TFSA or RRSP? Which is better, and which type of stocks or ETFs should be included? This might be one of the most common questions for Canadians in the personal finance and investment space. After first distinguishing between the two accounts, we are going to take a quantitative look at the two accounts.

Then, since most things in finance are not cut-and-dried, we will try to look at the more granular and qualitative factors that may influence the RRSP and TFSA decision. After this, we will then take a more granular look at the issue of asset location and see which types of holdings might make sense across different account types.

For investors who want to quickly see what they actually currently hold across different institutions and accounts, Portfolio Analytics lets you easily see all your investments by account type and on an overall basis.

What is a TFSA?

A TFSA (Tax-Free Savings Account) is what is known as a tax-exempt account. These types of accounts allow your investments to grow tax-free. The only catch is that the money being used to fund a TFSA has already been taxed as income. So you are using after-tax dollars and get no type of credit or rebate when funding this account, but you do get to enjoy the tax-free growth.

Once an investment is in a TFSA, it will grow as follows: (1+r)^n. This says that the gains grow and compound indefinitely (remember you have already paid income tax on the initial amounts).

What is an RRSP?

An RRSP (Registered Retirement Savings Plan) is a tax-deferred account. This means that you invest ‘before income tax’ dollars into the RRSP, allow them to grow tax-free but they are then taxed at your prevailing income tax rate when you withdraw from the account.

So the taxation on your income and the gains are being pushed back to a later period, but you still pay income tax on those funds once withdrawn.

In a TFSA, you pay initial income tax but those funds within the TFSA (and even when withdrawn) are not taxed. Amounts in an RRSP grow following this formula: (1+r)^n (1-Tn). The 'Tn' is the tax rate when the withdrawal occurs in the future.

The Simple Rule

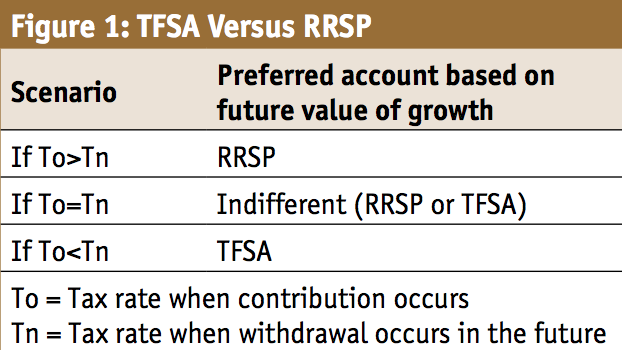

What follows is the simple rule, taken right from the CFA textbooks, to follow when determining which account is optimal to fund. It is one that is not often mentioned: If your tax rate is greater when funding the account than it will be when withdrawing, the RRSP is best to use as the compounded future value is higher.

If your tax rate when contributing is the same as the tax rate upon withdrawal, then you are indifferent to the accounts.

If your tax rate is less when funding the account than when withdrawing, you would prefer the tax-free account. Figure 1 puts this into a more formulaic view.

To think of this intuitively, if we look at the two equations provided earlier (1+r^n and 1+r^n*1-Tn) and focus on equivalent tax rates today and in the future, the end result can easily be seen. With the same growth in the accounts, the end amount is the same at the same tax rates. Feel free to plug some numbers in to test it out. Just be sure you are applying before and after-tax dollars appropriately! With this understanding, it is intuitive then that you would simply want to realize taxes, whenever your tax rate is the lowest.

RRSPs allow the realization of taxes in the future, TFSAs allow tax to be realized immediately. So why is it so hard to find this rule? This is likely because the situation can get complicated and does involve some uncertainty, mainly, determining what your tax rate in the future will be.

Your Future Tax Rate:

This is where layers of complexity are added. In order to make an optimal tax efficiency decision, you have to know what your tax picture will look like in the future. Many years ago, it was clearer that in retirement, individuals make less money.

But now with the proliferation of investing, people working later in life, a Boomer generation with some pretty solid pensions and high asset values with the help of housing prices, we tend to think that this future tax scenario has become a bit less clear for many.

This future determination of tax rates gets easier as time passes and things become more clear, but certainly at a young age when an individual starts on their financial journey, the decision is very difficult to make with any real accuracy.

Theory Versus Reality

This point is likely a little nuanced, especially if we are taking a long-term (over ten years) view on saving but it is worth mentioning. The growth formula used for an RRSP actually assumes that you are using before-tax dollars immediately when investing. In a lot of cases, this is not reality for many. A lot of savers have already paid income tax on funds being deposited into an RRSP. It is not until tax return season that the ‘before-tax’ amount is given back to the individual in the form of a credit. This creates two inefficiencies:

The first is that you are missing out on a year’s worth of potential investing. While the comparable TFSA contribution has had potential to grow since the beginning of the year, an individual has to wait to invest the extra amount until after the tax return has been filed. Realistically, in a down market, this would benefit the investor so it is probably fair to assume this issue cancels itself out over the long-term.

The second inefficiency is the assumption that the saver has the resolve to diligently reinvest that tax credit into the RRSP year in and year out. Often, life gets in the way and these types of credits are spent elsewhere.

