5i Research Weekly Rockets and Duds

It was a (US) Thanksgiving Miracle last week in the stock market, as the S&P 500 went up five days in a row and managed to eke out a small gain for the month of November, which had seen horrible losses earlier in the month. Even the TSX hit a record high on the back of strong gold/silver prices and a tech share rebound. Here are the big movers we noticed:

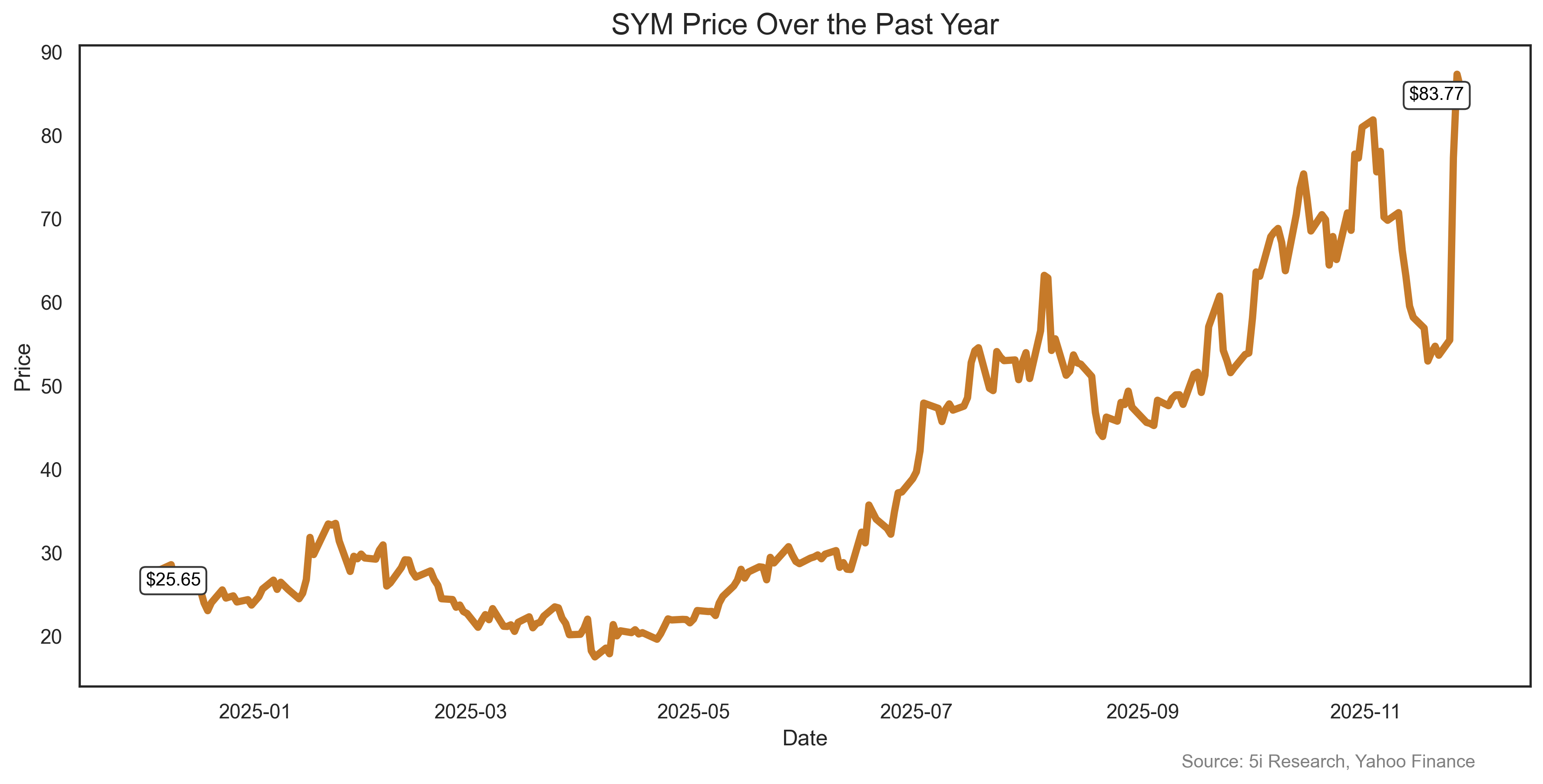

Symbotic Inc. SYM

Investing should be so easy, especially in hindsight! SYM is a company involved in robotics, AI and automation. Do you think it had a good fiscal fourth quarter? It certainly did. It also gave a strong outlook and announced its first customer in the healthcare sector. Shares rose 56% last week and are now up 253% this year. And it is NOT a small company, at a hefty $50 billion market cap. GO ROBOTS!

Investing should be so easy, especially in hindsight! SYM is a company involved in robotics, AI and automation. Do you think it had a good fiscal fourth quarter? It certainly did. It also gave a strong outlook and announced its first customer in the healthcare sector. Shares rose 56% last week and are now up 253% this year. And it is NOT a small company, at a hefty $50 billion market cap. GO ROBOTS!

Symbotic Inc. SYM

Investing should be so easy, especially in hindsight! SYM is a company involved in robotics, AI and automation. Do you think it had a good fiscal fourth quarter? It certainly did. It also gave a strong outlook and announced its first customer in the healthcare sector. Shares rose 56% last week and are now up 253% this year. And it is NOT a small company, at a hefty $50 billion market cap. GO ROBOTS!

Investing should be so easy, especially in hindsight! SYM is a company involved in robotics, AI and automation. Do you think it had a good fiscal fourth quarter? It certainly did. It also gave a strong outlook and announced its first customer in the healthcare sector. Shares rose 56% last week and are now up 253% this year. And it is NOT a small company, at a hefty $50 billion market cap. GO ROBOTS!

