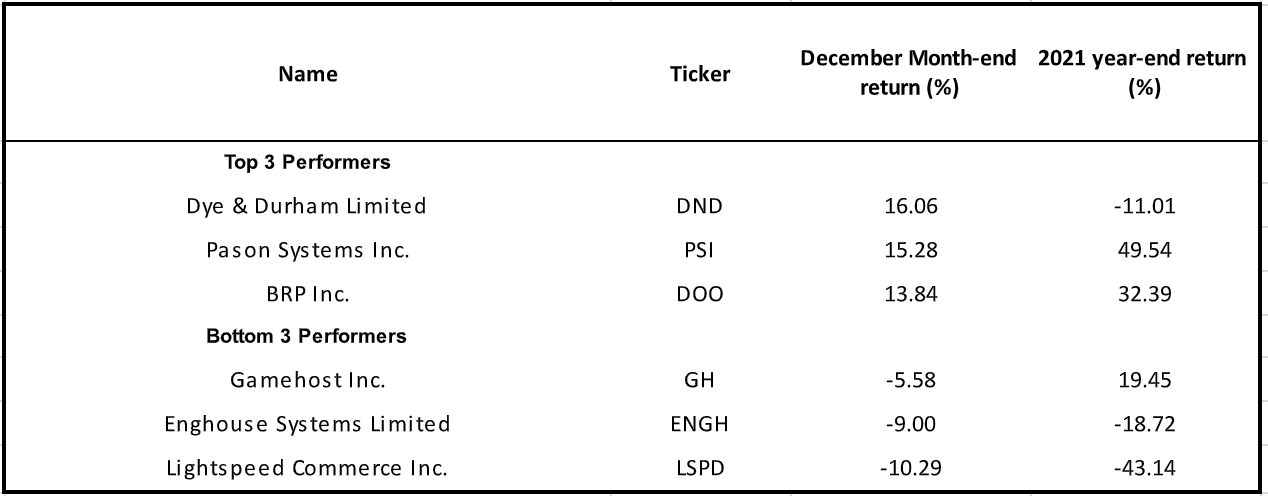

The TSX Index has enjoyed relatively strong steady growth since mid-March 2020 only to be interrupted by the emergence of the Omicron virus in November 2021. After some initial back and forth the index gained 3.3 % in December 2021. Financials, Materials and Real Estate have been the significant contributors. The Omicron virus continues to grow mightily and likely will impede growth to some degree over the next few months. Concerns over inflation are showing up, but increased wages are mitigating them and some Fed action is anticipated. In Canada surprisingly, strong employment numbers and high commodity prices are propping up the economy. In this piece, we take a look at the top and bottom performers of stocks on our 5i coverage list and discuss recent events. Readers can refer to the table below:

Durham Limited (DND)

The top performer in December was Dye and Durham Limited (DND) which was up 16.06% on the month. Yearly performance was choppy and was -11% overall. DND is a leading provider of cloud-based software and technology solutions to improve efficiency and productivity for legal and business professionals. This provides a long runway of opportunity which DND is rushing onto. The company wants to become a billion-dollar adjusted EBITDA company and projects that adjusted EBITDA will not be less than $350 million for 12 month period ended June 30, 2023. DND had blowout third quarter results; they have entered into two further acquisitions since: Telus Financial Solutions for $500 million and Link group for $3.2 billion. There is some pushback from the UK Competition and Markets Authority over the earlier acquisition of TMG, but this seems to be headed down a conciliatory path. At their recent annual general meeting, two of the directors seemed to be quite unpopular. Overall, DND is going ahead as strongly as it can.

Pason Systems Inc (PSI)

The second-best performing company was Pason Systems Inc (PSI) which was up 15.28% for the month and 49.5% for the year. PSI is an energy services company that provides data management systems for drilling rigs and enjoys a significant market share in North America and elsewhere. It essentially carried on its YTD performance and capitalized on the improved activity level of the energy industry leading to strong third quarter results which beat market estimates on all metrics. In mid December, PSI announced its intention of renewing its normal course issuer bid which seems to underscore its continued good performance. The price of oil continues to support this activity.

BRP Inc (DOO)

The third best performer was BRP Inc (DOO) which was up 13.84% for the month and 32.39% for the year. DOO is a diversified manufacturer of power sport vehicles and marine products for year-round use in leisure sports. Demand for products remains at an all-time high but results have been impacted by supply chain disruptions so that normalized diluted earnings per share at $1.48 were 30.5% lower than the corresponding prior period. DOO took action throughout the year allowing for increased volume delivery in coming quarters. We believe it is well-positioned for short-term and long-term growth.

Gamehost Inc (GH)

The third-worst performer was Gamehost Inc (GH). It is the last publicly traded casino operator in Canada. Revenues continue to decrease and its future and fundamentals are no longer not attractive to us.

Enghouse Systems (ENGH)

Enghouse was second worst being down 9% on the month and -18.72% on the year. ENGH had very strong results for the year ended October 31, 2020 due to an exceptional surge from remote work and video communications during the onset of COVID-19 which was not matched in 2021. Management effort was devoted to scaling costs to revenues which resulted in adjusted EBITDA of 36.1% (up 1% from prior year) for the year ended October 31, 2021; three acquisitions were folded in and a special dividend of $1.50 was paid. ENGH has disciplined management and should do well from here.

Lightspeed (LSPD)

Lightspeed (LSPD) remains in last place. Both organic growth and acquisitions boost revenues, but expenses continue to grow more than revenues proportionately. Moreover, there is a looming short report. Shares are trading at some 8.8x forward sales while growth prospects have increased. It has a strong customer footprint and plenty of cash together with a unique omnichannel commerce system. It needs to demonstrate it can better manage its expenses, but overall the valuation is much more attractive today.

Disclosure: Analysts of 5i Research and authors responsible for this report do not have a financial or other interest in any of the securities mentioned. The i2i Fund does not have a financial or other interest in any of the securities mentioned.

Comments

Login to post a comment.