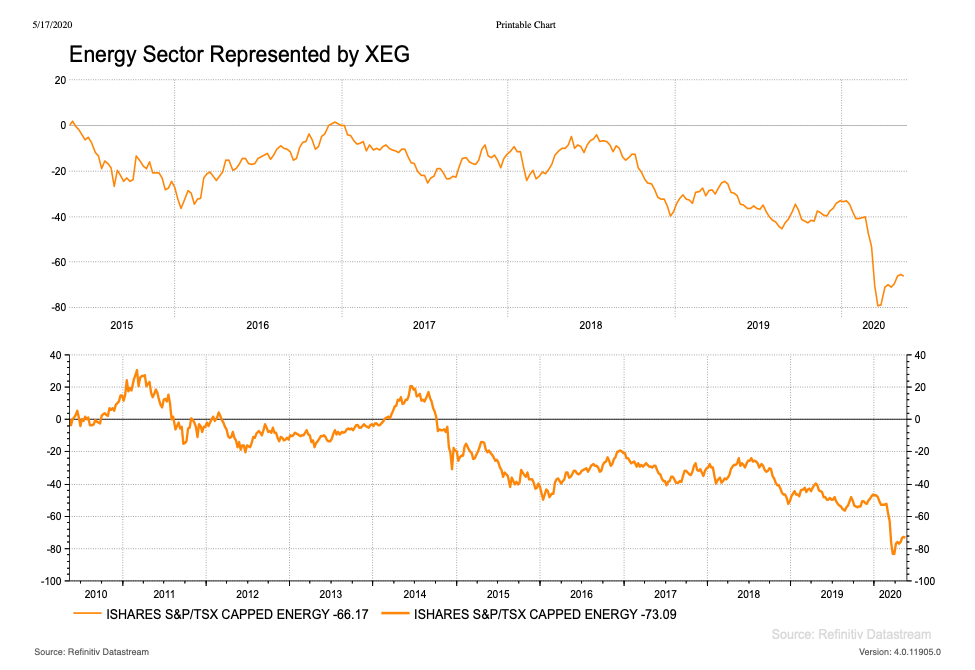

It is probably no surprise to readers that oil companies have been poor performers for some time now. For those of us that have managed to put the destruction in the back of our minds, the chart below is a reminder through the iShares ETF XEG over five (upper chart) and ten (lower chart) years.

There are many reasons the sector has been devastated:

- From a relative standpoint, there are many other industries out there that generate better and less risky returns on capital invested, making investors less willing to ‘pay up’ for these companies.

- From a demand point of view, other alternatives have been gaining ‘steam’, offering a substitute for oil on the margins.

- In Canada, looking at policy decisions, it is pretty clear that the government has very little appetite to support or encourage this industry, adding to uncertainty for investors and companies that might invest in the industry. We are not going to wade into the debate on whether this is right or wrong, much ink has been spilled on both sides. Regardless, this is the reality, whether one likes it or not.

- From a societal standpoint, the appetite for supporting oil is also on the decline while the appetite for alternative energies is rising from both a consumer and investor perspective.

- And, finally, the elephant in the room of OPEC being able to control where energy prices go has led to lower oil prices in the near-term, bringing the economics of many Canadian oil companies into question.

