5i Research Weekly Rockets and Duds

The stock market volatility continued again last week, with a very ugly intra-day reversal on Thursday, despite (continued) good corporate earnings reports. Investors may take a US Thanksgiving break this week and volumes may be quiet, but we doubt it really, as an economic crisis in Japan could bring out more angst and volatility.

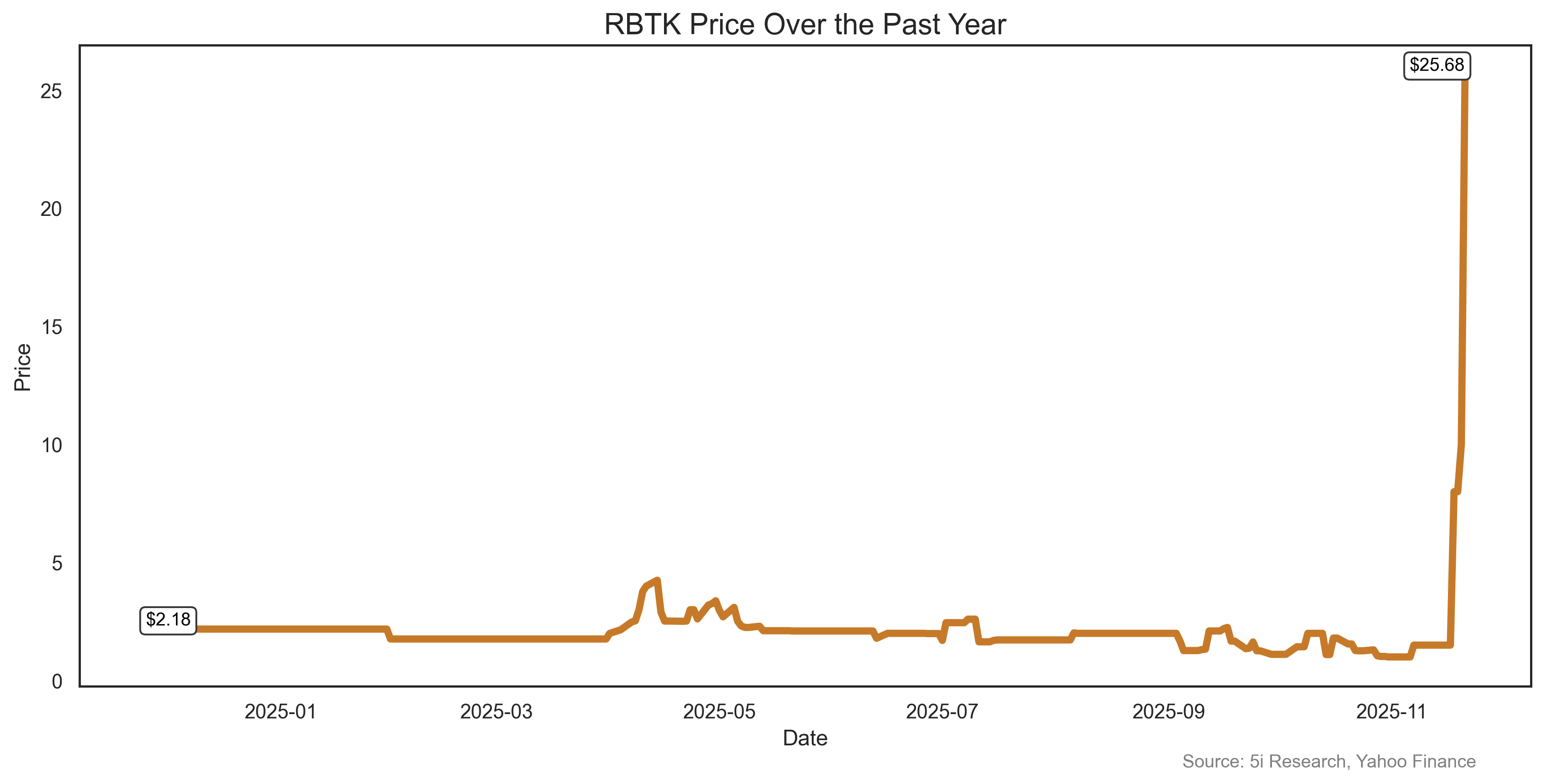

Zhen Ding Resources Inc. RBTK

Note we added the 'Skull and Crossbones' emoji here. Do not buy this stock! Generally, we avoid talking about over-the-counter companies. Trading on the OTC market, they typically hold huge risks, are often subject to manipulation, and even the exchange itself uses the skull-and-crossbones symbol to try and warn off investors. But Zhen Ding's move last week, as well as its Montreal head office, were too interesting. Market capitalization is $2.8 billion so it did make our screen, which tries to weed out tiny company movers of the week. RBTK shares rose 1,610% last week. No, that is not a typo. It is a distressed, near-bankrupt company that somehow owns mining rights in China and runs the company from Quebec. Insiders own 39%. It trades by appointment. We are highlighting it as an example of risks in the OTC market. Generally, when a stock surges, it means something good is happening. In this case, there is absolutely no news. Investors may be speculating on a recapitalization, or are just buying because it has a public stock listing, which can be valuable. There is nothing to account for the giant gain on the week. It didn't trade on Monday, then surged 433% on Tuesday, and another 181% for the balance of the week. Its move attracts interest, but there is nothing to buy here. Did we mention not to buy? No, really, don't.

Note we added the 'Skull and Crossbones' emoji here. Do not buy this stock! Generally, we avoid talking about over-the-counter companies. Trading on the OTC market, they typically hold huge risks, are often subject to manipulation, and even the exchange itself uses the skull-and-crossbones symbol to try and warn off investors. But Zhen Ding's move last week, as well as its Montreal head office, were too interesting. Market capitalization is $2.8 billion so it did make our screen, which tries to weed out tiny company movers of the week. RBTK shares rose 1,610% last week. No, that is not a typo. It is a distressed, near-bankrupt company that somehow owns mining rights in China and runs the company from Quebec. Insiders own 39%. It trades by appointment. We are highlighting it as an example of risks in the OTC market. Generally, when a stock surges, it means something good is happening. In this case, there is absolutely no news. Investors may be speculating on a recapitalization, or are just buying because it has a public stock listing, which can be valuable. There is nothing to account for the giant gain on the week. It didn't trade on Monday, then surged 433% on Tuesday, and another 181% for the balance of the week. Its move attracts interest, but there is nothing to buy here. Did we mention not to buy? No, really, don't.

