Participating licensed producers (LPs) of marijuana are inventing a new industry in real-time without a blueprint or template. This is very exciting from a risk/reward point-of-view, and Canadian marijuana stock investors who were early to the party have earned stellar returns over the short-term.

Aphria, one of the biggest licensed producers of marijuana, has returned +420% over the last year (what a coincidence).

Part 2 of this blog series will focus on four of the larger Canadian cannabis stocks, and will discuss company fundamentals, industry positioning, and general investment opportunity for the weed stocks.

(if you missed part 1 of the series, you can find it here)

Our group of LPs will be:

- Aurora Cannabis Inc. (TSX Venture: ACB)

- Aphria Inc. (TSX: APH)

- OrganiGram Holdings Inc. (TSX Venture: OGI)

- Canopy Growth Corporation (TSX: WEED)

We want to remind readers to remain cautious on the industry. Much can still happen leading up to the expected July 2018 legalization of the recreational cannabis market. In our opinion, stock prices fully reflect all news surrounding these companies and incorporate a large degree of optimism. Valuations are expensive. Even a higher risk equity investor with a the right time horizon would be wise to limit position sizes.

Investment Summary and Top Pick:

Of the group, we would prefer Canopy Growth Corporation at this time for its foothold in the industry, brand awareness, and peer relative valuation. Management has done a great job of moving quickly to secure production capacity and consolidate the market as the industry works its way through the early stages of its growth. There may also be a bit of a value play here with the recent decline in stock price but wait for signs of a recovery first.

Both Aphria and Aurora Cannabis would be our picks for higher growth potential due to the scale of their expansion plans and oncoming production capacity. However, valuations on these two names are high vs. peers and are likely most susceptible to contraction with any road bumps leading up to the expected 2018 legalization of the recreational market.

Aphria looks to have an added degree of risk however, as its expansion into the US means it is operating in a market where cannabis is still illegal at the federal level.

OrganiGram has established itself nicely in the industry and has a good foothold in the Atlantic provinces. However, the company recently had to recall a large amount of product and the stock suffered. There may continue to be some overhang here and the growth prospects, as well as operational stability, look second tier vs. peers.

The Canopy Growth Corporation (TSX: WEED): The Early Bird Catches The Worm

In a rapidly expanding market, the company that can capture the majority or market share and retain customers through effective branding could ultimately be expected to come out on top. Here, it is hard not to acknowledge Canopy Growth as the favourite.

Canopy Growth has first mover advantage in the cannabis industry and the largest market capitalization at $1.4 billion. Canopy currently has six licenses from Health Canada and operates five production facilities across Canada under three diversified brands: Tweed, Bedrocan and Mettrum Health.

These brands were amongst the first to be established in 2013 and 2014. This has allowed Canopy to capture a significant portion of the current market, and positions it well to attract potential recreational users once this market is legalized.

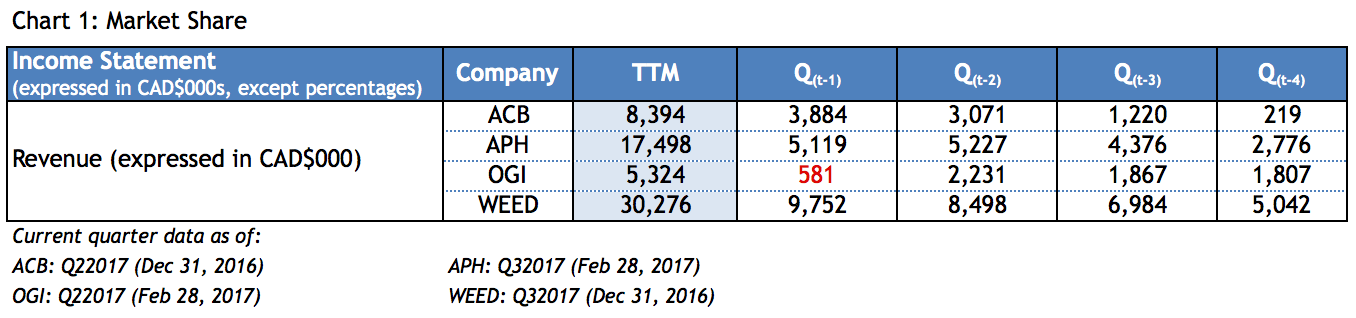

We can look at the total sales generated by our four large LPs as a proxy for market share and company position. Using ‘Chart 1: Market Share’ and taking these companies as an illustrative sample, the market has more than doubled in four quarters, going from $9.8 million to $18.2 million. With its most recent quarterly sales of $9.7 million, Canopy Growth has captured 54.0% of the market. Just as interesting, even with the sample market doubling, Canopy has still managed to maintain close to half of the market over the four quarters shown.

