5i Research Weekly Rockets and Duds

Last year saw some big movers, both ways. Here is our recap of the 2025 Rockets and Duds in the stock market.

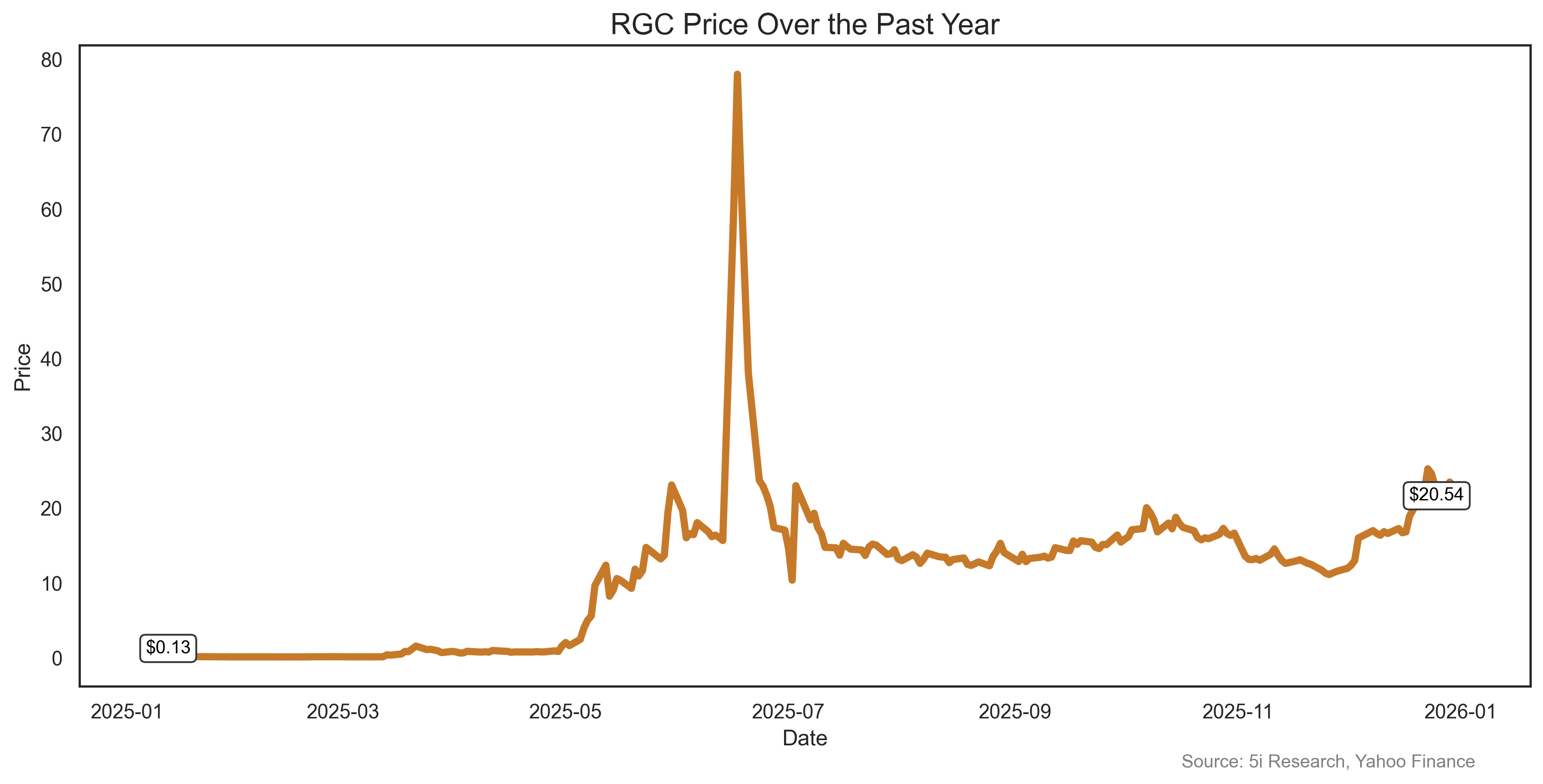

Regencell Bioscience Holding RGC

Sweet dreams are made of this. We did not want to add this to our Rockets list, but how can you not, with a 16,000% gain for the year. RGC has no revenue. It is based in Hong Kong. It's down 75% from its June 2025 peak. It has multiple lawsuits against it. Yet still it wins the contest for the biggest gain of the year. It is a 'traditional Chinese' medicine company that somehow attracted the MEME stock crowd, and things went crazy. It had a 38 for 1 stock split in June to add to the excitement. Its market cap (no revenue, remember) is still $10 billion. One day the ROCKET may crash, but 2025 was not the year.

Sweet dreams are made of this. We did not want to add this to our Rockets list, but how can you not, with a 16,000% gain for the year. RGC has no revenue. It is based in Hong Kong. It's down 75% from its June 2025 peak. It has multiple lawsuits against it. Yet still it wins the contest for the biggest gain of the year. It is a 'traditional Chinese' medicine company that somehow attracted the MEME stock crowd, and things went crazy. It had a 38 for 1 stock split in June to add to the excitement. Its market cap (no revenue, remember) is still $10 billion. One day the ROCKET may crash, but 2025 was not the year.

Sweet dreams are made of this. We did not want to add this to our Rockets list, but how can you not, with a 16,000% gain for the year. RGC has no revenue. It is based in Hong Kong. It's down 75% from its June 2025 peak. It has multiple lawsuits against it. Yet still it wins the contest for the biggest gain of the year. It is a 'traditional Chinese' medicine company that somehow attracted the MEME stock crowd, and things went crazy. It had a 38 for 1 stock split in June to add to the excitement. Its market cap (no revenue, remember) is still $10 billion. One day the ROCKET may crash, but 2025 was not the year.

Sweet dreams are made of this. We did not want to add this to our Rockets list, but how can you not, with a 16,000% gain for the year. RGC has no revenue. It is based in Hong Kong. It's down 75% from its June 2025 peak. It has multiple lawsuits against it. Yet still it wins the contest for the biggest gain of the year. It is a 'traditional Chinese' medicine company that somehow attracted the MEME stock crowd, and things went crazy. It had a 38 for 1 stock split in June to add to the excitement. Its market cap (no revenue, remember) is still $10 billion. One day the ROCKET may crash, but 2025 was not the year.