Note we added the 'Skull and Crossbones' emoji here. Do not buy this stock! Generally, we avoid talking about over-the-counter companies. Trading on the OTC market, they typically hold huge risks, are often subject to manipulation, and even the exchange itself uses the skull-and-crossbones symbol to try and warn off investors. But Zhen Ding's move last week, as well as its Montreal head office, were too interesting. Market capitalization is $2.8 billion so it did make our screen, which tries to weed out tiny company movers of the week. RBTK shares rose 1,610% last week. No, that is not a typo. It is a distressed, near-bankrupt company that somehow owns mining rights in China and runs the company from Quebec. Insiders own 39%. It trades by appointment. We are highlighting it as an example of risks in the OTC market. Generally, when a stock surges, it means something good is happening. In this case, there is absolutely no news. Investors may be speculating on a recapitalization, or are just buying because it has a public stock listing, which can be valuable. There is nothing to account for the giant gain on the week. It didn't trade on Monday, then surged 433% on Tuesday, and another 181% for the balance of the week. Its move attracts interest, but there is nothing to buy here. Did we mention not to buy? No, really, don't.

Note we added the 'Skull and Crossbones' emoji here. Do not buy this stock! Generally, we avoid talking about over-the-counter companies. Trading on the OTC market, they typically hold huge risks, are often subject to manipulation, and even the exchange itself uses the skull-and-crossbones symbol to try and warn off investors. But Zhen Ding's move last week, as well as its Montreal head office, were too interesting. Market capitalization is $2.8 billion so it did make our screen, which tries to weed out tiny company movers of the week. RBTK shares rose 1,610% last week. No, that is not a typo. It is a distressed, near-bankrupt company that somehow owns mining rights in China and runs the company from Quebec. Insiders own 39%. It trades by appointment. We are highlighting it as an example of risks in the OTC market. Generally, when a stock surges, it means something good is happening. In this case, there is absolutely no news. Investors may be speculating on a recapitalization, or are just buying because it has a public stock listing, which can be valuable. There is nothing to account for the giant gain on the week. It didn't trade on Monday, then surged 433% on Tuesday, and another 181% for the balance of the week. Its move attracts interest, but there is nothing to buy here. Did we mention not to buy? No, really, don't.

