Technology companies are changing the world at a rapid pace and create exciting investment opportunities for investors. The industry has also rewarded investors handsomely. Investors are certainly familiar with the hardware side of the industry and rightfully so; these companies have given us computers, smartphones, GPS, drones, autonomous cars, etc. Canadian companies have certainly made their mark here (remember the Blackberry?).

Investors are likely less familiar with the software side of the industry, and it is here where we will center this iteration of the 5i Research “Investing Insights and Industry Analysis” series.

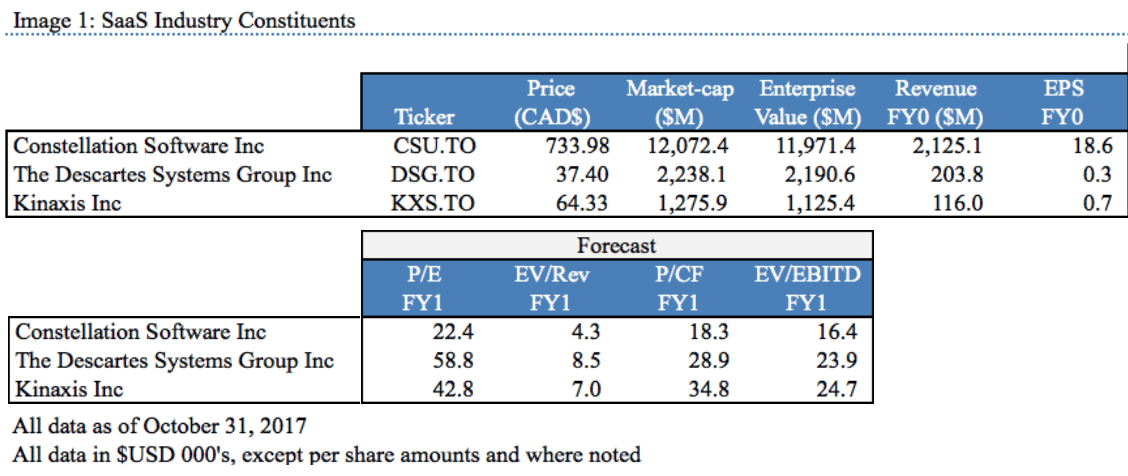

We will focus on Constellation Software, Descartes Systems Group and Kinaxis:

What connects these three companies together is the focus on software-as-a-service (SaaS). The SaaS business model is one in which software is licensed on a subscription basis and is centrally hosted by the provider. SaaS has become a common delivery model for many business applications, including office software, enterprise resource planning, and supply chain management, to name a few.

Unlike hardware sales, which can be ‘lumpy’ and incur long sales cycles, SaaS companies benefit from stable and recurring revenues, which typically result in attractive cash flows, as fees are paid over the life of the contract. The SaaS model is also different from a traditional software sales delivery model, where the software is sold as a perpetual license with a high up-front cost.

Top Picks

#1: CSU.TO: “best-in-class” acquisition growth; template for a well-run company

#2: KXS.TO: long-term growth stock with “bounce back” potential after a tough Q2 2017

#3: DSG.TO: a mini-CSU but a lofty premium valuation leaves little room for error

We have reports on all three SaaS peers but will quickly summarize the business for those that need a reminder.

If you are not yet a member of 5i Research and would like to see these reports, you can access them all by signing up for a free 1-month trial membership to 5i Research.

Constellation Software Inc. (CSU.TO)

Constellation Software Inc. is engaged in the development, installation and customization of mission-critical software for clients in a variety of verticals. If we had to pick a template for a well-run Company, CSU.TO would be top-of-mind. This company has returned 611.1% since we initiated coverage.

The Descartes Systems Group Inc. (DSG.TO)

DSG.TO is a provider of logistics and supply chain management software. The Company’s logistics platform allows customers to quickly and cost-effectively connect, collaborate, and transact business. DSG.TO benefits from visible and recurring revenues. This company has returned 120.8% since we initiated coverage.

Kinaxis Inc. (KXS.TO)

KXS.TO is a provider of cloud-based subscription software that enables customers to improve and accelerate analysis and decision-making across their supply chain operations. KXS.TO customers are generally large national or multinational enterprises with complex supply chain requirements. This company has returned 38.8% since we initiated coverage.

