5i Research Weekly Rockets and Duds

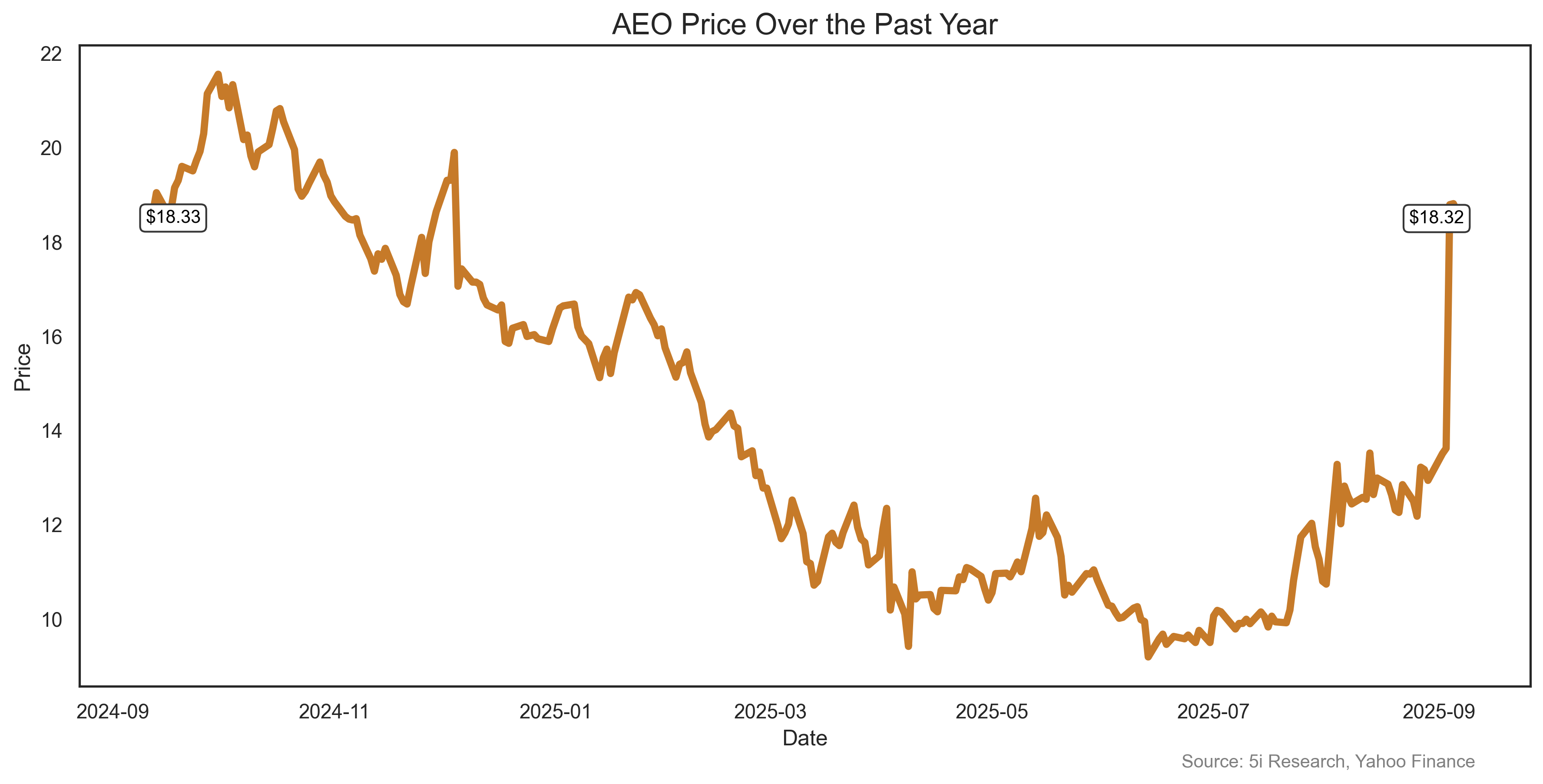

Moviegoers can debate whether Sydney Sweeney has any acting attributes. Who cares? She has, em, other attributes. Regardless, her jean ad campaign has, em, excited investors, and the stock rose 45% last week on news that second-quarter sales were better than expected, boosted by Ms Sweeney's ad campaign. The company noted, 'in just six weeks, the campaign has generated unprecedented new customer acquisitions'. AEO shares had their biggest intraday gain, ever, on Thursday.

