5i Research Weekly Rockets and Duds

Ho Hum, another record high on the market. Markets are as hot as the weather in Ontario these days, with daily records being set.

But not all is great at all companies. We will start off with some Duds in 5i Research's Stock Market Rockets and Duds from last week.

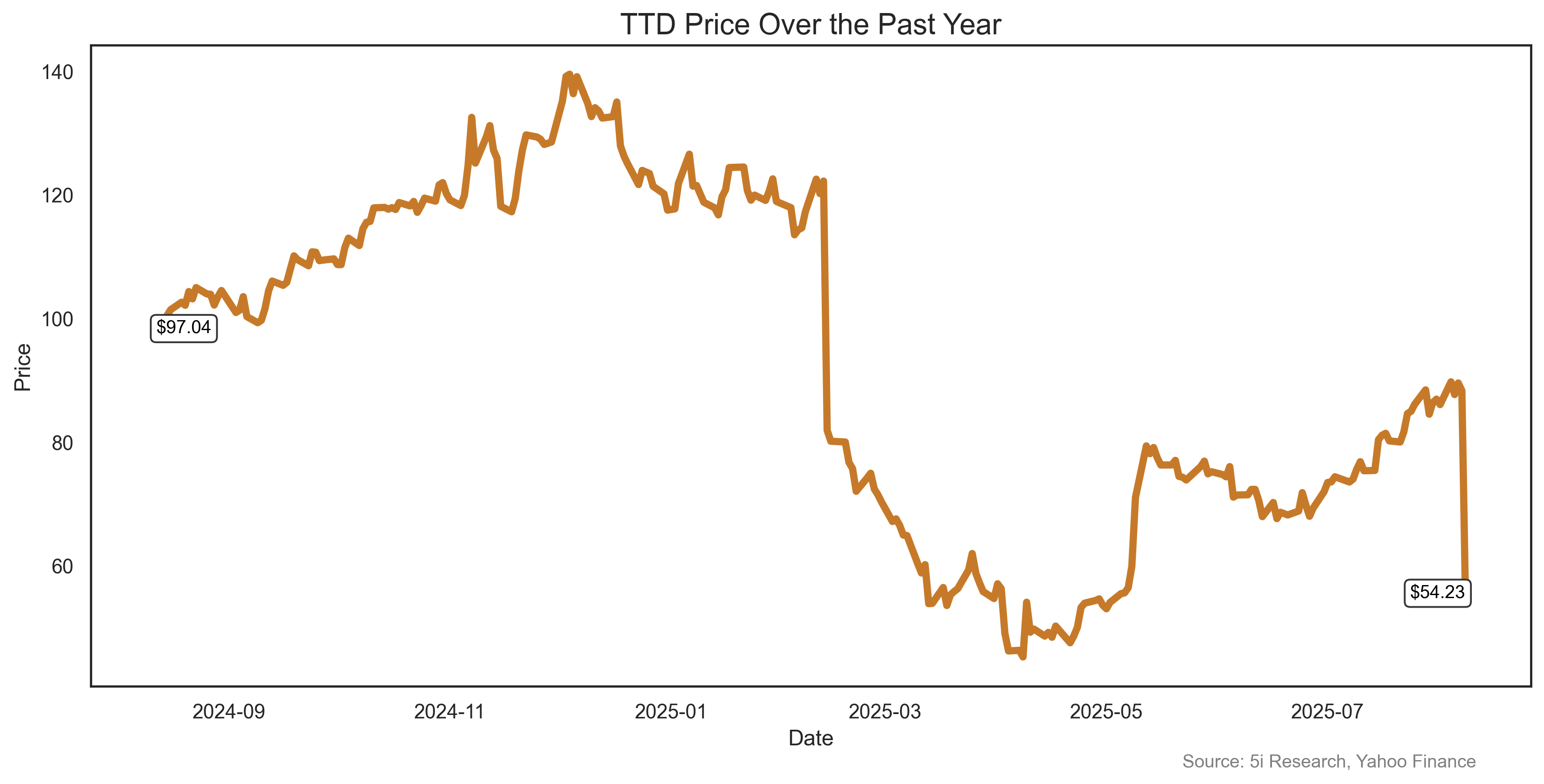

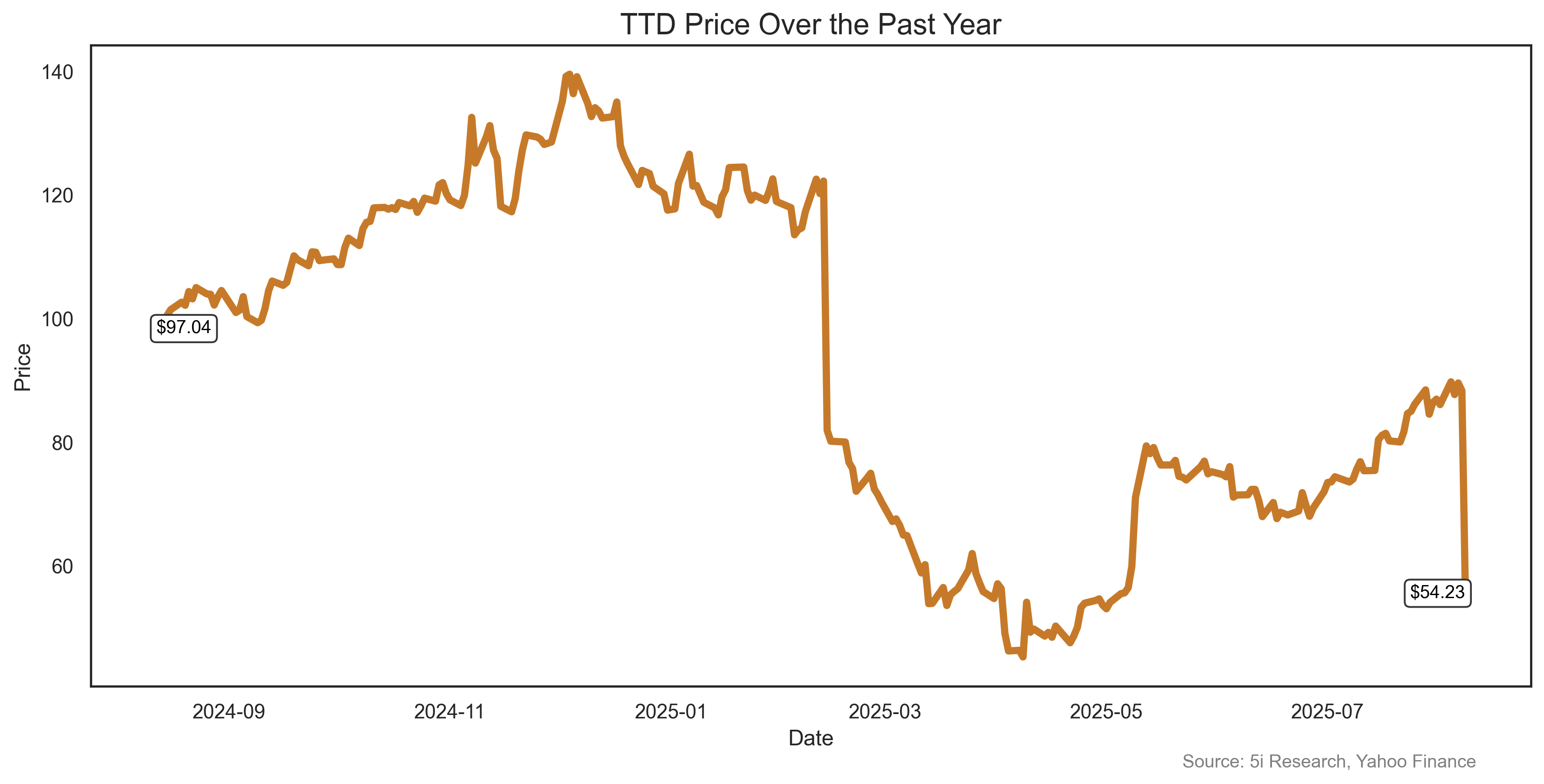

The Trade Desk Inc. TTD

Shareholders reading TTD's second-quarter report might have been happy....for about 20 seconds. After all, results beat expectations, and guidance was raised. But, earnings guidance was raised by--wait for it--a penny per share. For a company with a long history of outperformance, this was not enough. Shares plunged 37% last week as the company noted that advertisers were skittish. Numerous broker downgrades followed. Investors were TRADING in their TRADE Desk shares, with many assuming 'trade' meant 'sell'.

Shareholders reading TTD's second-quarter report might have been happy....for about 20 seconds. After all, results beat expectations, and guidance was raised. But, earnings guidance was raised by--wait for it--a penny per share. For a company with a long history of outperformance, this was not enough. Shares plunged 37% last week as the company noted that advertisers were skittish. Numerous broker downgrades followed. Investors were TRADING in their TRADE Desk shares, with many assuming 'trade' meant 'sell'.

Shareholders reading TTD's second-quarter report might have been happy....for about 20 seconds. After all, results beat expectations, and guidance was raised. But, earnings guidance was raised by--wait for it--a penny per share. For a company with a long history of outperformance, this was not enough. Shares plunged 37% last week as the company noted that advertisers were skittish. Numerous broker downgrades followed. Investors were TRADING in their TRADE Desk shares, with many assuming 'trade' meant 'sell'.

Shareholders reading TTD's second-quarter report might have been happy....for about 20 seconds. After all, results beat expectations, and guidance was raised. But, earnings guidance was raised by--wait for it--a penny per share. For a company with a long history of outperformance, this was not enough. Shares plunged 37% last week as the company noted that advertisers were skittish. Numerous broker downgrades followed. Investors were TRADING in their TRADE Desk shares, with many assuming 'trade' meant 'sell'.