It's All About Acquisitions and Increasing Contract Values

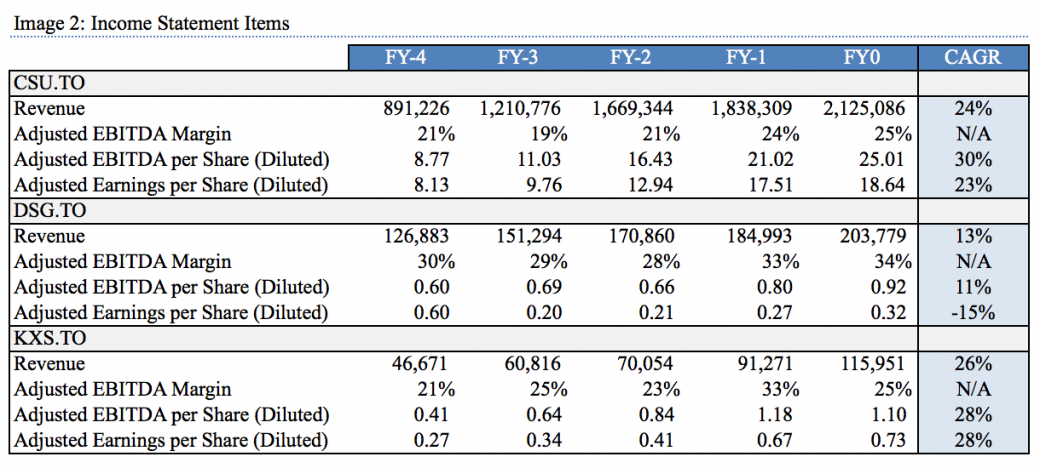

All three peers have established a consistent financial track record of strong revenue growth and earnings performance. Over the observed 5-year period, CSU.TO and KSX.TO have both earned a compound annual growth rate (CAGR) of ~25%. DSG.TO shows a slower but still impressive 13% pace. Peers have all generated attractive EBITDA margins and these tend to flow through the remainder of the Income Statement.

So, how do they do it? With a well-defined growth strategy rooted in a combination of acquisitions and expanding the value of existing customer contracts.

Let’s start with CSU.TO, which we consider to be one of the best capital allocators in Canada. The CSU.TO growth strategy is to acquire, manage and build market software businesses. Each vertical management team has extensive knowledge of their markets and deep customer relationships. This enables them to successfully identify, acquire, and then coach these businesses post-acquisition. CSU.TO owns companies that have a lot of annuity revenue. The free cash flow comes back into that vertical, and management goes out and buys more companies.

There are few better than CSU.TO when it comes to acquisitions and it is for this reason the stock is our peer #1 ‘Top Pick’ (and earns its ‘A’ rating from 5i Research). We think all investors should read the Annual Information Form (AIF) where management clearly defines their process. In the 2016 AIF, this can be found on pages 9 – 16. Its not all clear skies for CSU.TO but it’s a company that is hard to bet against.

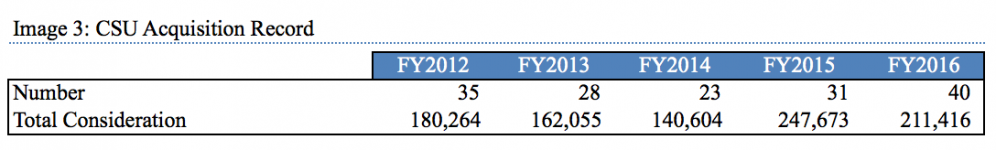

‘Image 3’ highlights the CSU.TO acquisition profile over the last five years:

CSU.TO made two large acquisitions in FY2013 but we have excluded these from the below figures to present a more comparative illustration (the acquisitions were Total Specific Solutions B.V. for aggregate cash consideration of $341,560; QuadraMed Corp. for aggregate cash consideration of $76,731).

CSU.TO has a dedicated team scouring the globe for acquisitions and targets averaging in the $5 million - $7 million range. Other than the larger 2013 acquisitions, we have not seen a ‘transformative’ acquisition from CSU.TO in some time. While a high volume of acquisitions will send the stock gradually higher, at a market-cap of over $15 billion investors likely will not see a big jump in share prices without larger purchases.

Earning its 5i internal title as a ‘mini CSU’, DSG.TO too has grown primarily via acquisition. Specifically, the Company targets acquisitions for its product portfolio where there is a high degree of customer overlap with DSG.TO users. This boosts growth due to cross-selling efforts to the value of each customer contract.

KXS.TO has also successfully managed its “Land and Expand” strategy: drive growth in the business through new customer acquisition and expansion of existing customers. Increasing revenues through new customer wins is a top growth priority. Over the last several years, approximately 65% of subscription growth has been derived from new customers. However, the sales cycle can be lengthy, as KXS.TO generally targets very large organizations. The ‘pro’ of this strategy is it tends to make KXS.TO products/services ‘sticky’ with customers, as switching costs can be large.

Recurring Revenues: What’s Under the Hood?

