5i Research Weekly Rockets and Duds

Never a dull moment in the markets, as last week's events clearly proved. Here is the latest version of Rockets and Duds from 5i Research.

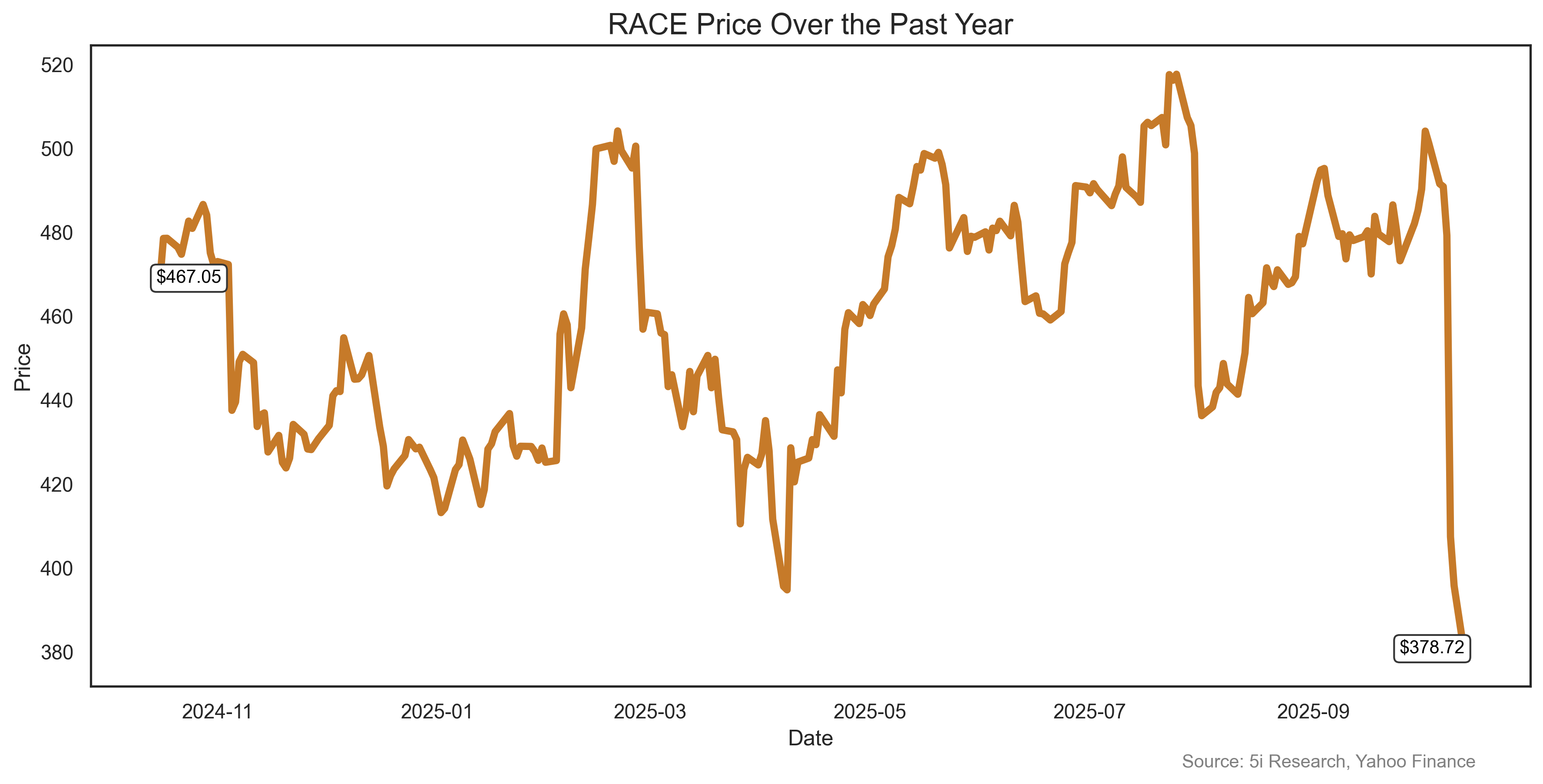

Ferrari NV RACE

Oh, let's shed a tear for all the poor Ferrari owners, who might need to sell their cool car now that the stock has dropped 21% in five days. We are not quite sure how you forecast weak sales when your cars cost $350,000, but that's what RACE did last week. The company downsized its growth plans for its new all-electric Elettrica car, now saying electric cars will now be 20% of sales in 2030, down from 40%. We think if they added 'real car' sounds to their electric car, sales would pick up. Everyone knows it's that high-performance engine sound that Ferrari buyers are after, right?

