Momentum is an anomaly that demonstrates securities that have outperformed relative to other assets (or peers) will continue to outperform while losers (who have performed poorly) will continue to underperform. The existence of momentum within the stock market has been documented as far back as 1801. There's even evidence that predates any academic research suggesting that momentum has been part of the market from the very beginning. During this current period of market concern (increased volatility due to trade woes and fears of slowing economic growth) there has been no exception to the momentum rule. The demand for safety and yield has continued to make momentum investing extremely successful. Not only has the momentum strategy continued to outperform in this environment but it's also provided a strategy that allows investors to block out all external noise (such as recession fears) while allowing them to stick with the trends that are working. While Utilities, REITs, and staples are not considered to be "glamorous" or "exciting", they are the sectors that continue to outperform (whether an investor likes it or not). Not only have these sectors outperformed on an absolute basis, but they have also been crushing many other sectors on a relative basis (such as energy and marijuana). The reason behind this outperformance is because of that demand for safety and yield as I mentioned above (these sectors offer low-volatility, modest growth, and a respectable yield). The companies within these sectors also rarely produce a big earnings surprise and are thus less stressful to own in times of uncertainty (flight to safety). This dynamic has many of these so-called "boring" names pushing to new all-time highs in price. If one was deploying a momentum-based investment strategy in their portfolio, it'd not only be benefiting from the yield, but also be benefiting from these new all-time highs in price. Another benefit of a momentum-based strategy is the ability to manage risk. As the old saying goes, "a trend will be your friend until the one time it's not". This allows investors to ride the trend (with zero thinking involved) until that one time the trend no longer exists. This can be accomplished by combining portfolio management tools with a trailing stop-loss order that is adjusted for the stock's volatility.