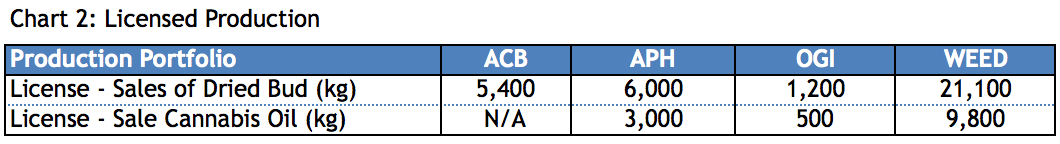

With six licenses in hand, Canopy Growth has a sales capacity of 30,900 kilograms (kg), which is more than three times as large as Aphria, the next largest licensed seller at 9,000 kg. As shown in ‘Chart 2: Production Portfolio’, Canopy’s sales capacity represents 65.7% of the 47,000 kg sample capacity.

Many are making the argument that the retail consumer will fuel future sector growth i.e. the marijuana industry will begin to resemble craft brewing rather than pharmaceuticals. Developing a strong connection with the consumer is of the utmost importance and here Canopy is second to none.

In the last year, Canopy has spent $11.2 million on sales and marketing, more than Aurora Cannabis and Aphria combined. Tweed, the company’s principle brand, has invested in cannabis content and periphery services. In addition, the partnership with Snoop Dogg (Leafs By Snoop) is a top seller in Colorado, where cannabis has already been legalized. Having several established brands gives Canopy flexibility to navigate the upcoming recreational market.

With strong brands, multiple product verticals and an international expansion underway (Germany, Brazil, Australia), Canopy Growth is our top pick for long-term price appreciation. For the opportunistic investor, there looks to be some value here with the stock down 35.0% in three months. The driving force here was use of banned pesticides by the company and a product recall. This has tarnished the stock certainly, but is old news.

Also, we think a portion of the fall was due to the stock simply needing a bit of a correction after its high flying antics. Keep in mind; this was really the only way for investors to get exposure to the space for some time without having to invest in the Venture exchange. Once the slide in the stock slows and we see a bit of a recovery, this could be a nice opportunity for the long-term investor.

Aurora Cannabis (TSX Venture: ACB):

Objects in Mirror are Closer Than They Appear

Aurora Cannabis is a latecomer to the cannabis industry and only began generating sales in its quarter ended March 31, 2016. However, the company is making up for lost time.

