5i Research Weekly Rockets and Duds

It's time for another 5I Research Rockets and Duds...

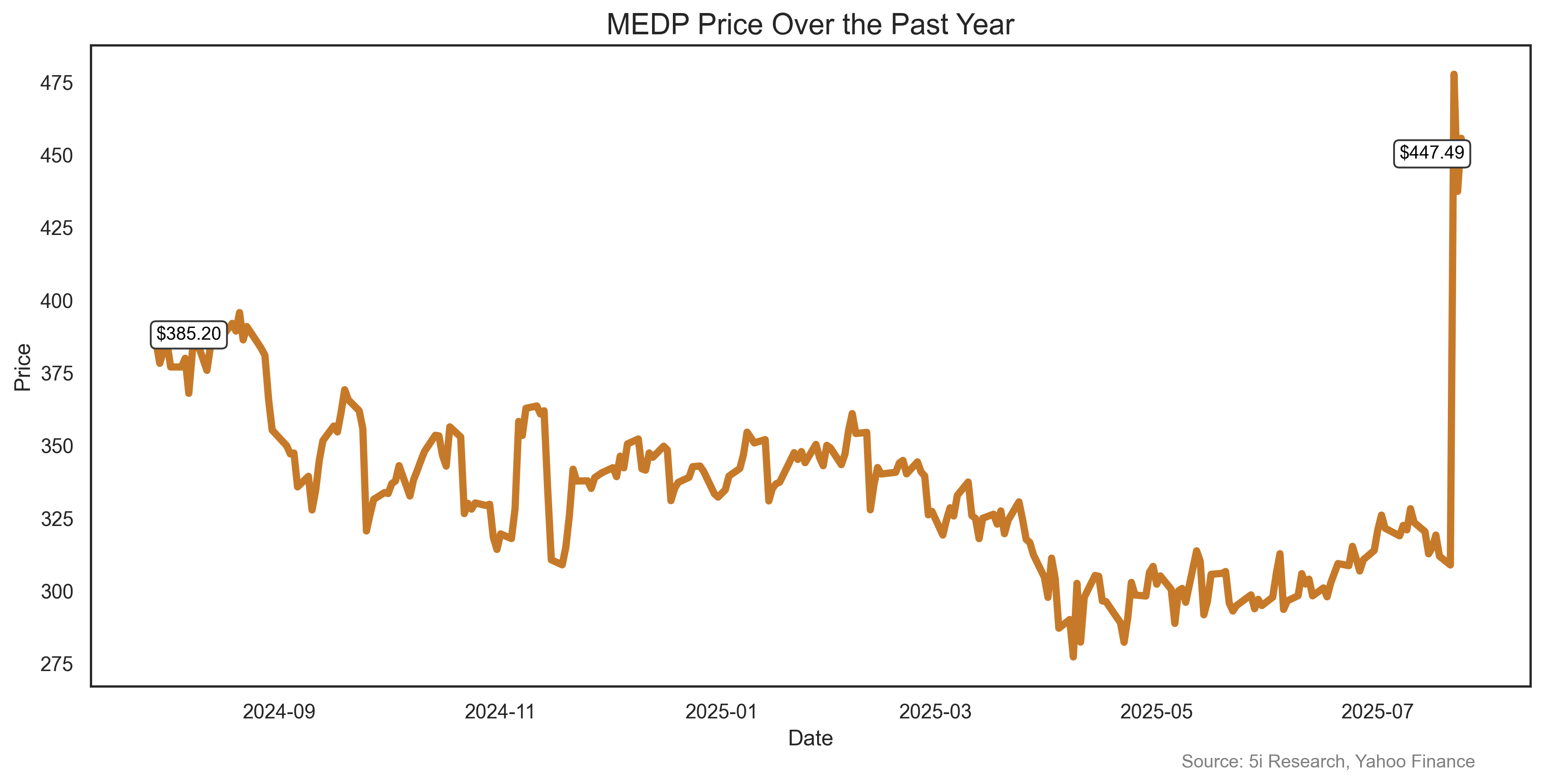

We listened to the Medpace conference call last week, and it was surprisingly hostile considering the company absolutely killed its second quarter earnings, coming in much better than expected. One analyst called it a 'shockingly strong' quarter. The stock rose 42% and numerous brokers upgraded the stock. But analysts seemed upset at the good news. They were, perhaps, embarassed that their estimates were not even close. Instead of the usual 'good quarter guys', it was more of a 'why did you sandbag us?' type of conference call. Oh well, shareholders are not analysts, and we are sure they happy with the company's performance.