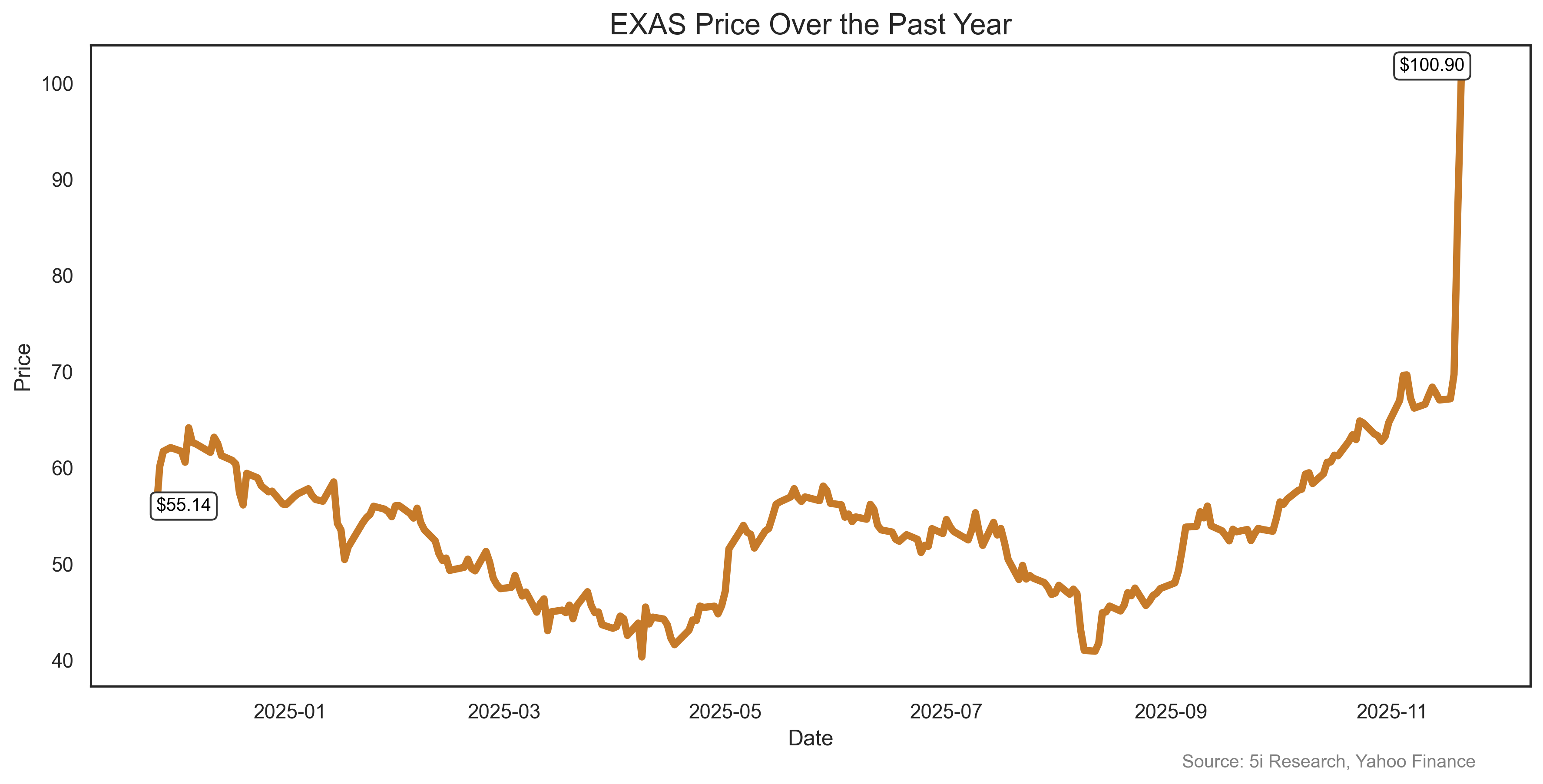

Exact Sciences Corp. EXAS

Shhh! Don't tell Elizabeth Holmes about this stock! Ms. Holmes, serving an 11-year prison sentence for fraud at her blood-testing company Thearanos, might not be so pleased to hear that Exact Science, another 'testing' company in the medical field, has agreed to a $21 billion takeover by Abbott Laboratories. We can hear Ms. Holmes whining, 'that should have been Theranos'. It might have been, except for the fraud part, and the fact that Theranos's products didn't work at all. Exact has accepted a $105 per share all-cash friendly offer for the company.

Shhh! Don't tell Elizabeth Holmes about this stock! Ms. Holmes, serving an 11-year prison sentence for fraud at her blood-testing company Thearanos, might not be so pleased to hear that Exact Science, another 'testing' company in the medical field, has agreed to a $21 billion takeover by Abbott Laboratories. We can hear Ms. Holmes whining, 'that should have been Theranos'. It might have been, except for the fraud part, and the fact that Theranos's products didn't work at all. Exact has accepted a $105 per share all-cash friendly offer for the company.

Shhh! Don't tell Elizabeth Holmes about this stock! Ms. Holmes, serving an 11-year prison sentence for fraud at her blood-testing company Thearanos, might not be so pleased to hear that Exact Science, another 'testing' company in the medical field, has agreed to a $21 billion takeover by Abbott Laboratories. We can hear Ms. Holmes whining, 'that should have been Theranos'. It might have been, except for the fraud part, and the fact that Theranos's products didn't work at all. Exact has accepted a $105 per share all-cash friendly offer for the company.

Shhh! Don't tell Elizabeth Holmes about this stock! Ms. Holmes, serving an 11-year prison sentence for fraud at her blood-testing company Thearanos, might not be so pleased to hear that Exact Science, another 'testing' company in the medical field, has agreed to a $21 billion takeover by Abbott Laboratories. We can hear Ms. Holmes whining, 'that should have been Theranos'. It might have been, except for the fraud part, and the fact that Theranos's products didn't work at all. Exact has accepted a $105 per share all-cash friendly offer for the company.