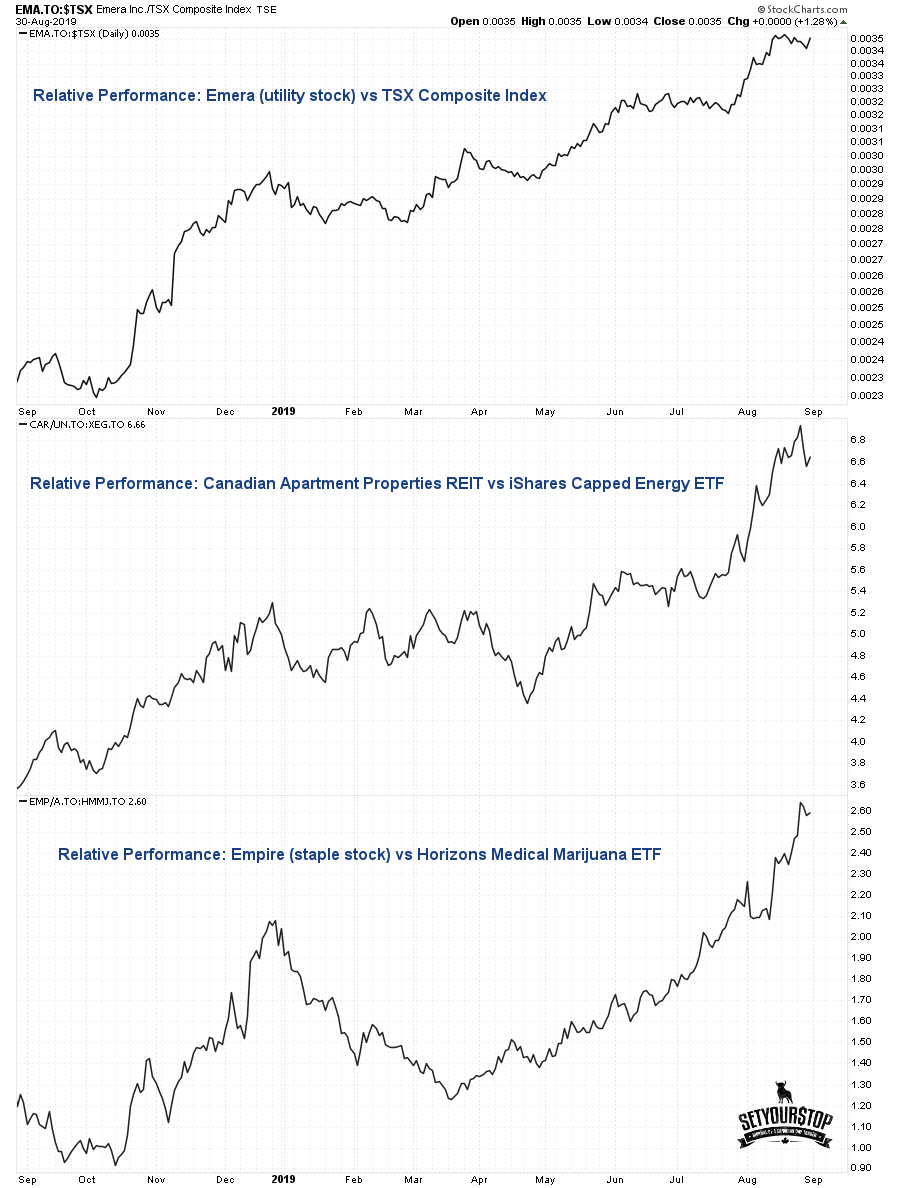

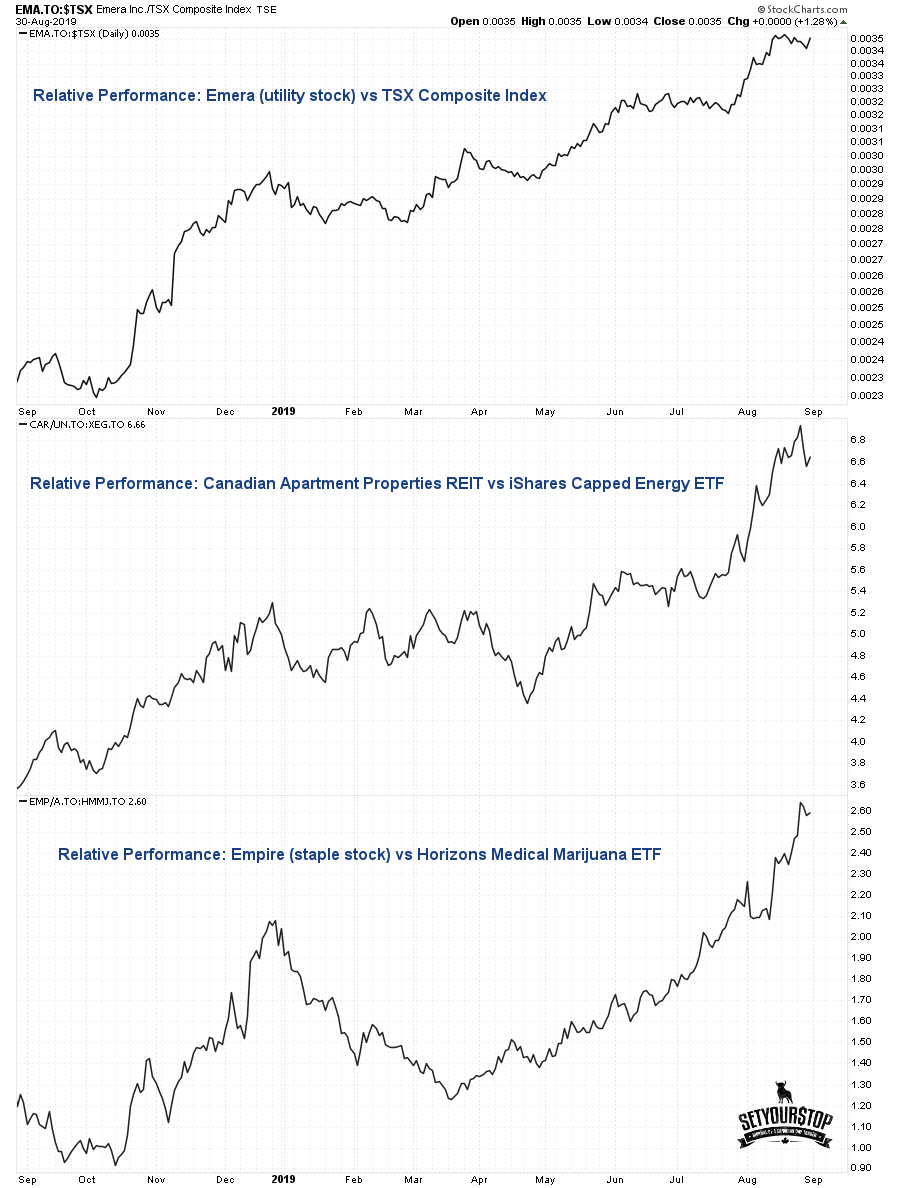

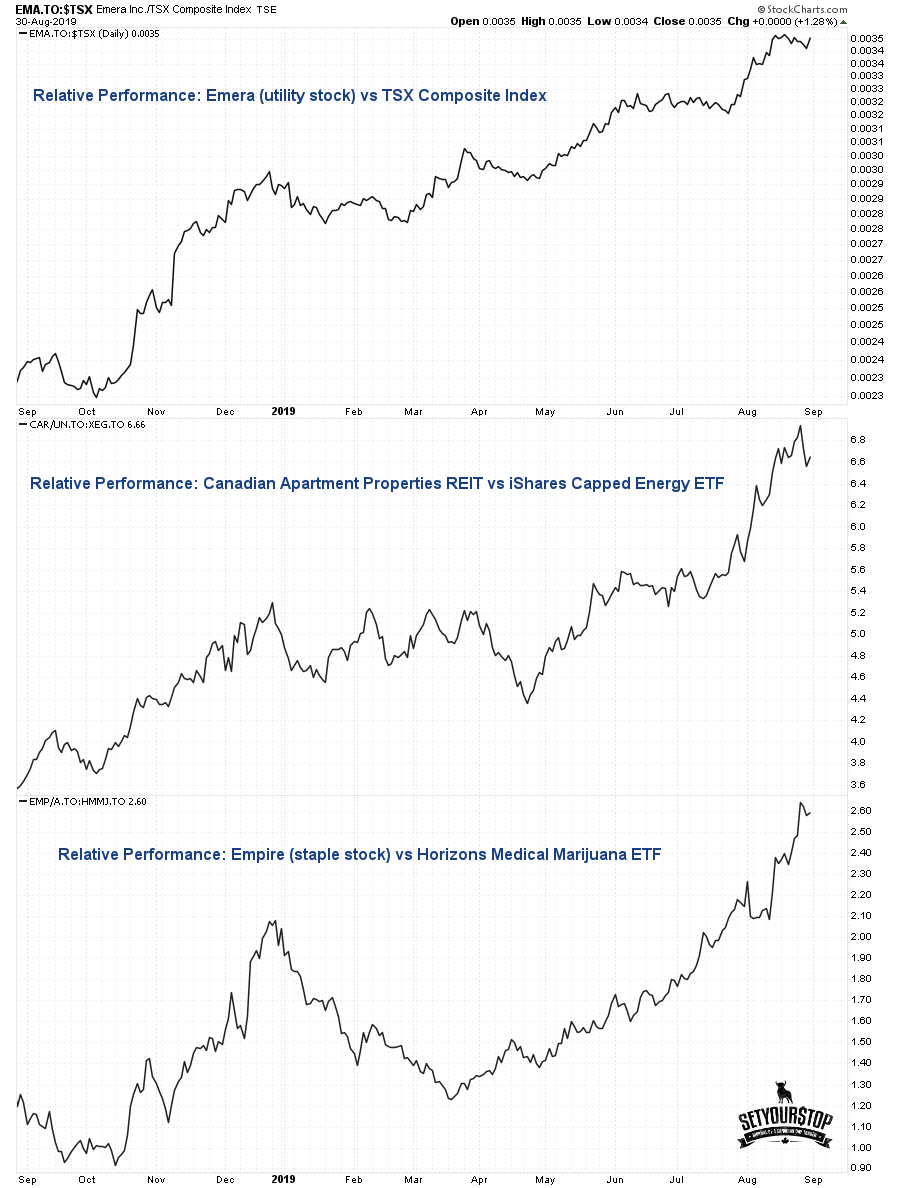

Here are three examples (a Utility vs TSX, a REIT vs Energy ETF, and a Staple vs Marijuana ETF) of so-called "boring" stocks (all pushing to a new all-time high in price) demonstrating the 1 year outperformance versus the Canadian benchmark and two other popular sectors. The purpose of this is to not only show the power of a simple momentum-based strategy (buying stocks that are breaking out in relative performance) but to also demonstrate why investors should block all outside noise (fear, media, opinion, thoughts, storytelling) and buy stocks that are actually "working" versus trying to buy stocks that they "think" could work.