We listened to the Medpace conference call last week, and it was surprisingly hostile considering the company absolutely killed its second quarter earnings, coming in much better than expected. One analyst called it a 'shockingly strong' quarter. The stock rose 42% and numerous brokers upgraded the stock. But analysts seemed upset at the good news. They were, perhaps, embarassed that their estimates were not even close. Instead of the usual 'good quarter guys', it was more of a 'why did you sandbag us?' type of conference call. Oh well, shareholders are not analysts, and we are sure they happy with the company's performance.

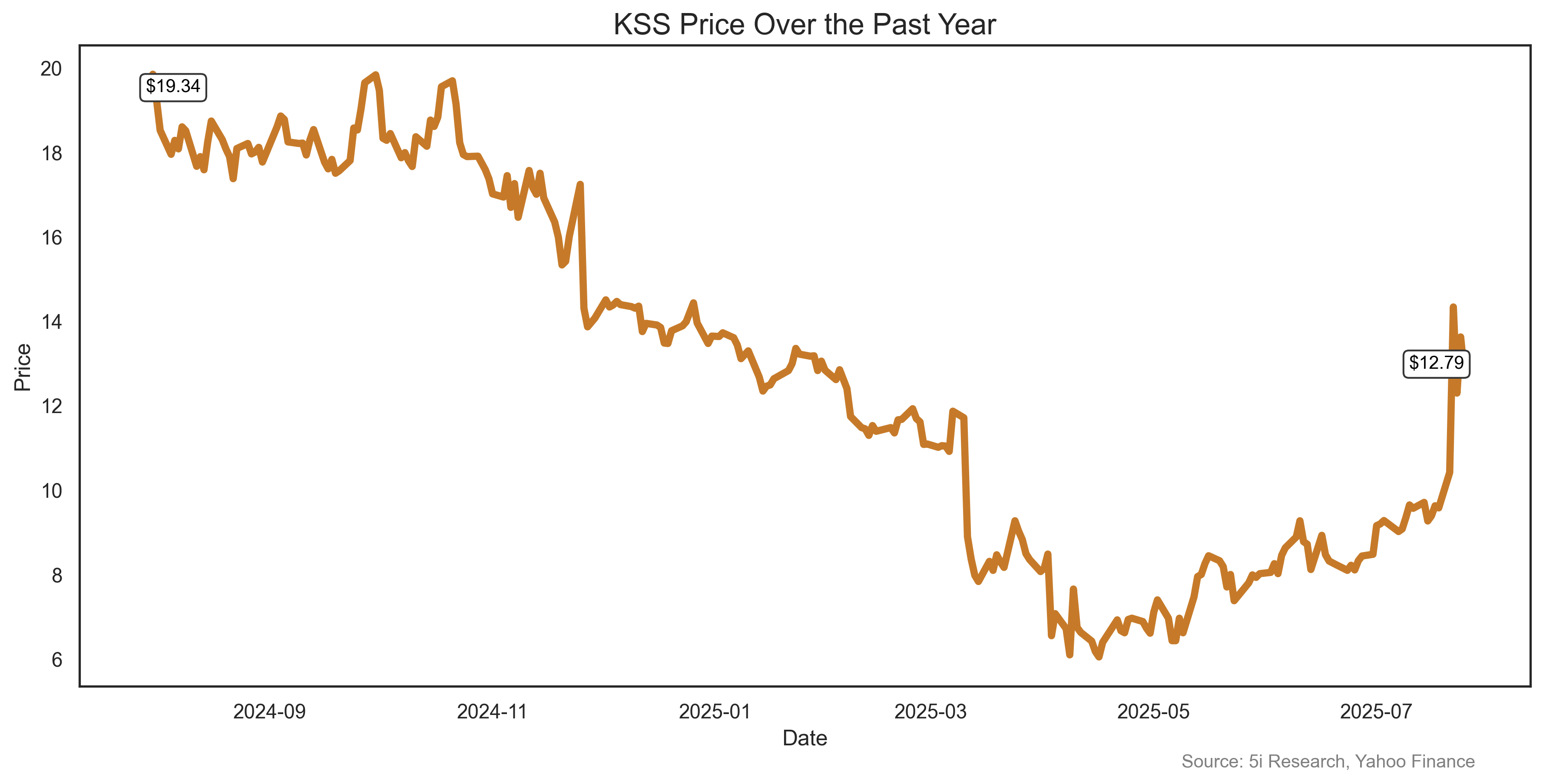

Kohls joined the Meme stock frenzy last week, with a 34% gain, though it is still down 9% for the year. The struggling debt-laden retailer does not seem like a candidate for gains, but with a 46% short interest investors are betting that Kohls might be the next Gamestop and drove shares much higher. Other Meme stocks went crazy last week, and we heard of several analysts who just decided to throw their CFA diploma in the garbage and also throw out their treasured copy of The Intelligent Investor.

Kohls joined the Meme stock frenzy last week, with a 34% gain, though it is still down 9% for the year. The struggling debt-laden retailer does not seem like a candidate for gains, but with a 46% short interest investors are betting that Kohls might be the next Gamestop and drove shares much higher. Other Meme stocks went crazy last week, and we heard of several analysts who just decided to throw their CFA diploma in the garbage and also throw out their treasured copy of The Intelligent Investor.

