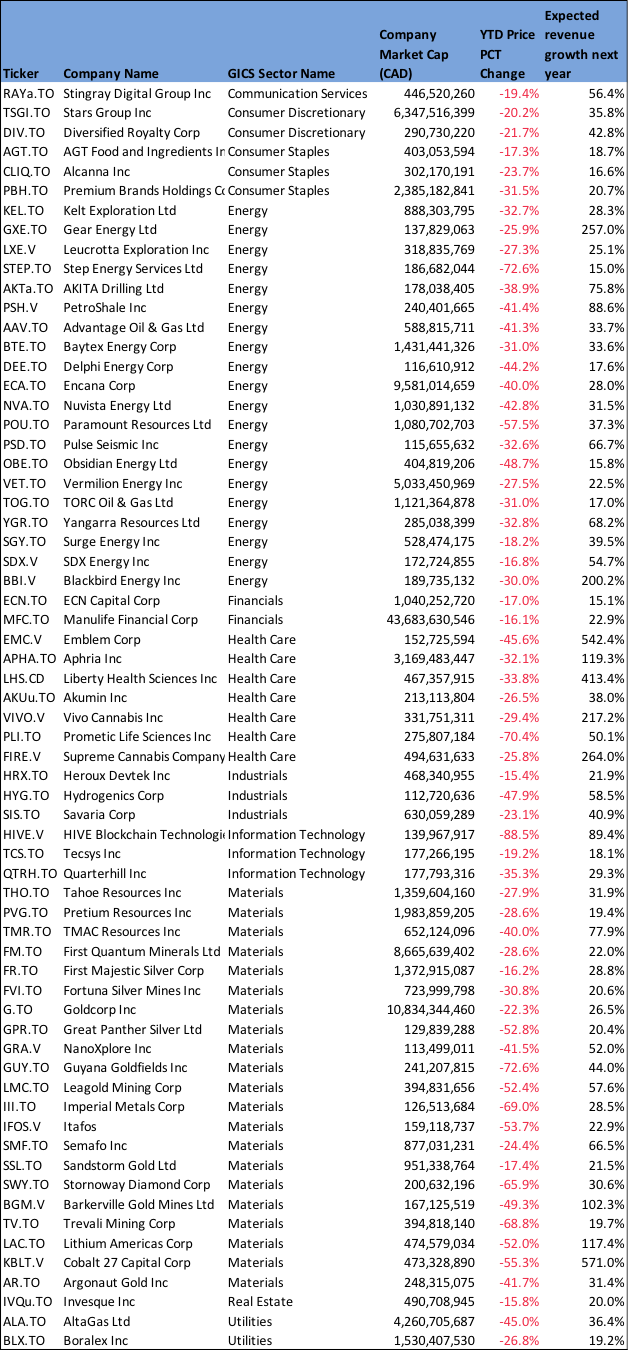

For long-time readers of the blog, you likely recognize the first iteration of our tax loss ideas, which can be found here and here. Essentially, we are looking for stocks that have seen year-to-date (YTD) declines of 15% or more but revenue growth estimates in excess of 15%. The idea being that these stocks may be candidates that get oversold as we approach year-end but still have potential to grow in the future.

As it should be no surprise, materials, and energy companies are the primary constituents of this list. This year we do have a new ‘Sheriff in town’ in terms of stocks on the list and that is none other than pot stocks. We won’t bother going too deep into the more material-based names (pot, energy, and materials) but let's drill down a little into the non-commodity names.

Remember to view our answered questions on these companies here. If you are not yet a member, get your free 1-month access here.

In our view, the most noteworthy names on the list, and 5i Research coverage companies, are Stars Group (TSGI), Premium Brands (PBH) and Savaria (SIS). All three names have been great performers at 5i Research with each name up 1,090%, 134%, and 229% as of October month-end respectively, since starting coverage on the names. While these have been strong over the long-term, these companies have seen a sell-off over the last few months. With large embedded gains over the years, they are all likely easy sell candidates to ‘lock-in’ gains. Of course, it is not a tax-loss for those who have held on over time, but profit taking combined with more recent shareholders that do have a loss could lead to pressure as year-end approaches. The one item that leaves us reluctant to view these as a tax-loss sale is that they remain solid companies overall and the benefits of tax-losses may be outweighed by potential future gains.

The other name that jumps out at us is that of Manulife Financial (MFC). Manulife is a large Canadian insurance company that is down roughly 16% over the year-to-date period and is only up roughly 8.9% over the last five years. We think this performance may set MFC up for additional weakness heading into year-end but also offers an opportunity to own a blue-chip financial stock that may have seen some undue selling over the last year.

The remainder of the tax-loss selling candidates in the above table consist of names that may be appropriate to consider selling for tax-loss purposes or watching to see if what appears to be irrational selling occurs in the coming weeks as an opportunity to add at more attractive prices.

Remember to view our answered questions on these companies here. If you are not yet a member, get your free 1-month access here (no credit card required).

Comments

Login to post a comment.