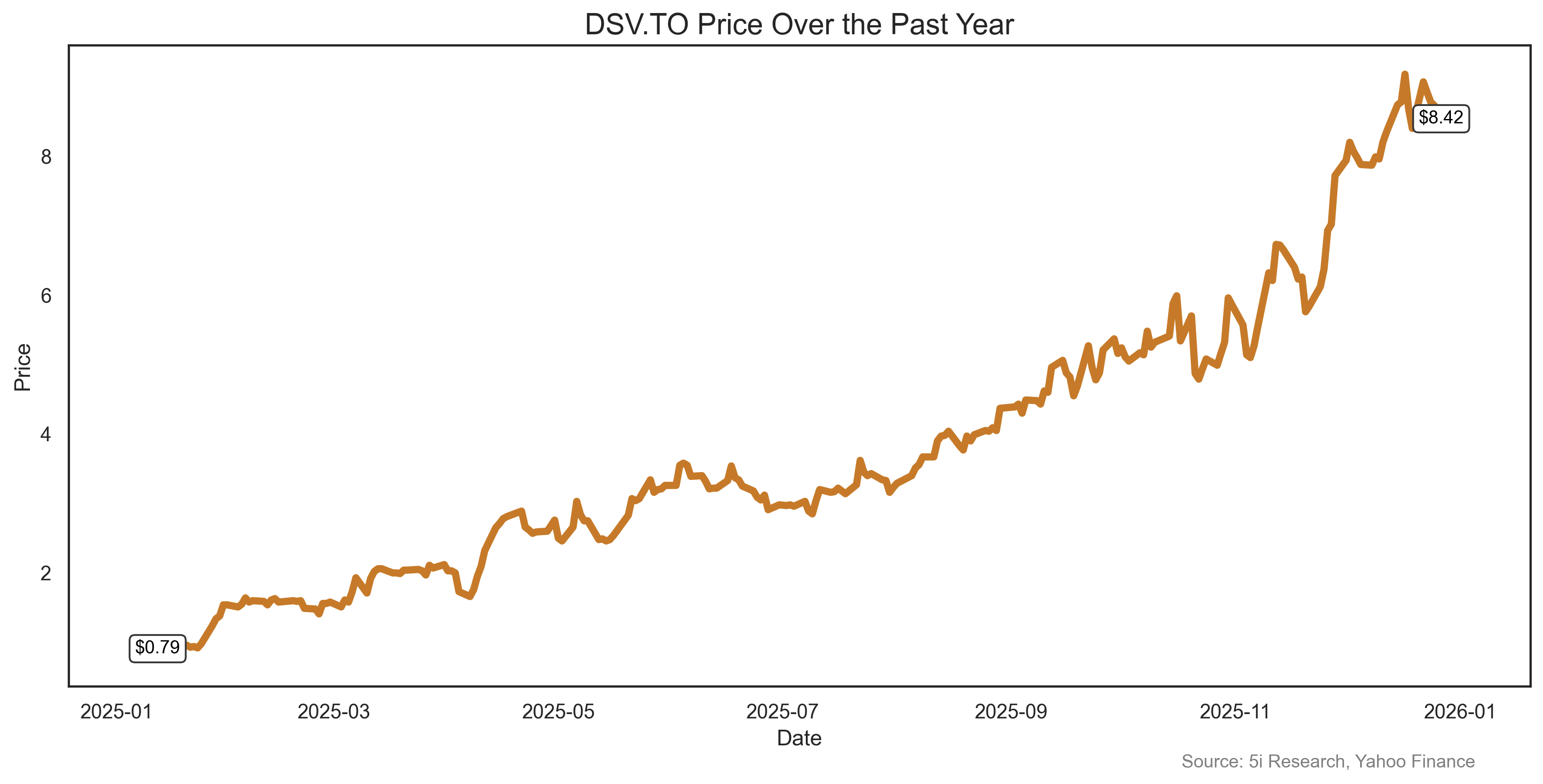

Discovery Silver DSV

As Chandler Bing might say, Can Eric Sprott (my former boss) GET any richer? Mr. Sprott owns 10% of the company, worth $680 million after the stock's 961% gain for the year. Eric owned even more of the company before selling down a bit near year end. Silver of course was the year's star, with a gain that dwarfed gold and the market. Discover started producing this year, and investors 'discovered' riches, that's for sure.

As Chandler Bing might say, Can Eric Sprott (my former boss) GET any richer? Mr. Sprott owns 10% of the company, worth $680 million after the stock's 961% gain for the year. Eric owned even more of the company before selling down a bit near year end. Silver of course was the year's star, with a gain that dwarfed gold and the market. Discover started producing this year, and investors 'discovered' riches, that's for sure.

As Chandler Bing might say, Can Eric Sprott (my former boss) GET any richer? Mr. Sprott owns 10% of the company, worth $680 million after the stock's 961% gain for the year. Eric owned even more of the company before selling down a bit near year end. Silver of course was the year's star, with a gain that dwarfed gold and the market. Discover started producing this year, and investors 'discovered' riches, that's for sure.

As Chandler Bing might say, Can Eric Sprott (my former boss) GET any richer? Mr. Sprott owns 10% of the company, worth $680 million after the stock's 961% gain for the year. Eric owned even more of the company before selling down a bit near year end. Silver of course was the year's star, with a gain that dwarfed gold and the market. Discover started producing this year, and investors 'discovered' riches, that's for sure.