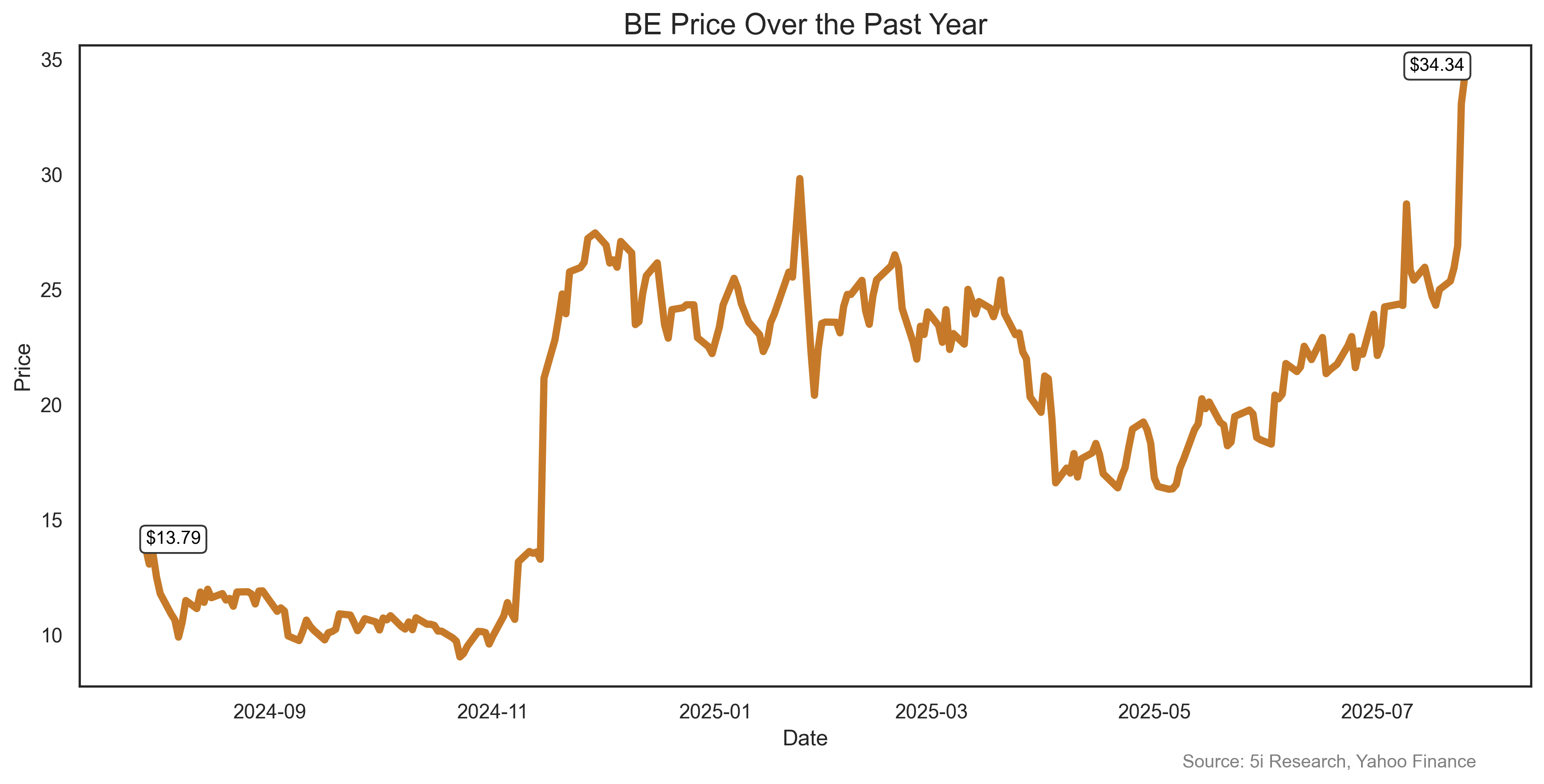

Bloom shares, well, bloomed last week, with a 37% gain, on news of a power collaboration deal with Oracle. As investors know, AI uses up a lot of power, and Bloom said on Thursday it will provide fuel cell technology to Oracle data centres within 90 days.

Bloom shares, well, bloomed last week, with a 37% gain, on news of a power collaboration deal with Oracle. As investors know, AI uses up a lot of power, and Bloom said on Thursday it will provide fuel cell technology to Oracle data centres within 90 days.