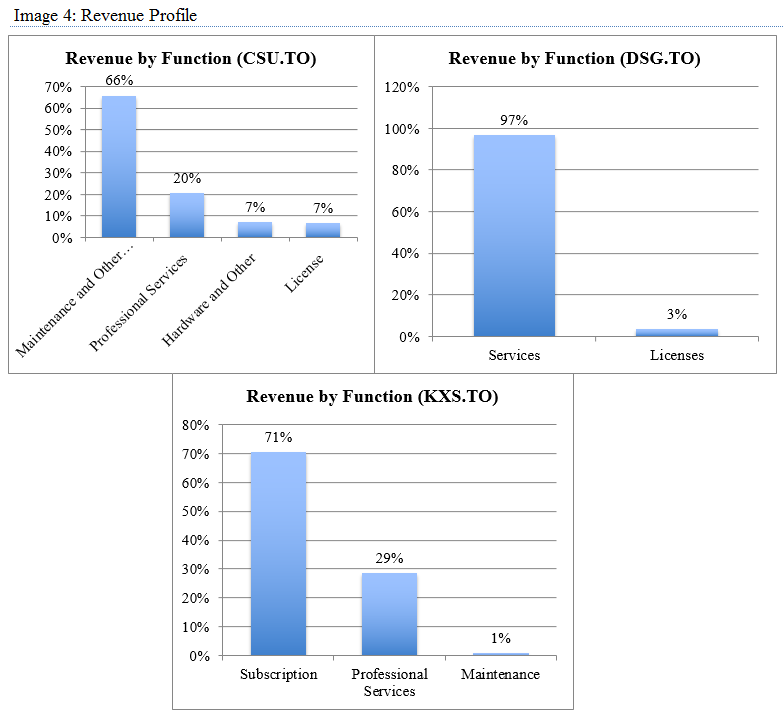

In ‘Image 4’ we show how each SaaS peer breaks out its revenue base.

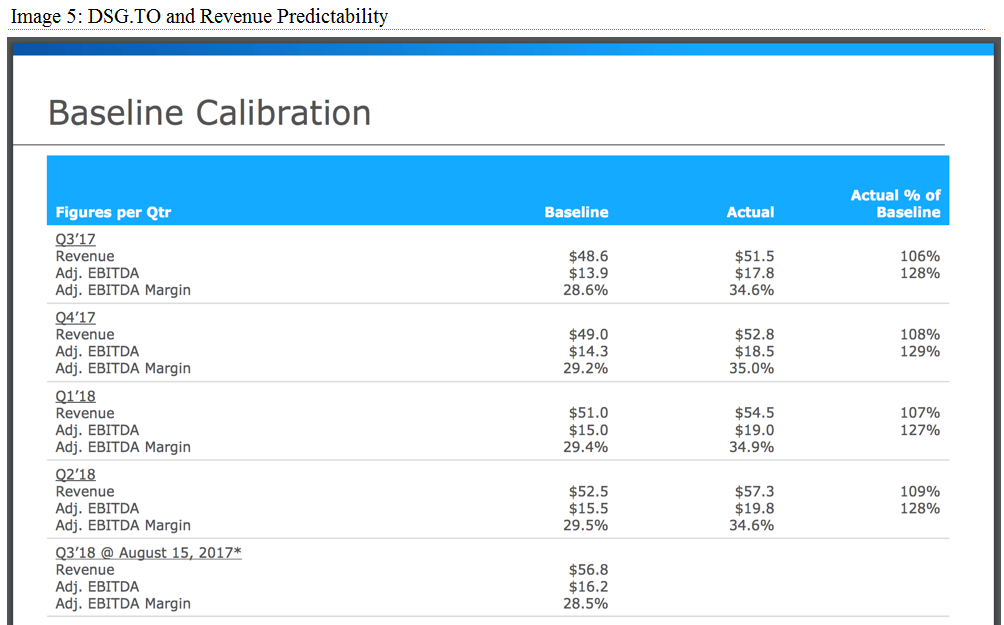

We will first highlight DSG.TO, as the Company has a high degree of revenue visibility. As a percentage of total revenues, services revenues were 97% of FY2017 revenues, and 95% and 93% in FY2016 and FY2015, respectively. The high percentage of services revenues reflects the DSG.TO emphasis on selling to new customers and expanding product offerings to existing customers under the SaaS business model. These revenues are so repetitive that the Company basically knows in advance what +90% of its quarterly revenues will be, and simply needs to spend the rest of the quarter earning the last +/- 10%.

Too good to be true? Simply take look at the below image from the DSG.TO September 2017 Investor Presentation. The Company is basically able to layout the next quarter’s “baseline” revenue, which are defined as visible, contracted and recurring revenues at the beginning of each quarter.

The KXS.TO subscription model also results in a high proportion of recurring revenue. The recurring nature of KXS.TO revenue provides high visibility into future performance. Typically, ~ 80% of annual subscription revenue is recognized from customers that are in place at the beginning of the year, and KXS.TO notes this continues to be the target going forward. When we are talking about recurring revenues, the longer the contract period, and the higher your ability to retain customers, the better. KXS.TO agreements with customers are typically two to five years in length. As per company financial statements:

“We believe the power of the subscription model is only fully realized when a vendor has high retention rates. High customer retention rates generate a long customer lifetime and a very high lifetime value of the customer.”