Moviegoers can debate whether Sydney Sweeney has any acting attributes. Who cares? She has, em, other attributes. Regardless, her jean ad campaign has, em, excited investors, and the stock rose 45% last week on news that second-quarter sales were better than expected, boosted by Ms Sweeney's ad campaign. The company noted, 'in just six weeks, the campaign has generated unprecedented new customer acquisitions'. AEO shares had their biggest intraday gain, ever, on Thursday.

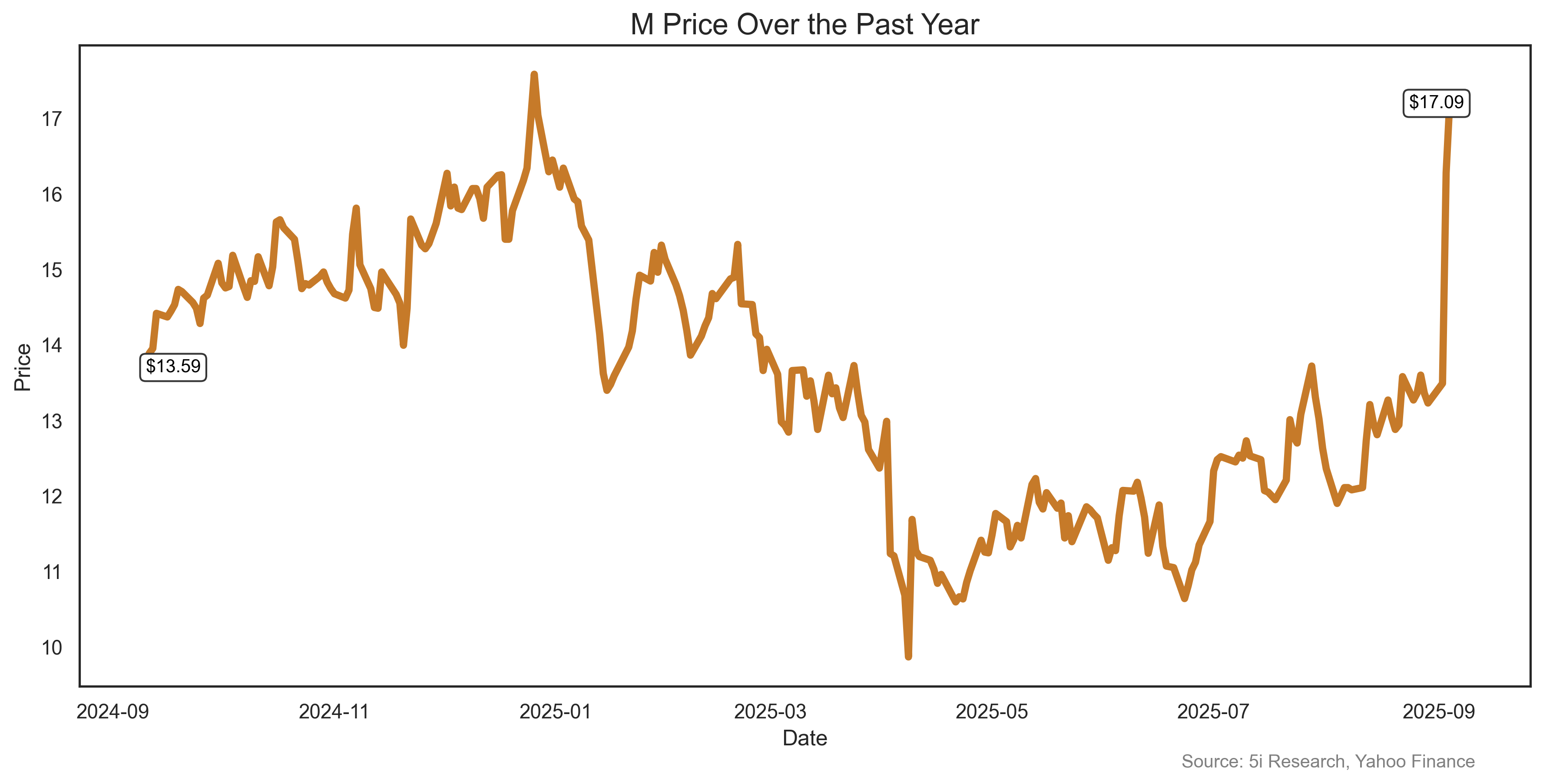

Aren't department stores dead? Well, with the demise of Hudson's Bay maybe it is just a Canadian thing. Macy's, with better than expected sales in the second quarter and with its 'Bold New Chapter' strategy, rose 31% last week as it also raised its fiscal outlook. Who would have thought its plan to close 150 stores would be so good? Maybe the stock would soar even higher if it closed ALL of its stores. Well, maybe not.

Aren't department stores dead? Well, with the demise of Hudson's Bay maybe it is just a Canadian thing. Macy's, with better than expected sales in the second quarter and with its 'Bold New Chapter' strategy, rose 31% last week as it also raised its fiscal outlook. Who would have thought its plan to close 150 stores would be so good? Maybe the stock would soar even higher if it closed ALL of its stores. Well, maybe not.