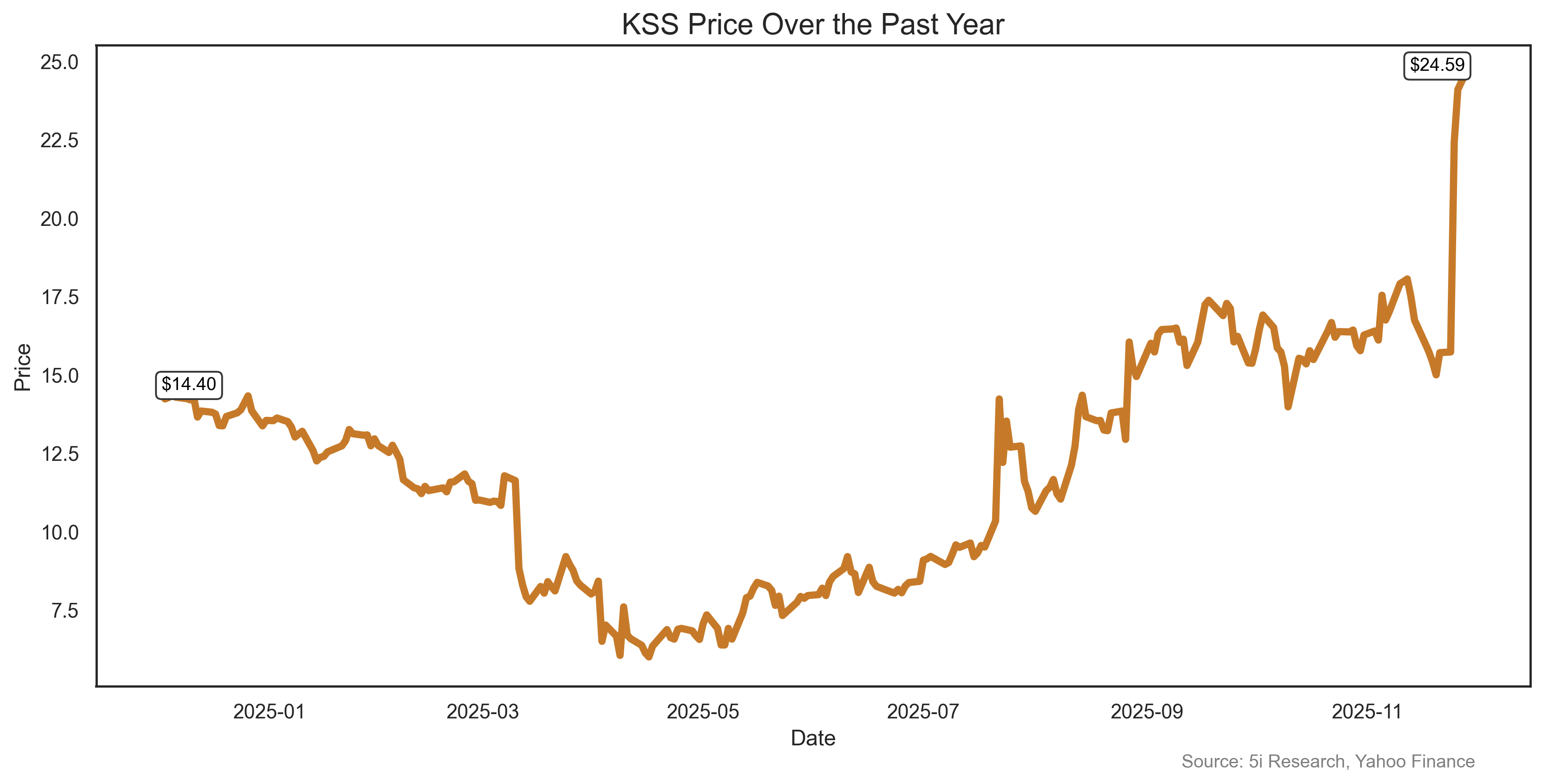

Kohl's Corporation KSS

Short sellers of Kohl's may be needing, um, some new pants.There is a 26% short interest in the company, but shares soared 56% last week as the company raised its sales guidance for the second time this year. A retailer of national brand clothing, KSS is bucking the trend of a US retail sales slowdown. Well, not really: sales are still expected to decline 3.5% to 4% for the year, but that is much better than what investors--and the short sellers--expected. Look for a gain in sales of undies next quarter as the short sellers go shopping and nurse their losses.

Short sellers of Kohl's may be needing, um, some new pants.There is a 26% short interest in the company, but shares soared 56% last week as the company raised its sales guidance for the second time this year. A retailer of national brand clothing, KSS is bucking the trend of a US retail sales slowdown. Well, not really: sales are still expected to decline 3.5% to 4% for the year, but that is much better than what investors--and the short sellers--expected. Look for a gain in sales of undies next quarter as the short sellers go shopping and nurse their losses.

Short sellers of Kohl's may be needing, um, some new pants.There is a 26% short interest in the company, but shares soared 56% last week as the company raised its sales guidance for the second time this year. A retailer of national brand clothing, KSS is bucking the trend of a US retail sales slowdown. Well, not really: sales are still expected to decline 3.5% to 4% for the year, but that is much better than what investors--and the short sellers--expected. Look for a gain in sales of undies next quarter as the short sellers go shopping and nurse their losses.

Short sellers of Kohl's may be needing, um, some new pants.There is a 26% short interest in the company, but shares soared 56% last week as the company raised its sales guidance for the second time this year. A retailer of national brand clothing, KSS is bucking the trend of a US retail sales slowdown. Well, not really: sales are still expected to decline 3.5% to 4% for the year, but that is much better than what investors--and the short sellers--expected. Look for a gain in sales of undies next quarter as the short sellers go shopping and nurse their losses.