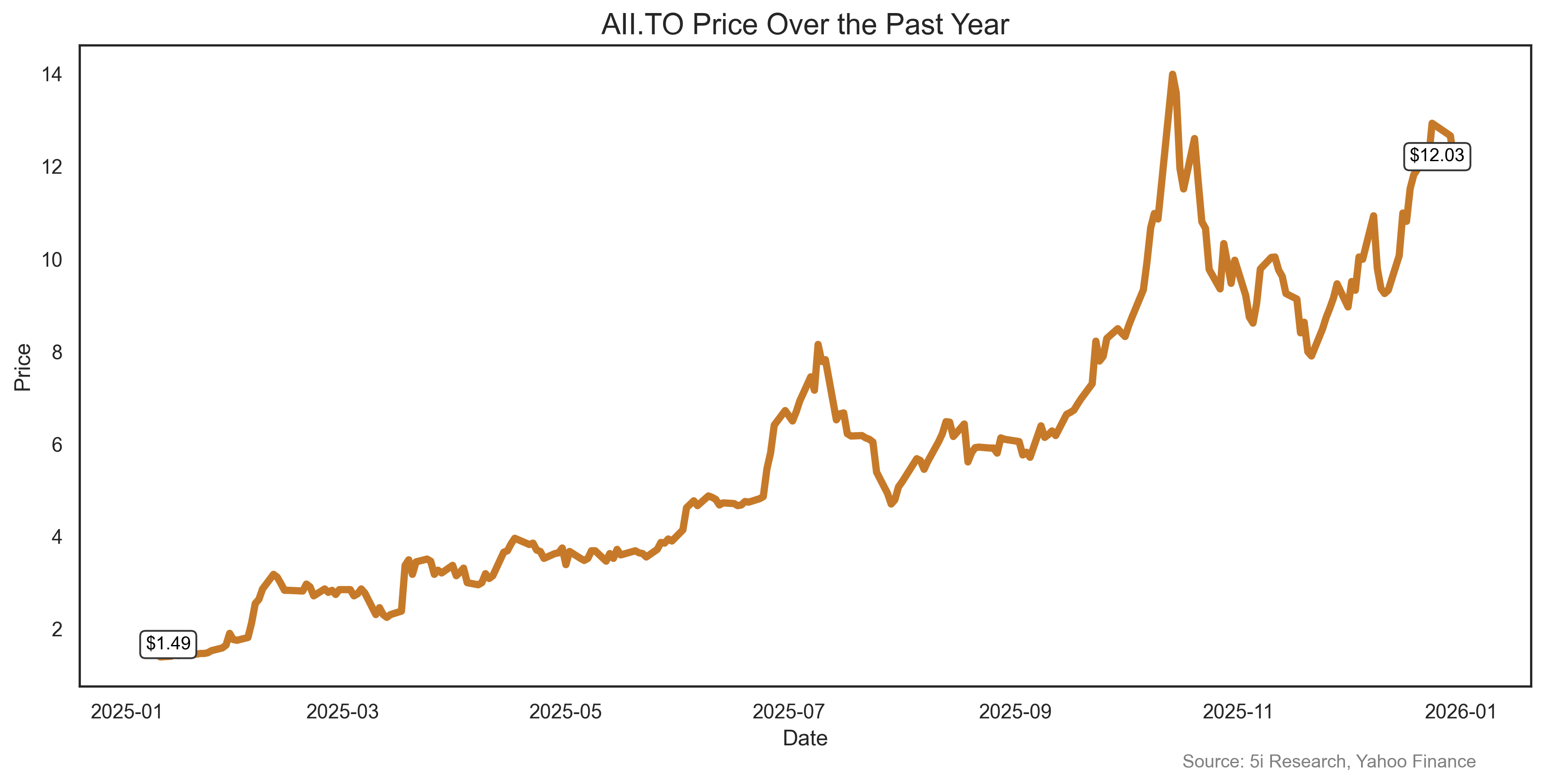

Almonty Industries Inc. AII

Looking at Almonty's stock symbol, you might think its big gain has something to do with artificial intelligence. But you would be wrong. AImonty owns a S. Korean tungsten mine, which just started production. Tungsten has been declared a critical metal by the US and several other countries. This, plus a large US financing, sent AII shares up 698% last year. Short sellers are, no doubt, in critical condition.

Looking at Almonty's stock symbol, you might think its big gain has something to do with artificial intelligence. But you would be wrong. AImonty owns a S. Korean tungsten mine, which just started production. Tungsten has been declared a critical metal by the US and several other countries. This, plus a large US financing, sent AII shares up 698% last year. Short sellers are, no doubt, in critical condition.

Looking at Almonty's stock symbol, you might think its big gain has something to do with artificial intelligence. But you would be wrong. AImonty owns a S. Korean tungsten mine, which just started production. Tungsten has been declared a critical metal by the US and several other countries. This, plus a large US financing, sent AII shares up 698% last year. Short sellers are, no doubt, in critical condition.

Looking at Almonty's stock symbol, you might think its big gain has something to do with artificial intelligence. But you would be wrong. AImonty owns a S. Korean tungsten mine, which just started production. Tungsten has been declared a critical metal by the US and several other countries. This, plus a large US financing, sent AII shares up 698% last year. Short sellers are, no doubt, in critical condition.

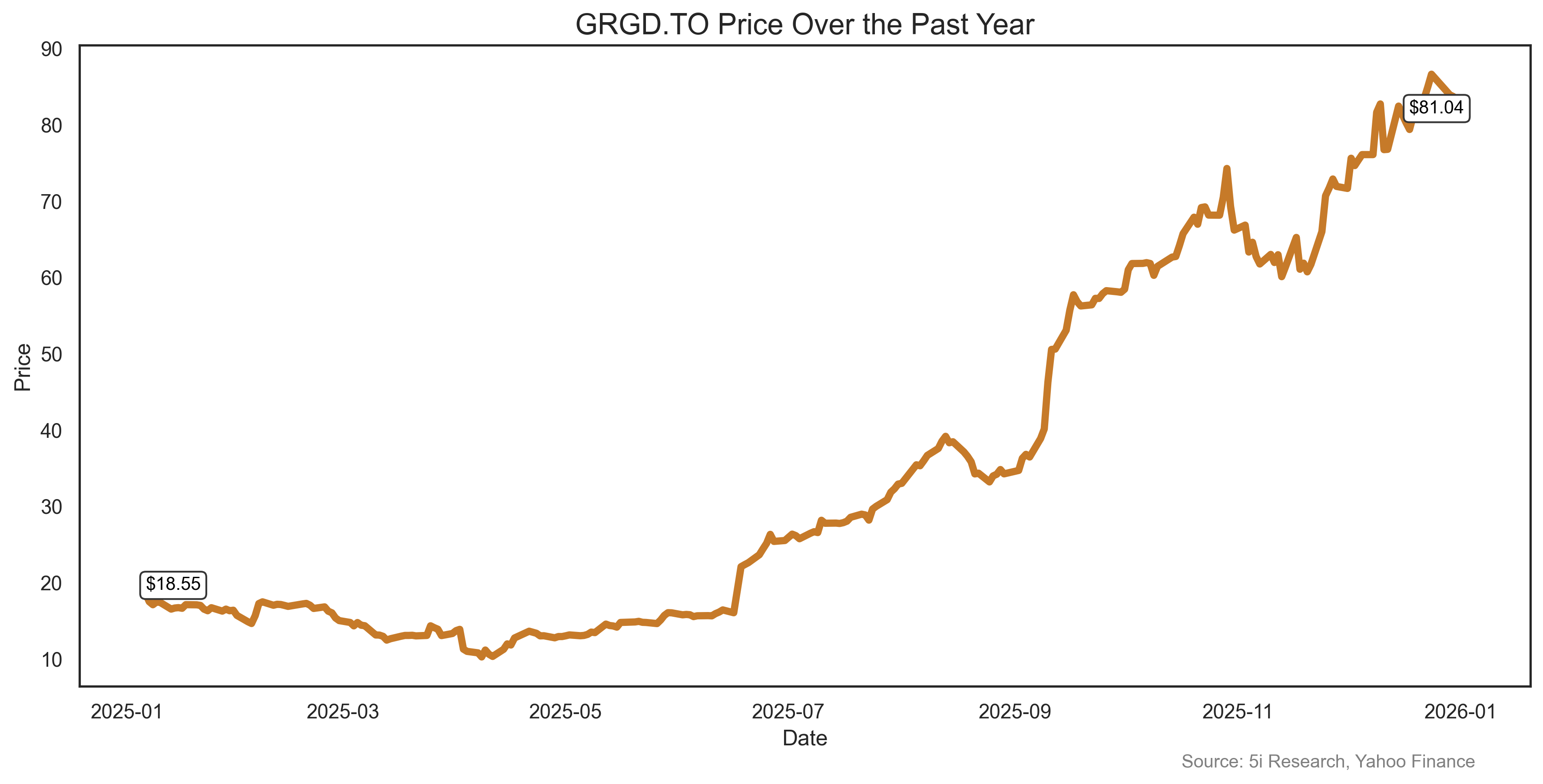

Groupe Dynamite Inc. GRGD

BOOM!!! Or, as JJ Walker might say, DY-NO-MITE!!!!! Young readers won't know what I'm talking about here, but trust me, it was GOOD TIMES. Groupe Dynamite, em, exploded, with a 2025 gain of 336%. GRGD reported absolutely stellar same store sales above 30%. Investors and fashion seekers lined up to buy shares of the fashion retailer. It has nothing to do with AI, crypto, or space, but took off nonetheless.