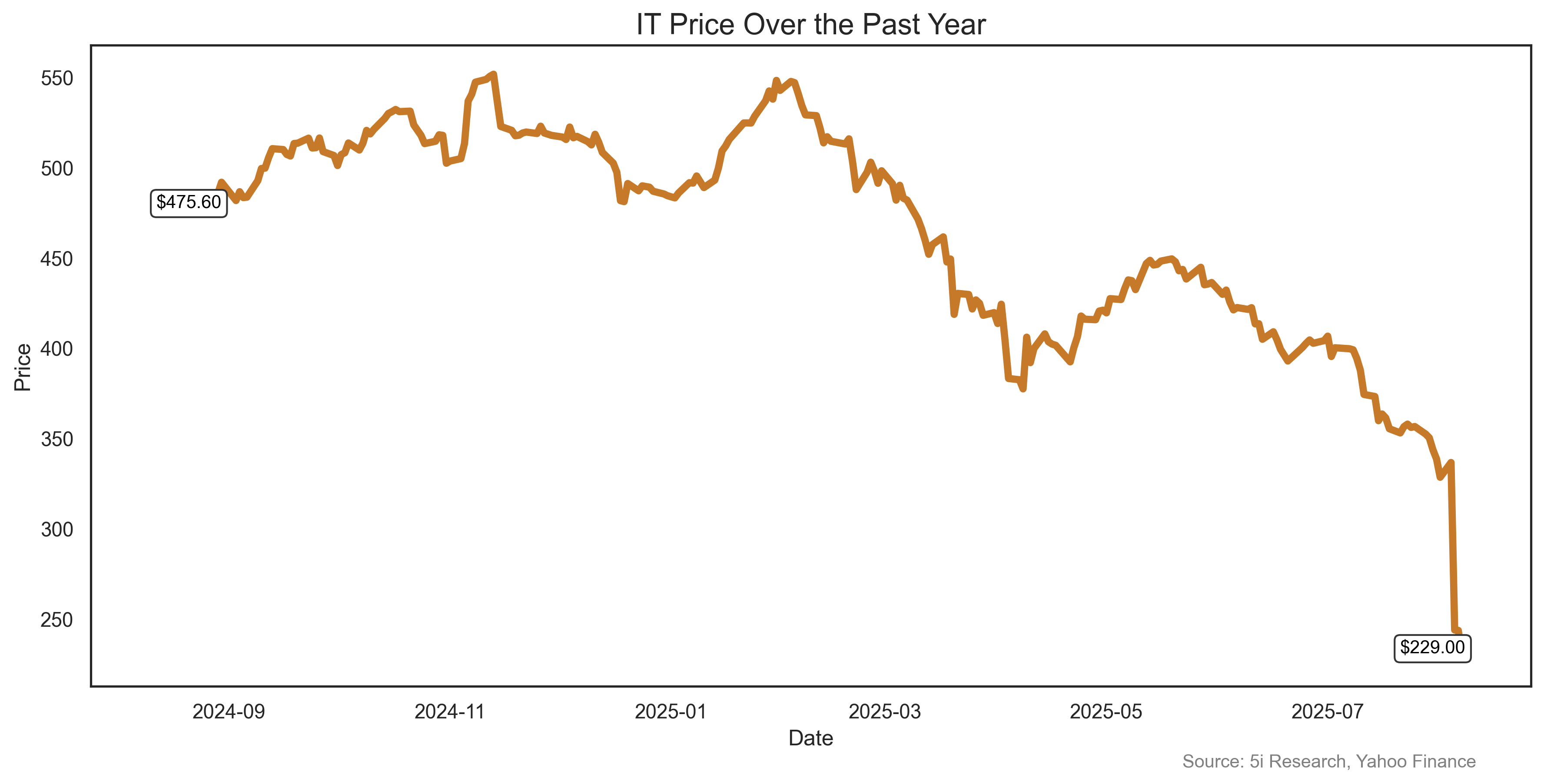

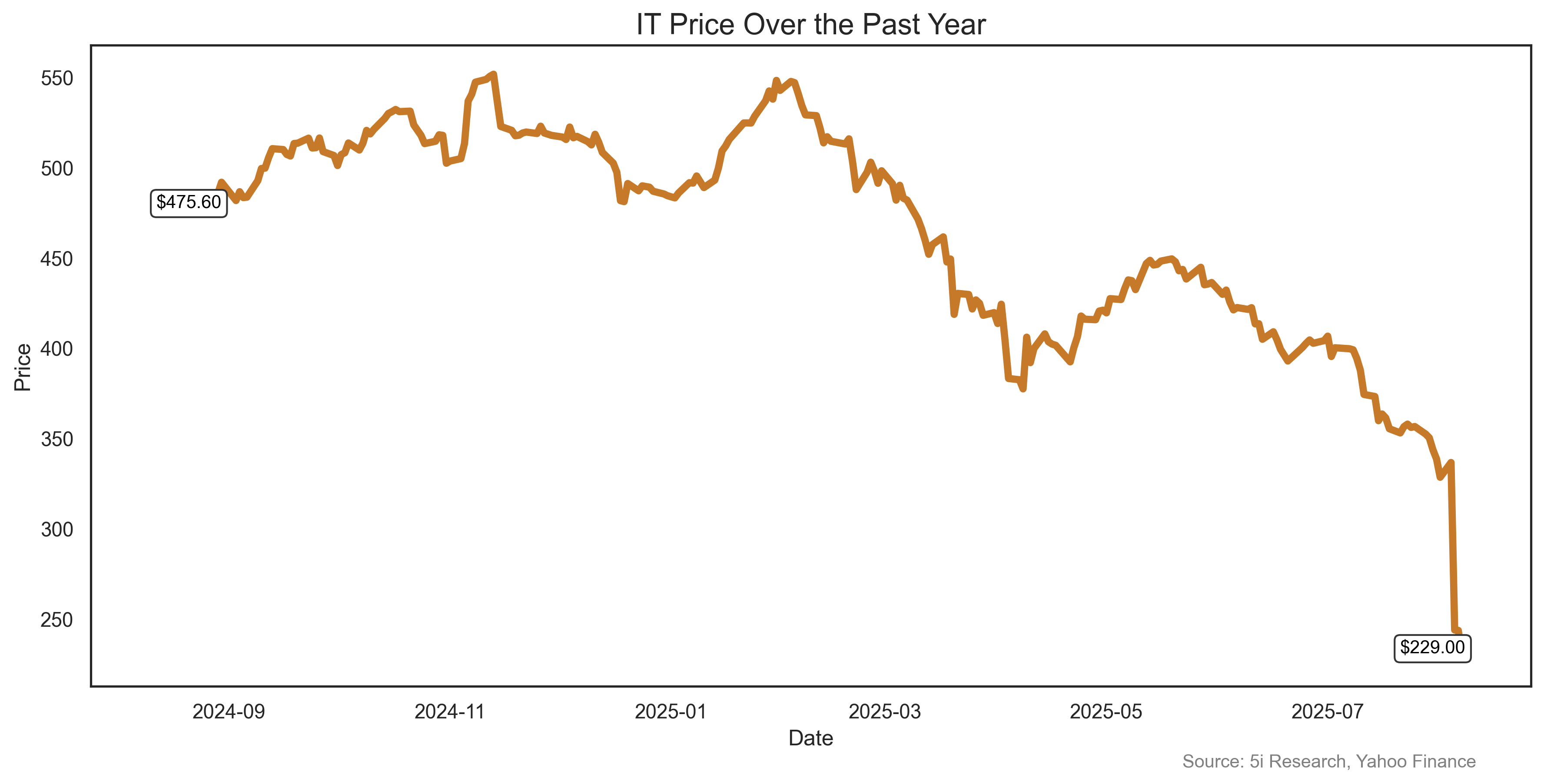

Gartner Inc. IT

Tech is hot, right? So one would think a company with the symbol 'IT" might be one of the hottest stocks around. But nope. IT plunged 30% last week, making it one of the worst large cap losers for the week. Investors didn't care that the company beat earnings estimates. They focused instead on slowing contract growth and were scared off by the CEO's comments that customer CEOs were acting like it's the "Great Recession'. So suddenly the company's 'IT' symbol is more attuned to the monster from the Stephen King movie rather than 'Information Technology'. In other words, the stock is in the sewer.