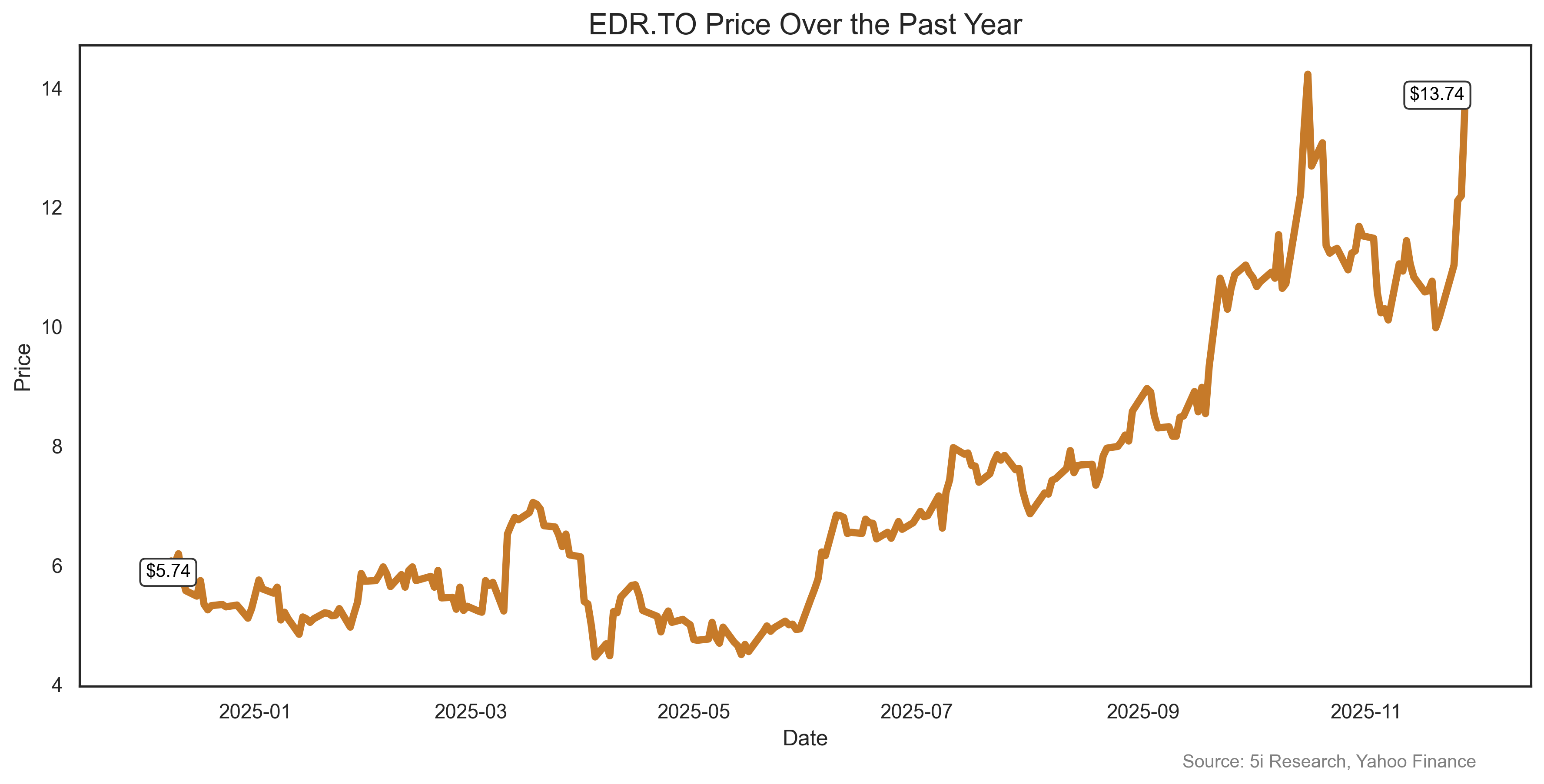

Endeavour Silver EDR

Endeavour had some news last week, selling an asset for $50 million. But that's not what moved the stock. A break-out in the price of silver, hitting all-time highs, caused most of the excitement. Shares rose 35% last week, and are now up 161% for the year. The company produced 3.04 million ounces of silver last quarter, up 88%. Silver, of course, is usually reserved for second place. But EDR clearly deserves a gold for this performance.

