Winpak's Landscape

Winpak (WPK) is a vertically integrated manufacturer and distributor of packaging materials and related packaging machines. Perishable foods and beverages account for more than 90 percent of sales during 2018 and 2017. Other markets WPK serves include medical, pharmaceutical, personal care, industrial and other consumer goods.

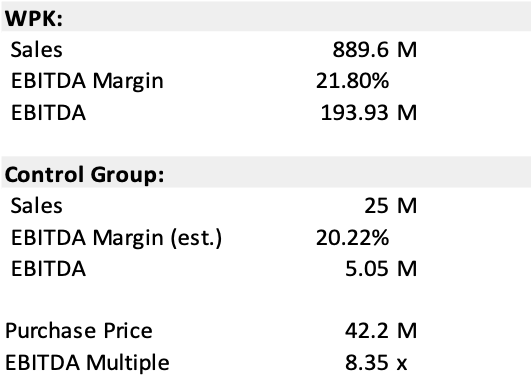

Management had previously identified pharmaceutical as their target market for growth. The recent acquisition of the Control Group, which specializes in printed packaging solutions to the pharmaceutical, healthcare and personal care industries, was well-received by shareholders. The price of US$42.2 million was paid from existing cash balance and compares well to US$25 million in sales. It would be fair to assume that the target operates at margins lower than WPK and that the purchase was made at an EBITDA multiple of 7-8x. WPK has been scouring through the market for a fair-valued acquisition for over a decade. With a strong cash balance of US$395 million at the end of the second quarter and solid cash flows, WPK remains ready for any M&A potential that arises. This vertically integrated acquisition, in our view, should be an accretive adding capacity, plastic die-cut lidding, and digital inspection capabilities, with minimal integration changes. Given that the Control Group’s majority of sales are in pharmaceuticals, this vertical addition to WPK should add roughly between 4-5% to the consolidated business over the next two years.

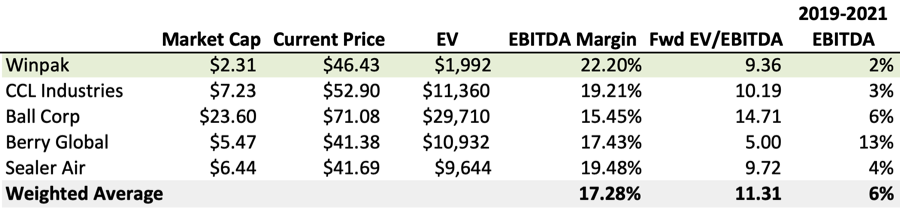

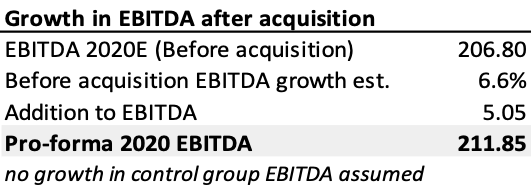

For our pro-forma calculation, we assume that no efficiency changes are made till 2020 as the transaction closes and integration begins. Prior to the acquisition announcement, WPK’s EBITDA was expected to see 6.6% growth by 2020 driven by resilient margins, potential M&A activity, and an increase in sales. As the Control Group primarily serves the pharma sector, which is considered a high growth and margin sector, we expect WPK's margins to be higher than the weighted average of other global players. The global players serve all sectors, including lower-growth and lower margin segments. However, we don’t expect Control Group’s margins to be as high as WPK’s, which is one of the best in the industry. So we took a mean weighted average, giving us an expected EBITDA margin of 20.2% for the Control Group.

Given the numbers above, we expect Control Group’s 2018 EBITDA to lay around $5.05 million. Assuming no growth in EBITDA until 2020, we arrive at a Pro-forma EBITDA value of $211.85 million for 2020.

Putting it all together

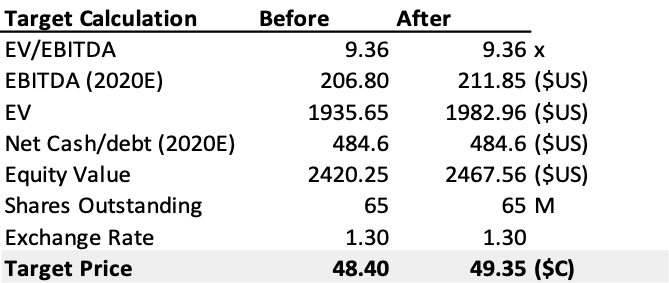

WPK is currently trading at a forward (NTM) EV/EBITDA multiple of 9.05x. This multiple is taking into account the recent acquisitions, investor confidence and stable profile of the company. The multiple is mostly in line with the industry and we assume the target multiple for our calculation, given its superior margins and strong balance sheet. After the purchase and considering little in the way of growth and using some assumptions listed below, we think shares could be valued in a range around $49.35.

To learn more on Winpak and read our full report on the company, you can sign up here.

Comments

Login to post a comment.