Tech is hot, right? So one would think a company with the symbol 'IT" might be one of the hottest stocks around. But nope. IT plunged 30% last week, making it one of the worst large cap losers for the week. Investors didn't care that the company beat earnings estimates. They focused instead on slowing contract growth and were scared off by the CEO's comments that customer CEOs were acting like it's the "Great Recession'. So suddenly the company's 'IT' symbol is more attuned to the monster from the Stephen King movie rather than 'Information Technology'. In other words, the stock is in the sewer.

Tech is hot, right? So one would think a company with the symbol 'IT" might be one of the hottest stocks around. But nope. IT plunged 30% last week, making it one of the worst large cap losers for the week. Investors didn't care that the company beat earnings estimates. They focused instead on slowing contract growth and were scared off by the CEO's comments that customer CEOs were acting like it's the "Great Recession'. So suddenly the company's 'IT' symbol is more attuned to the monster from the Stephen King movie rather than 'Information Technology'. In other words, the stock is in the sewer.

Tech is hot, right? So one would think a company with the symbol 'IT" might be one of the hottest stocks around. But nope. IT plunged 30% last week, making it one of the worst large cap losers for the week. Investors didn't care that the company beat earnings estimates. They focused instead on slowing contract growth and were scared off by the CEO's comments that customer CEOs were acting like it's the "Great Recession'. So suddenly the company's 'IT' symbol is more attuned to the monster from the Stephen King movie rather than 'Information Technology'. In other words, the stock is in the sewer.