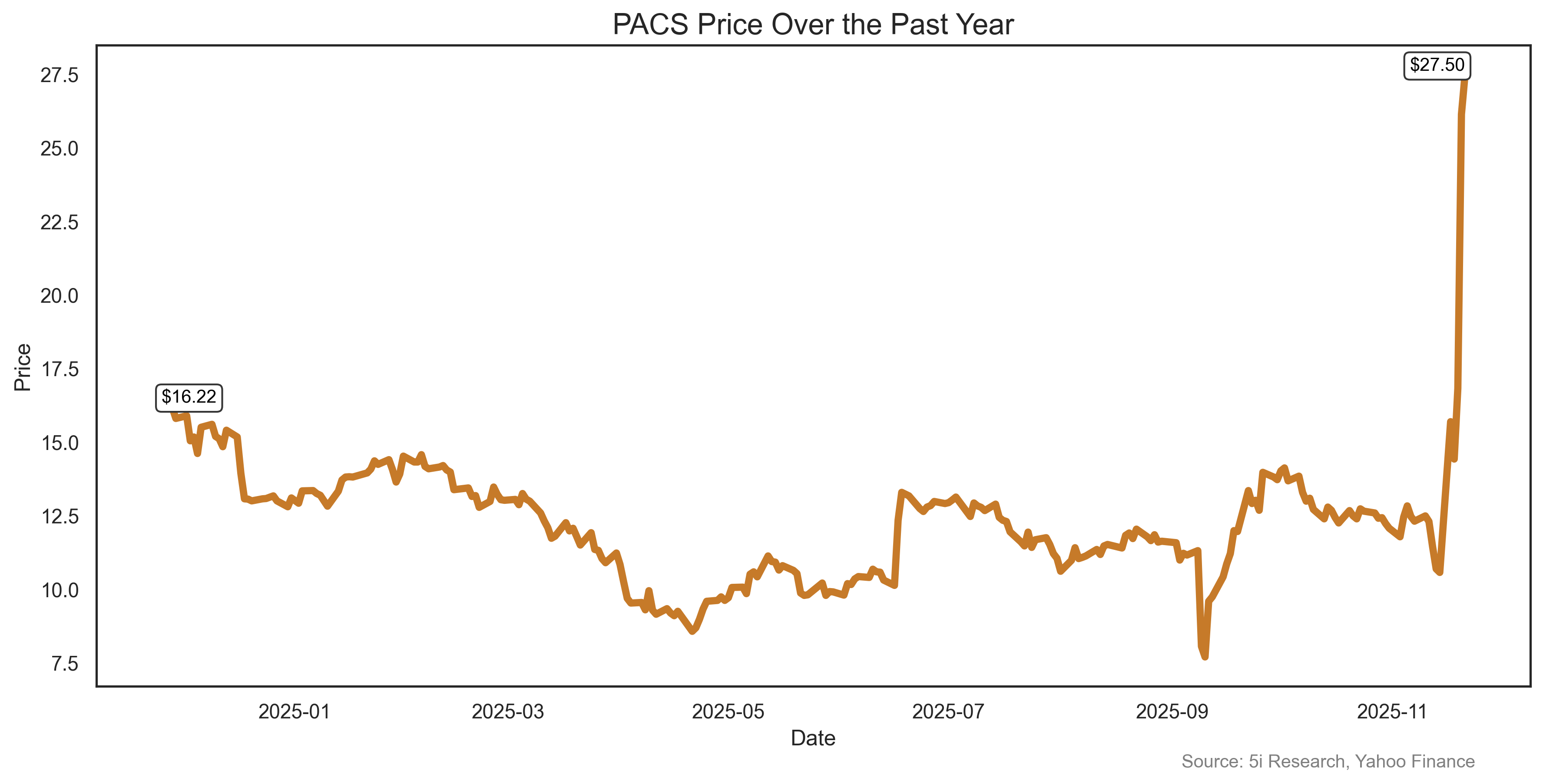

PACS Group Inc. PACS

'I'm not dead yet! I feel better!'. PACS, a nursing home operator, saw its shares surge 160% last week on news of a 31% boost in revenue in the third quarter. Sure, that sounds good, but the real news was that PACS has finalized its audit review and is in compliance with all of its accounting standards. In September, shares plunged to $8 amid short seller allegations, and then the CFO resigned, on 'code of conduct' violations. PACS initiated a probe, and this week completed that probe and all accounting issues have been resolved. The stock has tripled since the September low. Another example of why 'panic' is never a good investment strategy.

'I'm not dead yet! I feel better!'. PACS, a nursing home operator, saw its shares surge 160% last week on news of a 31% boost in revenue in the third quarter. Sure, that sounds good, but the real news was that PACS has finalized its audit review and is in compliance with all of its accounting standards. In September, shares plunged to $8 amid short seller allegations, and then the CFO resigned, on 'code of conduct' violations. PACS initiated a probe, and this week completed that probe and all accounting issues have been resolved. The stock has tripled since the September low. Another example of why 'panic' is never a good investment strategy.

'I'm not dead yet! I feel better!'. PACS, a nursing home operator, saw its shares surge 160% last week on news of a 31% boost in revenue in the third quarter. Sure, that sounds good, but the real news was that PACS has finalized its audit review and is in compliance with all of its accounting standards. In September, shares plunged to $8 amid short seller allegations, and then the CFO resigned, on 'code of conduct' violations. PACS initiated a probe, and this week completed that probe and all accounting issues have been resolved. The stock has tripled since the September low. Another example of why 'panic' is never a good investment strategy.

'I'm not dead yet! I feel better!'. PACS, a nursing home operator, saw its shares surge 160% last week on news of a 31% boost in revenue in the third quarter. Sure, that sounds good, but the real news was that PACS has finalized its audit review and is in compliance with all of its accounting standards. In September, shares plunged to $8 amid short seller allegations, and then the CFO resigned, on 'code of conduct' violations. PACS initiated a probe, and this week completed that probe and all accounting issues have been resolved. The stock has tripled since the September low. Another example of why 'panic' is never a good investment strategy.