BOOM!!! Or, as JJ Walker might say, DY-NO-MITE!!!!! Young readers won't know what I'm talking about here, but trust me, it was GOOD TIMES. Groupe Dynamite, em, exploded, with a 2025 gain of 336%. GRGD reported absolutely stellar same store sales above 30%. Investors and fashion seekers lined up to buy shares of the fashion retailer. It has nothing to do with AI, crypto, or space, but took off nonetheless.

BOOM!!! Or, as JJ Walker might say, DY-NO-MITE!!!!! Young readers won't know what I'm talking about here, but trust me, it was GOOD TIMES. Groupe Dynamite, em, exploded, with a 2025 gain of 336%. GRGD reported absolutely stellar same store sales above 30%. Investors and fashion seekers lined up to buy shares of the fashion retailer. It has nothing to do with AI, crypto, or space, but took off nonetheless.

BOOM!!! Or, as JJ Walker might say, DY-NO-MITE!!!!! Young readers won't know what I'm talking about here, but trust me, it was GOOD TIMES. Groupe Dynamite, em, exploded, with a 2025 gain of 336%. GRGD reported absolutely stellar same store sales above 30%. Investors and fashion seekers lined up to buy shares of the fashion retailer. It has nothing to do with AI, crypto, or space, but took off nonetheless.

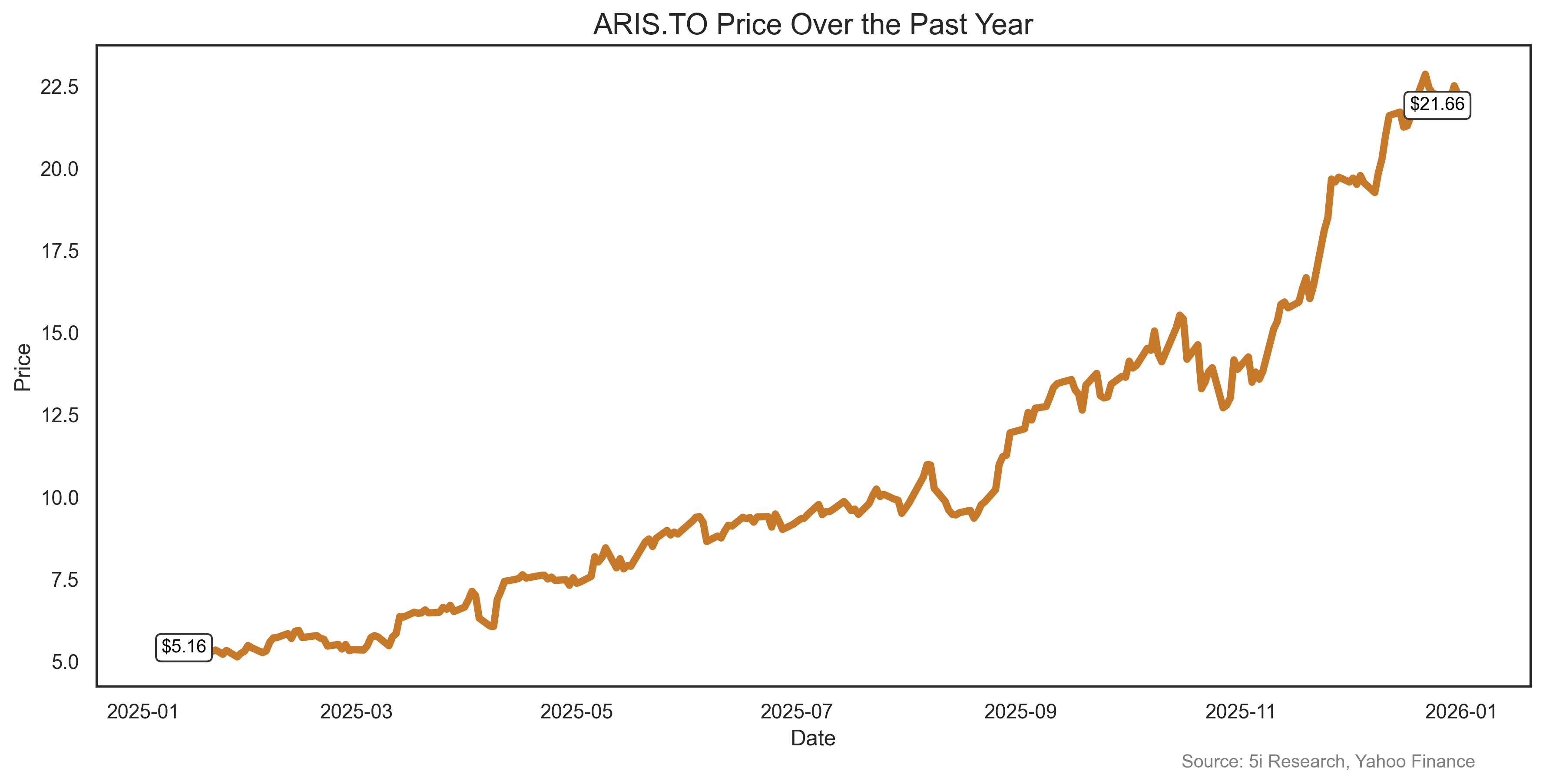

Aris Mining Corporation ARIS

Even with a 322% gain last year, ARIS shares still trade at only 13X earnings. Sure, silver rose a lot last year. But gold was no slouch, and ARIS reported strong production and made acquisitions to keep investors interested. ARIS, or so Chat GPT tells me, is a short form of Aristotle, meaning 'the best purpose', or 'excellence'. Aris Mining clearly lived up to its name last year with its giant gains.

Even with a 322% gain last year, ARIS shares still trade at only 13X earnings. Sure, silver rose a lot last year. But gold was no slouch, and ARIS reported strong production and made acquisitions to keep investors interested. ARIS, or so Chat GPT tells me, is a short form of Aristotle, meaning 'the best purpose', or 'excellence'. Aris Mining clearly lived up to its name last year with its giant gains.

Even with a 322% gain last year, ARIS shares still trade at only 13X earnings. Sure, silver rose a lot last year. But gold was no slouch, and ARIS reported strong production and made acquisitions to keep investors interested. ARIS, or so Chat GPT tells me, is a short form of Aristotle, meaning 'the best purpose', or 'excellence'. Aris Mining clearly lived up to its name last year with its giant gains.