Flexibility and Simplicity of the TFSA

This is the big qualitative differentiator in our view. RRSPs can be a bit confusing with various rules and guidelines to follow along with tracking them and claiming contributions appropriately for tax season. TFSA accounts are a bit easier to use as you are just taxed on your income and essentially free to do with that money what you will. You can withdraw without penalties, and unlike an RRSP, are not required to convert them to a RRIF and withdraw at a certain age.

This withdrawal flexibility is significant, especially for someone who is younger and may have more, large, or unexpected expenses. Yes, the contribution limits can be a bit confusing and were not well communicated by authorities in the past but this is the same as with RRSPs. We don’t think many people would be able to argue for an RRSP over a TFSA when it comes to enhanced simplicity and greater flexibility.

So there you have it. If someone asks whether to invest in a TFSA or RRSP, we can now respond with confidence that the answer depends on your tax rate in the future.

Our opinion on the RRSP versus TFSA debate:

Now that the TFSA has become a serious player in the retirement account conversation with the recent limit increase, we tend to favour the TFSA over an RRSP with the exception for the individual who can confidently say or determine that they will be in a lower tax bracket in the future than they are today.

With all of the rules and inefficiencies in an RRSP mentioned above, they offer too many opportunities for savers to have missteps and offer too much temptation to spend tax credits opposed to ferreting it away in your RRSP.

Flexibility is the other major factor where TFSAs get a big nod. Having the freedom to withdraw from these accounts in a pinch is a big advantage.

RRSP vs TFSA based on age

Keeping in mind that everyone’s situation is different, we think it is pretty safe to say that younger savers easily benefit from a TFSA more. Younger generations face some very large potential expenditures (housing, children, post-grad education, etc.) and being locked down by withdrawal rules can be a pain.

Not to mention that determining your future tax rate is very difficult at a young age and TFSA funds can always be transferred into an RRSP later in life. As individuals get older and have more clarity on the future while also are more likely to be in their prime earning years, the optimal decision is easier to determine through the earlier mentioned formulas.

Closing thoughts

It can become a complex topic with many ‘ifs’ that need to be taken into consideration but there are two truths we can glean from this conversation:

1. The important part is that you are utilizing at least one of these accounts. If you are using either a TFSA or RRSP, you are already ahead of the pack. If you have the funds and can use both, then you should be doing so.

2. TFSAs offer far more flexibility and if you do not save the tax credit from an RRSP contribution, TFSAs start to look more attractive overall.

Now that we have looked at which account to prioritize, what if you are in a situation where you are utilizing both types of accounts and want to know which stocks and funds to hold in an RRSP and a TFSA. This is the issue of asset location. See our answer and explanation of the strategy here.

Managing your RRSP and TFSA

While you should definitely have an TFSA and RRSP account, one of the frustrations that you will inevitably face as an investor is monitoring how all your investments are doing as a whole. This is especially problematic if you have investments across different accounts, like through your work and your personal account.

If you have a partner, that problem can easily double as now as now you may have twice as many accounts to manage, and it's extremely tedious to have to log into each account every time that you want a holistic view of all your investments. This is why we developed Portfolio Analytics where you can view your entire portfolio in one place, and have it analyzed to see if you are making any critical mistakes that may be exposing you to unnecessary risk, or limiting your returns. Take a look at what Portfolio Analytics has to offer to optimize your portfolio.

Asset Location: TFSA vs RRSP vs Non-registered account

Below we are going to look at guidelines for where different types of stocks and asset classes should be located between accounts (RRSP vs TFSA vs taxable account)

It is important to understand that the following are general guidelines only and do not constitute a financial plan and/or tax analysis. Determining optimal asset location for a large portfolio with many accounts is a complicated task and can depend on specific situations.

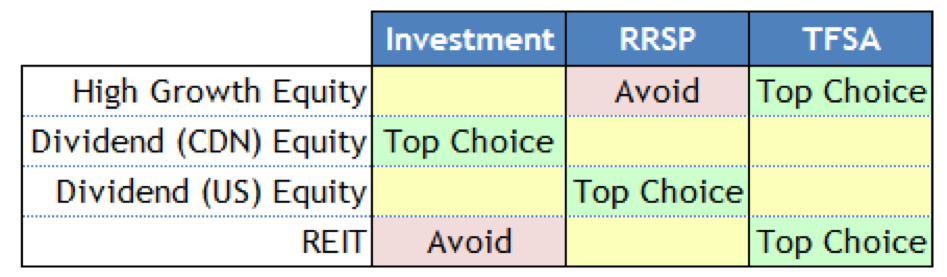

High Growth Stocks

Generally, we think the majority of these stocks should find their way into the TFSA. Profits on the stock will not incur capital gains tax when realized, nor will there be tax on the appreciated capital when withdrawn from the account. The RRSP is less ideal as gains withdrawn from the account are treated as ordinary income. So when you withdraw the resulting capital, not only do your ‘big wins’ get taxed in the first place (unlike a TFSA), they are also more punitive from an income vs. capital gains tax perspective, the latter which would occur in a typical cash account.

