Taking what we learned from our previous piece all about dividends and payout ratios, we wanted to look at a real life example of two high yielding, popular stocks in Canada and see if an investor would have been able to catch an unsustainable payout with more certainty. The two companies we will focus on are Grenville Strategic Royalty (Ticker: GRC) and Diversified Royalty (Ticker: DIV). Starting with Grenville Strategic Royalty, we will look at results back in November and then more recent results:

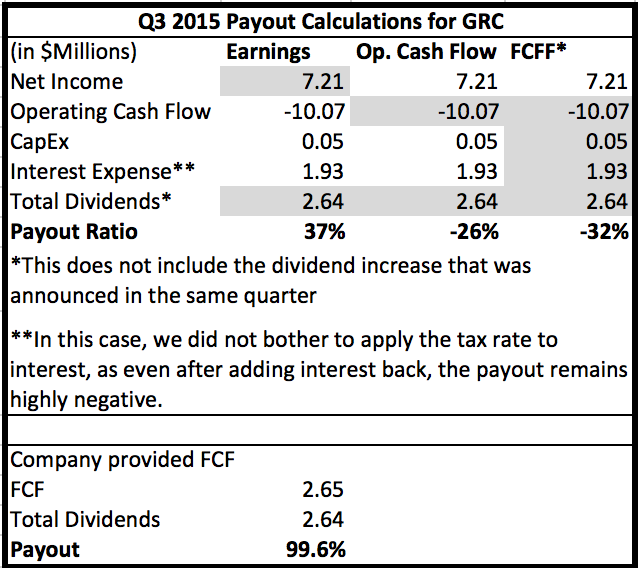

The Q3 2015 results at GRC included a 40% increase to the dividend, to $0.07 annually, due to what the company viewed as strong results. We think this is a good example of why investors should approach management provided payout ratios with caution. Since GRC is a royalty company (provides funds and takes a royalty on revenues), they would often cite an ‘average monthly royalty including contract buyouts’ which amounted to $369,419 for September. GRC also calculates Free Cash Flow of $2.65 million in Q3 2015 and $3.6 million for the 2015 YTD period. However, $2.2 million (or 61%) of this cash flow comes from contract buyouts which are reliant on the company to get bought out of their investments, something that we would view as hardly a sustainable metric that one can rely on for consistent dividends. Below we are putting some numbers to work to see the various ways one could calculate a payout ratio. We quite like this example as it highlights some of the cautions mentioned in our previous piece. The below analysis looks like the dividend is sustainable based on net income, but even taking a single, simple, extra step by looking at operating cash flows, an investor would have been given reason for pause. Taking it a step further to FCFF shows an even more negative payout. Meanwhile, using company provided metrics in the form of Free Cash Flow shows a distribution that is just enough. The shaded areas in each column represent numbers that were used in the calculation of the payout ratio under the respective methodology (i.e. Earnings, Op. Cash Flow and FCFF).

Fast-forward 12 months and the dividend has been cut nearly 30% and shares are down just over 70%. We are not trying to pick on this stock by any means but it is also a great illustration of how chasing high yielding names can be risky and a lot of grief (and money) can be saved with a few simple extra steps. One final note is that while the above chart uses a single quarter to illustrate a point, looking at annual or trailing twelve months (as well as longer-term trends) is usually more appropriate.

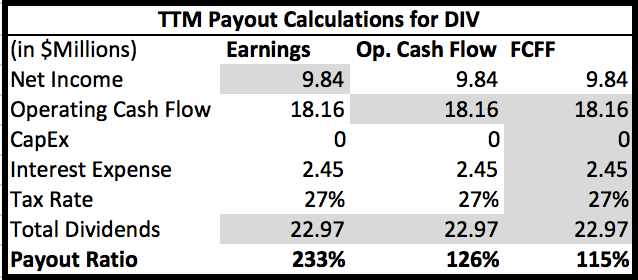

Another name we often have a lot of interest in through our Q&A section is Diversified Royalty (Ticker: DIV):

We have a bit of a different situation here where using net income would have led to an investor ignoring this as an investment in many cases but the more refined the calculation of cash flow becomes, the more sustainable the distribution begins to look. With that, it is still difficult to consider this a long-term, reliable income investment at this stage but the distribution may not be ‘as bad’ as many investors would think as can be seen above. More recently, DIV has actually sold one of their investments to Cara Operations (Ticker: CAO), which provides roughly four years worth of dividend payments in cash but the trick now for the company is their ability to reinvest those cash flows and generate a fair return that can sustain the dividend. If they are unable to do this in roughly four years time, they could find themselves in a similar situation as GRC.

One final note is that we do not formally cover either of these companies and the above analysis is no actual opinion on the investability of these names. This is more for informational and educational purposes than to consider them as actual investments.

If you learned something and are currently not a subscriber, we hope you will consider joining us for more investment insights and education.

Comments

Login to post a comment.

http://www.sharescope.co.uk/philoakley_article121.jsp