Even with a 322% gain last year, ARIS shares still trade at only 13X earnings. Sure, silver rose a lot last year. But gold was no slouch, and ARIS reported strong production and made acquisitions to keep investors interested. ARIS, or so Chat GPT tells me, is a short form of Aristotle, meaning 'the best purpose', or 'excellence'. Aris Mining clearly lived up to its name last year with its giant gains.

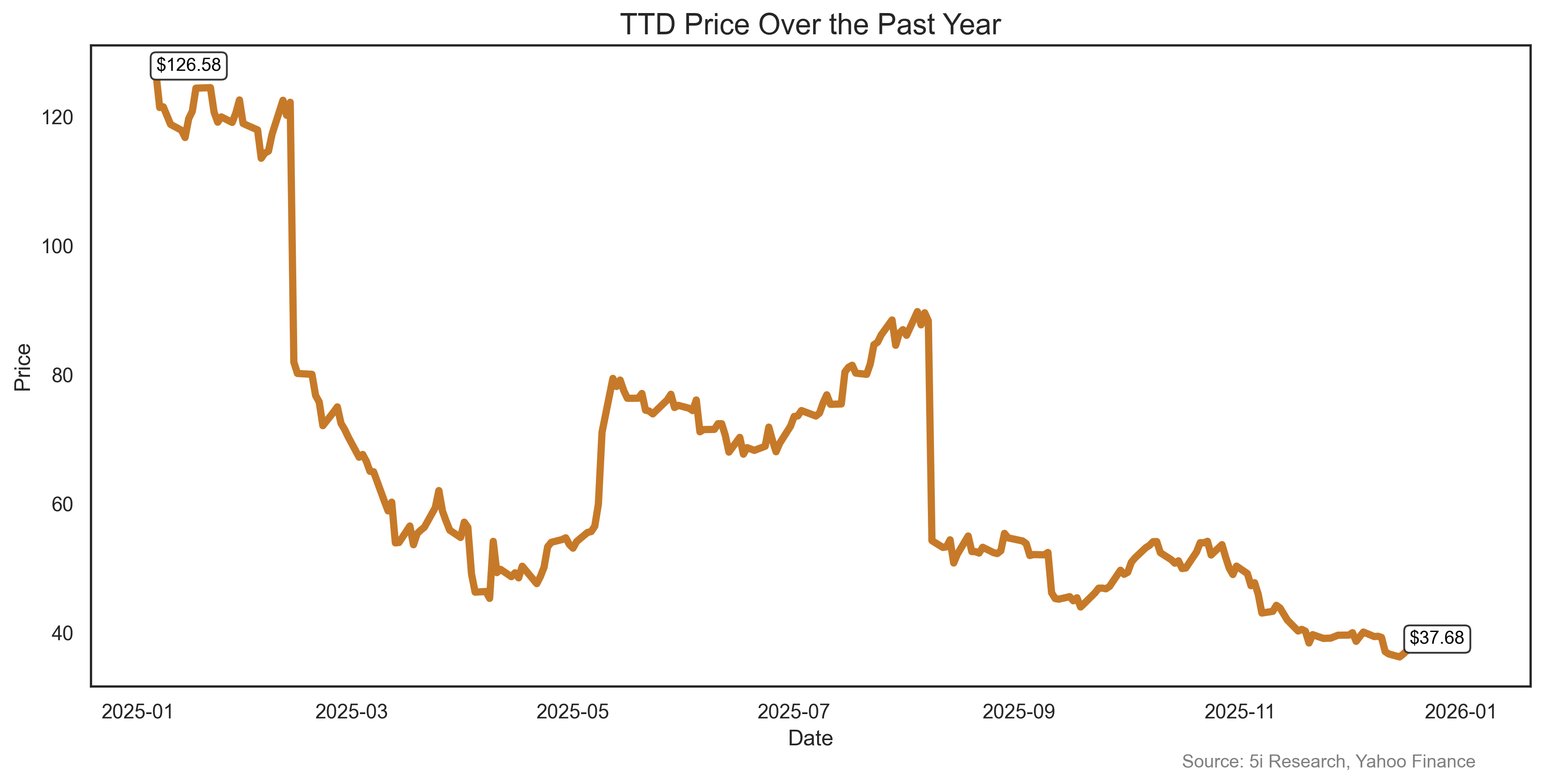

Trade Desk Inc. TTD

Down 68%, TTD has the dubious honour of being the worst-performing stock in the S&P 500 last year. And that's sad, considering it was only added to the prestigious index in July. It's sad when a super-high growth company that hasn't missed earnings estimates in ten years suddenly sees decelerating growth and missed numbers. The stock got crushed, even though most still see it as a decent play on the advertising market. Or, maybe AI takes away its business. Either way, investors didn't want to stick around to find out.

Down 68%, TTD has the dubious honour of being the worst-performing stock in the S&P 500 last year. And that's sad, considering it was only added to the prestigious index in July. It's sad when a super-high growth company that hasn't missed earnings estimates in ten years suddenly sees decelerating growth and missed numbers. The stock got crushed, even though most still see it as a decent play on the advertising market. Or, maybe AI takes away its business. Either way, investors didn't want to stick around to find out.

Down 68%, TTD has the dubious honour of being the worst-performing stock in the S&P 500 last year. And that's sad, considering it was only added to the prestigious index in July. It's sad when a super-high growth company that hasn't missed earnings estimates in ten years suddenly sees decelerating growth and missed numbers. The stock got crushed, even though most still see it as a decent play on the advertising market. Or, maybe AI takes away its business. Either way, investors didn't want to stick around to find out.

Down 68%, TTD has the dubious honour of being the worst-performing stock in the S&P 500 last year. And that's sad, considering it was only added to the prestigious index in July. It's sad when a super-high growth company that hasn't missed earnings estimates in ten years suddenly sees decelerating growth and missed numbers. The stock got crushed, even though most still see it as a decent play on the advertising market. Or, maybe AI takes away its business. Either way, investors didn't want to stick around to find out.