Of course we would all love to shelter ‘big wins’ on the next Kinaxis (KXS). However, hindsight is everything here. With the prospect of higher returns of course come higher risks and the potential to incur capital losses. While holding a large loss in a TFSA can be frustrating, we find the idea of holding a stock in a taxable account on the premise of harvesting capital losses to be a little contradictory. Not every stock will work out, but planning or expecting a material loss on it seems odd to us, unless you have run out of room in the TFSA. Then we would look to the cash account.

Dividend Stocks

Most investors understand that Canadian dividends are tax efficient investments and are the first asset class to be held in the cash account, if necessary. A distinction should be made between higher/lower yielding equity. The telecommunication and utility sectors are often associated with more generous payouts than other dividend sectors. For example, while Telus (T) and Loblaw (L) are both defensive in nature, one may wish to shelter the additional 260 basis points (bps) of yield on T. This thought can even be extended to GICs. The tax bill on a high-yield equity like Gibson Energy (GEI), just shy of an 8.0% yield, is probably higher than a 5-year GIC ladder in this rate environment.

Dividends outside of Canada do not receive the same preferential treatment and are taxed as ordinary income in a cash account, just like bond interest. In addition to Canadian tax, some countries impose a withholding tax on dividends paid to foreign investors. For example, dividends from U.S. stocks are subject to a levy of 15%. Canada has a tax treaty with the US (and other countries) whereby the withholding tax is exempted if the position is held in an RRSP.

Therefore, an RRSP is an ideal account for US dividend equity, which should be a priority over Canadian dividend equity in an RRSP. The next best place is likely the TFSA. Here, there is no tax treaty on foreign dividends or an ability to claim a tax credit (unlike a cash account). Many investors are quick to assume this makes the TFSA a poor choice but keep in mind the dividend itself is tax-free from a Canadian perspective. In a cash account, you will pay foreign withholding taxes but can claim an offsetting credit on your tax return. However, the foreign dividend is fully taxable.

Real Estate Investment Trust (REITs)

While REITs are one of the best friends for the income investor, they are not known for being tax efficient and we think these are best held in a tax-sheltered account.

A REIT payout has various components and each REIT is different in respect to the proportion of each component to the total. Where you hold the REIT depends on these underlying pieces. In general, the distribution is a mix of ‘other income’, fully taxable and not eligible for the dividend tax credit, ‘capital gains’ and ‘return of capital’. Return of capital is not taxable but does cause your adjusted cost base to fall.

The lower the cost base, the higher the realized capital gain will be when you eventually sell the REIT. A note should be made for REITs that pay almost all of their distribution as return of capital; NWH.UN comes to mind. Here, you would prefer to avoid the RRSP because profits are treated as ordinary income upon withdrawals, whereas they would receive the less onerous capital gains tax in a cash account (or avoid tax all together in the TFSA). In general, we would probably prefer REITs to be held in a TFSA to simply avoid any headaches involved with sorting out the composition of the distributions.

Exchange Traded Funds (ETFs)

Understanding the best account for your equity ETFs is detailed and will be covered in an issue of the ETF & Mutual Fund Update. Suffice to say, for a given asset class (such as US equity), understanding how the ETF invests in equity – segregated positions or other ETFs – and what exchange the fund trades on are important elements.

It’s Personal

Asset location is not as clear-cut as simple guidelines. Even investors with similar needs from the portfolio can have a different optimal structure.

Consider two dividend equity investors choosing between the RRSP or cash account. Both need income from the portfolio ‘today’; however, one is 65 and the other 45.

The older investor would likely choose the RRSP since they are forced to take a minimum payment for the eventual RRIF conversion. It makes sense to have income-producing vehicles fund this regular payout. The younger investor would likely choose the cash account, as any early withdrawals from the RRSP to fund the income needs would be penalized.

Another example of food for thought would be a young investor who seemingly would be correct in placing a US dividend stock in an RRSP to avoid withholding tax. However, if he/she can only contribute to either the TFSA or RRSP, one could argue that the TFSA should take priority so that RRSP contribution room is saved to lower higher future taxable income.

We will conclude by saying that asset location is not a concern if all of your capital can be housed in tax-sheltered accounts, especially if your portfolio is relatively small. If you have contribution room left in your RRSP or TFSA it rarely makes sense to hold investments in non-registered (taxable) accounts.

As your portfolio grows and you need to start making these asset location decisions. Understanding these general guidelines will go a long way but it may be worth consulting a fee-for-service financial advisor to determine the best asset location choices for your scenario if you still have questions.

Have you tried Portfolio Analytics?

Instantly learn whether you're making any critical mistakes in your portfolio.

Whether you're a DIY investor or using an advisor, how do you know if you’re taking unnecessary risks with your portfolio?

How do you know you’re not limiting your investment returns because you overlooked something or if your portfolio isn’t set up properly?

With Portfolio Analytics, we’ll instantly analyze your existing portfolio and inform you of any dangers and opportunities that we see. Learn more here.

Comments

Login to post a comment.