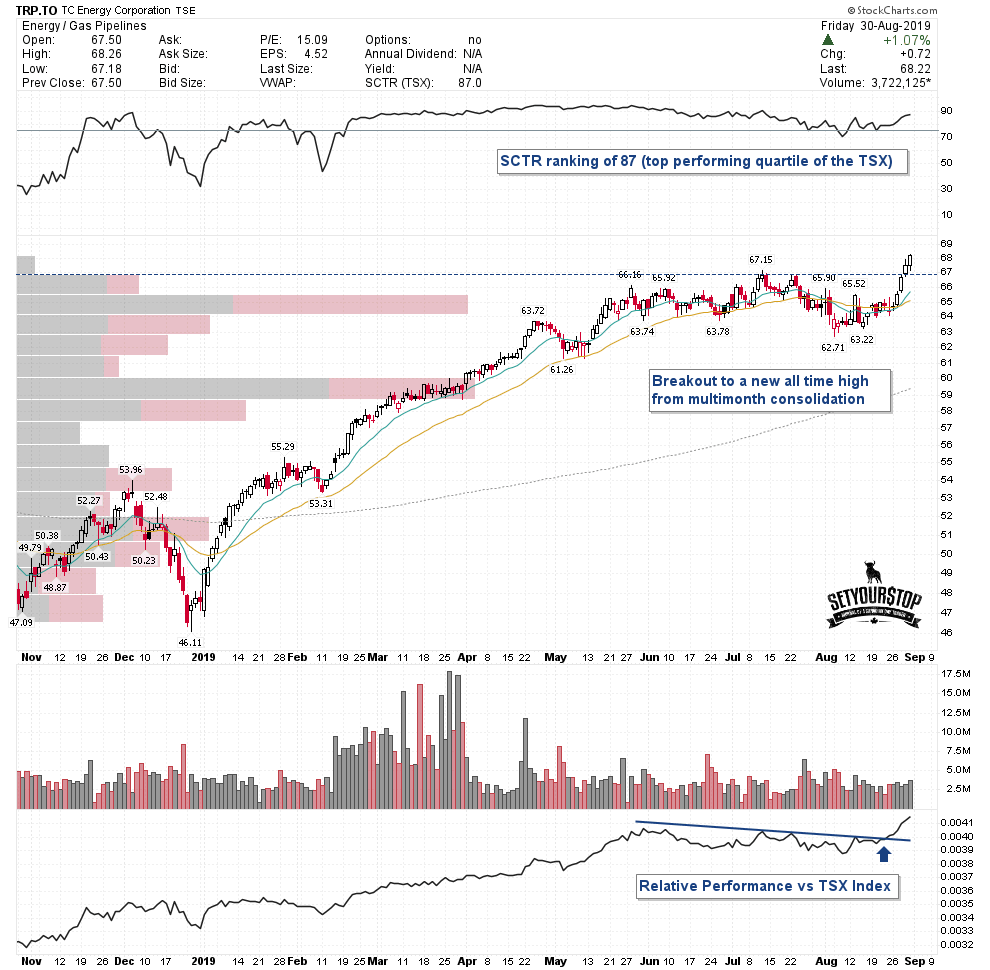

Below are three momentum-based setups fitting the above theme (low-volatility, modest growth, and a respectable yield) that are prompting a fresh trend following buy signal. Ideally one wants to see a stock breaking out from a basing pattern while relative performance pushes to a new 52-week high.