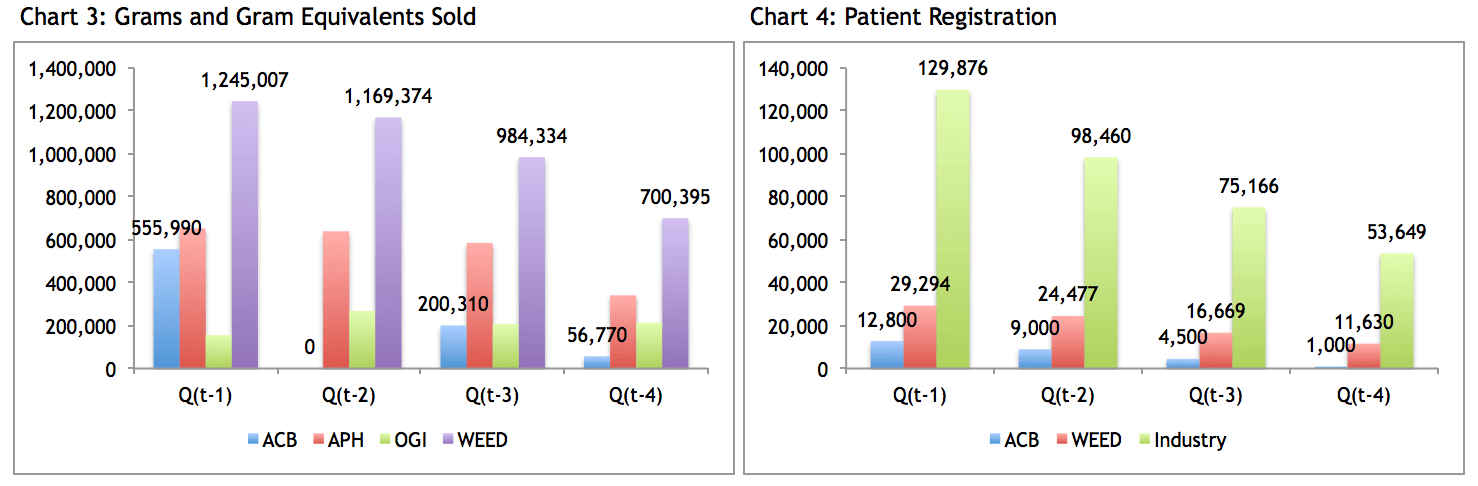

As ‘Chart 3: Grams and Gram Equivalents Sold’ shows, in the most recent quarter, Aurora sold just shy of 560,000 grams of product. This is a big jump for a company that only reported 56,770 of grams sold less than a year ago. This metric is likely the most important when evaluating past and future growth potential. As such, Aurora Cannabis is one of the fastest growing LPs in the industry.

The company also prides itself on having the fastest pace for onboarding patients with 12,000 patients in its recent quarter vs. only 1,000 three quarters ago. With 130,000 total registered industry users, this is almost a 10.0% market share.

However, we would use caution here. Not all LPs in the industry report this metric, and some consider it a less useful tool. The metric includes all-time patient registrations, meaning a portion of the number could no longer be a customer. The number also includes the same patient who is counted in other LP patient numbers. Finally, it also fails to account for good or bad customers based on the quantity of product that the customer is consuming. “Grams sold” addresses these issues for the most part.

The company has a massive expansion plan under way with the Aurora Sky project, which will position the company to be one of the largest in the industry. Today, Aurora operates a 55,000 sq. ft. purpose built indoor facility in Cremona, Alberta with an annual production capacity just shy of 6,000 kg. As per company estimates, the Aurora Sky project could produce over 100,000 kg of dried marijuana annually at full capacity, 20x current production!

The warehouse is being built strictly for production of cannabis and is not an overhauled site. A dedicated, state-of-the-art facility at such a large size represents a significant opportunity for Aurora to achieve industry-leading economies of scale. Management anticipates costs per gram to be the lowest in Canada, but they would not be the first company to make such a claim. The facility is expected to be complete late 2017.

Even more exciting, the project goes a long way to strengthening Aurora’s customer service strategy, a focal point for long-term growth. Aurora offers same-day delivery in Calgary and Edmonton, and is the only LP in Alberta.

Aurora Sky will be adjacent to the Edmonton airport, making it the only such facility in the world located at an international airport. This gives Aurora superior logistics over competitors and will help the company lower shipping costs and times, making it the favourite to one day offer same-day delivery across the country.

As well, the company is the only in the world with a mobile app on Android and Apple for purchase of legal cannabis. Customers can order product in the morning, the delivery ships the same day and arrives at dinner. The company thinks of itself as the “Amazon of cannabis”.

Achievements aside, we note this was one of the more ‘pitchy’ presentations at the recently attended 2017 GMP Cannabis Conference.

Finally, Aurora recently made a splash in the international market and acquired a 19.9% stake in Cann Group, Australia’s first licensed medical cannabis producer.

The company also acquired Peloton Pharmaceuticals recently for $7.0 million. The facility provides direct access to the Quebec market and will shorten supply lines to Atlantic provinces.

Aphria (TSX: APH): Tortoise vs. The Hare?

If this were a race to some sort of finish line, Aurora would be running at the fastest speed. Not to be outdone, Aphria Inc. is keeping pace, but with a more ‘slow and steady’ mindset.