Oh, let's shed a tear for all the poor Ferrari owners, who might need to sell their cool car now that the stock has dropped 21% in five days. We are not quite sure how you forecast weak sales when your cars cost $350,000, but that's what RACE did last week. The company downsized its growth plans for its new all-electric Elettrica car, now saying electric cars will now be 20% of sales in 2030, down from 40%. We think if they added 'real car' sounds to their electric car, sales would pick up. Everyone knows it's that high-performance engine sound that Ferrari buyers are after, right?

Oh, let's shed a tear for all the poor Ferrari owners, who might need to sell their cool car now that the stock has dropped 21% in five days. We are not quite sure how you forecast weak sales when your cars cost $350,000, but that's what RACE did last week. The company downsized its growth plans for its new all-electric Elettrica car, now saying electric cars will now be 20% of sales in 2030, down from 40%. We think if they added 'real car' sounds to their electric car, sales would pick up. Everyone knows it's that high-performance engine sound that Ferrari buyers are after, right?

Oh, let's shed a tear for all the poor Ferrari owners, who might need to sell their cool car now that the stock has dropped 21% in five days. We are not quite sure how you forecast weak sales when your cars cost $350,000, but that's what RACE did last week. The company downsized its growth plans for its new all-electric Elettrica car, now saying electric cars will now be 20% of sales in 2030, down from 40%. We think if they added 'real car' sounds to their electric car, sales would pick up. Everyone knows it's that high-performance engine sound that Ferrari buyers are after, right?