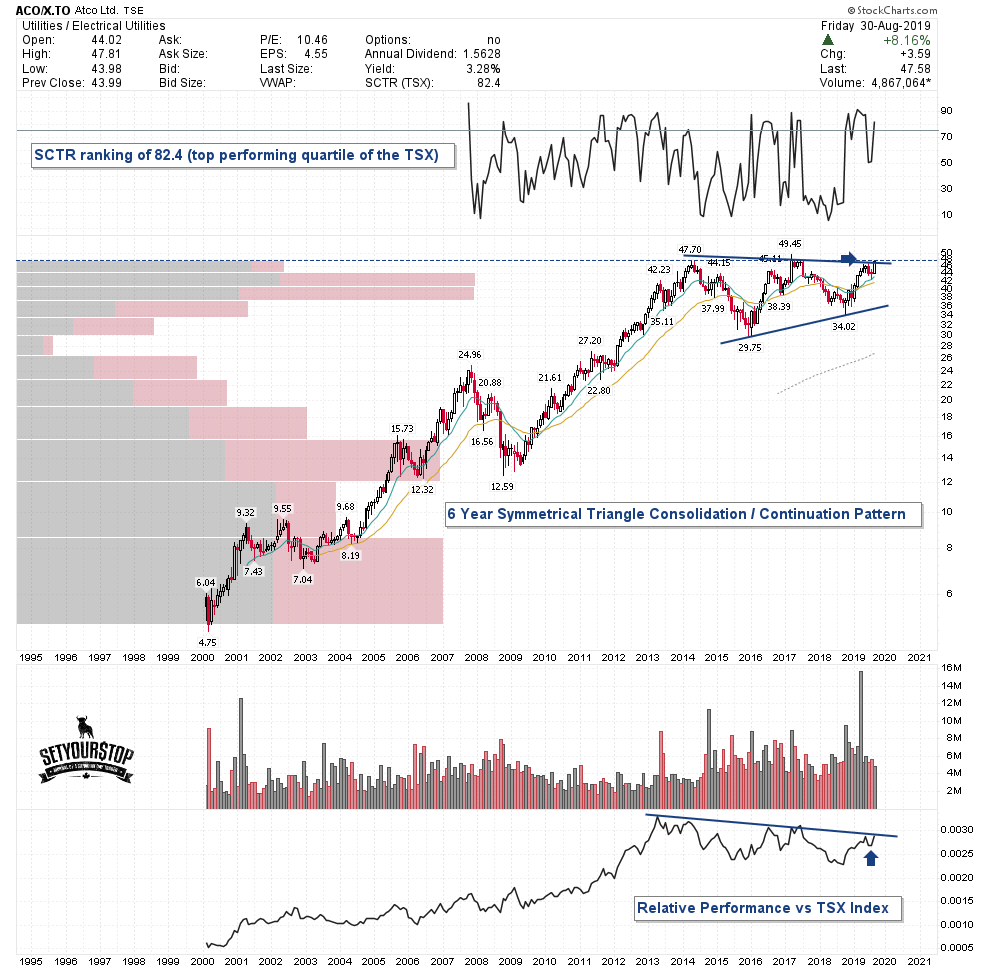

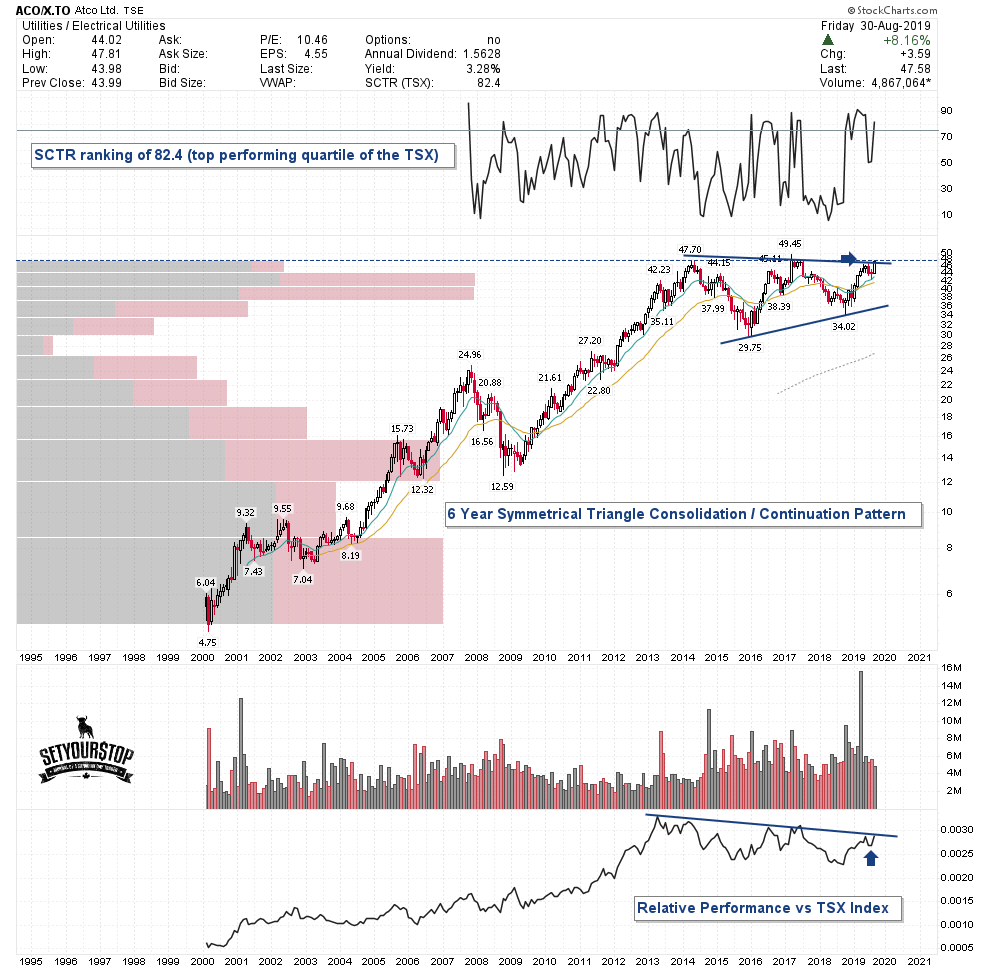

Atco (TSX:ACO.X) just printed a new 52-week high and is now attempting to break out to a new all-time high from a 6-year symmetrical triangle consolidation / continuation pattern (the bigger the base the higher the space). This is all happening while relative performance vs the TSX index touches a new 52-week high and threatens to breakout above a long-term downtrend line. This price action is very bullish and suggests the beginning of a new major uptrend is now underway.