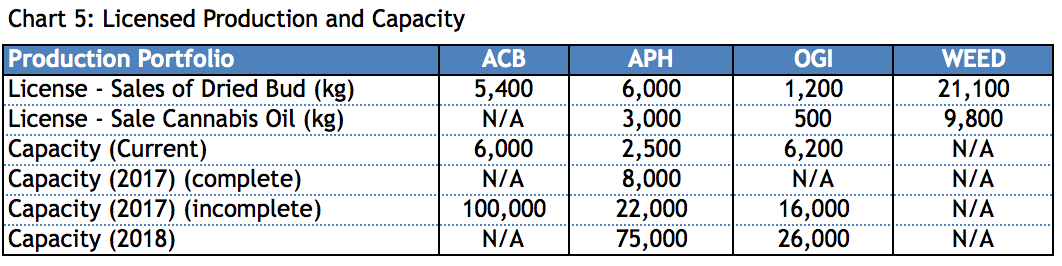

‘Chart 5: Licensed Production and Capacity' shows production expansion schedules for our peer group. Aphria is in the midst of a four-part expansion project. The company began the year with a production capacity of 2,500 kg and has since completed stage II of its build out, adding incremental capacity of 5,500 kg. The company expects to add an additional capacity of 14,000 kg in 2017, and a final 53,000 kg in 2018, bringing its total production potential to 75,000 kg. The project is expected to be complete in July 2018, putting it close to a year behind Aurora.

However, the company looks to have more capacity coming online sooner, with Part III expected to be complete in September 2017. This could help boost its market share in the short-term.

In this race, both Aphria and Aurora Cannabis are of course playing catch-up to the leader, Canopy Growth. However, Canopy does not disclose its future production capacity targets. This puts a big question mark for those betting on the race.

Regardless, Aphria continues to be one of the most active Canadian LPs and is making an aggressive move into the United States (US). On April 4, 2017, the company announced the launch of its US expansion strategy through a lead entity to be renamed Liberty Health Sciences Inc. that will operate in the US under the brand “Aphria USA”.

In connection with the investment, Liberty will acquire the assets of Chestnut Hill Tree Farm LLC, a licensed holder and authorized dispensing organization in the State of Florida. This is the largest acquisition to date. While the initial investment relates to the State of Florida, the intention of Aphria’s US expansion strategy is to target key states that have approved the medical use of marijuana.

The company also increased its ownership in an Arizona-based medical marijuana producer, Arizona Cooperstate Farms Investors. Ownership increased from 10.0% to 18.5%. The company expects to continue to deploy capital and export its know-how to the US by partnering with local companies for the production of medical marijuana.

Given the size of the market, seeing a Canadian company make a move into the US is always exciting. However, these big bets always come with big risks and there are plenty of examples where mature companies have come home with their tail between their legs. While we do not doubt Aphria’s ‘know how’, the cannabis industry is no exception to the rule and comes with more risk vs. other industries.

In Canada, federal legislation uniformly governs the cultivation, distribution, sale and possession of medical marijuana under the Access to Cannabis for Medical Purposes Regulations. In the United States, marijuana is largely regulated at the state level.

While marijuana is legal in many US state jurisdictions (we believe this number to be 29), it continues to be a controlled substance under the United States federal Controlled Substances Act. As such, a legalized state may be in violation of federal law in the United States. This is certainly a tricky operating environment.

OrganiGram (TSX Venture: OGI): Betting on a Turnaround Story

Investor sentiment towards OgraniGram has been mute of late, as the company was recently involved in a significant product recall, which resulted in their organic certification being revoked.

From a November 2016 peak of $4.5, the stock lost more than half of its value at a March 2017 low of $2.02, demonstrating the type of volatility the space can see on bad news.

For the quarter, the recall resulted in the company issuing $2.1 million in sales returns on gross revenue of $1.4 million. In addition, inventory levels fell to $1.9 million from $3.7 million in the previous quarter with $1.3 of destroyed inventory in March 2017.

The company is of course taking measures to protect this from happening again but it may continue to hold the stock down for a while without a big (good) news story. For the investor looking to find some value in the industry, this may be a good bet at current prices if you have the right risk tolerance.

Organigram is currently one of two LPs in Atlantic Canada but has the only license to produce and sell both medical marijuana and cannabis oil in Atlantic Canada.