We certainly agree and as a testament to the Company’s capabilities, the net revenue retention rates remain over 100%, as it also includes sales of additional applications, users and sites to existing customers.

Cash Flows: Steady as She Goes

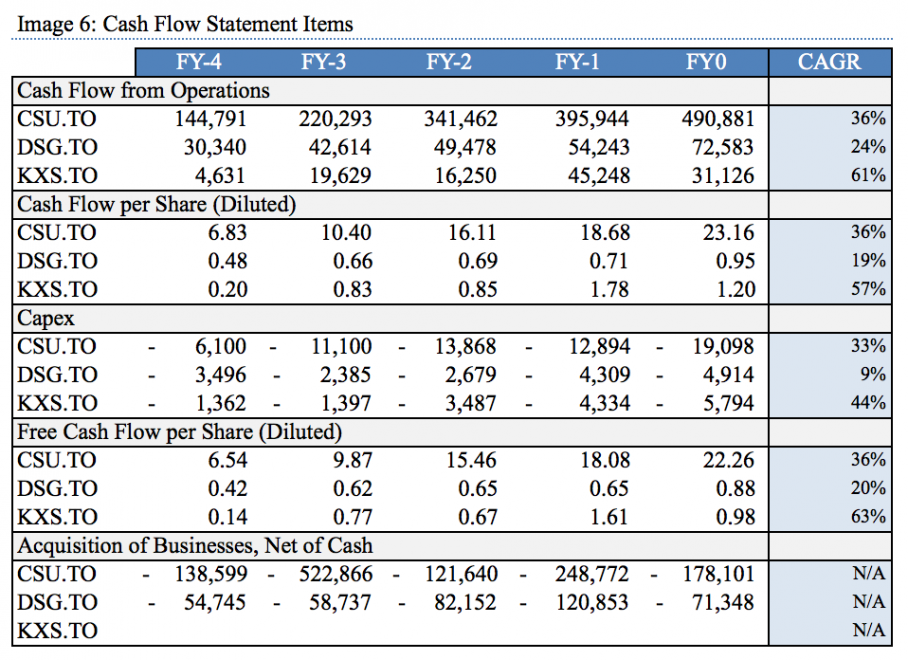

We have talked a lot about how the SaaS business model results in a high degree of recurring revenue and consistent cash flows. In ‘Image 6’ we show how each company backs up those claims. Simply put, all three SaaS peers generate significant cash flows and have a great track record of increasing free cash flow per share. The only real ‘miss’ was the FY2016 result for KXS.TO.

With such strong cash flow generation, peers are able to fund a large portion of their acquisition activity with internally generated cash flow, and are able to avoid taking on excessive debt to finance growth.

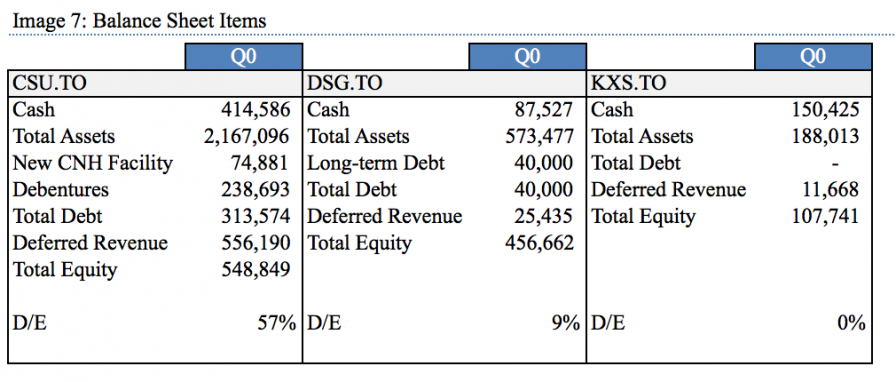

As we show in ‘Image 7’, peers boast clean balance sheets and have managed to keep debt low (and have avoided using their outstanding shares as an ATM to fund growth).

CSU.TO does however show a 57% debt-to-equity (D/E) leverage ratio. In 2013, CSU.TO drew on a credit facility to help finance the large TSS acquisition, driving up bank indebtedness. In 2014, the Company issued debentures to pay down the TSS Acquisition Facility. In 2015, CSU.TO issued an additional tranche of debentures to pay down its credit facility. While the D/E ratio is high relative to peers, the D/E ratio is fine in the context of a going concern entity. The Company prudently managed proceeds from the debt issues/credit facilities, and we have no worry that CSU.TO will not be able to pay down this debt with its large cash flow profile, should it choose to do so.