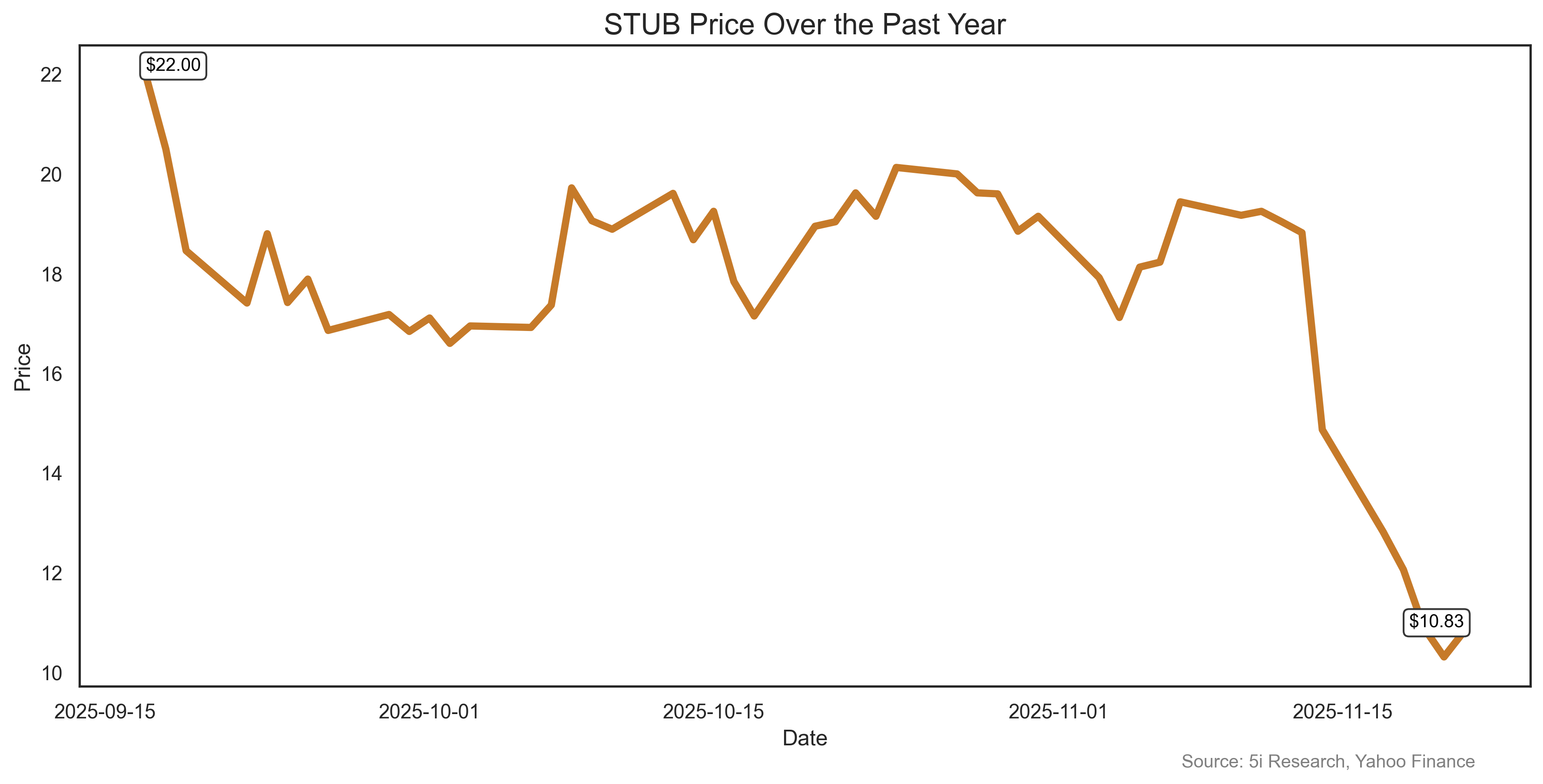

Stubhub Holdings Inc. STUB

You know, here at Rockets and Duds we try not to be emotional. But after spending $1,000 for concert tickets with a face value of $200 this year, we couldn't help but smile at STUB's recent decline. You see, the UK has decided that it is wrong to sell concert and event tickets at multiples of their face value. The UK proposes to ban sales above their original purchase price, and has also moved to ban excessive fees and service charges. Finally, a government working for the people! STUB, which of course is a major ticket-reseller site, saw its shares fall 27% last week on this news, and are now less than half of their September IPO price. Hopefully, future concert-goers don't own shares, otherwise the money they now save on concert tickets might be totally offset by their losses on the stock.