Endeavour had some news last week, selling an asset for $50 million. But that's not what moved the stock. A break-out in the price of silver, hitting all-time highs, caused most of the excitement. Shares rose 35% last week, and are now up 161% for the year. The company produced 3.04 million ounces of silver last quarter, up 88%. Silver, of course, is usually reserved for second place. But EDR clearly deserves a gold for this performance.

Endeavour had some news last week, selling an asset for $50 million. But that's not what moved the stock. A break-out in the price of silver, hitting all-time highs, caused most of the excitement. Shares rose 35% last week, and are now up 161% for the year. The company produced 3.04 million ounces of silver last quarter, up 88%. Silver, of course, is usually reserved for second place. But EDR clearly deserves a gold for this performance.

Endeavour had some news last week, selling an asset for $50 million. But that's not what moved the stock. A break-out in the price of silver, hitting all-time highs, caused most of the excitement. Shares rose 35% last week, and are now up 161% for the year. The company produced 3.04 million ounces of silver last quarter, up 88%. Silver, of course, is usually reserved for second place. But EDR clearly deserves a gold for this performance.

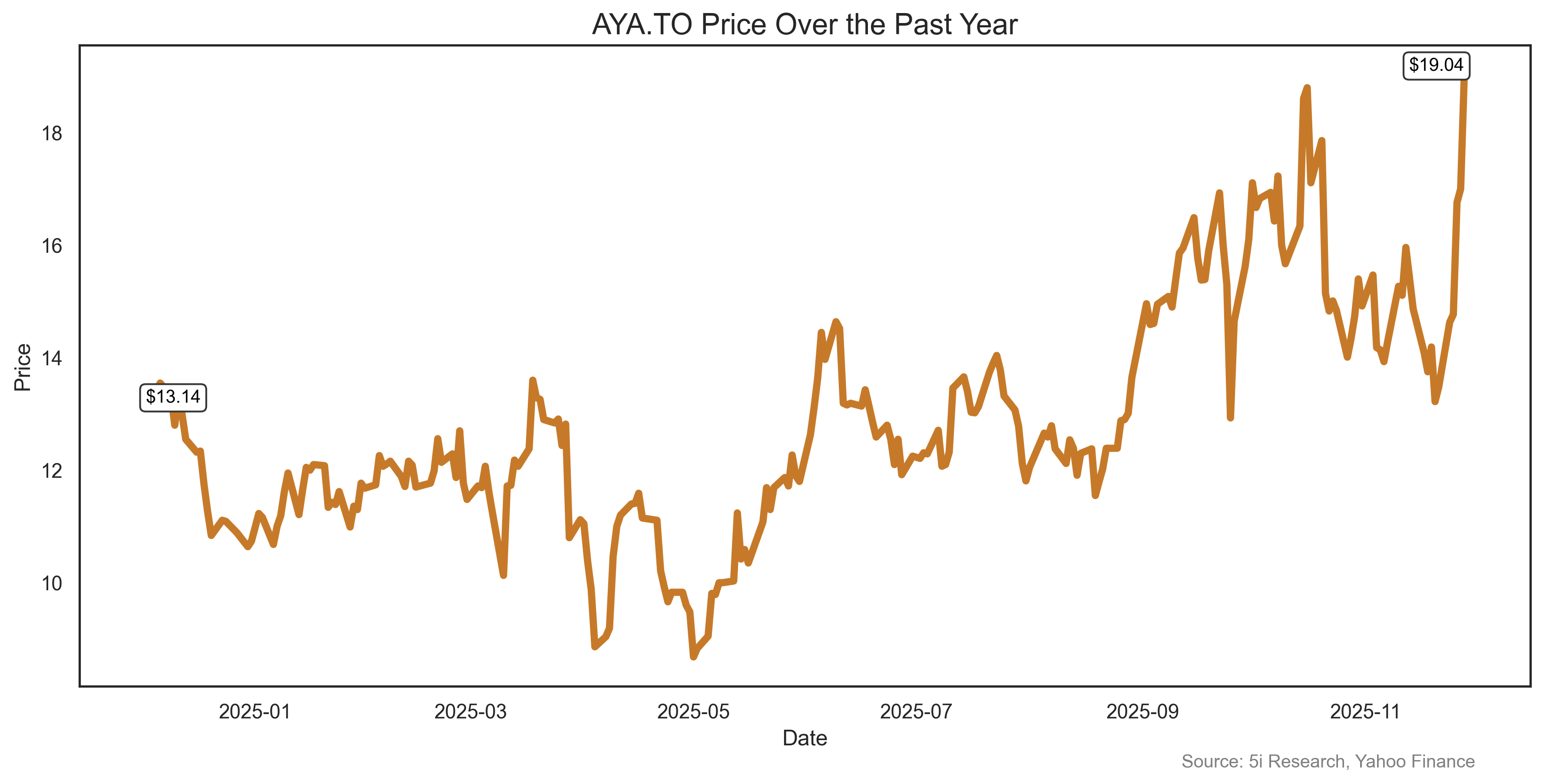

Aya Gold & Silver Inc. AYA

Not to be outdone, AYA, another Canadian precious metals company, rose 41% last week. It too joined the silver party, as the commodity is now up 95% for the year, its best performance since 1979. AYA reported strong intercepts at its Boumadine property in Morocco to keep the party going. Aya? More like Ye-haw!

Not to be outdone, AYA, another Canadian precious metals company, rose 41% last week. It too joined the silver party, as the commodity is now up 95% for the year, its best performance since 1979. AYA reported strong intercepts at its Boumadine property in Morocco to keep the party going. Aya? More like Ye-haw!

Not to be outdone, AYA, another Canadian precious metals company, rose 41% last week. It too joined the silver party, as the commodity is now up 95% for the year, its best performance since 1979. AYA reported strong intercepts at its Boumadine property in Morocco to keep the party going. Aya? More like Ye-haw!

Not to be outdone, AYA, another Canadian precious metals company, rose 41% last week. It too joined the silver party, as the commodity is now up 95% for the year, its best performance since 1979. AYA reported strong intercepts at its Boumadine property in Morocco to keep the party going. Aya? More like Ye-haw!

