Pot stocks have been on a high on the TSX for the last year or two but it looks like all of the buzz surrounding the sector might finally be burning out.

No more puns, we promise.

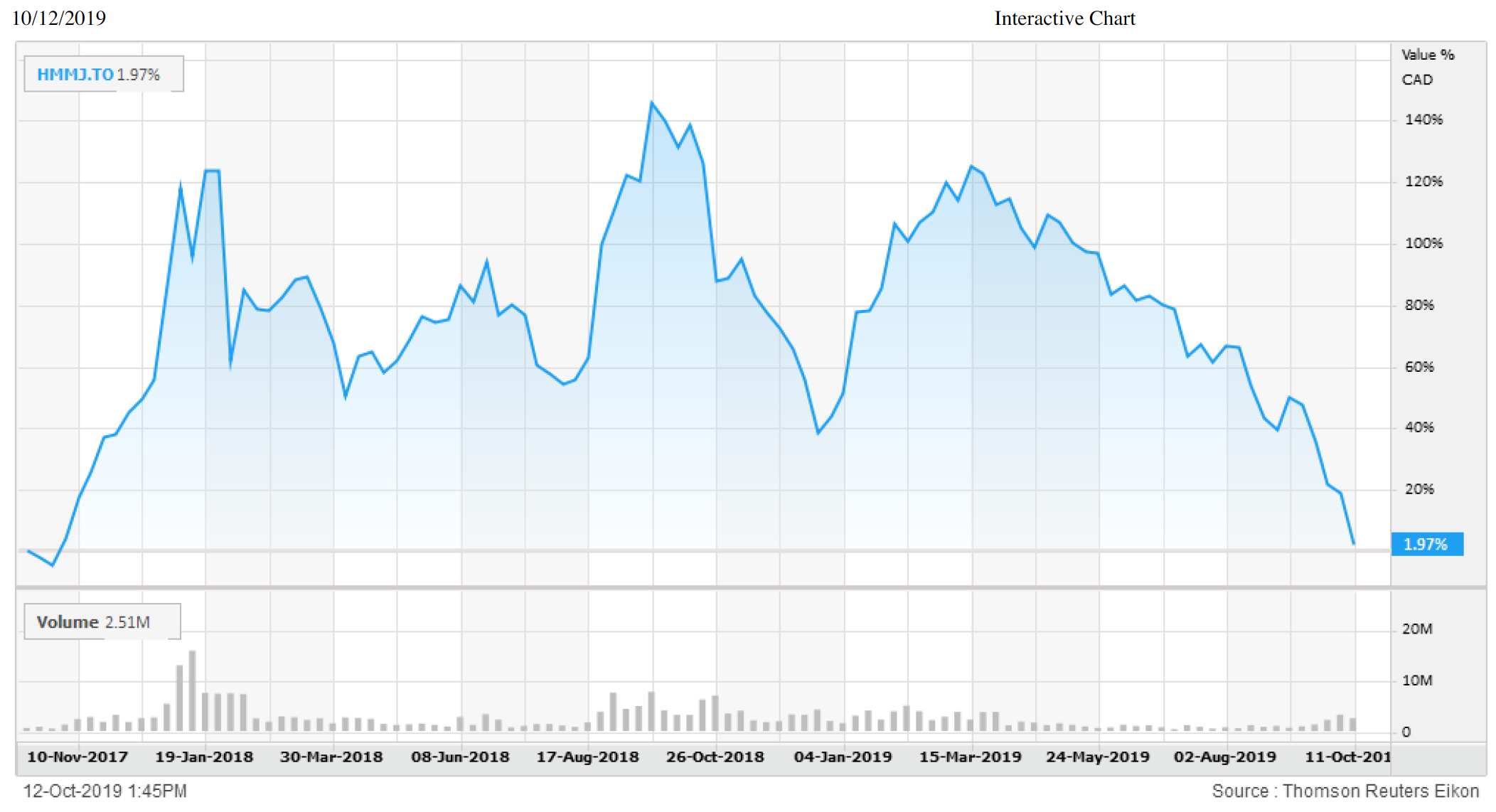

Looking at performance, these names have crossed a bit of an interesting point in the recent weeks. Essentially, most names have given up all the gains they have seen in the last two years. Here is a chart of HMMJ over this period.

An investor could have still traded the space for a profit but had to endure a great deal of volatility and some pretty good timing in order to play this right. If you were a holder for 2 years, you received ‘bond-like’ returns with a great deal more of volatility. Here are some of the more popular names and their performance, to see what it has been like ‘within’ the ETF.

