5i Research Weekly Rockets and Duds

This week's 5i Research Rockets

and Duds

and Duds

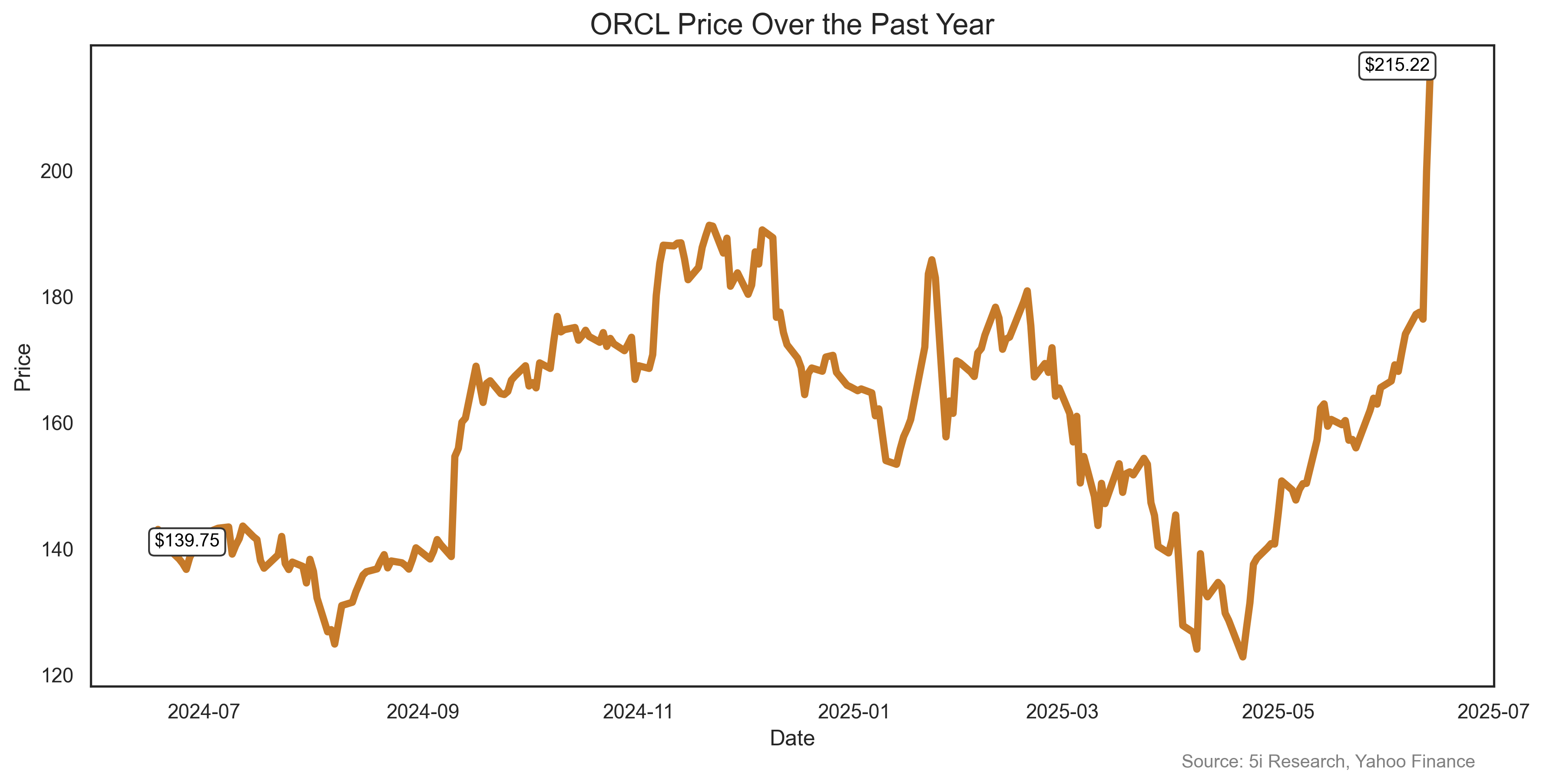

An oracle is a person or thing considered to provide insight, wise counsel or prophetic predictions, most notably including precognition of the future, inspired by deities. If done through occultic means, it is a form of divination. Oracle the company predicted the future last week and the stock rose 24% as it raised its guidance on the back of big momentum in its cloud business. Not bad considering the size of the company, at $603 billion market cap. Maybe Oracle should get into the stock picking business with such foresight.