All peers have attractive credit facilities available to them, in some cases with no principal drawn upon the facility, which positions them well for future growth. In addition, peers benefit from a negative net debt position (more cash than debt). For example, KXS.TO has a $150 million cash position, which represents 80% of the last quarter’s assets. Both the CSU.TO and DSG.TO cash position represent 15% - 20% of the balance sheet.

Premium Valuation: These Companies are No Secret

So far, we have talked about how great these companies are. So how did we determine the order for our ‘Top Picks’. Mostly, this came down to a stock performance and a valuation decision.

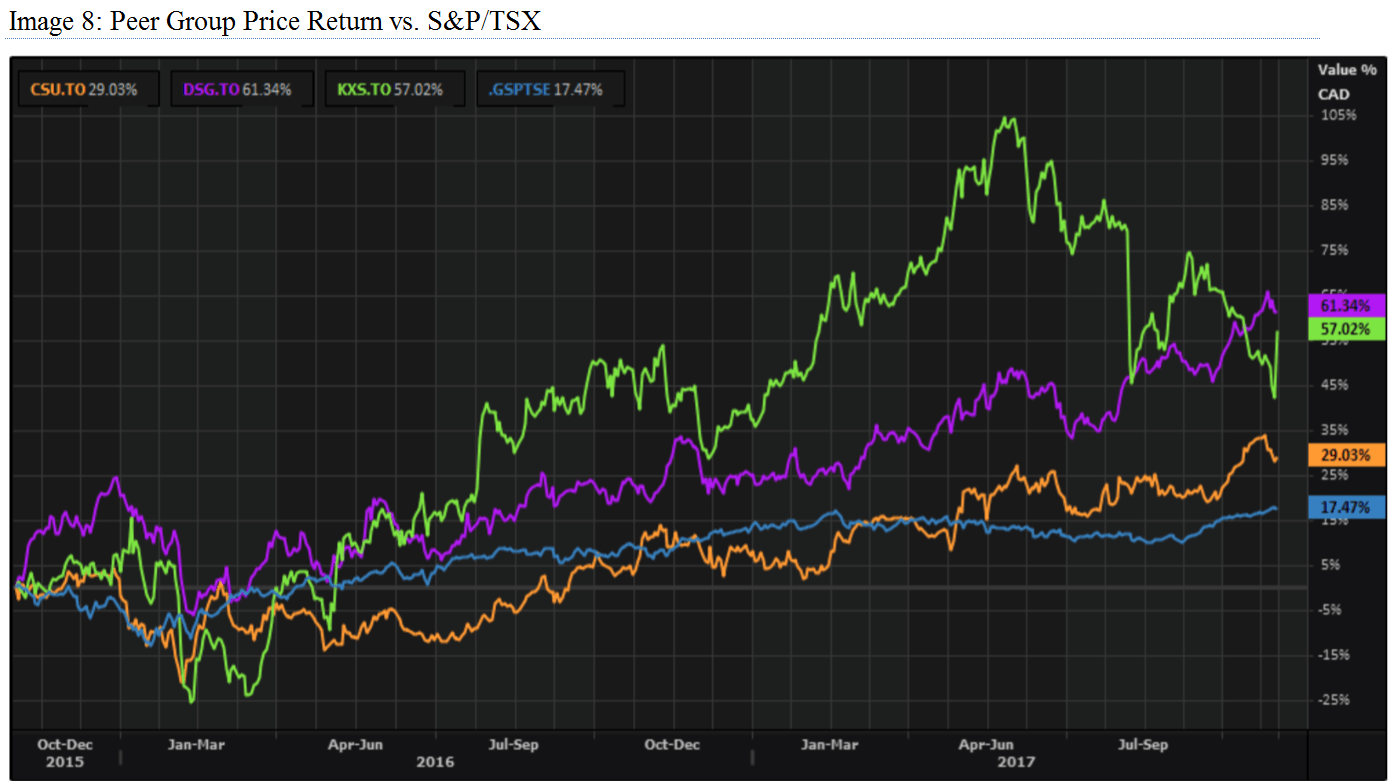

It’s hard to fly under the radar when you aggressively grow sales and cash flows, have a high degree of recurring revenue, and maintain a clean balance sheet. Investors certainly seem to like these stocks and as per ‘Image 8’, all are up handsomely over the last two years, especially in the context of the S&P/TSX.

Most will be quick to note the recent drop on KXS.TO. During Q22017, an Asian-based customer did not make certain scheduled payments under its contract. Many have speculated this to be Samsung (a recent large contract won by KXS.TO) but we have not seen much visibility around this. KXS.TO has since terminated the contract with this customer and has initiated arbitration proceedings for payment of all amounts due under the contract and damages.

It’s for this reason that we have chosen KXS.TO as #2 pick.

