If you have ever bought a house, you know that location can be everything. Investments are not that different and what investment goes into which account can have a meaningful impact on your returns. This discussion, more formally known as “asset location”, will be the focus of this blog, as we frequently receive questions from 5i members on the topic.

It is important to understand that the following are general guidelines only and do not constitute a financial plan and/or tax analysis. Determining optimal asset location for a large portfolio with many accounts is a complicated task and can depend on specific situations.

High Growth Equity: Hindsight is 20-20.

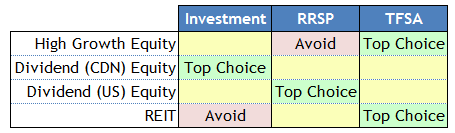

Generally, we think the majority of these stocks should find their way into the TFSA. Profits on the stock will not incur capital gains tax when realized, nor will there be tax on the appreciated capital when withdrawn from the account. The RRSP is less ideal as gains withdrawn from the account are treated as ordinary income. So when you withdraw the resulting capital, not only do your ‘big wins’ get taxed in the first place (unlike a TFSA), they are also more punitive from an income vs. capital gains tax perspective, the latter which would occur in an typical cash account.

Of course we would all love to shelter ‘big wins’ on the next Kinaxis (KXS). However, hindsight is everything here. With the prospect of higher returns of course come higher risks and the potential to incur capital losses. While holding a large loss in a TFSA can be frustrating, we find the idea of holding a stock in a taxable account on the premise of harvesting capital losses to be a little contradictory. Not every stock will work out, but planning or expecting a material loss on it seems odd to us, unless you have run out of room in the TFSA. Then we would look to the cash account.

Dividend Equity: Never forget where you came from.

Most investors understand that Canadian dividends are tax efficient investments and are the first asset class to be held in the cash account, if necessary. A distinction should be made between higher/lower yielding equity. The telecommunication and utility sectors are often associated with more generous payouts than other dividend sectors. For example, while Telus (T) and Loblaw (L) are both defensive in nature, one may wish to shelter the additional 260 basis points (bps) of yield on T. This thought can even be extended to GICs. The tax bill on a high-yield equity like Gibson Energy (GEI), just shy of an 8.0% yield, is probably higher than a 5-year GIC ladder in this rate environment.

Dividends outside of Canada do not receive the same preferential treatment and are taxed as ordinary income in a cash account, just like bond interest. In addition to Canadian tax, some countries impose a withholding tax on dividends paid to foreign investors. For example, dividends from U.S. stocks are subject to a levy of 15%. Canada has a tax treaty with the US (and other countries) whereby the withholding tax is exempted if the position is held in an RRSP. Therefore, an RRSP is an ideal account for US dividend equity, which should be a priority over Canadian dividend equity in an RRSP. The next best place is likely the TFSA. Here, there is no tax treaty on foreign dividends or an ability to claim a tax credit (unlike a cash account). Many investors are quick to assume this makes the TFSA a poor choice but keep in mind the dividend itself is tax-free from a Canadian perspective. In a cash account, you will pay foreign withholding taxes but can claim an offsetting credit on your tax return. However, the foreign dividend is fully taxable.

REITs: the Devil is in the details.

While REITs are one of the best friends for the income investor, they are not known for being tax efficient and we think these are best held in a tax-sheltered account. A REIT payout has various components and each REIT is different in respect to the proportion of each component to the total. Where you hold the REIT depends on these underlying pieces. In general, the distribution is a mix of ‘other income’, fully taxable and not eligible for the dividend tax credit, ‘capital gains’ and ‘return of capital’. Return of capital is not taxable but does cause your adjusted cost base to fall. The lower the cost base, the higher the realized capital gain will be when you eventually sell the REIT. A note should be made for REITs that pay almost all of their distribution as return of capital; NWH.UN comes to mind. Here, you would prefer to avoid the RRSP because profits are treated as ordinary income upon withdrawals, where as they would receive the less onerous capital gains tax in a cash account (or avoid tax all together in the TFSA). In general, we would probably prefer REITs to be held in a TFSA to simply avoid the any headaches involved with sorting out the composition of the distributions.

ETFs:

Understanding the best account for your equity ETFs is detailed and will be covered in an issue of the ETF & Mutual Fund Update. Suffice to say, for a given asset class (such as US equity), understanding how the ETF invests in equity – segregated positions or other ETFs – and what exchange the fund trades on are important elements.

It’s Personal

Asset location is not as clear-cut as simple guidelines. Even investors with similar needs from the portfolio can have a different optimal structure. Consider two dividend equity investors choosing between the RRSP or cash account. Both need income from the portfolio ‘today’; however, one is 65 and the other 45. The older investor would likely choose the RRSP since they are forced to take a minimum payment for the eventual RRIF conversion. It makes sense to have income-producing vehicles fund this regular payout. The younger investor would likely choose the cash account, as any early withdrawals from the RRSP to fund the income needs would be penalized.

Another example of food for though would be a young investor who seemingly would be correct in placing a US dividend stocks in an RRSP to avoid withholding tax. However, if he/she can only contribute to either the TFSA or RRSP, one could argue that the TFSA should take priority so that RRSP contribution room is saved to lower higher future taxable income.

We will conclude by saying that asset location is not a concern if all of your capital can be housed in tax-sheltered accounts, especially if your portfolio is relatively small. If you have contribution room left in your RRSP or TFSA it rarely makes sense to hold investments in non-registered (taxable) accounts. As your portfolio grows and you need to start making these asset location decisions, we are reminded of the words from the famous rapper Notorious B.I.G: “Mo money Mo Problems”. Understanding these general guidelines will go a long way but it may be worth consulting a fee-for-service financial advisor to determine the best asset location choices for your scenario.

Comments

Login to post a comment.

Thanks Frank

Thanks.