An oracle is a person or thing considered to provide insight, wise counsel or prophetic predictions, most notably including precognition of the future, inspired by deities. If done through occultic means, it is a form of divination. Oracle the company predicted the future last week and the stock rose 24% as it raised its guidance on the back of big momentum in its cloud business. Not bad considering the size of the company, at $603 billion market cap. Maybe Oracle should get into the stock picking business with such foresight.

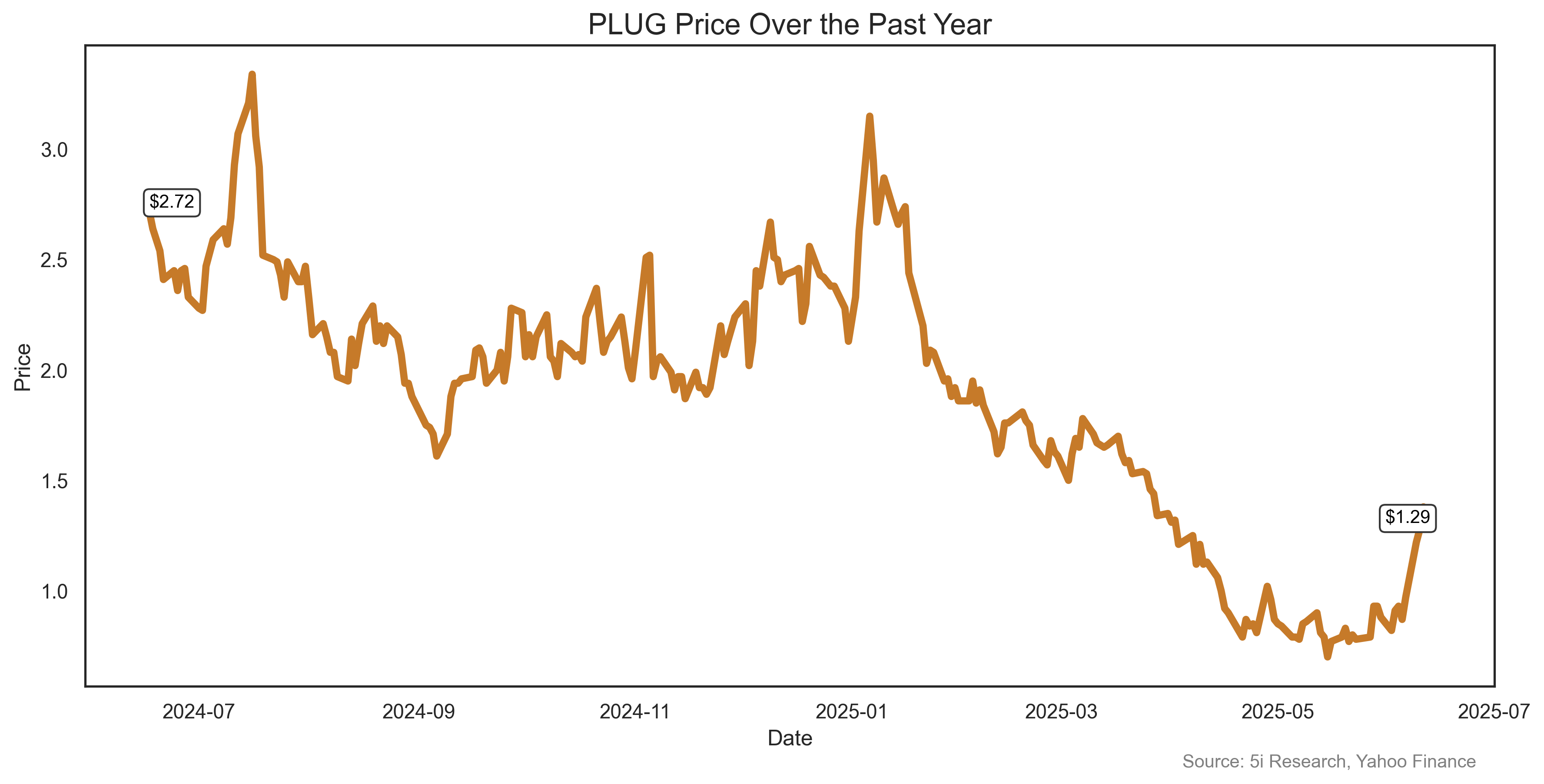

While PLUG makes the Rockets list this week, don't get too excited. Shares were $73 each four years ago, and even with last week's 33% pop they trade at a paltry $1.29 today. PLUG shares rose on the news of the CFO buying 650,000 shares, and the announcement of a new project in Uzbekistan.

While PLUG makes the Rockets list this week, don't get too excited. Shares were $73 each four years ago, and even with last week's 33% pop they trade at a paltry $1.29 today. PLUG shares rose on the news of the CFO buying 650,000 shares, and the announcement of a new project in Uzbekistan.