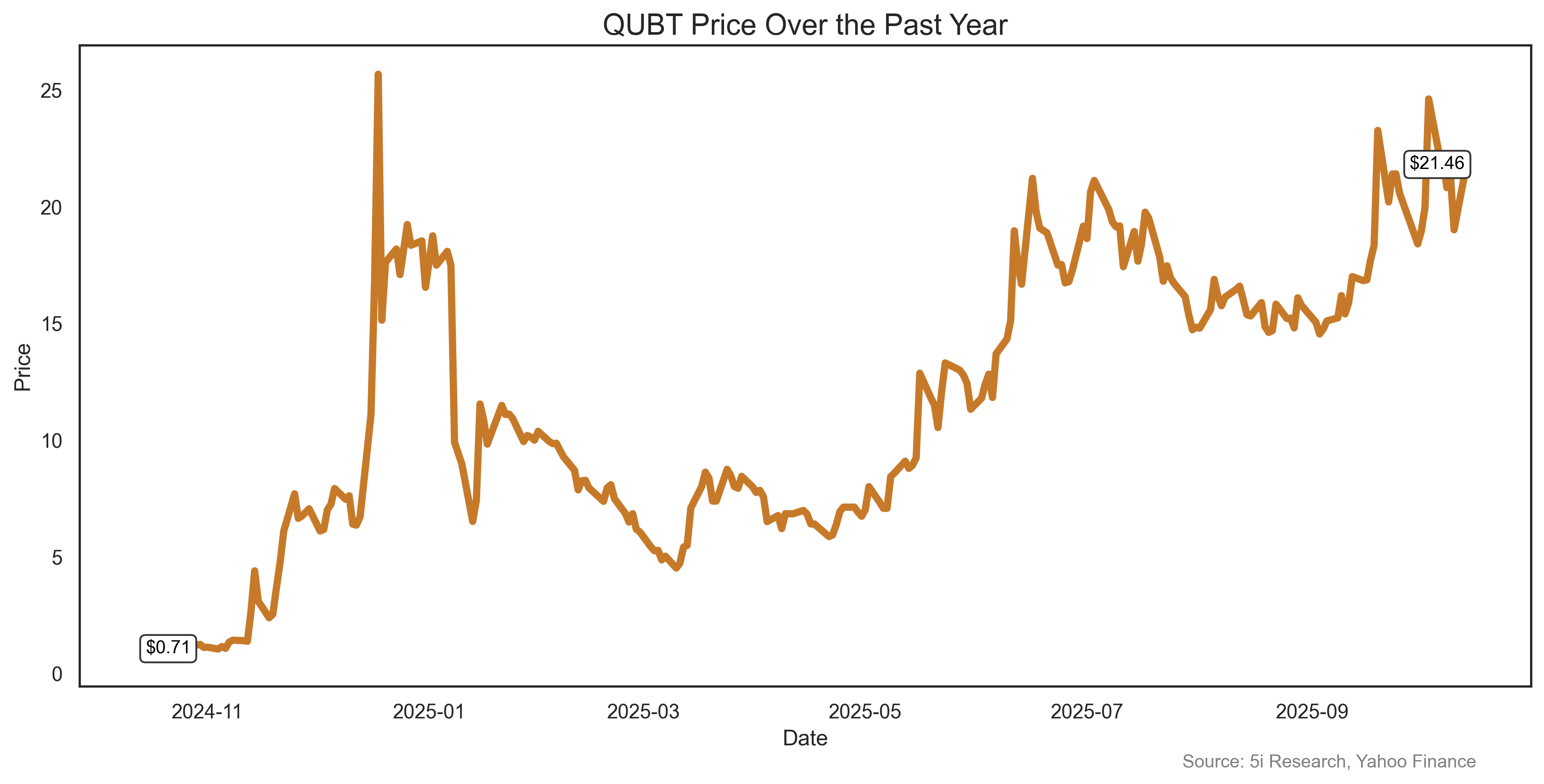

Quantum Computing Inc. QUBT

Another week, another quantum computing stock makes our list, this time on the DUD side, with QUBT dropping 23% last week. Was this due to the fact that quantum computing companies can still only add two three-digit numbers together with just 80% accuracy? Of course not. Investors don't care about such trivial details such as quantum not actually having real-world accuracy yet. Shares fell on news of a $750 million private placement by the company. The deal is about 20% the market cap of the whole company, and investors took a buying pause, after jamming QUBT stock up 2,600% in the past year. Revenue for the $3.5 billion company was less than half a million dollars last year. Does THAT add up?

Another week, another quantum computing stock makes our list, this time on the DUD side, with QUBT dropping 23% last week. Was this due to the fact that quantum computing companies can still only add two three-digit numbers together with just 80% accuracy? Of course not. Investors don't care about such trivial details such as quantum not actually having real-world accuracy yet. Shares fell on news of a $750 million private placement by the company. The deal is about 20% the market cap of the whole company, and investors took a buying pause, after jamming QUBT stock up 2,600% in the past year. Revenue for the $3.5 billion company was less than half a million dollars last year. Does THAT add up?

Another week, another quantum computing stock makes our list, this time on the DUD side, with QUBT dropping 23% last week. Was this due to the fact that quantum computing companies can still only add two three-digit numbers together with just 80% accuracy? Of course not. Investors don't care about such trivial details such as quantum not actually having real-world accuracy yet. Shares fell on news of a $750 million private placement by the company. The deal is about 20% the market cap of the whole company, and investors took a buying pause, after jamming QUBT stock up 2,600% in the past year. Revenue for the $3.5 billion company was less than half a million dollars last year. Does THAT add up?

Another week, another quantum computing stock makes our list, this time on the DUD side, with QUBT dropping 23% last week. Was this due to the fact that quantum computing companies can still only add two three-digit numbers together with just 80% accuracy? Of course not. Investors don't care about such trivial details such as quantum not actually having real-world accuracy yet. Shares fell on news of a $750 million private placement by the company. The deal is about 20% the market cap of the whole company, and investors took a buying pause, after jamming QUBT stock up 2,600% in the past year. Revenue for the $3.5 billion company was less than half a million dollars last year. Does THAT add up?