The problem with buying a higher valuation stock (which we quantify shortly) is that if the company falters, you can expect a sharp reaction from markets. We have seen this play out with KXS.TO in the wake of the cancelled Asian-based contract. In our opinion, these concerns are overblown. The stock price decline is not reflective of a poor product or company fundamentals, but more so a one-time issue (hopefully). At the time or publishing, KXS.TO reported its quarterly results and crushed its earnings estimate. The stock finished the trading day up 12%. This is an example of how investors need to look beyond short-term hiccups and focus on the long-term growth story.

With solid fundamentals and an already 21% decline over the last 3-months, we see value in KXS.TO shares and think the stock is a good ‘bounce back’ candidate.

Peers are well recognized by financial markets and as such trade at premium valuations. In ‘Image 1’ we have previously shown forward valuation metrics across a variety of fundamentals. CSU.TO is clearly the cheapest option of the three at a P/E of 22.4x vs. DSG.TO (mini CSU) at 58.8x. To some extent, this makes sense as one can expect higher growth from DSG.TO with a $2.2 billion enterprise value vs. CSU.TO at $12.0 billion. Pound for pound, a $x acquisition will have a larger impact on DSG’s growth rate vs. the larger CSU.TO

With the benefits of the SaaS business model being recurring revenues and consistent cash flows, qualities investors are happy to pay for, it makes sense to examine valuation metrics around these fundamentals.