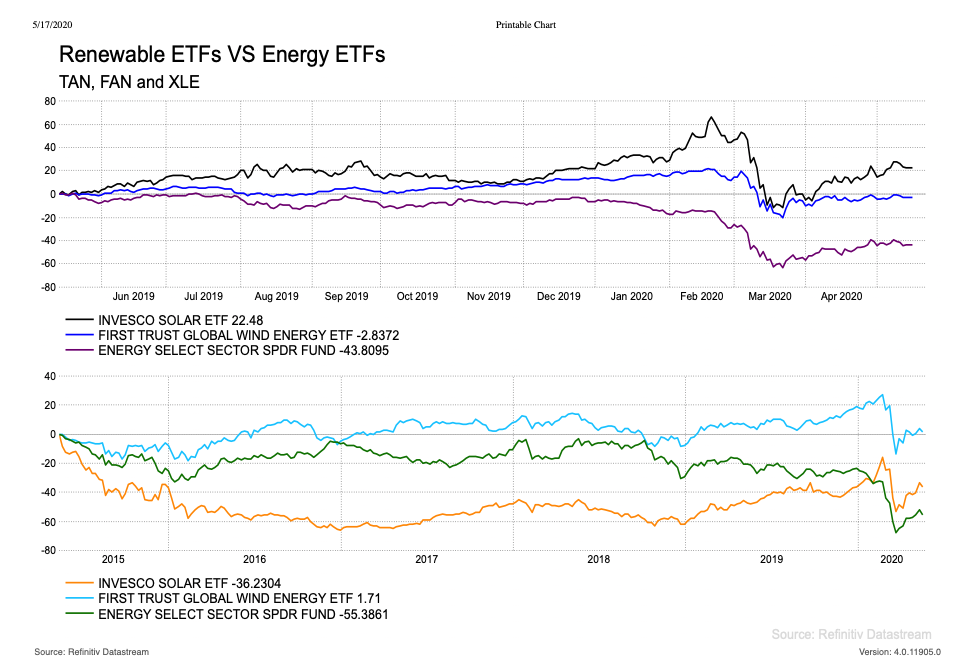

Some of the above points relate to the ‘fundamentals’ of an oil company such as how quickly they can grow earnings or the types of returns they can generate for an investor. Other points impact the valuation multiples, or how much an investor is willing to pay for a business. If you operate in a jurisdiction where the government is not aligned with an industry, you will likely pay a lower multiple for that business. Alternatively, to gain exposure for the theme du jour that everyone is interested in, such as ESG, investors are willing to pay a premium at this time. To help drive this point home, take a look at the valuations and the performance of an oil ETF and some renewable energy ETFs.

Energy Select Sector SPDR ETF (XLE):

- P/B = 1.1

- P/CF = 4.5

First Trust Global Wind Energy ETF (FAN):

- P/B = 1.7

- P/CF = 7.8

Invesco Solar ETF (TAN):

- P/B = 1.77

- P/E = 18.4 (P/CF not provided)

Over one- and five-year periods, XLE has underperformed both FAN and TAN. More interestingly, if we ignore the recent decline in all ETFs, due to the recent crisis for the one-year chart, there is a pretty clear negative correlation in performance between TAN and XLE.

What is the biggest mistake Canadian oil companies are making?

They need to stop considering themselves ‘oil’ companies and start viewing themselves as ‘energy’ companies.

And when I say ‘energy’ I mean everything energy. Oil companies should produce oil, be buying wind farms, and putting up solar farms at levels that actually move the needle on revenues.

If oil companies pivoted their strategy, proclaimed they are now energy companies and said that they will be diverting all future cash flows into renewable energy projects, they would take care of a few problems in one fell swoop:

- Share valuations would very likely be re-rated higher.

- A pivot to supporting renewable energy puts them in a better light from a political and societal perspective.

- Provides optionality for capital allocation and revenue diversification – When oil prices are high, they can invest in oil projects. When oil prices are low, they can invest in alt-energy projects.

A simple but minor shift in strategy could actually lead to better fundamentals and drastically improve the demand for shares within the industry and help to ease what looks more and more like an inevitable transition into a more balanced composition of sources of energy within Canada.

Maybe I am missing something, maybe it is too simplistic, but it does not look like many or any oil companies are even trying to consider alternatives. A strategy shift such as this could have a lot of potential in improving investor sentiment toward the sector, giving oil companies control of the narrative again, and even reducing reliance on oil cartels.

We have not seen this development yet but keep an eye out for this over the coming years. And oil companies that benefit from such a strategy, feel free to send the cheques for free consulting our way!

Take care,

![]()

Thinking about becoming a 5i Research Member? There is no better time to join but don't just take our word for it. Try it for free for the next month and experience all the benefits of the 5i Research membership. (And don't worry. We won't ask for your credit card upfront)

Please note that the author does not hold a financial or other interest in securities mentioned.

Comments

Login to post a comment.