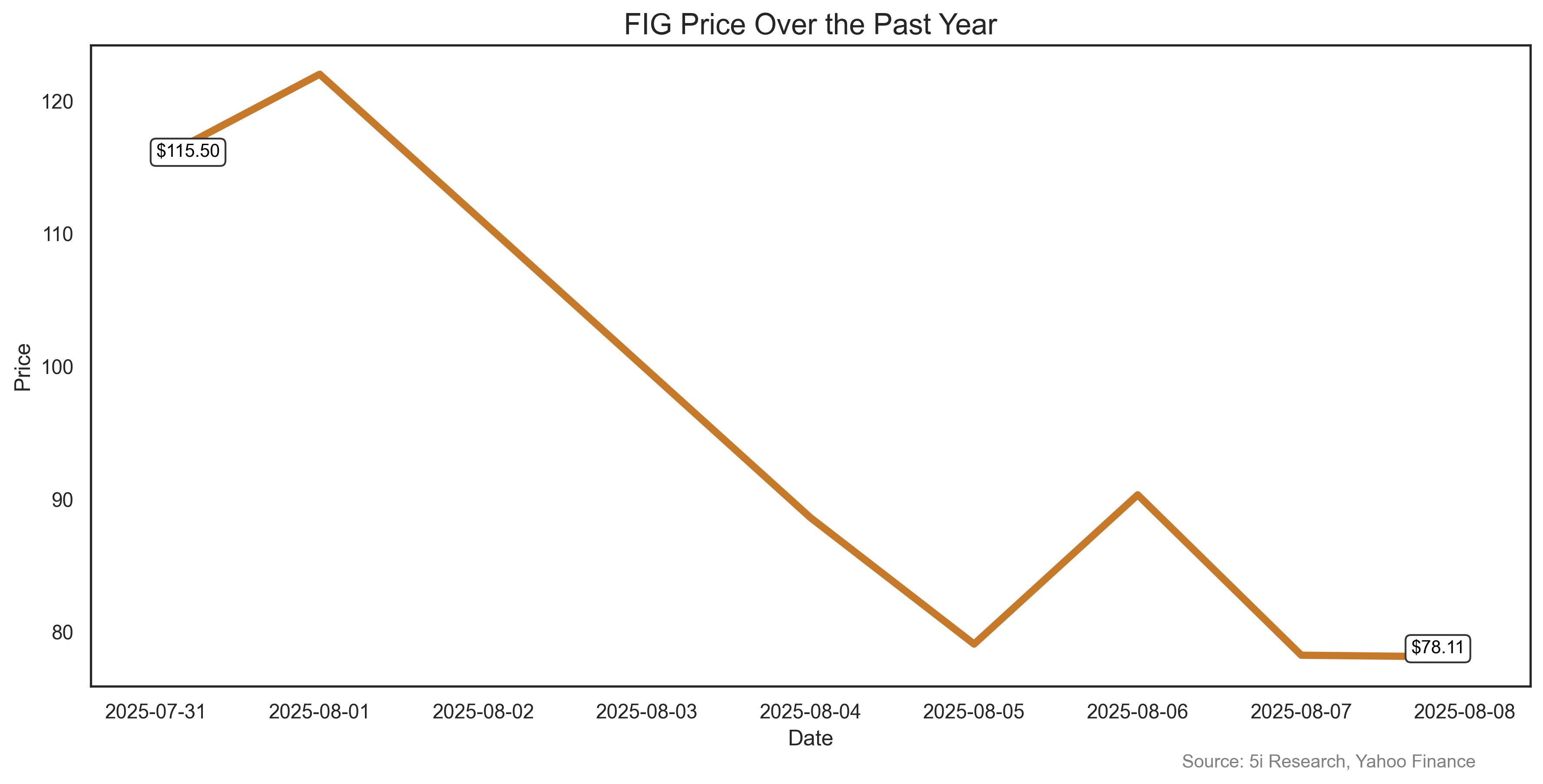

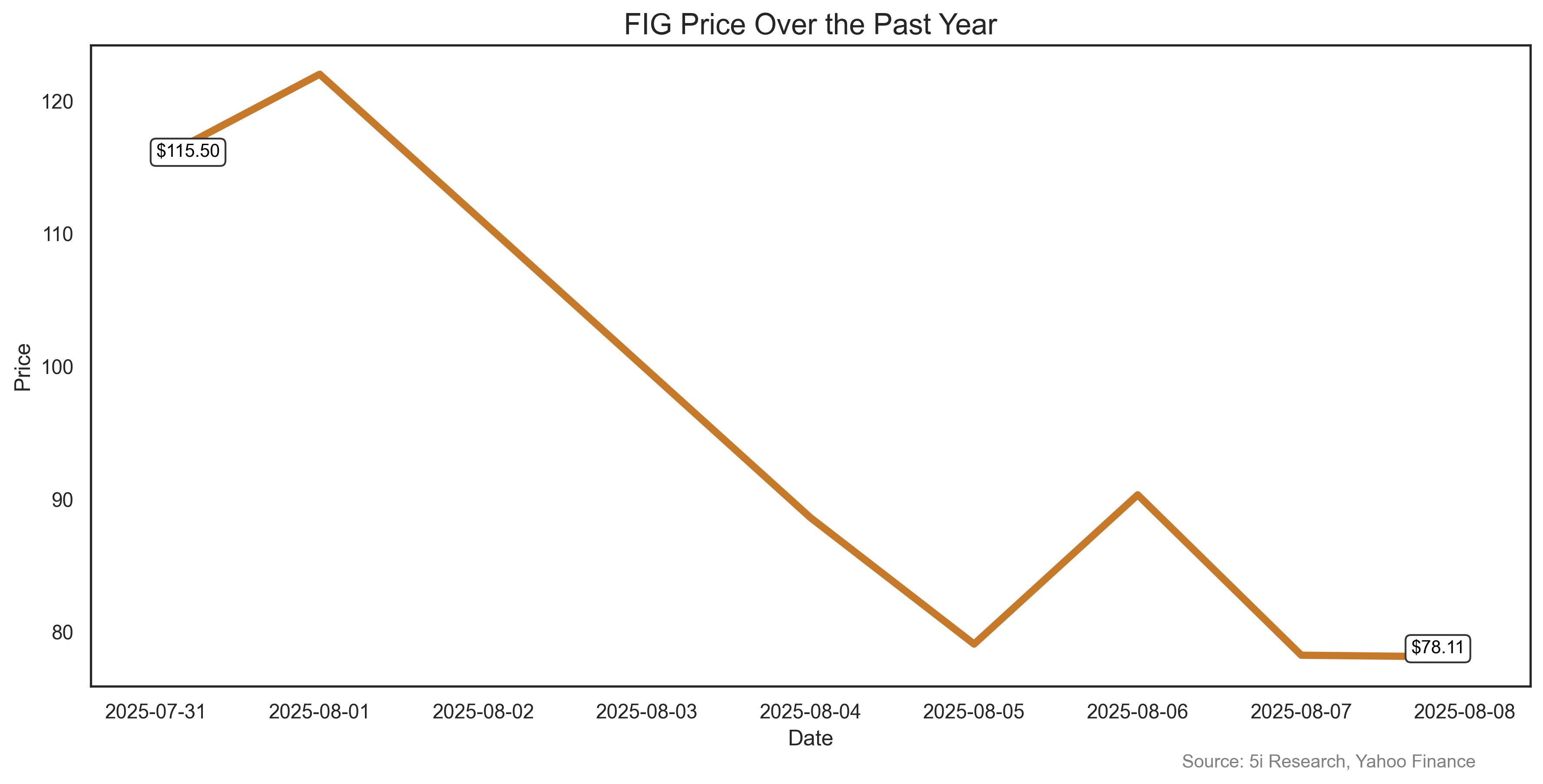

Figma Inc. FIG

IPO investors got a good lesson in gravity last week as FIG shares fell 36%. Sure, they are still more than double their IPO price of less than two weeks ago, but someone paid $143 for this stock last week, now at $83. There was no particular news here, just an investor lesson in something called 'reality'.

IPO investors got a good lesson in gravity last week as FIG shares fell 36%. Sure, they are still more than double their IPO price of less than two weeks ago, but someone paid $143 for this stock last week, now at $83. There was no particular news here, just an investor lesson in something called 'reality'.

IPO investors got a good lesson in gravity last week as FIG shares fell 36%. Sure, they are still more than double their IPO price of less than two weeks ago, but someone paid $143 for this stock last week, now at $83. There was no particular news here, just an investor lesson in something called 'reality'.

IPO investors got a good lesson in gravity last week as FIG shares fell 36%. Sure, they are still more than double their IPO price of less than two weeks ago, but someone paid $143 for this stock last week, now at $83. There was no particular news here, just an investor lesson in something called 'reality'.