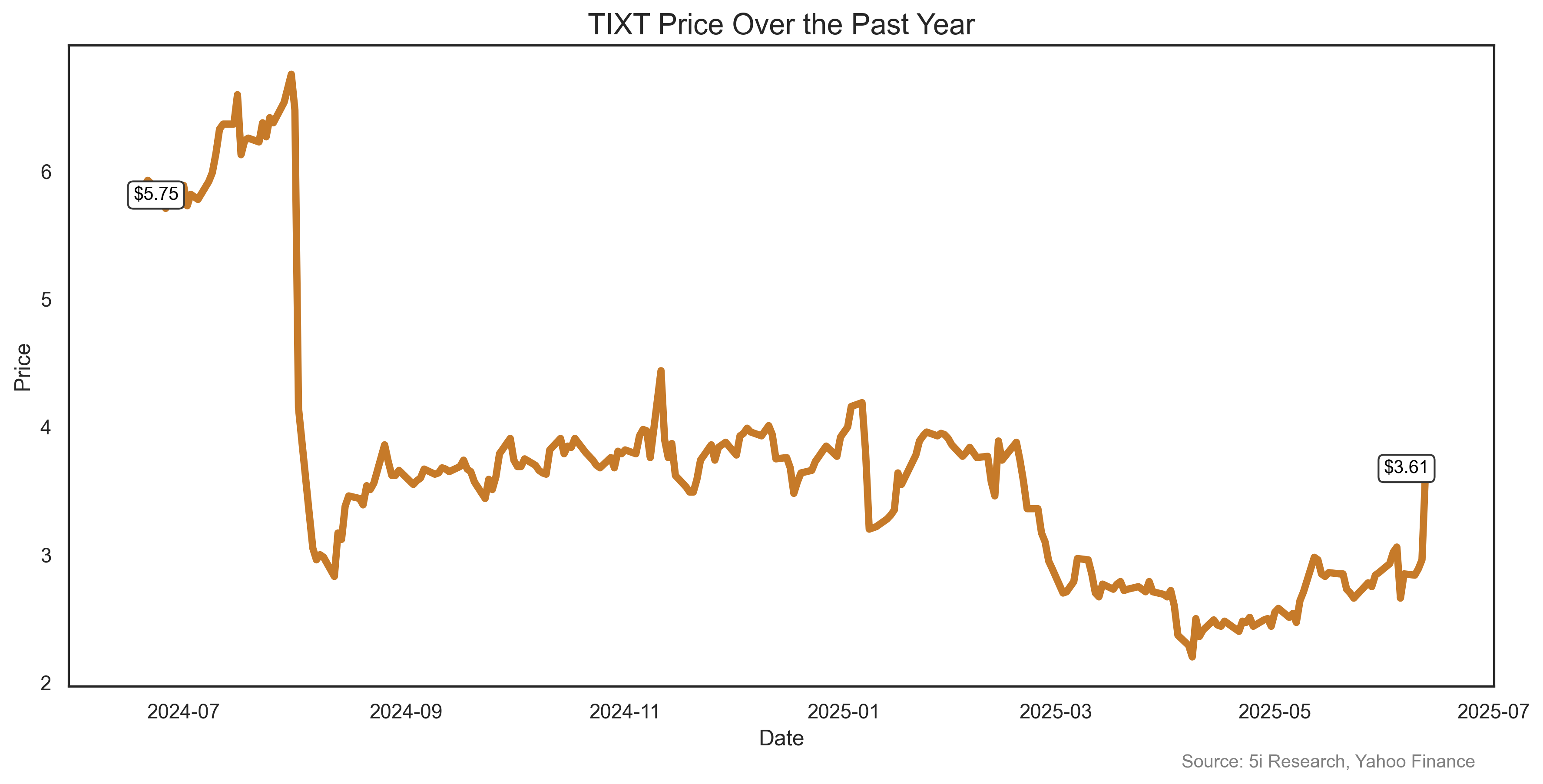

Wow, maybe Telus Corp., the boring telecommunications company, should get into the more-exciting and more-profitable short selling business instead. Telus, the parent company, spun off part of Telus International, its digital tech subsidiary, in 2021, selling shares for $25 US$. Last week, Telus announced a $500 million buyback of its subsidiary, at $3.40 US$. So, Telus essentially short-sold its own subsidiary. Long suffering Telus International shareholders saw a 25% gain in their shares last week, but just might be feeling a little hood-winked here as well.

Wow, maybe Telus Corp., the boring telecommunications company, should get into the more-exciting and more-profitable short selling business instead. Telus, the parent company, spun off part of Telus International, its digital tech subsidiary, in 2021, selling shares for $25 US$. Last week, Telus announced a $500 million buyback of its subsidiary, at $3.40 US$. So, Telus essentially short-sold its own subsidiary. Long suffering Telus International shareholders saw a 25% gain in their shares last week, but just might be feeling a little hood-winked here as well.