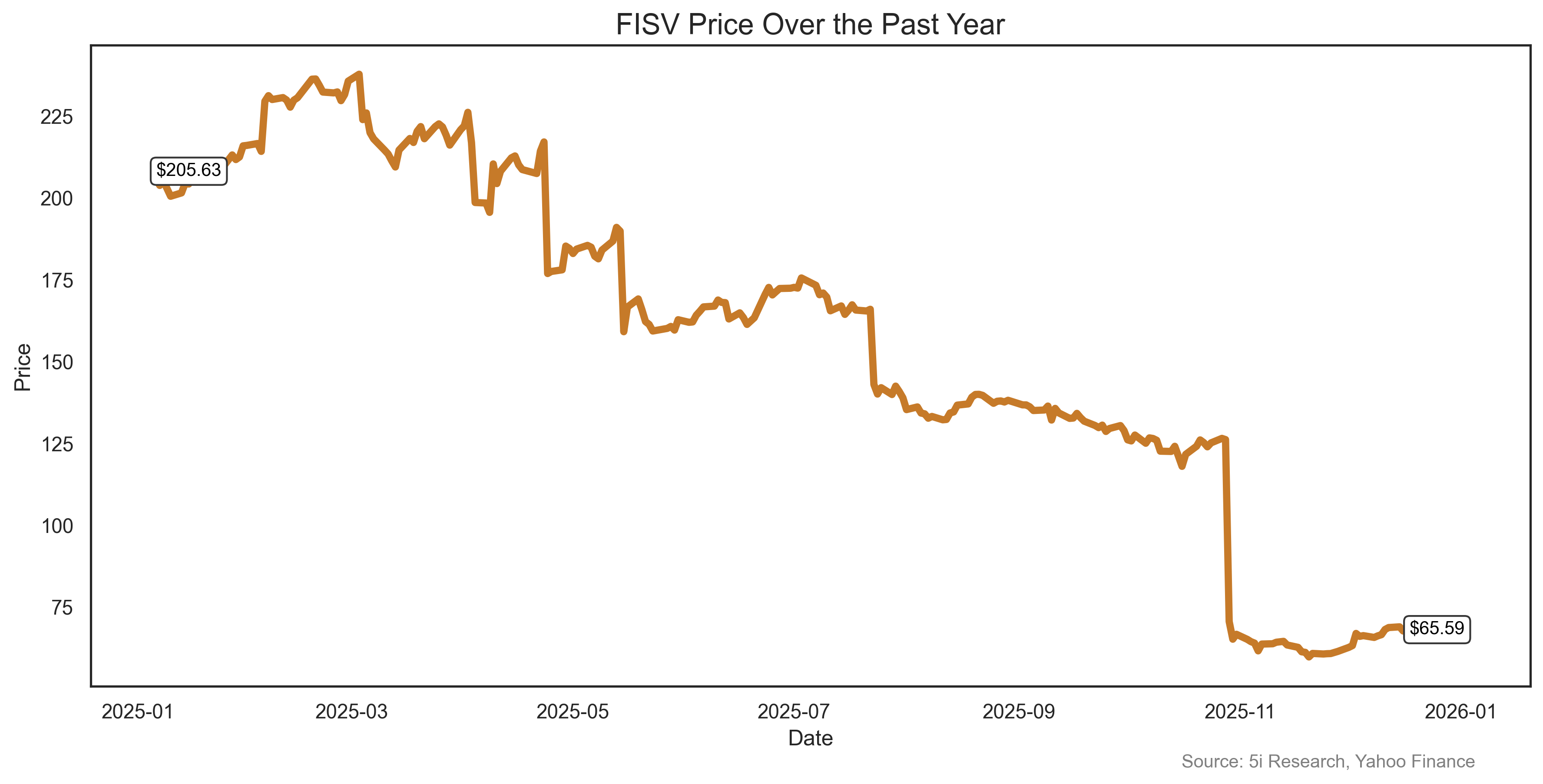

Fiserve Inc. FISV

Fiserv collapsed in October, missing estimates and forecasting much slower growth. Down 67%, the decline was sharp and harsh, for what was once a $100 billion company. Valuation has dropped to 7 times' earnings, but investors still don't care much.

Fiserv collapsed in October, missing estimates and forecasting much slower growth. Down 67%, the decline was sharp and harsh, for what was once a $100 billion company. Valuation has dropped to 7 times' earnings, but investors still don't care much.

Fiserv collapsed in October, missing estimates and forecasting much slower growth. Down 67%, the decline was sharp and harsh, for what was once a $100 billion company. Valuation has dropped to 7 times' earnings, but investors still don't care much.

Fiserv collapsed in October, missing estimates and forecasting much slower growth. Down 67%, the decline was sharp and harsh, for what was once a $100 billion company. Valuation has dropped to 7 times' earnings, but investors still don't care much.