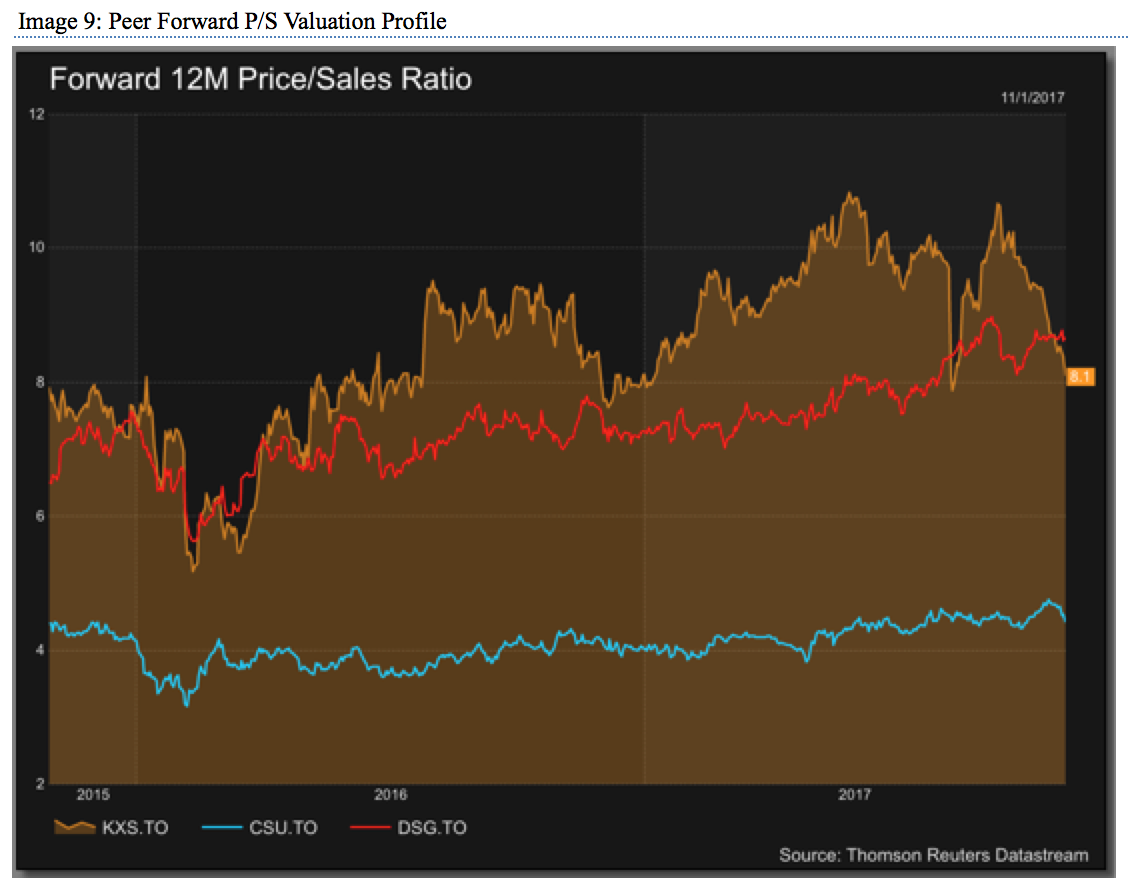

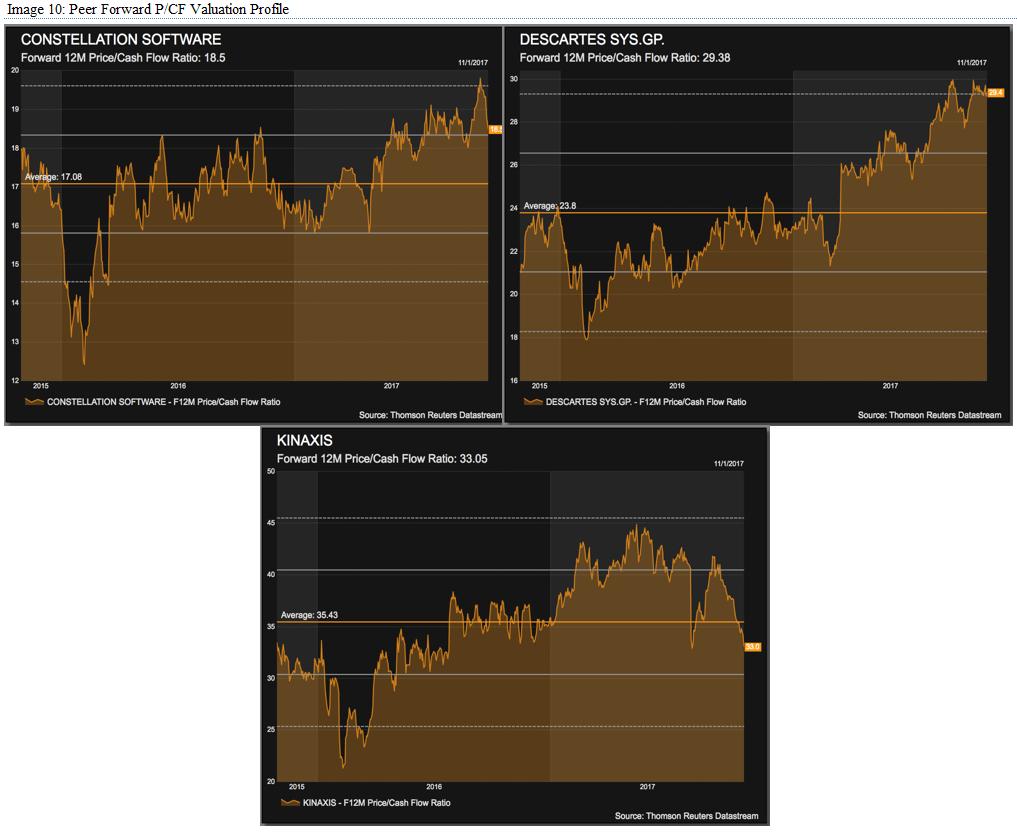

In ‘Image 9’ we show the forward price-to-sales (P/S) of our peer companies. In ‘Image 10’, we then show the individual price-to-cash flow (P/CF) profiles.

From ‘Image 9’, we can see the smaller, more aggressive stocks trade at a higher P/S vs. CSU.TO but this does not surprise us given CSU.TO’s relative size. We also note that the CSU multiple is relatively stable vs. peers, which show a higher degree of volatility. From the P/S perspective, we can conclude that CSU.TO is a stock that rarely goes on sale. A value investor who waited on the sidelines to establish a position would have likely never found an attractive entry valuation point and over the last few years, would have missed out on big gains. We would pick away at a position and buy CSU.TO ‘on the dips’.

On the flip side, valuation metrics for DSG.TO and KXS.TO are relatively more volatile and investors should take an active investing approach to these stocks. A contraction in the multiple could be a good time to establish a full position in these higher growth names. For example, as we can see in ‘Image 10’, KXS.TO is trading below its 2-year P/CF valuation average and represents an attractive entry point for more aggressive investors, in our opinion. Both CSU.TO and DSG.TO are trading at large premiums to their 2-year average.

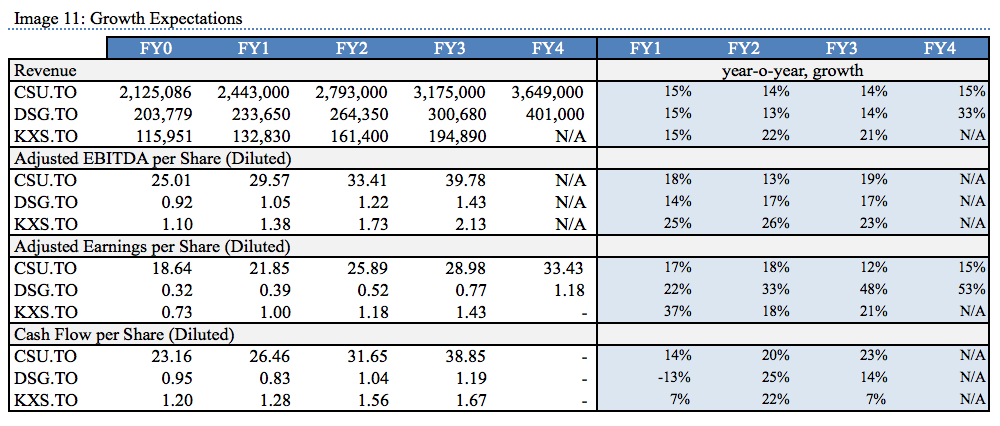

In our opinion, all three premiums are deserved due to strong fundamentals but they do of course imply higher growth expectations. In ‘Image 11’ below, we show analyst expectations for peer fundamentals over the next 3 – 4 years.