The company has a production capacity of 6,200 kg. Expansion plans are expected to increase capacity to 16,000 kg in 2017 and then 26,000kg in 2018. The growth looks good and plans are fully funded but this expansion rate is of course second tier to Aphria and Aurora.

Most companies tout themselves as a low cost producer, understanding the importance this metric carries. However, of the four LPS examined here, OrganiGram leads the pack. In the last quarter the company reported a cost per gram of $1.85. The company’s location is advantageous vs. Ontario (majority of the licences are issued here). At 5.11 cents/kWh versus ~ 18 cents/kWh in Ontario, Organigram’s electricity costs are significantly cheaper than Ontario. Wages are 5-10% cheaper partly due to an available workforce and low costs of living.

The company also has some strategic partnerships in place that position it well for the potential legalization of recreational cannabis. OrganiGram has an exclusive Canadian brand licensing, product development, and distribution agreement with TGS International. TGS is a proven market leader based in Denver, Colorado, with recognized, award winning premium brands and product lines. The partnership with TGS is key is provinces like British Columbia and Alberta that will be allowed company-owned stores. TGS has experience on what the customer experience should look like.

Taking a Look Under the Hood: Financial Statement Overview

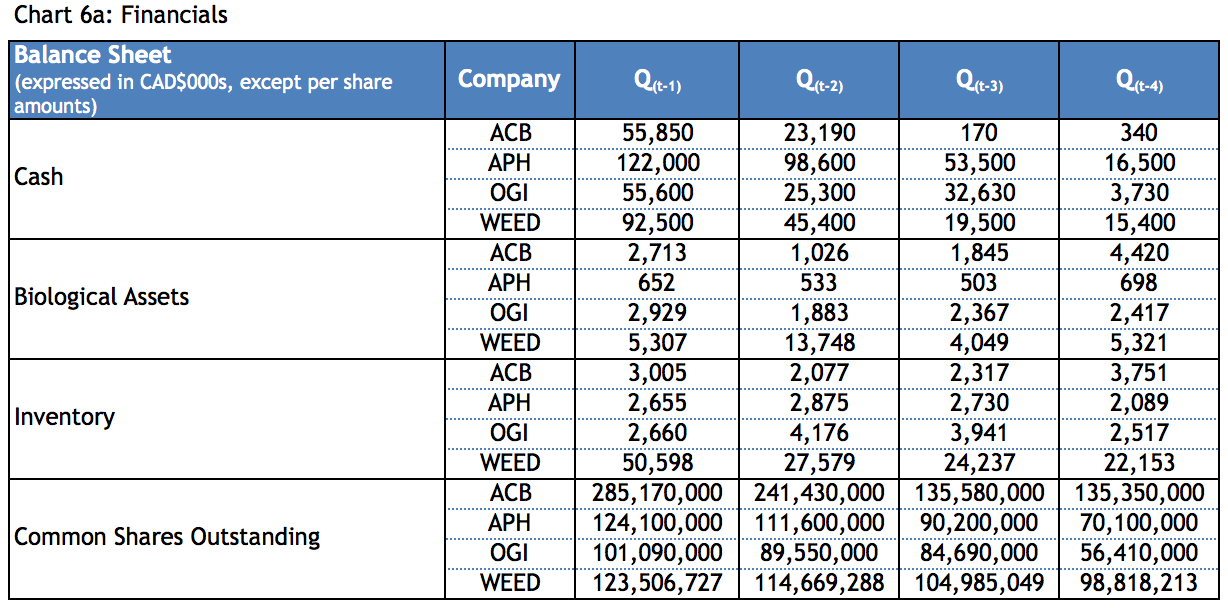

Most industry LPs have a significant cash position on their balance sheet. At $122.0 million, Aphria has the largest as an absolute, and this represents 60.1% of total assets. However, Aurora’s $56.0 million cash position is the largest at 86.6% of total assets. Some of this cash will of course be required to pay for facility expansion (all of which is now fully funded) but will also be used to take advantage of international expansion opportunities as they arise. Given the fast pace at which the industry is developing, companies feel they need the flexibility on their balance sheet ‘today’ to adapt quickly.

Canopy Growth has the lowest cash balance at 33.0% of total assets. This should not be surprising, as Canopy is the most established in the industry and already has significant production capacity (and overall strategy) in place. We like this fact, as idle cash is an opportunity cost when not being put to productive use.