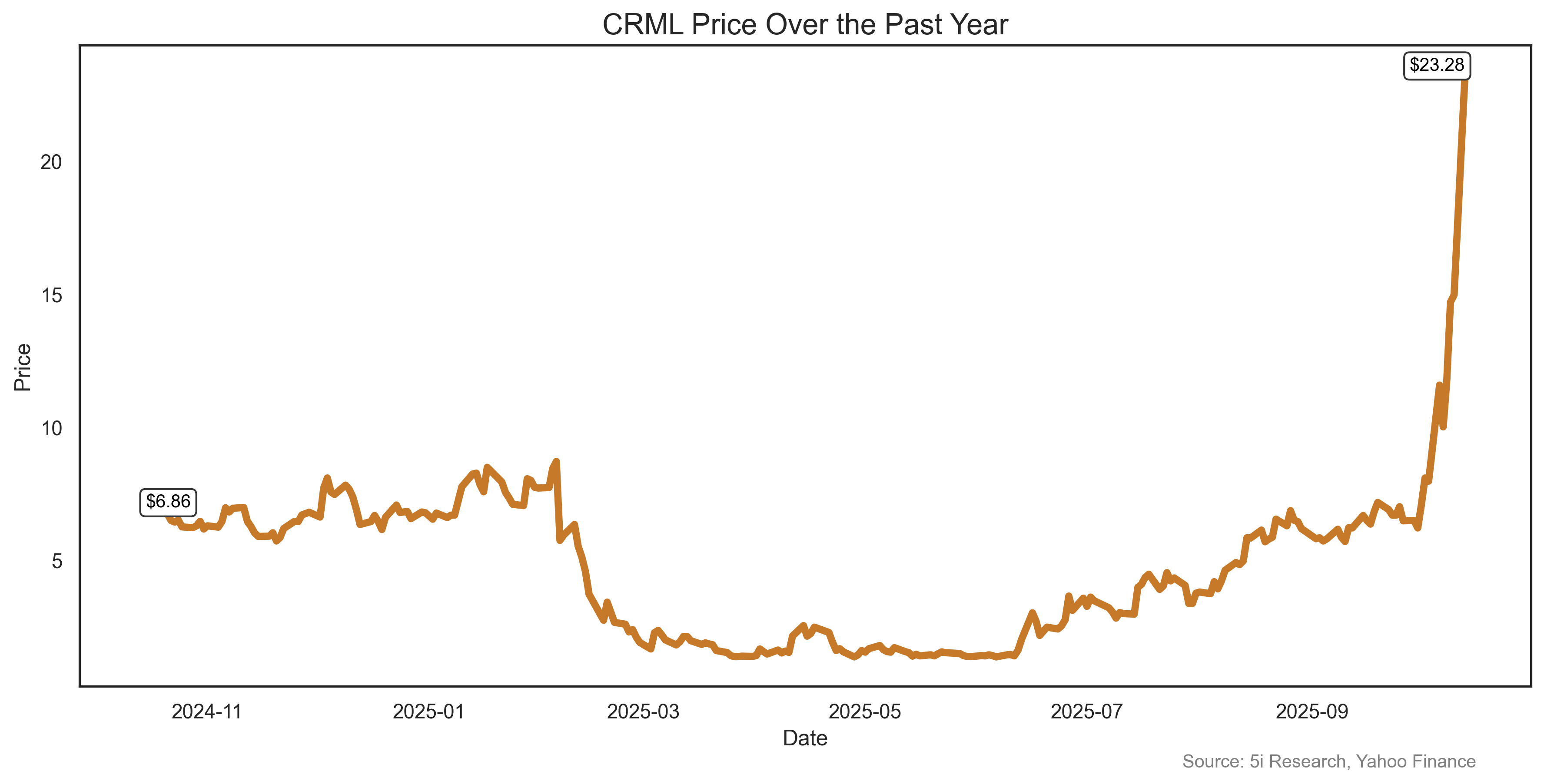

Critical Metals Corp. CRML

It's PARTY TIME in the rare earth sector, with the US looking for investments and China restricting supply and Trump threatening retaliation with giant tariffs if China doesn't play fair. Investors are scrambling trying to pre-guess which metals company the US administration is going to buy next. CRML thus rose 88% last week, even though mid-week the White House denied that it was the next target. The company has no revenue, is losing money, and has negative cash flow. But that doesn't matter, right? RIGHT?

It's PARTY TIME in the rare earth sector, with the US looking for investments and China restricting supply and Trump threatening retaliation with giant tariffs if China doesn't play fair. Investors are scrambling trying to pre-guess which metals company the US administration is going to buy next. CRML thus rose 88% last week, even though mid-week the White House denied that it was the next target. The company has no revenue, is losing money, and has negative cash flow. But that doesn't matter, right? RIGHT?

