Within Portfolio Analytics, we wanted to design a baseline for what we think a balanced, growth, and conservative asset allocation should look like. There are many ways one could go about this exercise, such as looking at historical returns and extrapolating forward for different asset classes. This of course, assumes the past will rhyme with the future. Another way would be to look at expected returns from the market and create the 'optimal' portfolio. We wanted to look at what many of the major asset management firms have for their allocations and see if they are similar, where they differ, and why. We think this type of analysis can be used as a good baseline when developing your own asset allocations.

In our preliminary research, we first looked at the model portfolios of about eight financial institutions and ETF providers, including Vanguard, iShares and BMO. We then listed the equity/bond and geographic allocations of their base conservative, balanced and growth portfolios. This allowed us to begin building the overall framework for asset allocations and then make adjustments for how we view markets.

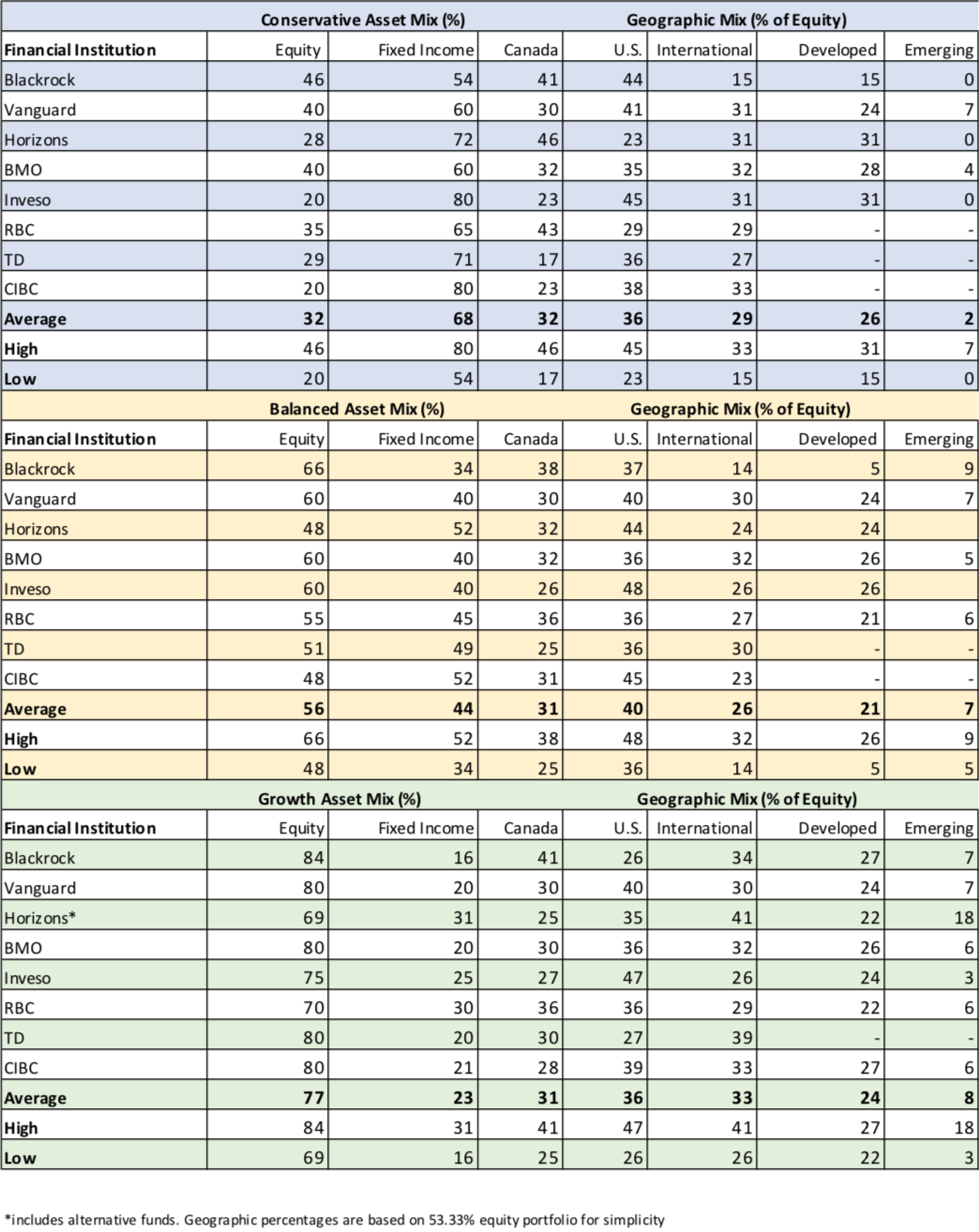

Below is the table for the various ETF providers we looked at and allocations for their conservative, balanced and growth portfolios. For an investor just getting started or wondering how their portfolio structure compares to what a more traditional approach might be, these tables can be a great starting point.