This should concern shareholders, as the means to generate this cash is done so at the expense of shareholder dilution. You can see this trend in the expanding shares outstanding. Over the four quarters shown, Aurora Cannabis shareholders have been hurt the most via dilution effects, and common shares outstanding have grown 120.4% while Canopy shares have only expanded 25.4%

Biological assets are worth pointing out, as investors are likely unfamiliar with this asset. Plants that are in pre-harvest are considered biological assets and are capitalized on the balance sheet at fair market value less cost to sell at their point of harvest. Costs to sell include trimming, fulfillment, testing and shipping costs. In determining the fair value of biological assets, management is required to make several estimates, including: the expected cost required to grow the cannabis up to the point of harvest; harvesting costs; selling costs; sales price; and, expected yields for the cannabis plant. These estimates are subject to volatility and discretion!

So, investors can think of biological asset as product in ‘the pipeline’. Inventory represents assets that are closer to going to market. At 18.0% of total assets, Canopy Growth has the largest inventory position, again reflecting its established position in the industry. Canopy has 8,375 kg of dry cannabis on hand. Of this 711 kg is available for sale, 3,809 kg are available for testing, and 3,855 kg are sidelined for oil conversion. The company had an unusually high harvest this quarter 5,264 kg (1,711 kg the previous quarter). The record harvest finds its way into ‘available for testing’ to be approved for sale.

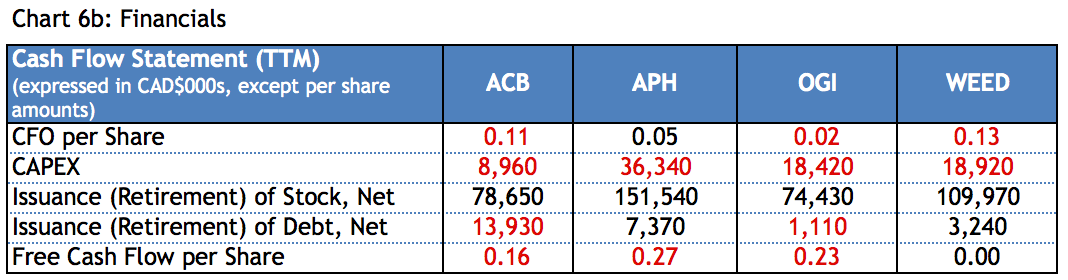

Several Canadian marijuana companies have raised substantial amounts of cash in order to prepare for tremendous growth. We can see this growth preparation quickly in the cash flow statement and the outsized ‘issuance of stock’ line item.

LPs favour this route over debt, as their high flying stock allows them to consistently raise cash through equity financings at increasingly attractive prices. For young companies, interest payments on debt are less attractive, as the business would be better off reinvesting every dollar it brings in. As well, cash flows are generally negative for the industry at this early growth stage, so servicing debt can create some pressure.