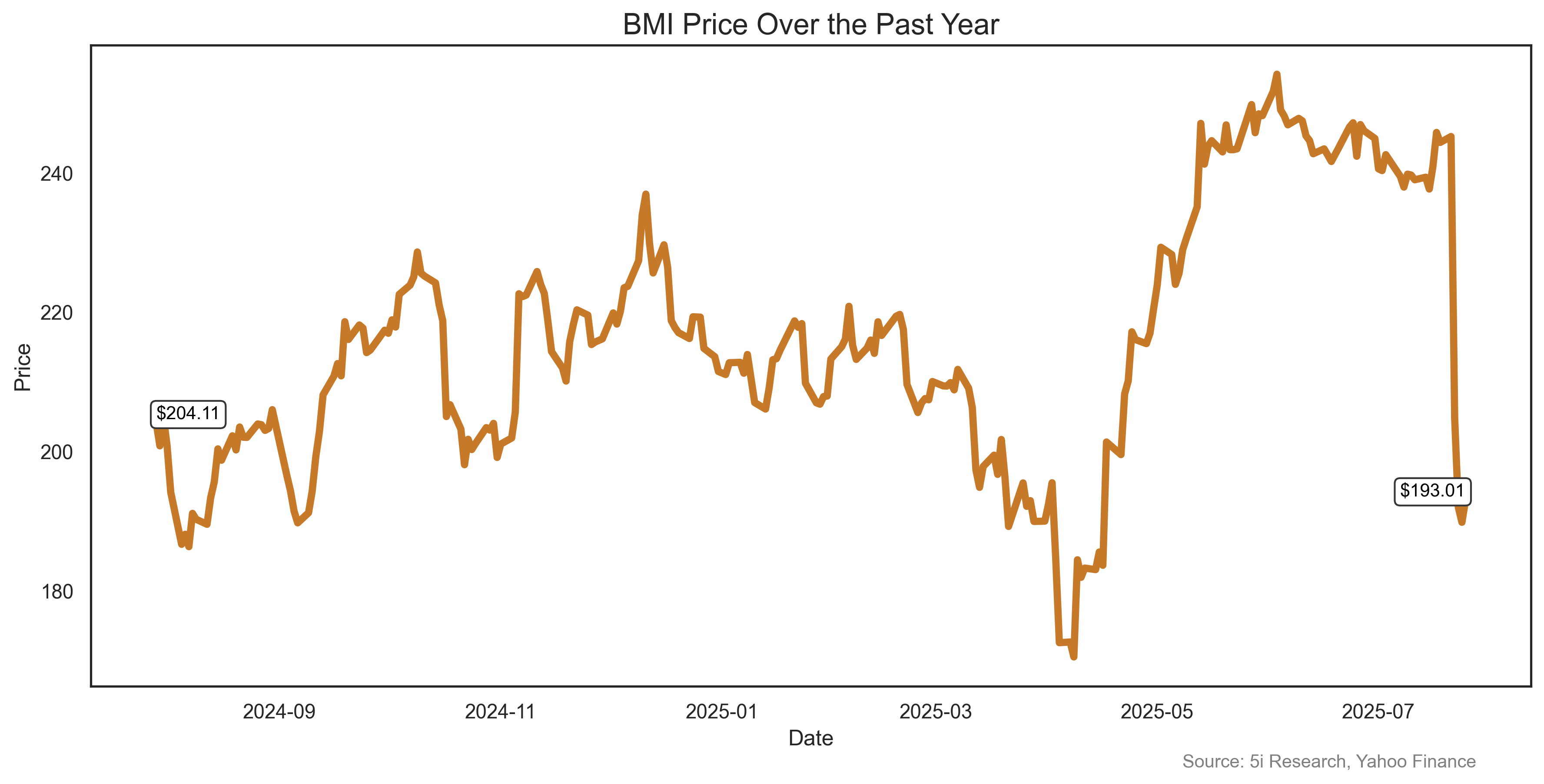

Badger shares were down 21% last week on weak earnings, which missed forecasts. Is this noteworthy? Not really, but with the AI frenzy, the Meme stock frenzy, space and power companies surging and a lot of irrational exhuberance, we needed to note at least one stock that is actually doing what it is supposed to be doing. Sure, it's not great news, but investors can take comfort in the fact that at least a few stocks are following their fundamental performance, rather than moving because of some Redditt chat board.

Badger shares were down 21% last week on weak earnings, which missed forecasts. Is this noteworthy? Not really, but with the AI frenzy, the Meme stock frenzy, space and power companies surging and a lot of irrational exhuberance, we needed to note at least one stock that is actually doing what it is supposed to be doing. Sure, it's not great news, but investors can take comfort in the fact that at least a few stocks are following their fundamental performance, rather than moving because of some Redditt chat board.