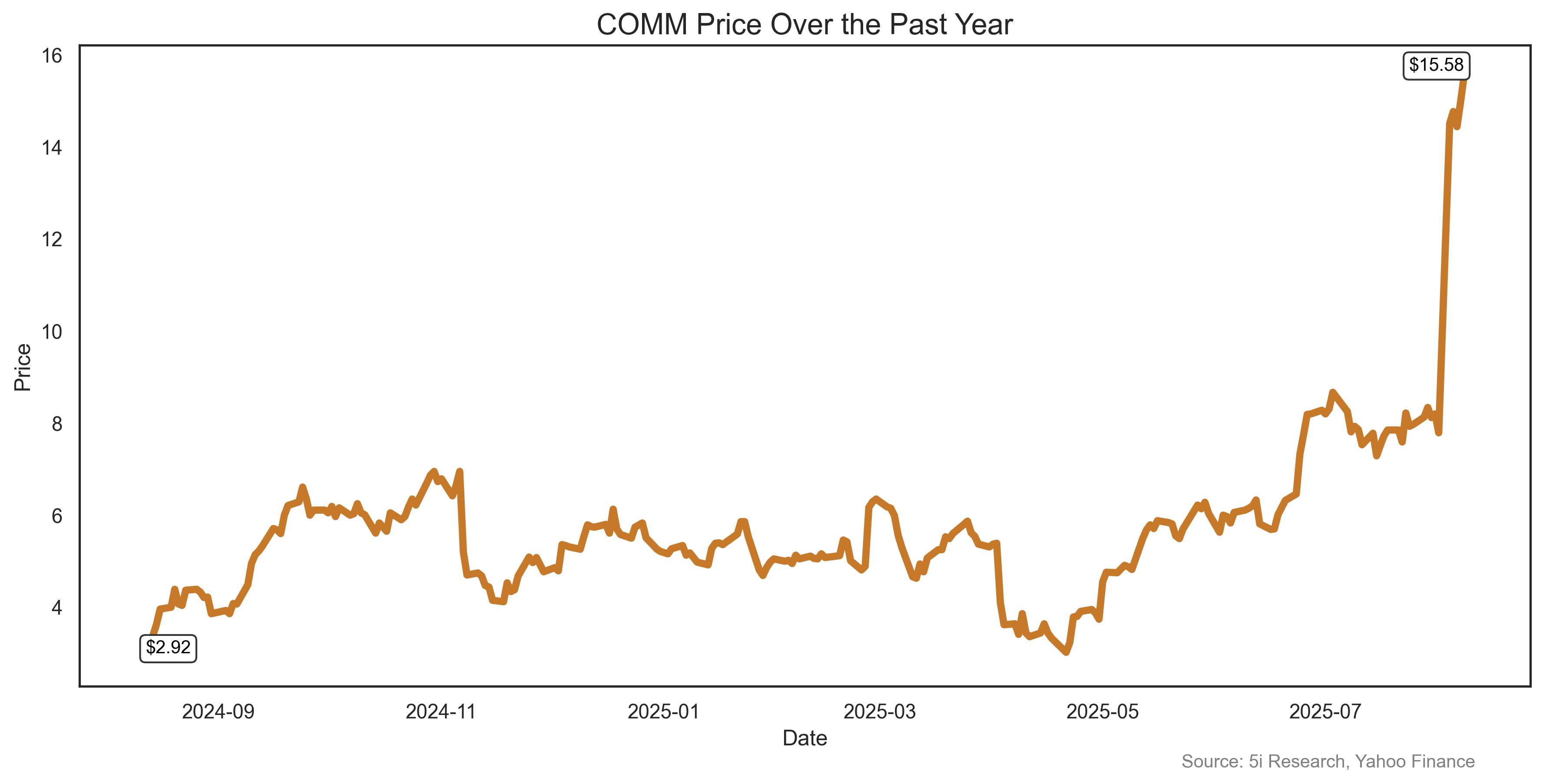

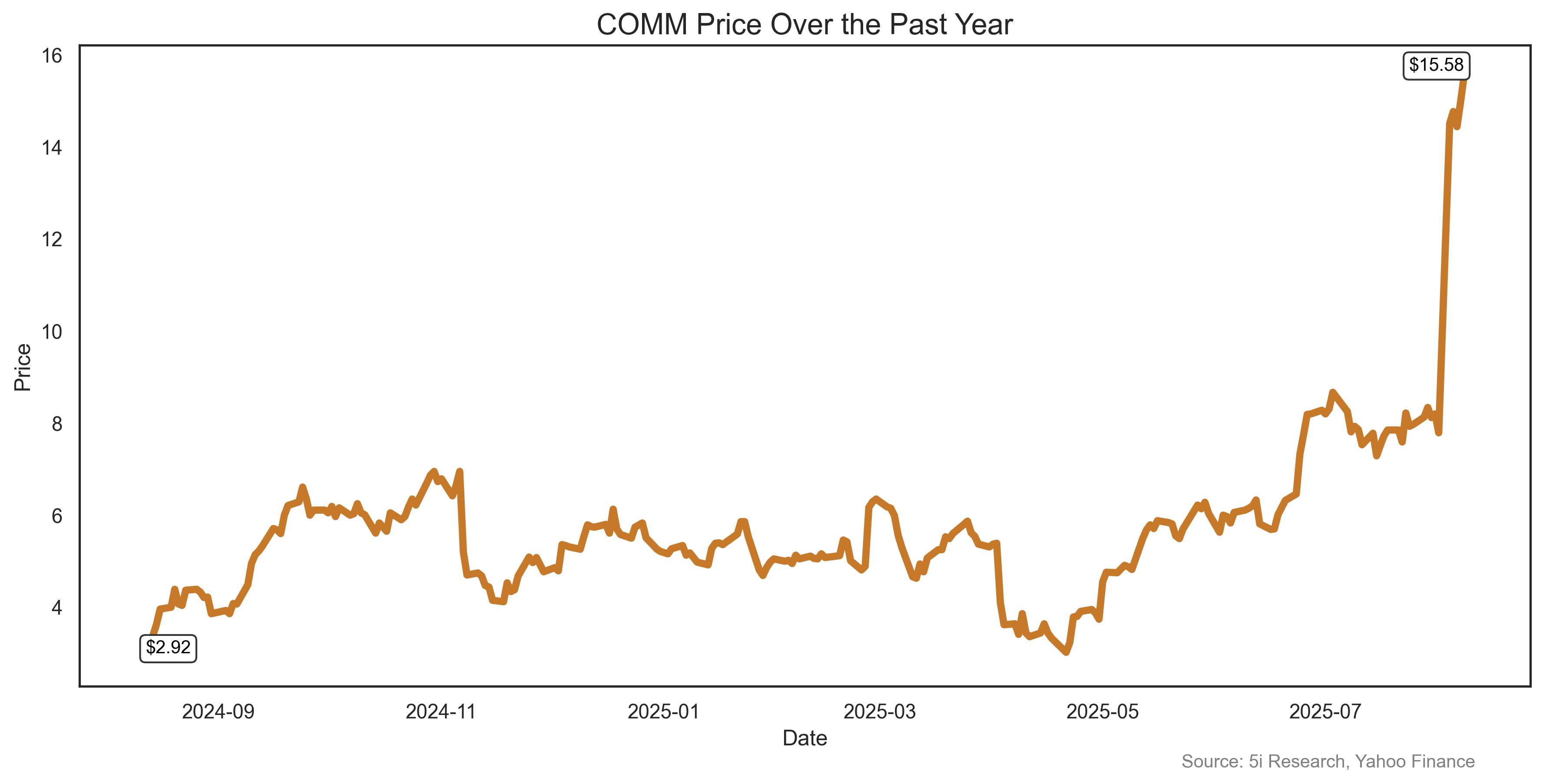

Commscope Holdings Co Inc. COMM

OK class, pay attention. Yes, we know it's summer but lessons can still be learned. Today's class: Question: How do you get your stock price up 100% in a week, and 200% so far this year? Answer: Sell one of your divisions for $10 billion, even though your entire market cap is less than $4 billion. That's what COMM did last week, selling its connectivity and cable business to Amphenol (APH) for $10.5 billion. The deal will enable COMM to pay off all of its debt and preferred shares, and still leave it with a significant amount of cash. Investors went gaga as the business gets significantly de-risked.

OK class, pay attention. Yes, we know it's summer but lessons can still be learned. Today's class: Question: How do you get your stock price up 100% in a week, and 200% so far this year? Answer: Sell one of your divisions for $10 billion, even though your entire market cap is less than $4 billion. That's what COMM did last week, selling its connectivity and cable business to Amphenol (APH) for $10.5 billion. The deal will enable COMM to pay off all of its debt and preferred shares, and still leave it with a significant amount of cash. Investors went gaga as the business gets significantly de-risked.

OK class, pay attention. Yes, we know it's summer but lessons can still be learned. Today's class: Question: How do you get your stock price up 100% in a week, and 200% so far this year? Answer: Sell one of your divisions for $10 billion, even though your entire market cap is less than $4 billion. That's what COMM did last week, selling its connectivity and cable business to Amphenol (APH) for $10.5 billion. The deal will enable COMM to pay off all of its debt and preferred shares, and still leave it with a significant amount of cash. Investors went gaga as the business gets significantly de-risked.

OK class, pay attention. Yes, we know it's summer but lessons can still be learned. Today's class: Question: How do you get your stock price up 100% in a week, and 200% so far this year? Answer: Sell one of your divisions for $10 billion, even though your entire market cap is less than $4 billion. That's what COMM did last week, selling its connectivity and cable business to Amphenol (APH) for $10.5 billion. The deal will enable COMM to pay off all of its debt and preferred shares, and still leave it with a significant amount of cash. Investors went gaga as the business gets significantly de-risked.