Last week

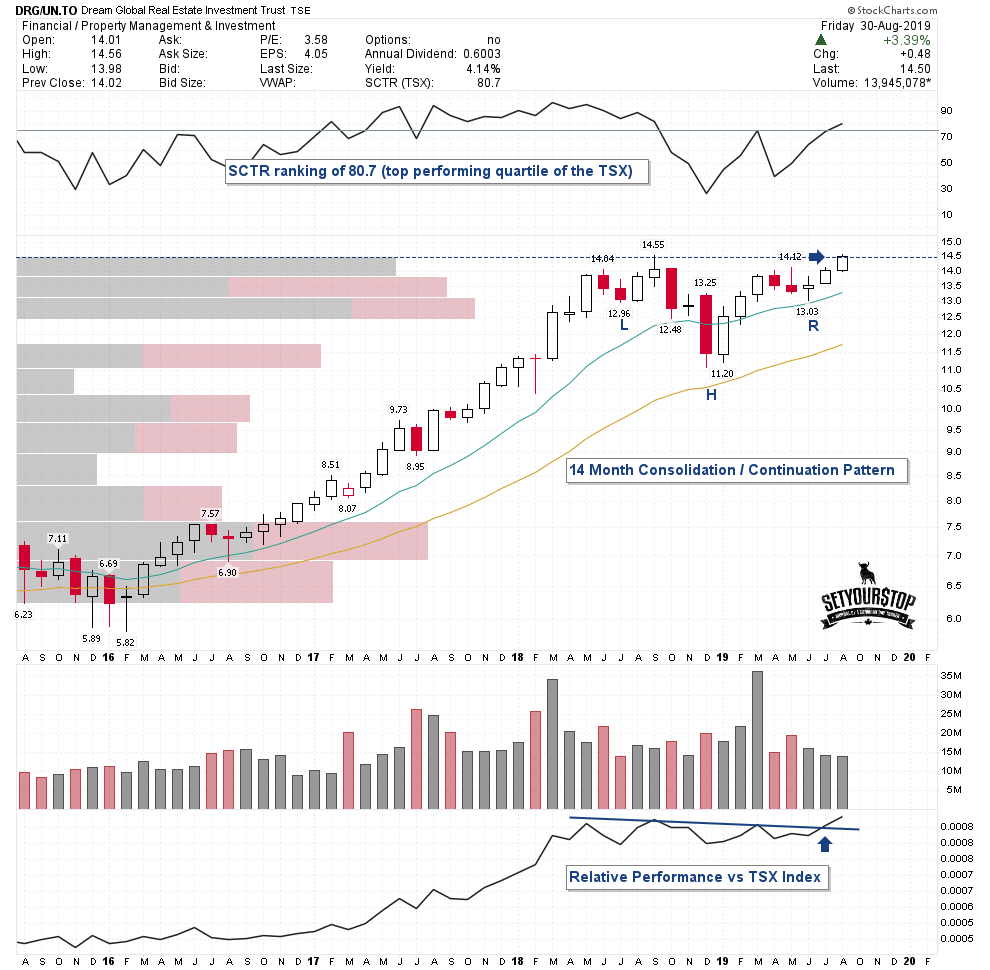

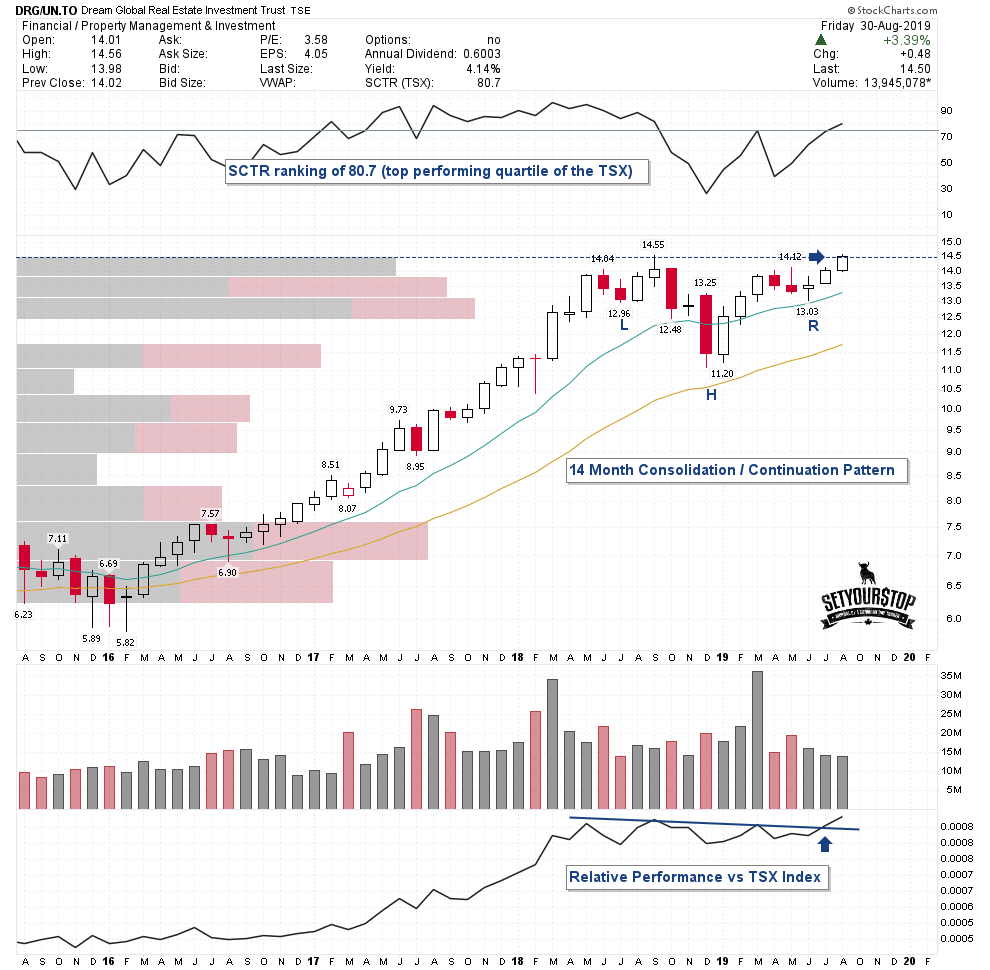

Dream Global REIT (TSX:DRG.UN) touched a new all time high as price action started to push higher from a 14 month inverse head and shoulders consolidation/continuation pattern as relative performance vs the TSX index pushed to a new 52 week high (suggesting a continuation of the prevailing uptrend is now underway).