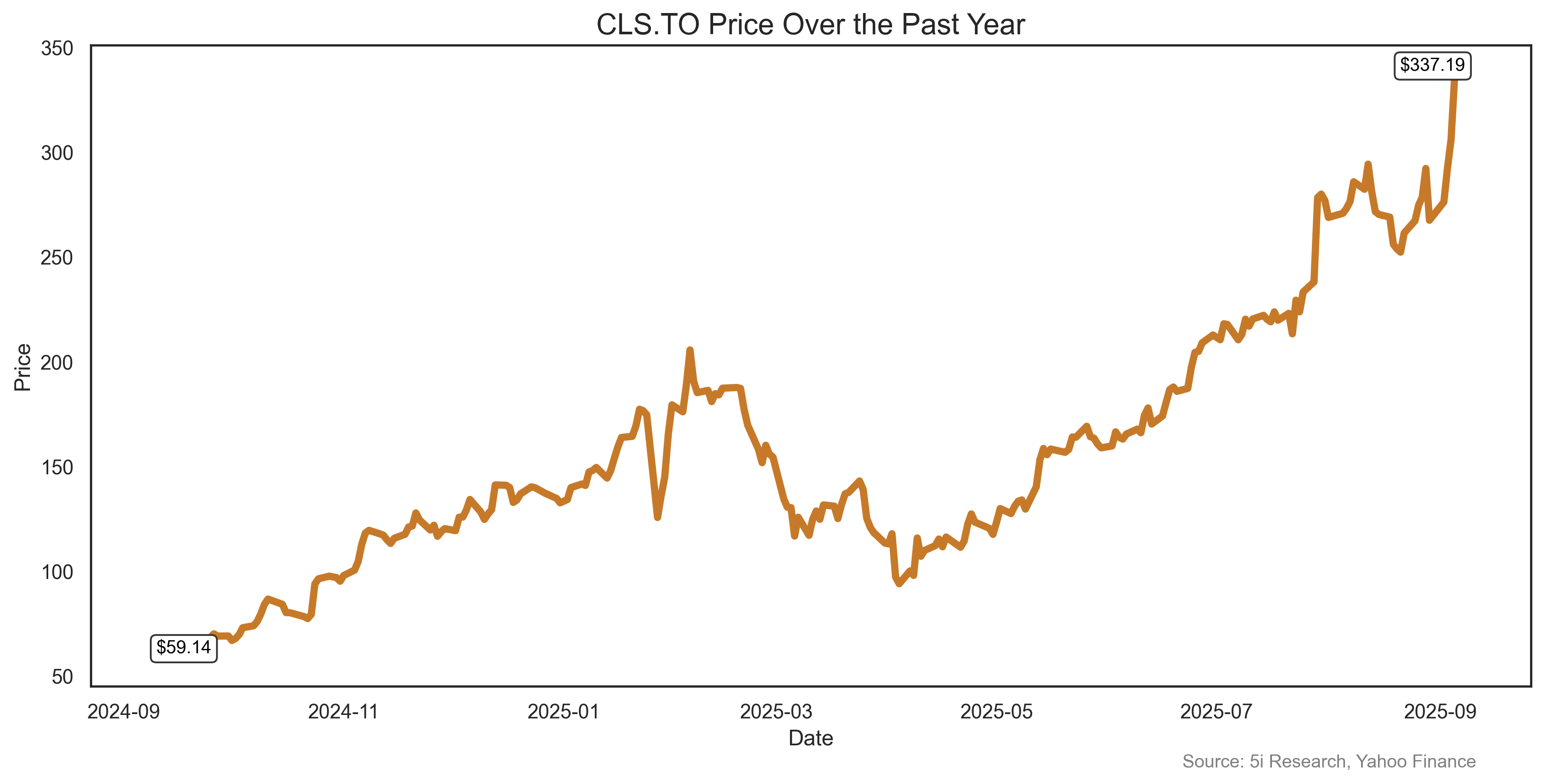

Celistica's massive transformation continues. For years, if not decades, no one cared about this stock, which was spun out of IBM decades ago. But now, with a 26% gain last week, the stock is up nearly 100-fold since the dark days of the early Covid pandemic. It is quickly becoming one of Canada's largest tech companies. Last week's move came on the news that OpenAI was expanding with Broadcom, and Celestica is a supplier to broadcom. We are not sure how long this AI boom is going to last, but Celestica is certainly making the hay while the sun shines.

Celistica's massive transformation continues. For years, if not decades, no one cared about this stock, which was spun out of IBM decades ago. But now, with a 26% gain last week, the stock is up nearly 100-fold since the dark days of the early Covid pandemic. It is quickly becoming one of Canada's largest tech companies. Last week's move came on the news that OpenAI was expanding with Broadcom, and Celestica is a supplier to broadcom. We are not sure how long this AI boom is going to last, but Celestica is certainly making the hay while the sun shines.