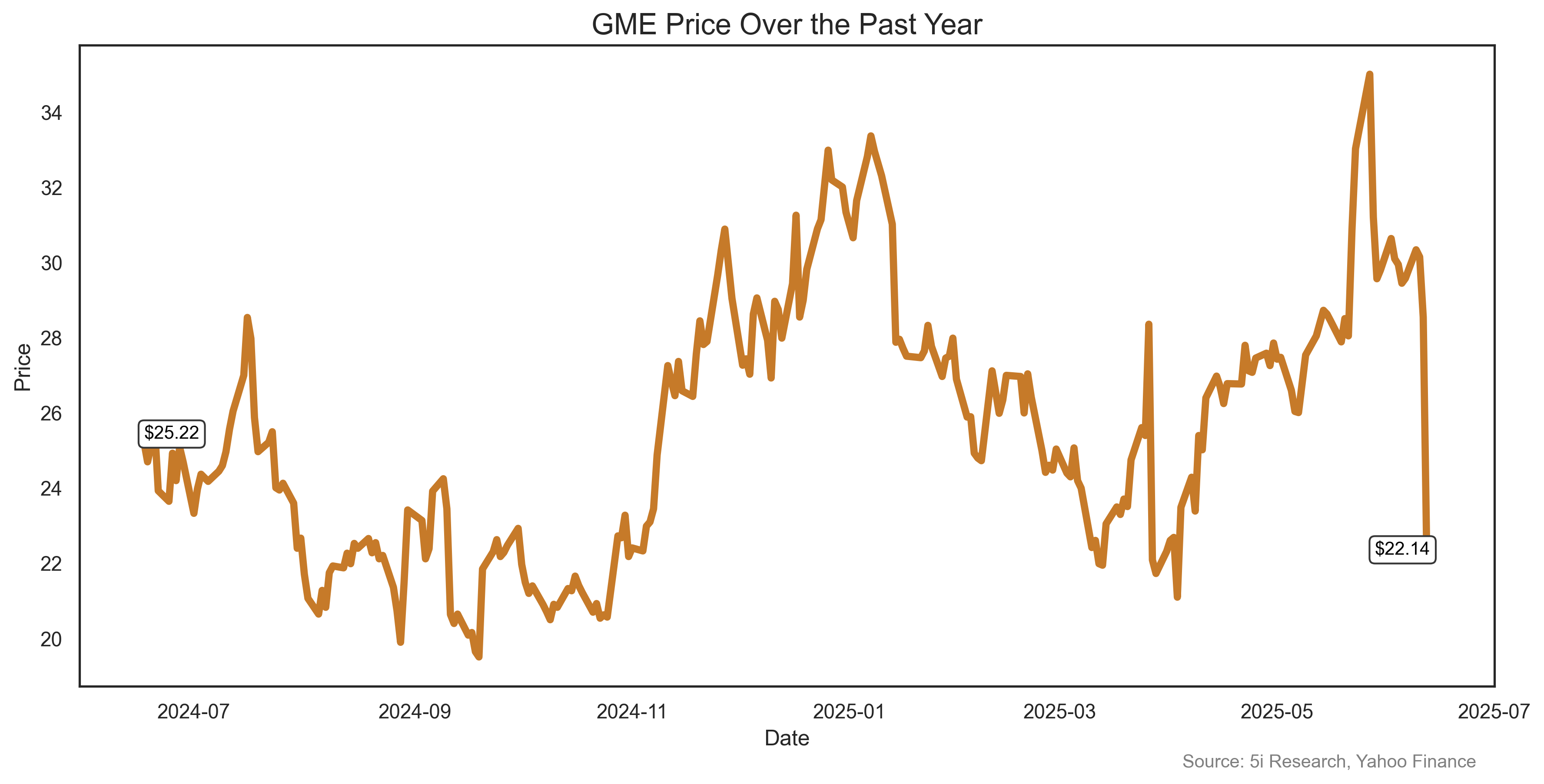

Yes, Gamestop is still around. The king of the Meme stocks, its core business still sucks, as it reported disappointing sales and earnings last week. But no matter, it is becoming a bitcoin company instead! Shares fell 25% on news of a giant $2 billion issue of convertible notes, with the proceeds likely to go towards the purchase of more bitcoin for the company's treasury. Time will tell if there will be a sequel to the movie 'Dumb Money' about GameStop short-sellers. Working title: 'Dumber Money'.

Yes, Gamestop is still around. The king of the Meme stocks, its core business still sucks, as it reported disappointing sales and earnings last week. But no matter, it is becoming a bitcoin company instead! Shares fell 25% on news of a giant $2 billion issue of convertible notes, with the proceeds likely to go towards the purchase of more bitcoin for the company's treasury. Time will tell if there will be a sequel to the movie 'Dumb Money' about GameStop short-sellers. Working title: 'Dumber Money'.  Viasat Inc. VSAT