You know, here at Rockets and Duds we try not to be emotional. But after spending $1,000 for concert tickets with a face value of $200 this year, we couldn't help but smile at STUB's recent decline. You see, the UK has decided that it is wrong to sell concert and event tickets at multiples of their face value. The UK proposes to ban sales above their original purchase price, and has also moved to ban excessive fees and service charges. Finally, a government working for the people! STUB, which of course is a major ticket-reseller site, saw its shares fall 27% last week on this news, and are now less than half of their September IPO price. Hopefully, future concert-goers don't own shares, otherwise the money they now save on concert tickets might be totally offset by their losses on the stock.

You know, here at Rockets and Duds we try not to be emotional. But after spending $1,000 for concert tickets with a face value of $200 this year, we couldn't help but smile at STUB's recent decline. You see, the UK has decided that it is wrong to sell concert and event tickets at multiples of their face value. The UK proposes to ban sales above their original purchase price, and has also moved to ban excessive fees and service charges. Finally, a government working for the people! STUB, which of course is a major ticket-reseller site, saw its shares fall 27% last week on this news, and are now less than half of their September IPO price. Hopefully, future concert-goers don't own shares, otherwise the money they now save on concert tickets might be totally offset by their losses on the stock.

You know, here at Rockets and Duds we try not to be emotional. But after spending $1,000 for concert tickets with a face value of $200 this year, we couldn't help but smile at STUB's recent decline. You see, the UK has decided that it is wrong to sell concert and event tickets at multiples of their face value. The UK proposes to ban sales above their original purchase price, and has also moved to ban excessive fees and service charges. Finally, a government working for the people! STUB, which of course is a major ticket-reseller site, saw its shares fall 27% last week on this news, and are now less than half of their September IPO price. Hopefully, future concert-goers don't own shares, otherwise the money they now save on concert tickets might be totally offset by their losses on the stock.