It's PARTY TIME in the rare earth sector, with the US looking for investments and China restricting supply and Trump threatening retaliation with giant tariffs if China doesn't play fair. Investors are scrambling trying to pre-guess which metals company the US administration is going to buy next. CRML thus rose 88% last week, even though mid-week the White House denied that it was the next target. The company has no revenue, is losing money, and has negative cash flow. But that doesn't matter, right? RIGHT?

It's PARTY TIME in the rare earth sector, with the US looking for investments and China restricting supply and Trump threatening retaliation with giant tariffs if China doesn't play fair. Investors are scrambling trying to pre-guess which metals company the US administration is going to buy next. CRML thus rose 88% last week, even though mid-week the White House denied that it was the next target. The company has no revenue, is losing money, and has negative cash flow. But that doesn't matter, right? RIGHT?

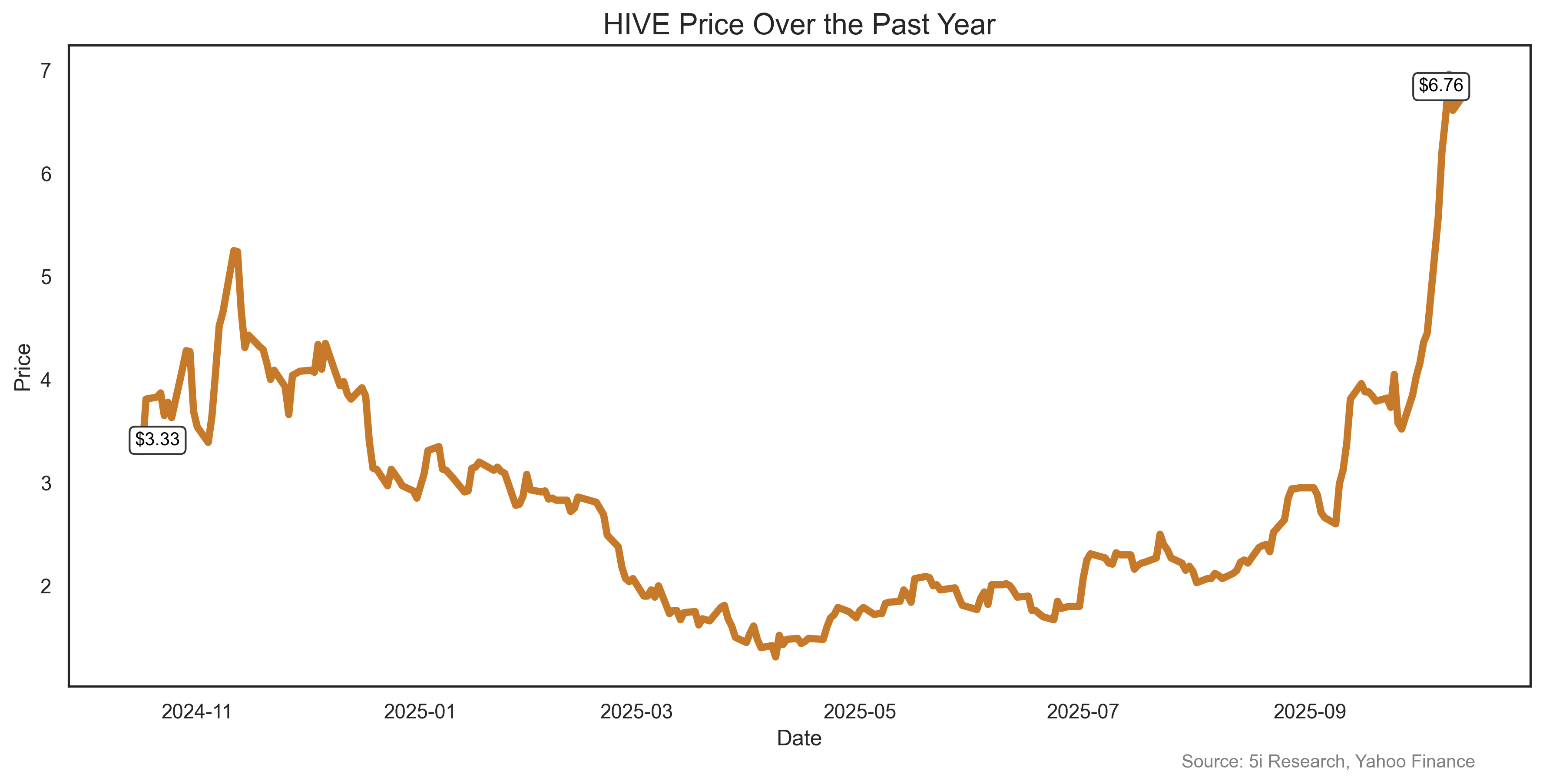

Hive Digital Technologies Ltd.

We always like to see a Canadian company in our weekly update, especially on the ROCKETS side of the equation. Hive rose 48% last week on news it had mined 267 bitcoin in September. This news came nicely in tandem with a big move in bitcoin, at least at the start of last week. HIVE's production of bitcoin rose 8% month-over-month and 138% year-over-year. Average hashrate was 19.4 exahash per second. Of course it was.

We always like to see a Canadian company in our weekly update, especially on the ROCKETS side of the equation. Hive rose 48% last week on news it had mined 267 bitcoin in September. This news came nicely in tandem with a big move in bitcoin, at least at the start of last week. HIVE's production of bitcoin rose 8% month-over-month and 138% year-over-year. Average hashrate was 19.4 exahash per second. Of course it was.

We always like to see a Canadian company in our weekly update, especially on the ROCKETS side of the equation. Hive rose 48% last week on news it had mined 267 bitcoin in September. This news came nicely in tandem with a big move in bitcoin, at least at the start of last week. HIVE's production of bitcoin rose 8% month-over-month and 138% year-over-year. Average hashrate was 19.4 exahash per second. Of course it was.

We always like to see a Canadian company in our weekly update, especially on the ROCKETS side of the equation. Hive rose 48% last week on news it had mined 267 bitcoin in September. This news came nicely in tandem with a big move in bitcoin, at least at the start of last week. HIVE's production of bitcoin rose 8% month-over-month and 138% year-over-year. Average hashrate was 19.4 exahash per second. Of course it was.