What is interesting here is the consistency in growth expectations we observe in the revenue and EBITDA fundamental over the upcoming 3 – 4 years. To a certain degree, this is what one would expect, echoing the benefits of the SaaS model we have thus far discussed.

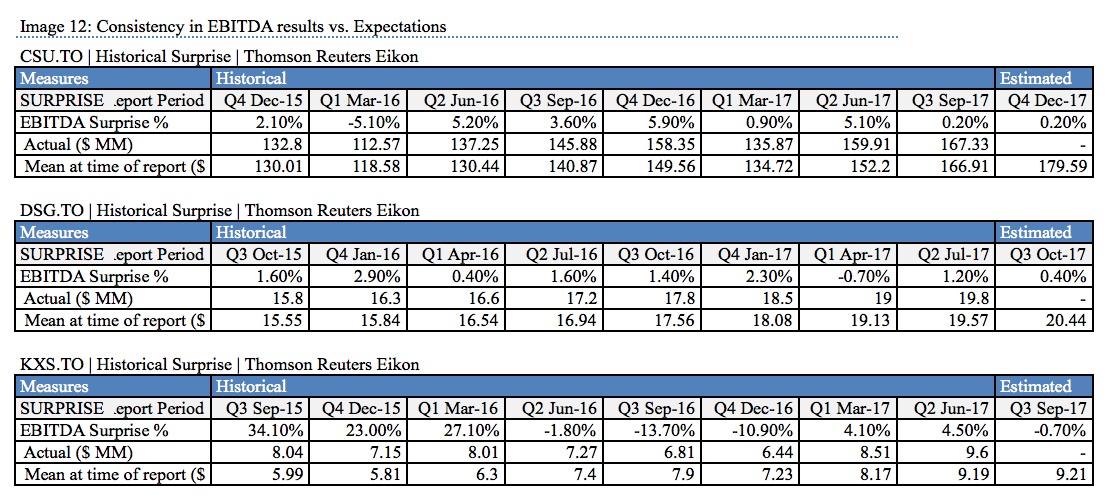

While we have full faith in these peers and their management team, as we previously noted the challenge of high growth expectations and premium valuations is that if a company falters, you can expect the stock to sharply correct, even drastically overshoot on the downside. If we had to pick one peer at risk for a sharp correction in the event of an earnings miss, it would be DSG.TO.

It is for this reason DSG.TO earns the #3 spot on our pick list.

We want to clarify that we like DSG.TO a lot and of course, a big earnings miss would hurt any of these peers. However, DSG.TO looks to be the most expensive of the peers and is up 61% over the last two years. As well, unlike a larger operator such as CSU.TO, a smaller company like DSG.TO may not receive a ‘one-time pass’ from markets on an earnings miss. KXS.TO also shows a lofty valuation but with some wind already taken out of its sails after the last quarter, one could expect a bit less downside on another rough quarter, given the 21% drop since the last.

That being said, DSG.TO has a good 2-year record of not disappointing on quarterly results, and below we show in ‘Image 10’ the EBITA historical surprise for each peer. As a faster growing company, KXS.TO has shown more volatility.

Be sure to read our in-depth reports on each of these companies and get your questions answered by our Research Team when you sign up for a free 1-month trial membership to 5i Research.

As a reminder, the “Industry-At-A-Glace” blogs are not meant to serve as full company analyses or investment recommendations. Rather, the series is an introductory comparative discussion on industry constituent companies and drivers of return. Investors are encouraged to perform their own due diligence.

Comments

Login to post a comment.

I own all 3 so it was great to learn more about their businesses.

Thanks,

Mike B

Example are abondant Sales Force (CRM ) and many others.

I strongly believe that AVO will need to be added to this list (on the radar list) within the next 12-18 months as the company is shifting from an electronic hardware supplier to a software business model with SaaS with Artificial intelligence for video analytical and a huge IP and licenses moat

A+

Fascinating read! Loved it. You broadened immensely my knowledge of the industry. Great stuff. I particularly liked your focus on specific companies within the industry instead of describing the sector in general terms. I can't wait to read more pieces like this one.

Robert