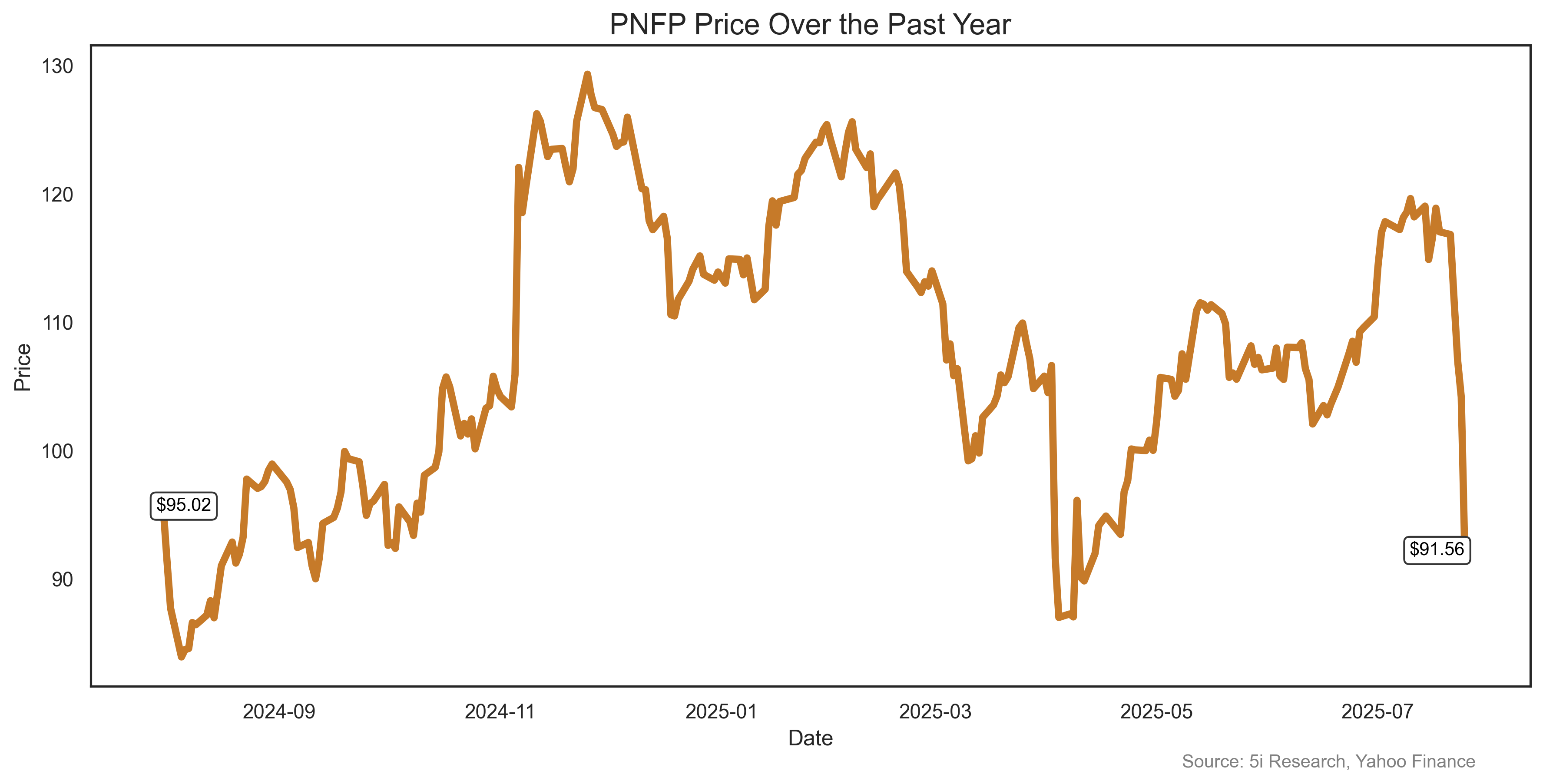

One of the most-depressing things for an investor is to see one of their stocks enter into a merger or takeover agreement, only to see their shares DECLINE on the supposedly-good news. Pinnacle shareholders experienced that joy last week as the stock fell 22% following the news of its planned merger with Synovus Financial Corp., in an $8 billion combination. The merger might make business sense, but shareholders didn't really care: numerous class action lawsuits were filed last week on the news.

One of the most-depressing things for an investor is to see one of their stocks enter into a merger or takeover agreement, only to see their shares DECLINE on the supposedly-good news. Pinnacle shareholders experienced that joy last week as the stock fell 22% following the news of its planned merger with Synovus Financial Corp., in an $8 billion combination. The merger might make business sense, but shareholders didn't really care: numerous class action lawsuits were filed last week on the news.

Take Care,

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Comments

Login to post a comment.