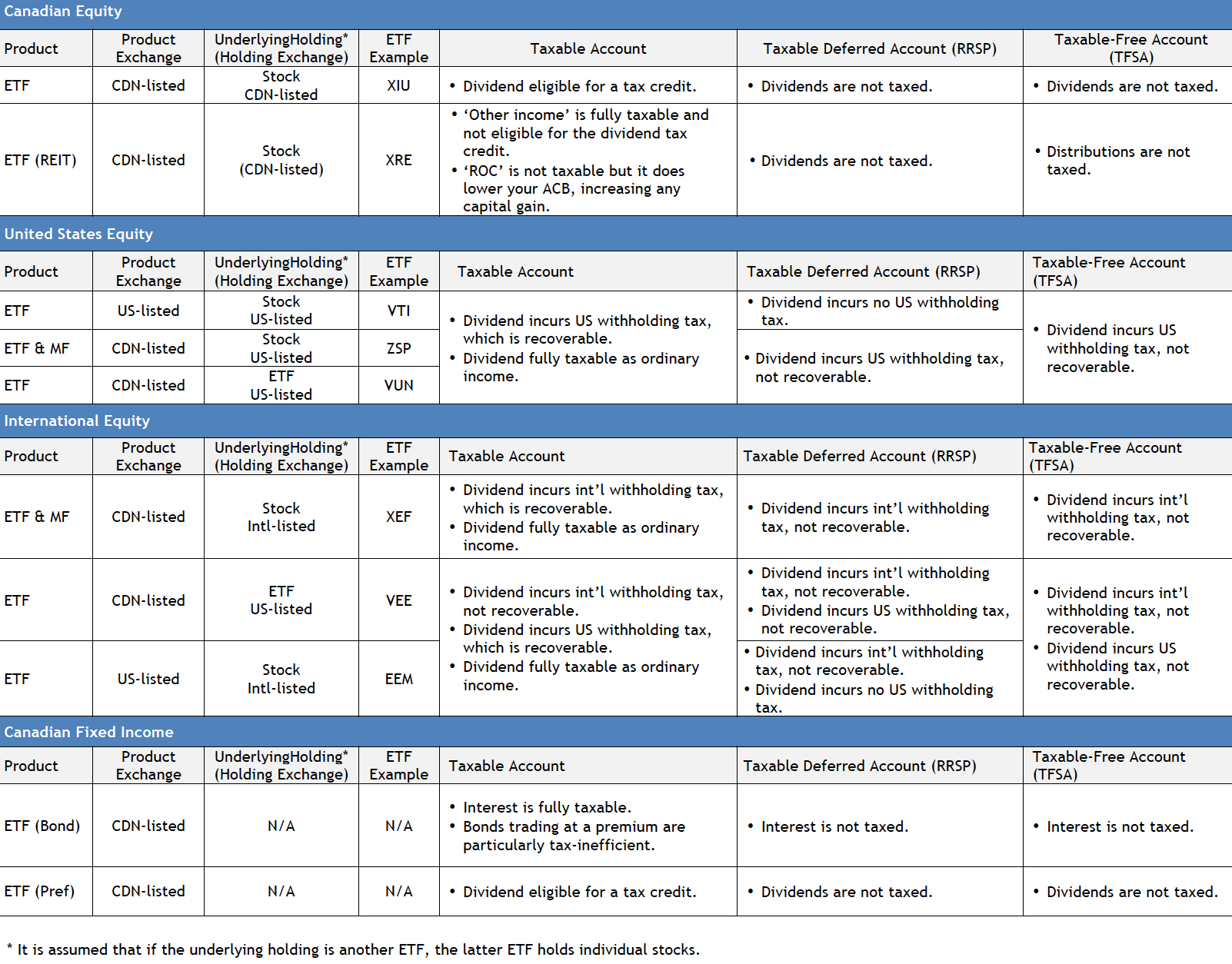

The amount of tax you pay on an ETF distribution depends on two factors: the structure of the ETF and the account in which it is held. To best summarize the tax implications, we thought it easiest to prepare a table, which is presented below.

You can also download the table here (upon clicking this link, save it by right-clicking on the image and selecting "save image as...")