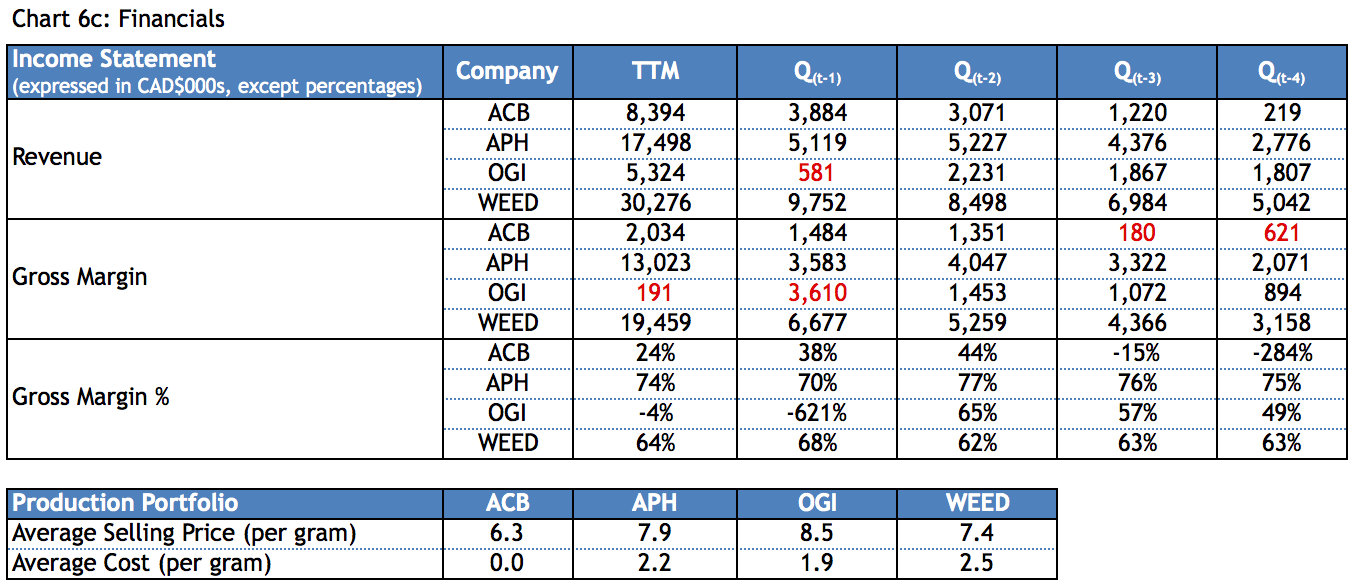

As it relates to the income statement, growth in revenues shows how quickly the industry is moving. Canopy Growth has almost doubled its quarterly revenue in less than a year and Aurora is doing a solid job of ramping up sales. OrganiGram’s negative quarterly result reflects the inventory recall. Margins for established players like Canopy and Aphria are mostly stable and look attractive at trailing 12-month (TTM) levels of 64.0% (Canopy) and 74.0% (Aphria).

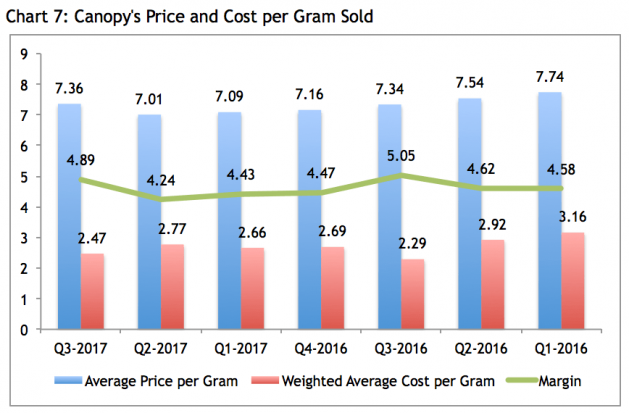

We also show the most recent average selling price and cost per gram sold, and a rough margin can be calculated from these two figures. Aurora does not disclose its cost per gram. Aphria has a slightly superior price point vs. Canopy, but it is important to know that these figures show higher volatility quarter to quarter, in this early growth stage. Selling prices are also generally contracting. Margins also vary based on the number of pre-harvest plants, the strains being grown, and where the pre-harvest plants are in the grow cycle at the end of the period.

Below we show quarterly data for Canopy Growth’s revenue and cost per gram.

Margins are a very important part of the overall picture. LPs that can maximize their margin in the long-term vs. peers should see a corresponding return in their stock price. However, we believe that focusing on LPs gaining market share via metrics such as ‘grams sold’ is more important at this early stage of growth. Margins will continue to be volatile and reflect additional capacity coming online, new product development, industry consolidation, etc. Instead of spending too much time ‘today’ agonizing over the lowest cost producer, looking for those LPs with the best foothold in the market, growing their brand, etc., would be your best bet.

A Less Useful Tool: Valuations

We will not spend too much time here as trying to value cannabis stocks based on fundamentals is mostly a waste of time. LPs need to go from start-up to grown-up, and cannot trade on estimates forever. Eventually they will lose the fight to gravity. By 2018, with the legalization of the recreational market, there will start to be more of a focus on the fundamentals.

That said there is some useful information that can be taken away here. First, we think investors should focus their attention on sales, as this metric is important for early growth industries and investors recognize those stocks expected to capture more of the market.