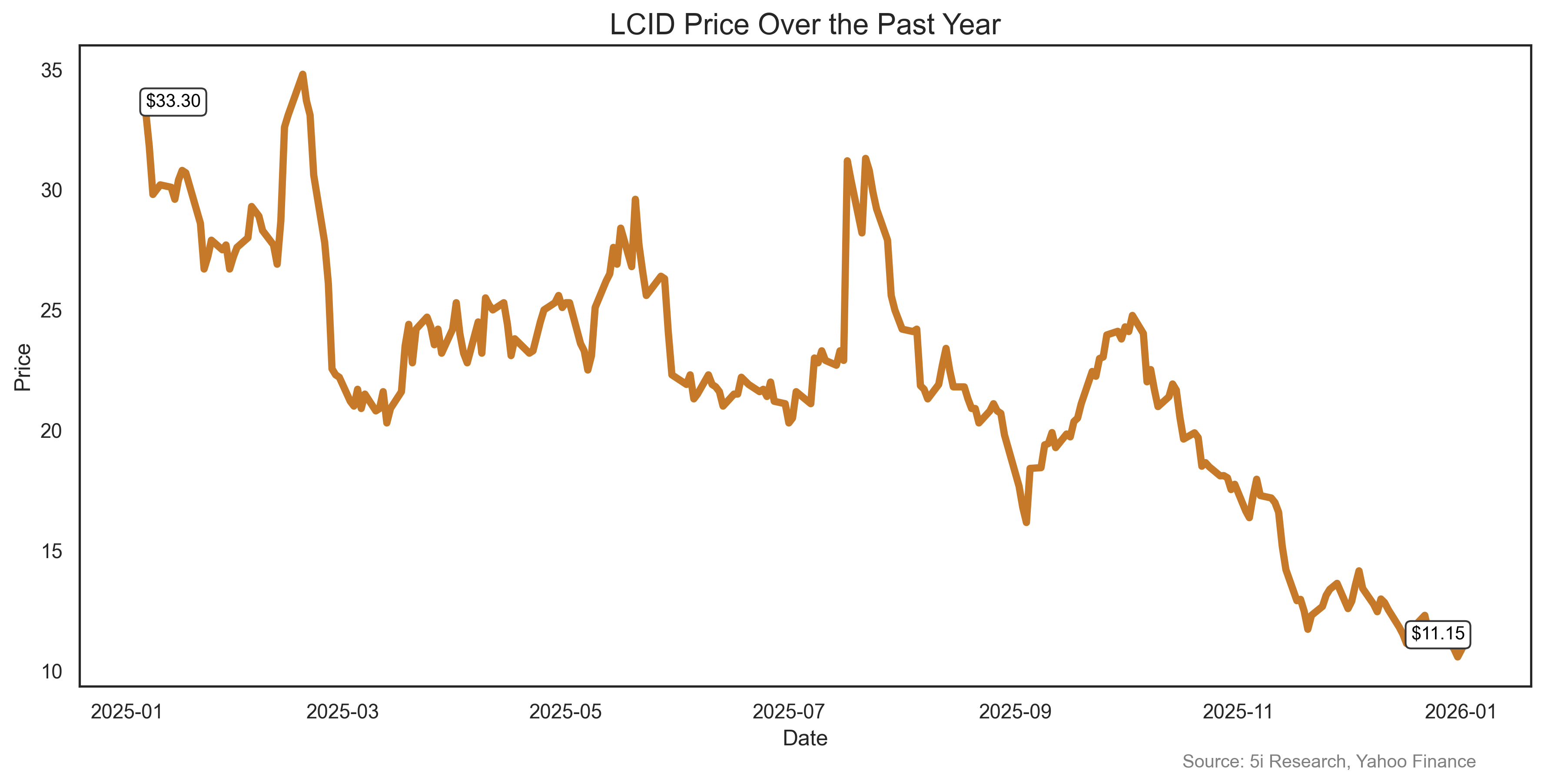

Lucid Group Inc. LCID

Lucid cars look pretty cool, and they are selling. Lucid sales have more than doubled since 2023. Trouble is, the company just can't make any money. It will lose more than $3 billion when 2025 numbers are reported, and cash flow is also negative. With plenty of competition, investors decided to sell the shares down 65%.

Lucid cars look pretty cool, and they are selling. Lucid sales have more than doubled since 2023. Trouble is, the company just can't make any money. It will lose more than $3 billion when 2025 numbers are reported, and cash flow is also negative. With plenty of competition, investors decided to sell the shares down 65%.

Lucid cars look pretty cool, and they are selling. Lucid sales have more than doubled since 2023. Trouble is, the company just can't make any money. It will lose more than $3 billion when 2025 numbers are reported, and cash flow is also negative. With plenty of competition, investors decided to sell the shares down 65%.

Lucid cars look pretty cool, and they are selling. Lucid sales have more than doubled since 2023. Trouble is, the company just can't make any money. It will lose more than $3 billion when 2025 numbers are reported, and cash flow is also negative. With plenty of competition, investors decided to sell the shares down 65%.

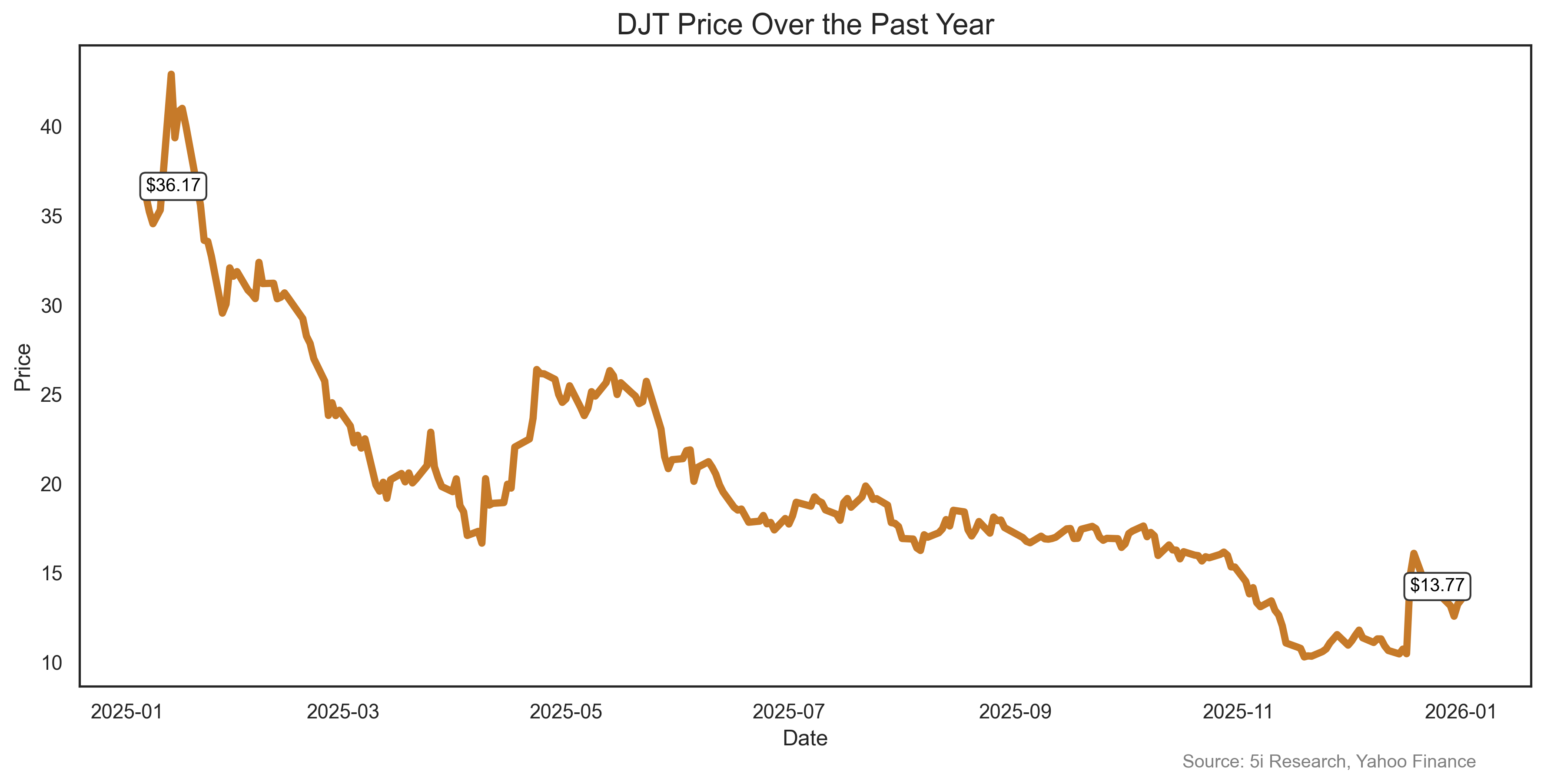

Trump Media & Technology Group DJT

-61%. Truth Social, Donald Trump's social media site, and competitor to X, somehow is worth $4 billion, even though it has revenue of only about $4 million. Investors realized that an app with a couple of dozen subscribers (we jest, it must be a couple of thousand) is just not worth that much. Still, it was worth $7 billion at the start of 2025, so go figure. The DONALD himself likely realized this thing was overpriced, and in December arranged a merger with TAE Technologies, an energy fusion company. Since TAE is not expected to see commercial operations until at least 2031, investors can continue to wildly speculate that this thing is worth anything for another five years. DJT also announced it will distribute some digital tokens to shareholders. We can't make this stuff up.