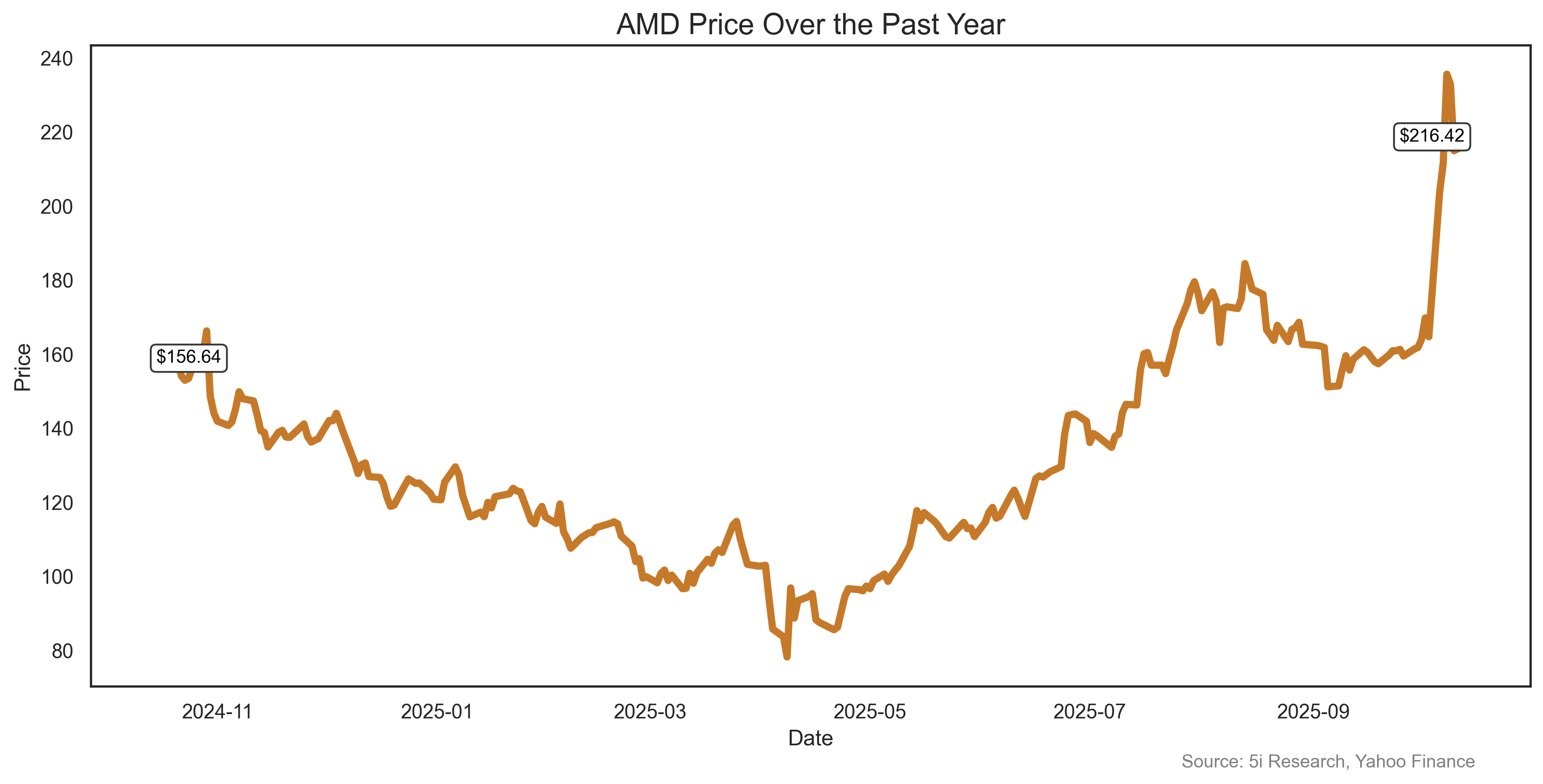

Advanced Micro Devices Inc. AMD

It is certainly not every week that a $348 BILLION company makes it onto our big movers list. But as noted, last week was far from ordinary. AMD, in its ongoing battle for AI-chip dominance with Nvidia Inc., won last week's skirmish as OpenAI announced it would be buying 10% of the company. Things are starting to get a bit incestious, as not long ago Nvidia itself said it would invest $100 billion into OpenAI. So, does Nvidia now own part of AMD indirectly? Is that any way to compete? Oh well, investors clearly don't care who owns whom, as AMD shares rose 31% last week on this news and on the back of several broker upgrades.

It is certainly not every week that a $348 BILLION company makes it onto our big movers list. But as noted, last week was far from ordinary. AMD, in its ongoing battle for AI-chip dominance with Nvidia Inc., won last week's skirmish as OpenAI announced it would be buying 10% of the company. Things are starting to get a bit incestious, as not long ago Nvidia itself said it would invest $100 billion into OpenAI. So, does Nvidia now own part of AMD indirectly? Is that any way to compete? Oh well, investors clearly don't care who owns whom, as AMD shares rose 31% last week on this news and on the back of several broker upgrades.

It is certainly not every week that a $348 BILLION company makes it onto our big movers list. But as noted, last week was far from ordinary. AMD, in its ongoing battle for AI-chip dominance with Nvidia Inc., won last week's skirmish as OpenAI announced it would be buying 10% of the company. Things are starting to get a bit incestious, as not long ago Nvidia itself said it would invest $100 billion into OpenAI. So, does Nvidia now own part of AMD indirectly? Is that any way to compete? Oh well, investors clearly don't care who owns whom, as AMD shares rose 31% last week on this news and on the back of several broker upgrades.

It is certainly not every week that a $348 BILLION company makes it onto our big movers list. But as noted, last week was far from ordinary. AMD, in its ongoing battle for AI-chip dominance with Nvidia Inc., won last week's skirmish as OpenAI announced it would be buying 10% of the company. Things are starting to get a bit incestious, as not long ago Nvidia itself said it would invest $100 billion into OpenAI. So, does Nvidia now own part of AMD indirectly? Is that any way to compete? Oh well, investors clearly don't care who owns whom, as AMD shares rose 31% last week on this news and on the back of several broker upgrades.

Take Care,

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Analysts of 5i Research responsible for this report have a financial or other interest in AMD. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.