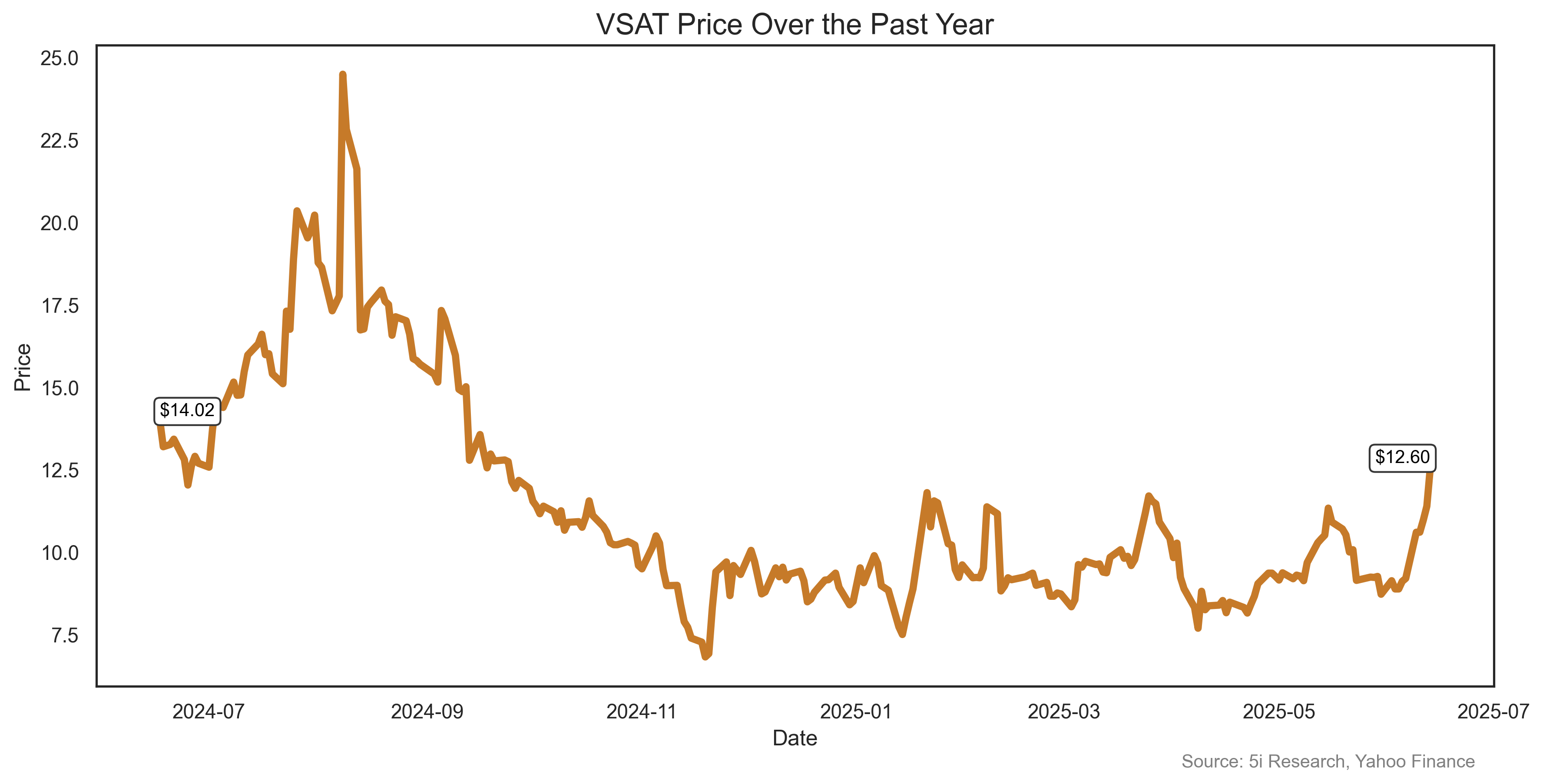

Viasat Inc. VSAT

Question: How to get your stock to rise 37% in a week? Answer: Get $568 million from a customer who is in bankruptcy. That's exactly what happened to VSAT last week, after Ligado, a satellite communications company that declared bankruptcy in January, The two companies, along with AST Space Mobile (ASTS) reached an agreement where ASTS will pay Ligado more than $500 million, and then Ligado will settle with Viasat. It is a long complicated story, but at the end of it all Viasat gets $568 million, a big chunk of money considering its $1.5 billion market cap.

Question: How to get your stock to rise 37% in a week? Answer: Get $568 million from a customer who is in bankruptcy. That's exactly what happened to VSAT last week, after Ligado, a satellite communications company that declared bankruptcy in January, The two companies, along with AST Space Mobile (ASTS) reached an agreement where ASTS will pay Ligado more than $500 million, and then Ligado will settle with Viasat. It is a long complicated story, but at the end of it all Viasat gets $568 million, a big chunk of money considering its $1.5 billion market cap. Take Care,

Take Care,

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

Comments

Login to post a comment.