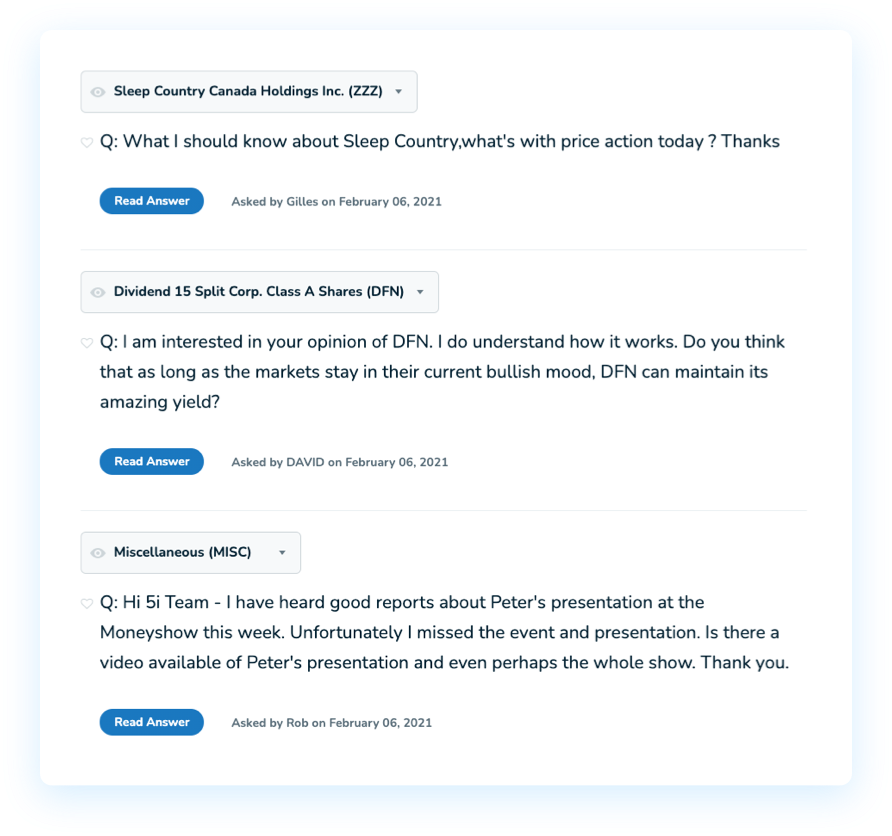

Review of Pollard Banknote Limited

The company’s operating results in recent quarters have been quite weak, but management has a solid outlook as the company sees improving instant ticket volumes and has been awarded two very important long-term contracts. The momentum of the underlying business has started to build, and PBL expects strong volume growth in 2026. However, this good news has not yet been reflected in the financials or valuation multiples. We think PBL today offers an attractive entry point given the positive future prospects. With that said, the recent numbers do not look impressive yet. For now, we are maintaining our rating of a B but will be open to an upgrade if near-term numbers are solid and management continues to execute.