Asset Mix

Right off the bat, we can see that there is significant variance in the equity and bond allocations in the conservative portfolios, with the lowest equity exposure being 20% (Invesco & CIBC) and the highest at 46% (Blackrock). Other providers are somewhere in between, at around 30-35% equity. This is understandable given the lack of consensus as to what exactly a conservative investor should look like. Here, there is a battle between some investors desiring almost no volatility while receiving a decent income, and others are fine with very low volatility, income and the prospect of at least some growth in capital. These differences may reflect the different conservative target audience of each provider.

For the balanced and growth portfolios, there doesn't seem to be much variation and allocations are within standard industry ranges, with most balanced portfolios in a 50/50 to 60/40 equity/bond mix and growth between 70/30 and 85/15.

Overall, Horizons is the most conservative for all the different asset mixes, while Blackrock was the most aggressive in all portfolios.

Geographic Mix

When looking at geographic allocation we measured it as a percentage of the equity allocation. We use a percentage of equity because this is where we think geographic diversification makes the biggest difference in portfolio returns for investors. We leave out bonds in considering geographic allocation because we do not necessarily see added value in playing different geographies in this space for the average investor.

What we found interesting was that the allocation averages tended to be consistent for each geography and each of the investor types with Canada at 31-32% the US, 36-40% and International exposure, 26-33%. Although these averages are consistent, the different providers did vary on their respective takes on geography. We are generally of the view that Canadian investors wishing to be more conservative tend to allocate more to Canadian equities, due to a number of reasons including home-bias, familiarity and deeper 'home country knowledge'. Results are mixed with providers with some keeping Canadian allocation relatively stable, others decreasing/increasing Canadian exposure as the investment style becomes more aggressive. What we did find consistent however is increased international exposure as you go from conservative to growth.

Where we were a bit surprised was the consensus across firms on the Canadian geographic allocation. In theory, one could justify a Canadian allocation below 10% given its representation globally. So it is interesting to see very few firms straying out and suggesting this to be the case. In fairness, due to tax and dividend reasons, there is a case for Canadian's to have a home bias (and we agree), but it is interesting to us that there was a consensus on this issue with all firms indicating an 'overweight' to Canadian equities.

The international column summarizes the international exposure to both developed emerging markets. While institutions like RBC, CIBC and TD did not always make their emerging vs developed market exposure easy to find, most international exposure, especially in conservative and balanced portfolios is developed market exposure.

Structuring The Asset Allocations

After evaluating and comparing the different equity/bond and geographic allocations, we then set our own allocations for the base portfolios according to our 5i philosophy.

We hold a strong conviction that holding equity, in the long run, is the way to generate greater returns and build wealth whether you are a growth or income investor, so our asset allocations are tilted a bit more to the 'aggressive' side. Overall, we are generally of the view that investors need more equity than they think in a world where pensions are not what they used to be, individuals are living longer and many big expenses are growing faster than wages are.

Another argument for less fixed income is that we are still in a low-interest rate environment on a historical basis making the rate of compensation (bond yields) not all that attractive. The fact that investors can put their money in very safe blue-chip equities and realize a dividend yield comparable to most bond yields make it even less attractive to own bonds. Not to mention the capital growth from equities and that dividends are taxed more favourably than interst income. On an after-tax basis, we think it becomes all the more difficult to justify holding 'too much' fixed income.

A final argument for less bond exposure is inflation. Bond returns erode faster than equities on a real return basis.

Each of the three base asset allocations extend into a more risk-averse version and an alpha version (more risk).

For those that want to see the aset allocations and also gain access to a tool that tracks their holdings across all accounts, highlights portfolio risks and gives an easy-to-understand breakdown of their portfolios (even breaking down exposures within funds), we encourage you to give Portfolio Analytics a try.

Comments are disabled on this post.

Comments are disabled on this post.