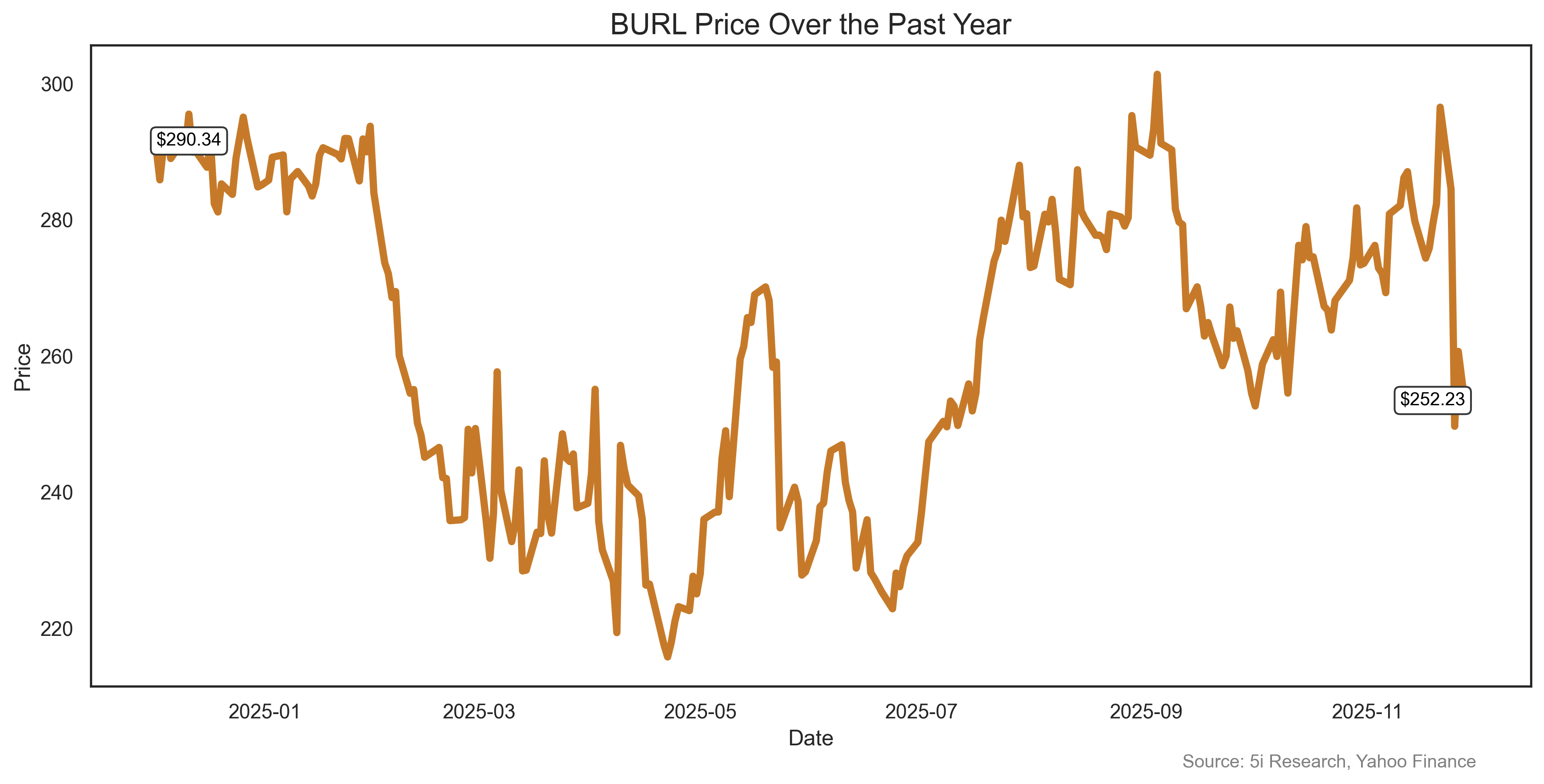

Burlington Stores Inc. BURL

Usually in our Rockets and Duds we get lots of stocks which decline more than 20% for our report. Last week, for our screen of the 'DUDS' we found a total of ZERO shares with 20% or more loss on the week. BURL was about the best we can do, with a decline of 15% last week. Its third-quarter comparable sales rose 1%, but that missed expectations. It also offered a weak outlook. We guess everyone was shopping at Kohl's instead, obviously.

Usually in our Rockets and Duds we get lots of stocks which decline more than 20% for our report. Last week, for our screen of the 'DUDS' we found a total of ZERO shares with 20% or more loss on the week. BURL was about the best we can do, with a decline of 15% last week. Its third-quarter comparable sales rose 1%, but that missed expectations. It also offered a weak outlook. We guess everyone was shopping at Kohl's instead, obviously.

Usually in our Rockets and Duds we get lots of stocks which decline more than 20% for our report. Last week, for our screen of the 'DUDS' we found a total of ZERO shares with 20% or more loss on the week. BURL was about the best we can do, with a decline of 15% last week. Its third-quarter comparable sales rose 1%, but that missed expectations. It also offered a weak outlook. We guess everyone was shopping at Kohl's instead, obviously.

Usually in our Rockets and Duds we get lots of stocks which decline more than 20% for our report. Last week, for our screen of the 'DUDS' we found a total of ZERO shares with 20% or more loss on the week. BURL was about the best we can do, with a decline of 15% last week. Its third-quarter comparable sales rose 1%, but that missed expectations. It also offered a weak outlook. We guess everyone was shopping at Kohl's instead, obviously.

Take Care,

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Analysts of 5i Research responsible for this report do not have a financial or other interest securities mentioned. The i2i Fund does not have a financial or other interest securities mentioned.

Comments

Login to post a comment.