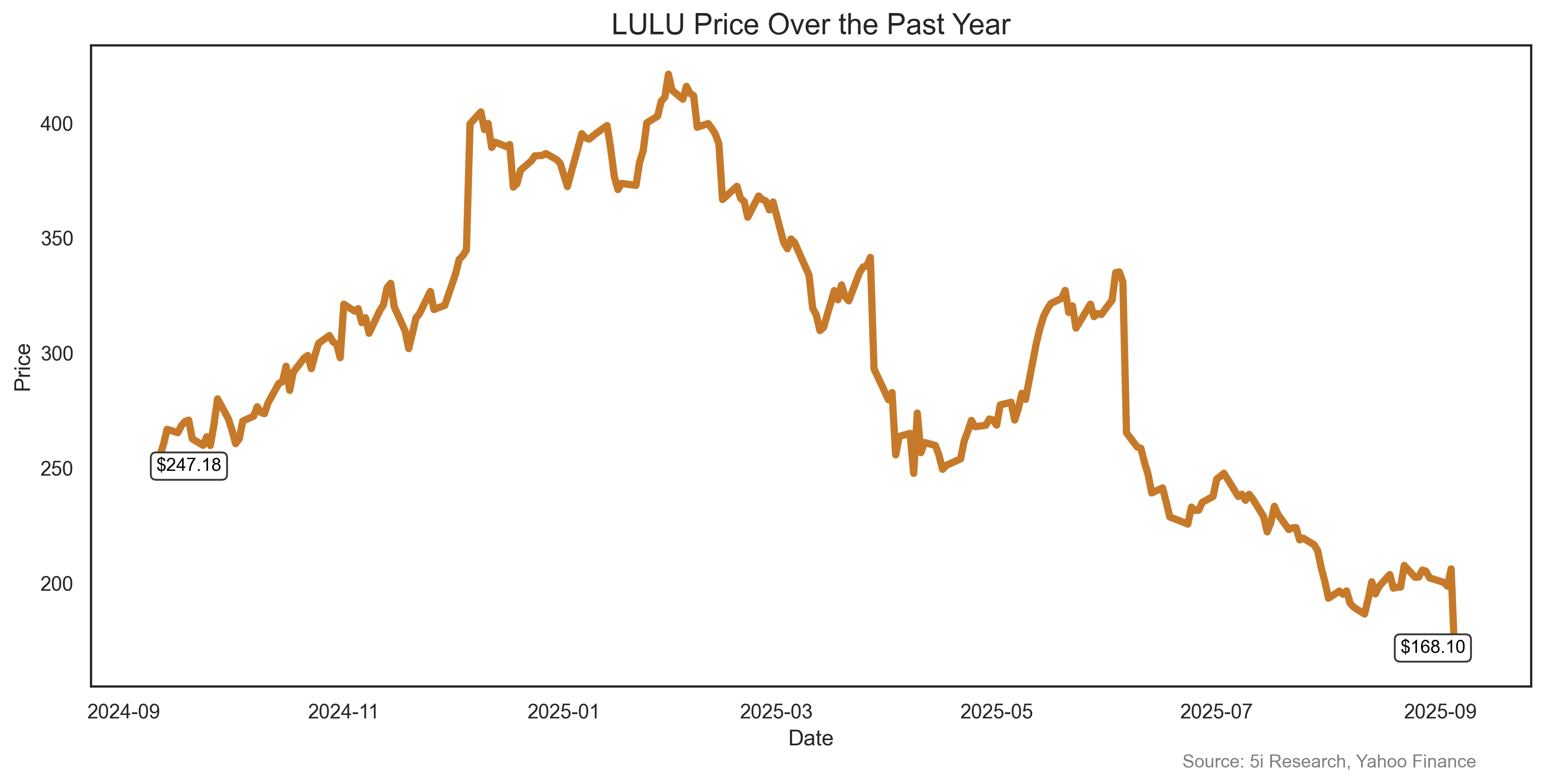

Quiz: Lululemon fell 17% last week because: a) It re-introduced those 'see through' yoga pants. b) It decided to go 'AI' and change its name to AI Lululemon.AI. c) It reported yet another weak sales quarter and outlook, and the stock hit a five year low. Answer: (c).

Quiz: Lululemon fell 17% last week because: a) It re-introduced those 'see through' yoga pants. b) It decided to go 'AI' and change its name to AI Lululemon.AI. c) It reported yet another weak sales quarter and outlook, and the stock hit a five year low. Answer: (c).