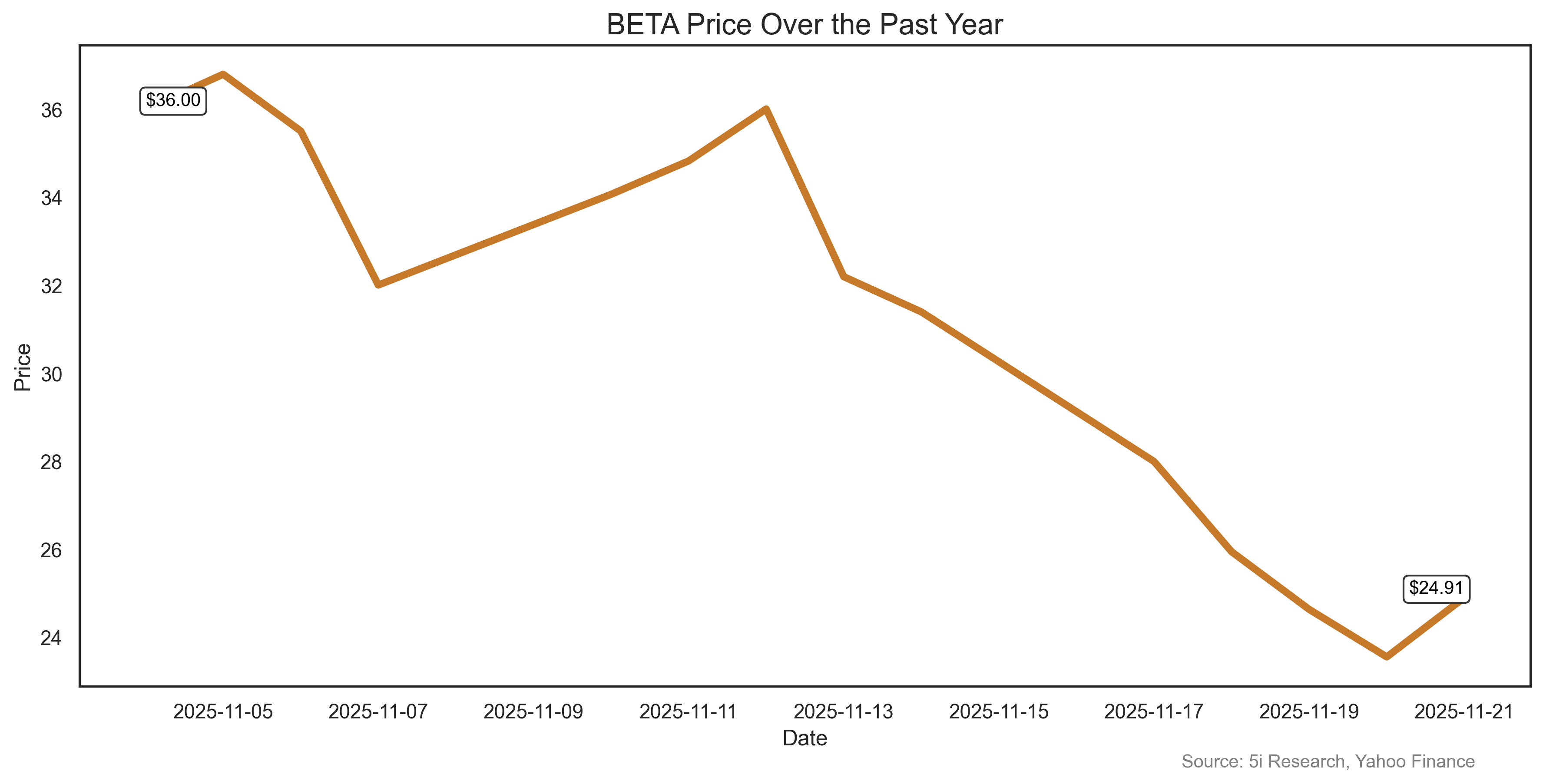

BETA Technologies BETA

Well, it might be back to the drawing board for BETA. Clearly some bugs need to be worked out here. BETA, another entrant in the electric aircraft market, went public earlier this month at $34 per share. Shares are now $25, after a drop of 21% last week. BETA did win a small charging contract in Abu Dhabi last week, but the stock plunged anyway. In a risk-off market, when investors are selling well-established, highly profitable companies, it gets hard for a $5.7 billion newly-public company with only $15 million in revenue last year to get much attention. It looks like it's too early for BETA.

Well, it might be back to the drawing board for BETA. Clearly some bugs need to be worked out here. BETA, another entrant in the electric aircraft market, went public earlier this month at $34 per share. Shares are now $25, after a drop of 21% last week. BETA did win a small charging contract in Abu Dhabi last week, but the stock plunged anyway. In a risk-off market, when investors are selling well-established, highly profitable companies, it gets hard for a $5.7 billion newly-public company with only $15 million in revenue last year to get much attention. It looks like it's too early for BETA.

Well, it might be back to the drawing board for BETA. Clearly some bugs need to be worked out here. BETA, another entrant in the electric aircraft market, went public earlier this month at $34 per share. Shares are now $25, after a drop of 21% last week. BETA did win a small charging contract in Abu Dhabi last week, but the stock plunged anyway. In a risk-off market, when investors are selling well-established, highly profitable companies, it gets hard for a $5.7 billion newly-public company with only $15 million in revenue last year to get much attention. It looks like it's too early for BETA.

Well, it might be back to the drawing board for BETA. Clearly some bugs need to be worked out here. BETA, another entrant in the electric aircraft market, went public earlier this month at $34 per share. Shares are now $25, after a drop of 21% last week. BETA did win a small charging contract in Abu Dhabi last week, but the stock plunged anyway. In a risk-off market, when investors are selling well-established, highly profitable companies, it gets hard for a $5.7 billion newly-public company with only $15 million in revenue last year to get much attention. It looks like it's too early for BETA.

Take Care,

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Analysts of 5i Research responsible for this report do not have a financial or other interest securities mentioned. The i2i Fund does not have a financial or other interest securities mentioned.

Comments

Login to post a comment.