The table shows how four ETF strategies – Canadian equity, US equity, international equity and fixed income – incur different taxation when held in a taxable vs. tax-sheltered account. There are five common structures to ETFs for tax purposes, as summarized by Canadian Couch Potato:

• Canadian ETF that holds US or international stocks, directly

• Canadian ETF that holds a US-listed ETF comprised of US stocks

• Canadian ETF that holds a US-listed ETF comprised of international stocks

• US-listed ETF that holds US stocks, directly

• US-listed ETF that holds international stocks, directly

Some points worth highlighting:

• In any account, if you use Canadian-listed ETFs for you international exposure, an ETF that holds stocks directly will be more tax efficient than one that holds an underlying US-listed ETF.

• In a TFSA, use a Canadian-listed ETF for foreign exposure. A US-listed ETF offers no tax advantage.

• In a taxable account, Canadian-listed ETFs are often a better choice. When investing for exposure to the US, US-listed ETFs offer no tax advantage.

• In a taxable account, foreign equity exposure always incurs withholding taxes. Canadian ETFs (and mutual funds) that directly hold foreign stocks can track the withholding taxes and report them to the investor. This then allows the investor to apply for the foreign tax credit and recover the tax, in most cases.

• When a Canadian ETF holds a US-listed ETF of international stocks, there are likely two levels of foreign withholding tax. One from the domicile of the dividend and another from the US. In tax-sheltered accounts, neither is recoverable.

Food For Thought with ETFs, TFSAs and RRSPs

Far from black and white, it is easy to get bogged down trying to minimize foreign withholding taxes but tax efficiency should never be the starting point of portfolio construction. It should only be considered after building an appropriate asset mix.

For example, a conservative investor with a large amount of capital to deploy in the taxable account should not buy risky stocks simply because they do not want to hold bonds due to poor tax efficiency. Nor should minimizing withholding taxes be your first task when picking a fund, as fees are just as important. And do not forget foreign currency conversion fees if debating a US-listed vs. CAD-listed fund.

Withholding Tax vs Tax Liability

A distinction also needs to be made between avoiding foreign withholding taxes and avoiding tax liability. Let us take two sample ETFs from our chart.

Assume that for your US allocation, you choose to hold VTI in an RRSP ($50,000), as this does not incur withholding tax. For your international allocation, you choose XEF in a taxable account ($50,000), as the withholding tax is eventually recoverable (not so in the RRSP or TFSA).

VTI yields 2.0% and XEF yields 3.4%. Your tax rate is 40.0%. In this scenario, your tax liability is on the XEF dividend as the VTI dividend is sheltered. So you have dividends of $1,700 (3.4%)($50,000) and pay tax of $680 (40.0%)($1,700).

Now let us flip accounts on VTI/XEF, a seemingly tax inefficient solution. One may be surprised to hear the tax liability falls to $655. Your tax liability is on the VTI dividend, as the XEF dividend is sheltered. So you have dividends of $1,000 (2.0%)($50,000) and pay tax of $400 (40.0%)($1,000).

You also lose $255 to an assumed 15.0% XEF withholding tax (0.15) ($1,700). In this example, it made more sense to shelter the high yield due to the tax bracket vs. minimizing withholding tax.

The Importance of Age

Age is also an important consideration. Young investors with less wealth, starting their careers are often able to only make a contribution to either a TFSA or RRSP, but not both.

For a US allocation (as defined by VTI), an investor may choose the RRSP, as this incurs no withholding tax unlike the TFSA. However, saving the RRSP contribution room for later years to lower taxable income may make more sense, as future salary income would be expected to be higher.

Closing Thoughts

This example should make clear that there is no simple, single solution. However, this should offer an investor a very solid guideline and starting point when attempting to determine how to approach asset allocation with a TFSA and RRSP.

Have you tried Portfolio Analytics?

Instantly learn whether you're making any critical mistake in your portfolio.

Whether you’re a DIY investor or using an advisor, how do you know if you’re taking unnecessary risks with your portfolio?

How do you know you’re not limiting your investment returns because you overlooked something or if your portfolio isn’t set up properly?

With Portfolio Analytics, we’ll instantly analyze your existing portfolio and inform you of any dangers and opportunities that we see. Learn more here.

Comments

Login to post a comment.