-61%. Truth Social, Donald Trump's social media site, and competitor to X, somehow is worth $4 billion, even though it has revenue of only about $4 million. Investors realized that an app with a couple of dozen subscribers (we jest, it must be a couple of thousand) is just not worth that much. Still, it was worth $7 billion at the start of 2025, so go figure. The DONALD himself likely realized this thing was overpriced, and in December arranged a merger with TAE Technologies, an energy fusion company. Since TAE is not expected to see commercial operations until at least 2031, investors can continue to wildly speculate that this thing is worth anything for another five years. DJT also announced it will distribute some digital tokens to shareholders. We can't make this stuff up.

-61%. Truth Social, Donald Trump's social media site, and competitor to X, somehow is worth $4 billion, even though it has revenue of only about $4 million. Investors realized that an app with a couple of dozen subscribers (we jest, it must be a couple of thousand) is just not worth that much. Still, it was worth $7 billion at the start of 2025, so go figure. The DONALD himself likely realized this thing was overpriced, and in December arranged a merger with TAE Technologies, an energy fusion company. Since TAE is not expected to see commercial operations until at least 2031, investors can continue to wildly speculate that this thing is worth anything for another five years. DJT also announced it will distribute some digital tokens to shareholders. We can't make this stuff up.

-61%. Truth Social, Donald Trump's social media site, and competitor to X, somehow is worth $4 billion, even though it has revenue of only about $4 million. Investors realized that an app with a couple of dozen subscribers (we jest, it must be a couple of thousand) is just not worth that much. Still, it was worth $7 billion at the start of 2025, so go figure. The DONALD himself likely realized this thing was overpriced, and in December arranged a merger with TAE Technologies, an energy fusion company. Since TAE is not expected to see commercial operations until at least 2031, investors can continue to wildly speculate that this thing is worth anything for another five years. DJT also announced it will distribute some digital tokens to shareholders. We can't make this stuff up.

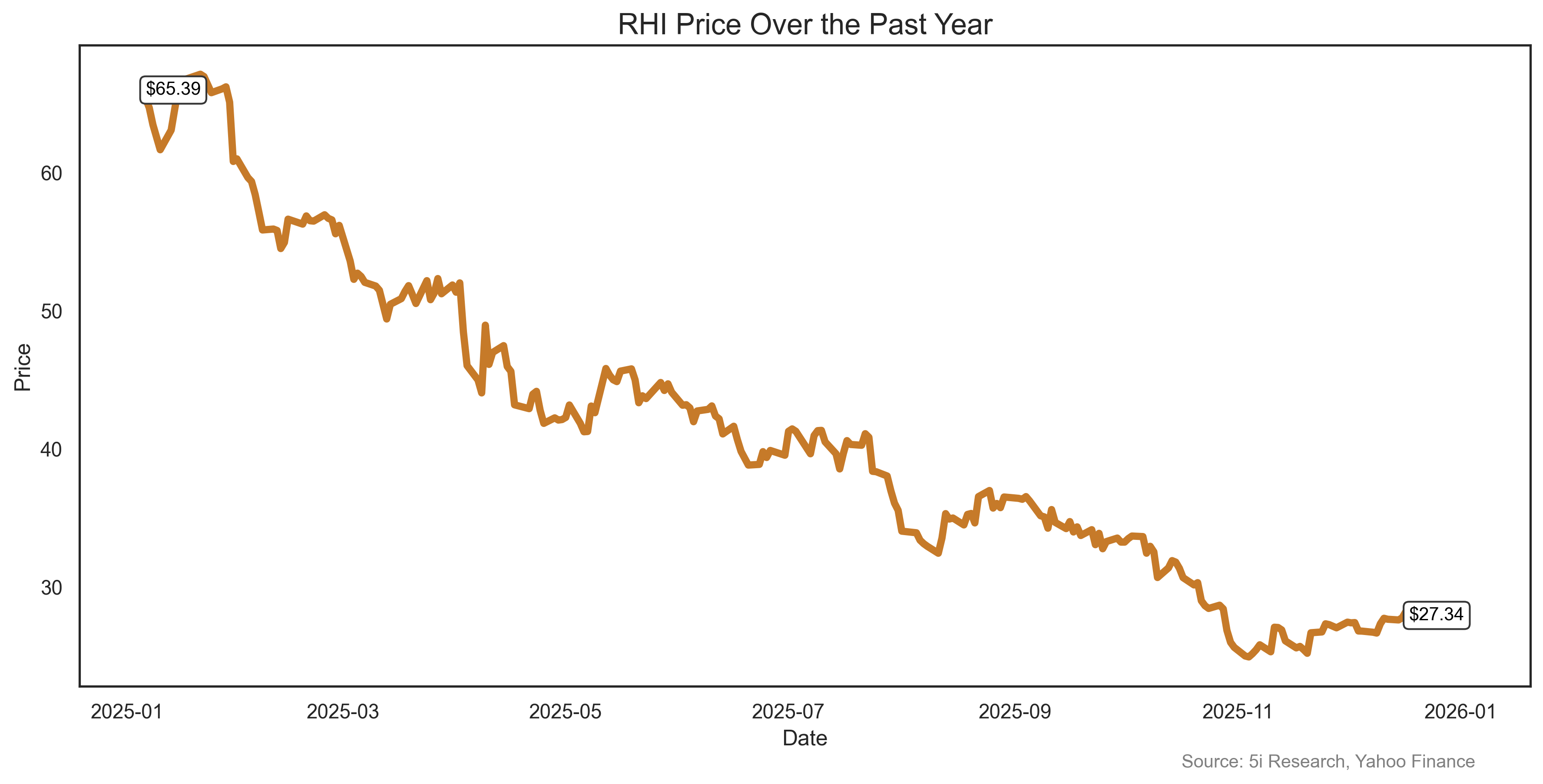

Robert Half Inc. RHI

Are you looking for a job? Are the robots helping you with the task? Robert Half would like your business. Please. Please! RHI shares fell 57% last year on missed earnings, lowered guidance and other issues. The company provides temporary and permanent staffing solutions, but as the robots take over we guess companies do not need their placement services so much any more. So, Robert HALF shares were cut in HALF.

Are you looking for a job? Are the robots helping you with the task? Robert Half would like your business. Please. Please! RHI shares fell 57% last year on missed earnings, lowered guidance and other issues. The company provides temporary and permanent staffing solutions, but as the robots take over we guess companies do not need their placement services so much any more. So, Robert HALF shares were cut in HALF.

Are you looking for a job? Are the robots helping you with the task? Robert Half would like your business. Please. Please! RHI shares fell 57% last year on missed earnings, lowered guidance and other issues. The company provides temporary and permanent staffing solutions, but as the robots take over we guess companies do not need their placement services so much any more. So, Robert HALF shares were cut in HALF.

Are you looking for a job? Are the robots helping you with the task? Robert Half would like your business. Please. Please! RHI shares fell 57% last year on missed earnings, lowered guidance and other issues. The company provides temporary and permanent staffing solutions, but as the robots take over we guess companies do not need their placement services so much any more. So, Robert HALF shares were cut in HALF.

Take Care,

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Analysts of 5i Research responsible for this report have a financial or other interest in TTD, FISV. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.