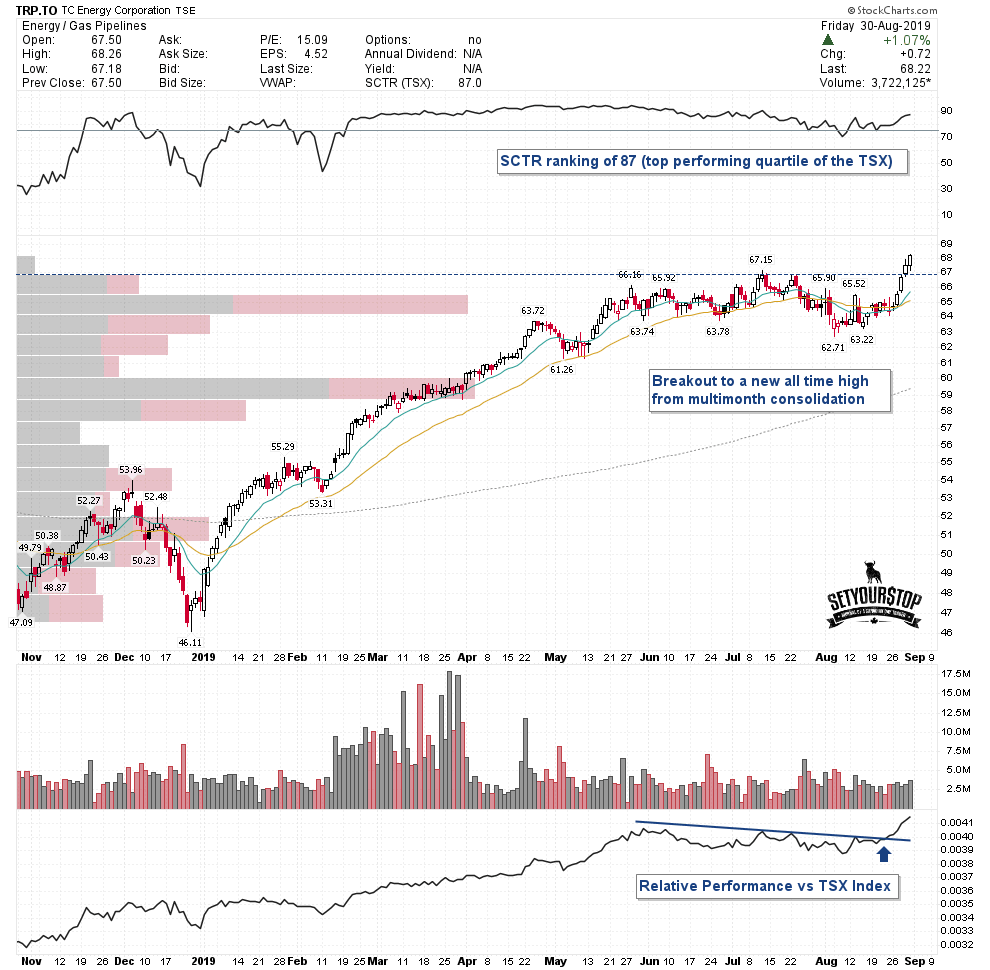

TC Energy (TSX:TRP) has just issued a momentum buy signal after breaking out from a basing pattern to new all-time highs in both price and relative performance vs the TSX index (suggesting a continuation of the prevailing uptrend). Even though TRP is energy-related, pipeline companies fall under the utility category.

The author of the article does not own any positions in the above-mentioned securities at the time of publishing.

Have a question? Sign up for free to ask 5i's Research Team your top question, plus get instant access to Canada's top stocks, three model portfolios, and over 75,369 answered investments questions. Get your free 5i Research Trial here.

Comments

Login to post a comment.