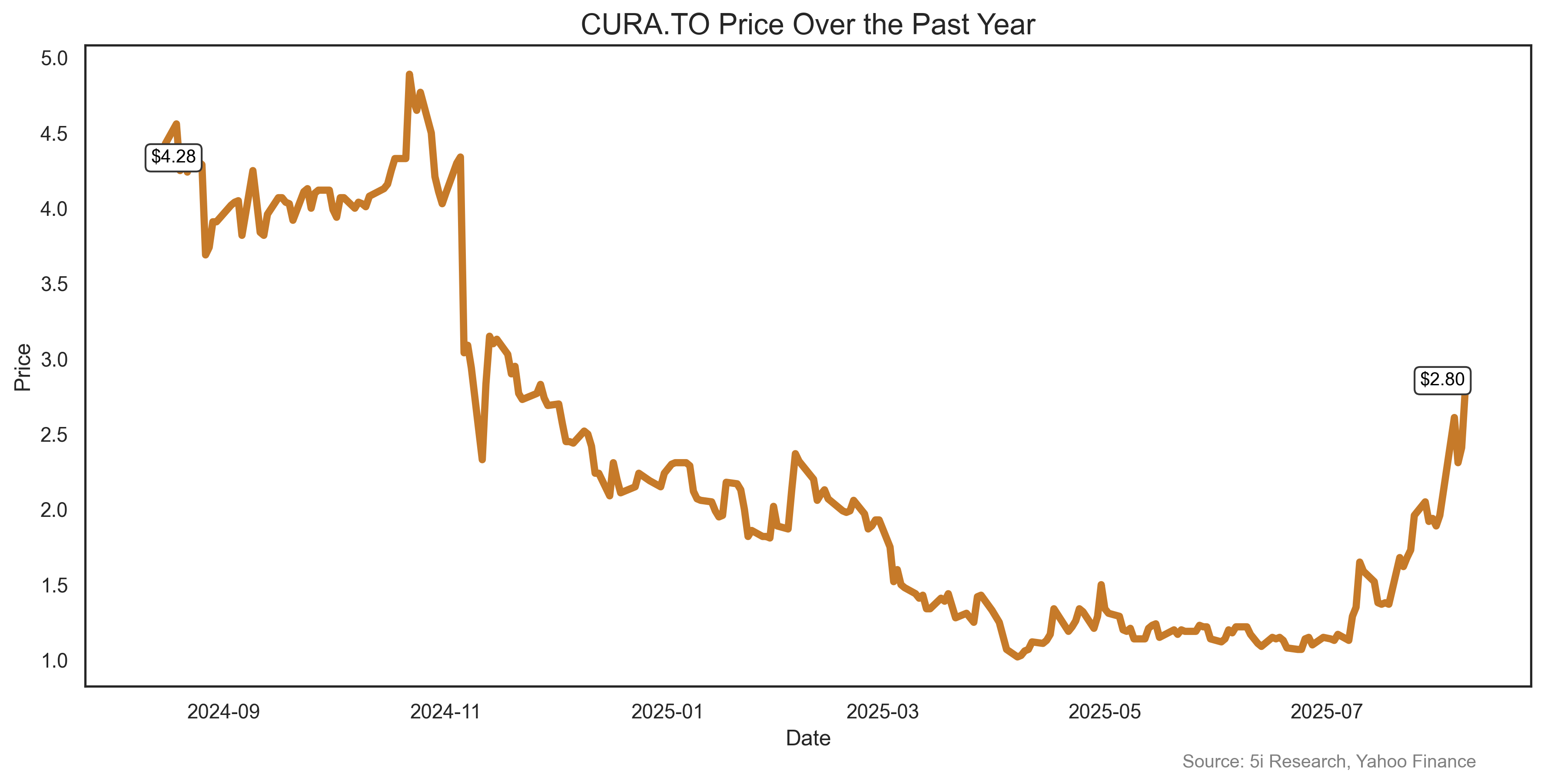

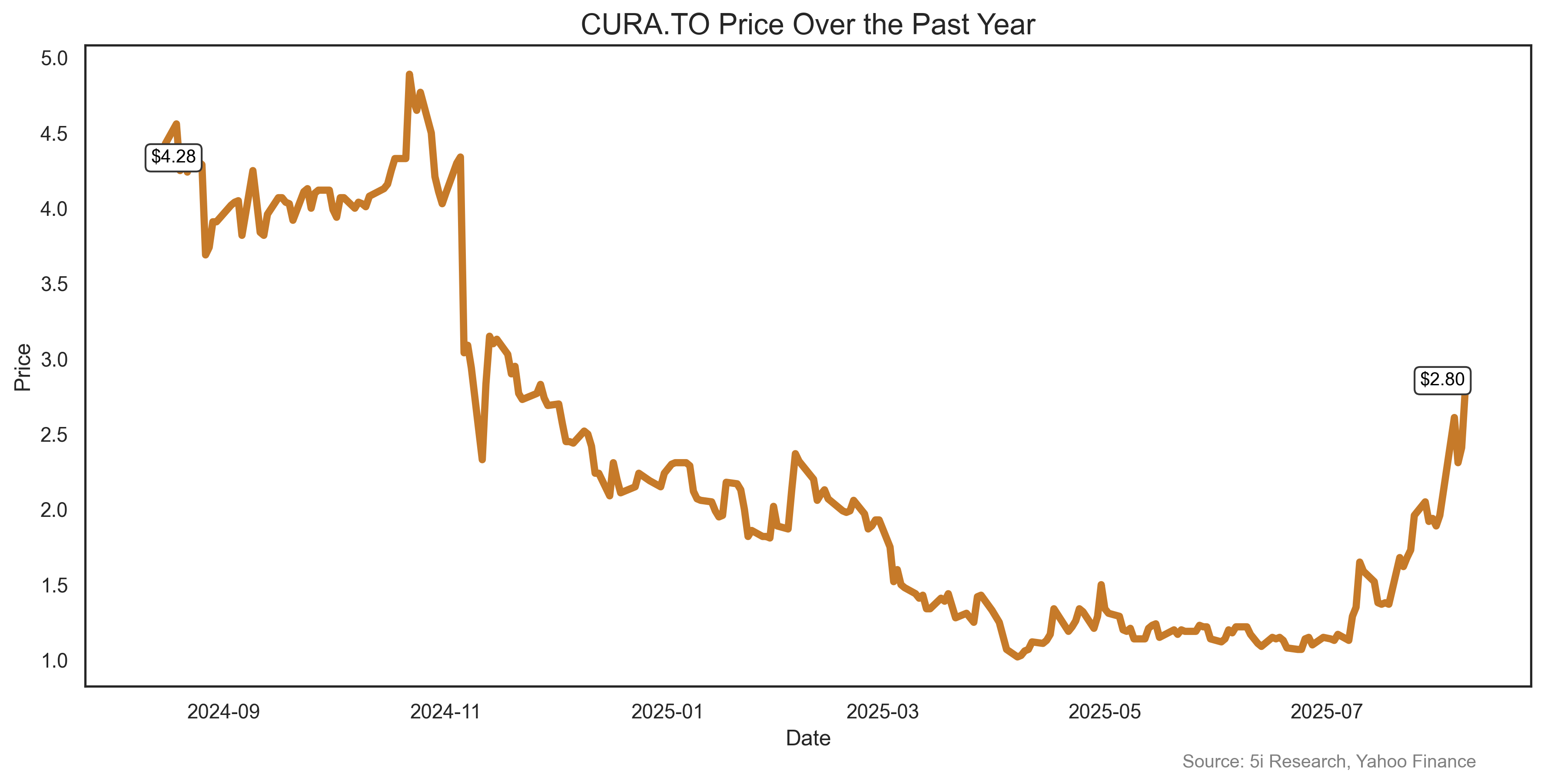

Curaleaf Holdings Inc. CURA

CURA makes another appearance in the Rockets and Duds, with a 43% gain last week. Nothing much going on here, just 'domestic stabilization, and robust international momentum' according to the company. The cannabis company reported strong results and outlook, and investors might have wondered what they've been smoking, considering most cannabis companies have done nothing but go down for five years. Maybe there is a turn in the industry. Maybe new 'HIGHS' are ahead for the sector.

CURA makes another appearance in the Rockets and Duds, with a 43% gain last week. Nothing much going on here, just 'domestic stabilization, and robust international momentum' according to the company. The cannabis company reported strong results and outlook, and investors might have wondered what they've been smoking, considering most cannabis companies have done nothing but go down for five years. Maybe there is a turn in the industry. Maybe new 'HIGHS' are ahead for the sector.

CURA makes another appearance in the Rockets and Duds, with a 43% gain last week. Nothing much going on here, just 'domestic stabilization, and robust international momentum' according to the company. The cannabis company reported strong results and outlook, and investors might have wondered what they've been smoking, considering most cannabis companies have done nothing but go down for five years. Maybe there is a turn in the industry. Maybe new 'HIGHS' are ahead for the sector.

CURA makes another appearance in the Rockets and Duds, with a 43% gain last week. Nothing much going on here, just 'domestic stabilization, and robust international momentum' according to the company. The cannabis company reported strong results and outlook, and investors might have wondered what they've been smoking, considering most cannabis companies have done nothing but go down for five years. Maybe there is a turn in the industry. Maybe new 'HIGHS' are ahead for the sector.

Take Care,

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Analysts of 5i Research responsible for this report have a financial or other interest in TTD. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.