Book value is also an important metric and gives those investors debating an investment an idea of the level of ‘safety’ associated with each LP. In simple terms, book value would be the amount of money that a holder of a common share would get if a company were to liquidate, so a stock price closer to the book value per share is ideal.

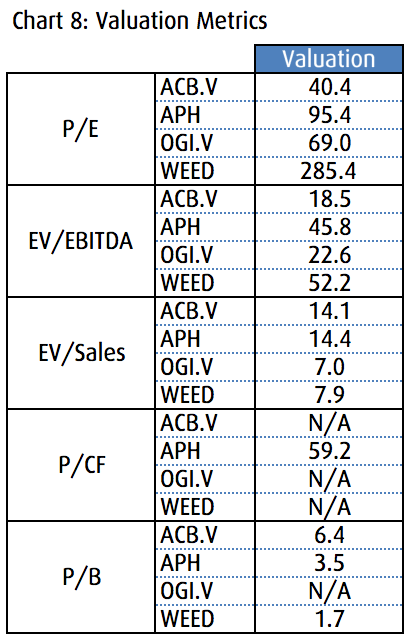

With this in mind, Aurora and Aphria are the more expensive investments, while Canopy and OrganiGram look to represent some ‘value’ in the industry. See ‘Chart 8: Valuation Metrics’.

At an enterprise value-to-EBITDA (EV/EBITDA) of roughly 14x, Aurora and Aphria trade at twice that of Canopy and Organi

Gram. The markets are recognizing Aurora and Aphria as the higher growth opportunities due to their massive expansion plans, which will bring significant increases in capacity and hopefully sales. However, with so much optimism at these lofty levels, these stocks are now most at risk of a contraction in the multiple if the general industry hits a road bump, or the individual growth strategies face a setback/delay.

We can also see these relative premiums in the price-to-book (P/B) multiple. At a P/B of 6.4x, Aurora Cannabis is nearly 4x as an expensive vs. Canopy Growth, the industries most established LP. Market value per share is a forward-looking metric that takes into account a company's earning power in the future. With increases in a company's estimated profitability, expected growth and safety of its business, the market value per share grows higher relative to the book value per share. Here, we would disagree that Aurora (and Aphria) should trade at such a premium to Canopy. At 4x the multiple of the industry’s most established player, Canopy stock could be a decent ‘value’ play at current prices.

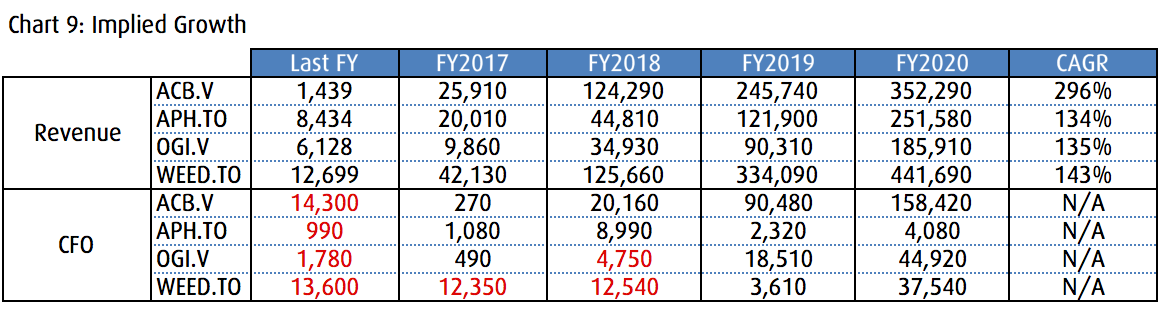

Finally, we want to quickly give the investor an idea of the optimism that is supporting Canadian marijuana stocks and the lofty valuations. In ‘Chart 9: Implied Growth’, we show market expectations for revenue growth over the next few fiscal years (FY). We also show the implied annual growth rate that would be needed for weed stock companies to take revenues from the most recent FY to their estimated 2020 level. For example, Aurora Cannabis would need to grow revenue each year by almost 300% to support its valuation. We think these numbers speak for themselves and we will let investors draw their own conclusions.

Sign up for the blog below for more updates!

Looking for more industry-at-a-glance analysis?

See our insights on Canadian Midstream Oil and Gas Stocks.

Comments

Login to post a comment.