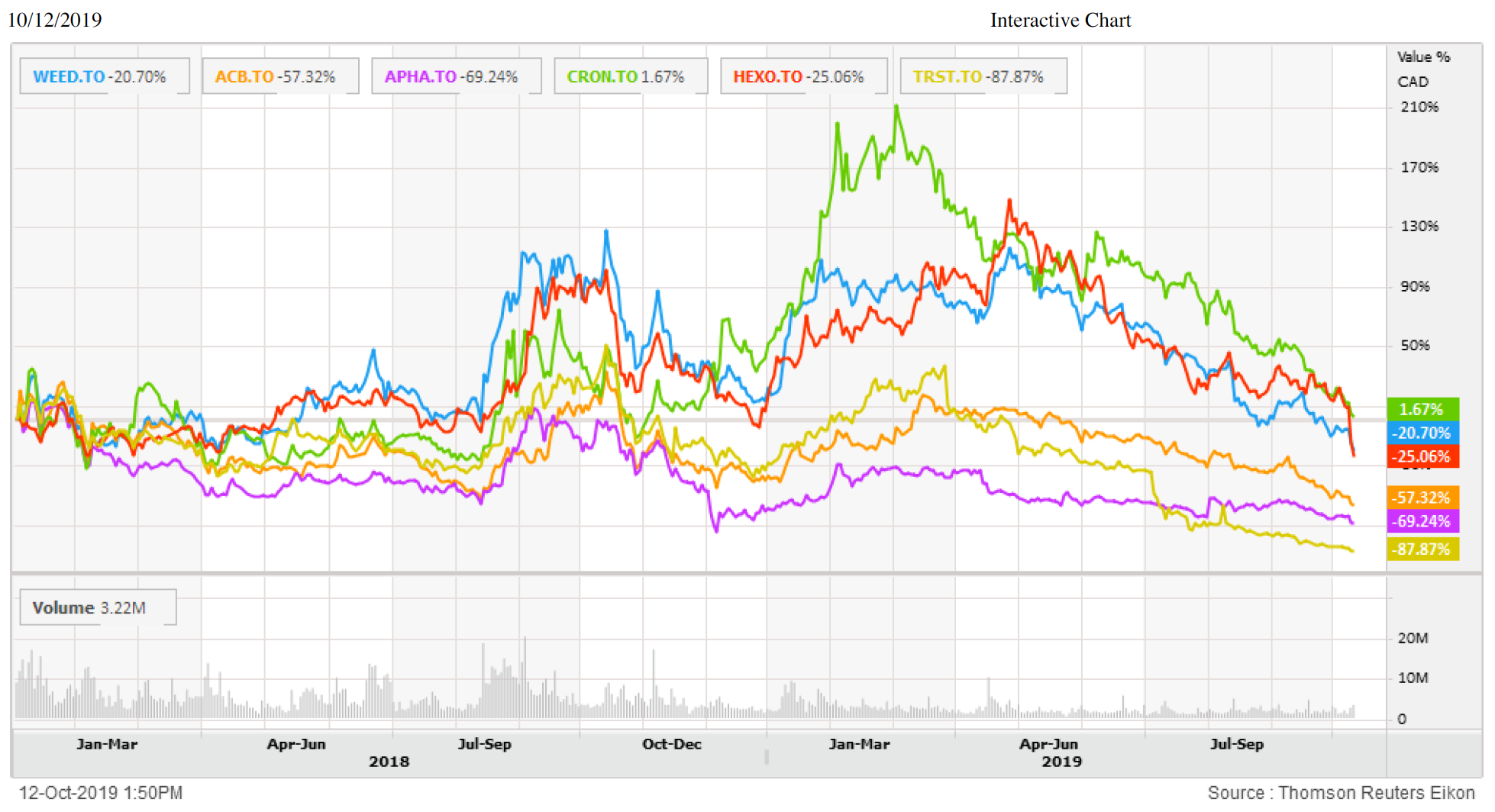

Here we have Canopy Growth, Cronos, Aurora Cannabis, Aphria, Hexo, and Canntrust since December 27, 2019 up to October 11, 2019. We are being a bit creative with the timeframes here, moving them to December, but the point we are getting at is that there has been a long stretch of time where no matter when you purchased these companies, you are probably deep in the red. There are a few items lining up here that might make us reluctant to think the downturn is over though:

Sentiment has clearly shifted

Similar to when the space was rocking; no news could knock these stocks off course. Now, as they are seeing declines, the news that might have been spun as a positive just a year ago is being ignored (and probably rightfully so).

Pot stocks are seeing declines right ahead of tax loss selling season

Year-to-date, most of these stocks are down 20% to 30%. With the momentum to the downside and year-end coming, one has to think that there is going to be a lot of selling pressure for investors looking to claim tax losses. There also might be a good number of investors sitting on gains trying to lock them in as quick as possible, in case the declines get any worse. In short, there are a lot of reasons to sell in this market and given results from many producers (revenue misses and guidance being pulled in some cases), it is tough to see a whole lot of reason to expect many positive catalysts any time soon.

The analysts are starting to ‘catch-up’

Price targets are coming down and recommendations are flipping from positive to negative. As an example, one analyst has just cut their price target on Canopy from $77 to $25. In fairness, we think some finger pointing at some analyst targets is reasonable. It is ‘nice’ that these calls are coming out as the space looks to be in freefall but they did not seem to be there when canopy was trading at 10, 20 and even 30 times sales. Same goes for names like Aurora and Cronos (and most names really). The group that is technically supposed to be the ‘rational actor’ really appear to have helped fuel or legitimize the fires. Another good lesson to not trust analyst target prices.

So, there are a handful of reasons we might expect the space to do worse still, and we have not even touched on valuations which are still around 7 times sales for many names amid declining estimates. We won’t bother diving into a valuation discussion here other than to say that these companies have used their stock price as currency for years now, which is fine. However, when the prices are down 50% from recent highs, issuing shares to fund operations becomes much more expensive and doubles the dilution current investors experience. So, even if one views the valuations as cheap or fair, you need to also be confident that they will not have to issue shares to fund operations and most of these names remain operating cash flow negative, indicating a need for sources of financing still.

In a follow-up to this piece, we also want to look at why these stocks are seeing a sustained decline. With the volatility in these names, an investor can ‘make a case’ for being involved but investing in a stock that can move 10% any given day gets harder and harder to call an investment. Being believers in momentum, we also view it as very difficult to try and step in front of this negative momentum in the space, akin to catching a falling knife. Overall, just know what you are getting into with these stocks and don’t think that just because they are down ‘X%’ over a period does not mean that they cannot go down that amount again.

Not a member? Sign up to 5i Research now.

*The author does not hold a position in any companies or funds mentioned at the time of publishing.

Comments

Login to post a comment.