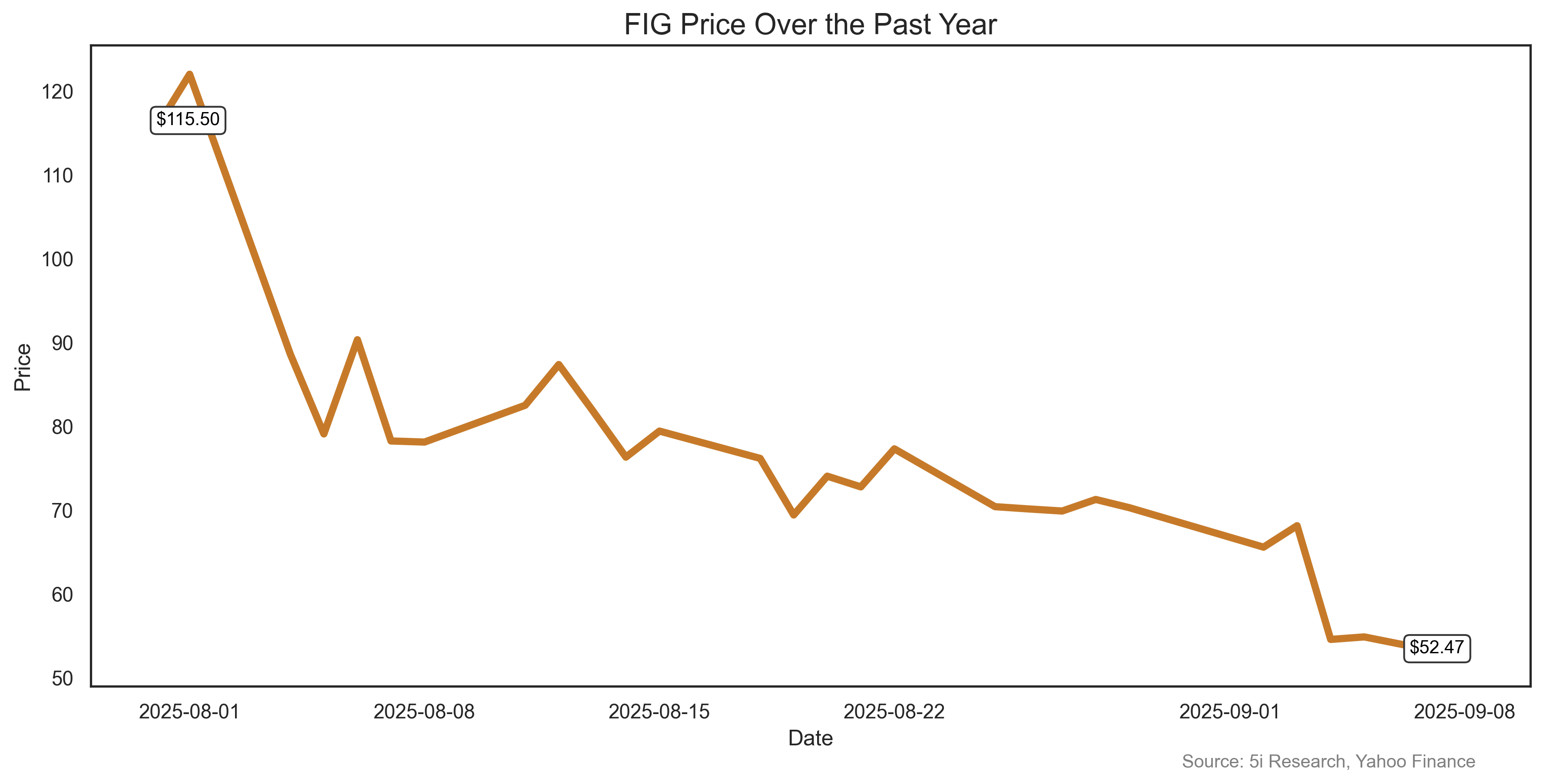

You know that feeling you get when you 'miss' a hot Initial Public Offering (IPO). Those dreams of wealth vanished simply because you could not get on the Presidents' buying list, or your broker just doesn't like you. Well, fear not, my investment friends! Just wait a few months and then say, 'I told you it was no good!'. Figma shares fell 22% last week, on news of a disappointing sales outlook following its July IPO. Investors simply, well, hate it when a company guides lower-than-expected after raising billions in brand new capital. FIG shares, while still up from their IPO price, are down 62% from their peak valuation set just last month.

You know that feeling you get when you 'miss' a hot Initial Public Offering (IPO). Those dreams of wealth vanished simply because you could not get on the Presidents' buying list, or your broker just doesn't like you. Well, fear not, my investment friends! Just wait a few months and then say, 'I told you it was no good!'. Figma shares fell 22% last week, on news of a disappointing sales outlook following its July IPO. Investors simply, well, hate it when a company guides lower-than-expected after raising billions in brand new capital. FIG shares, while still up from their IPO price, are down 62% from their peak valuation set just last month.

Take Care,

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Analysts of 5i Research responsible for this report have a financial or other interest in LULU. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.