5i Research Weekly Rockets and Duds

This week's 5i Research Rockets

and Duds

and Duds

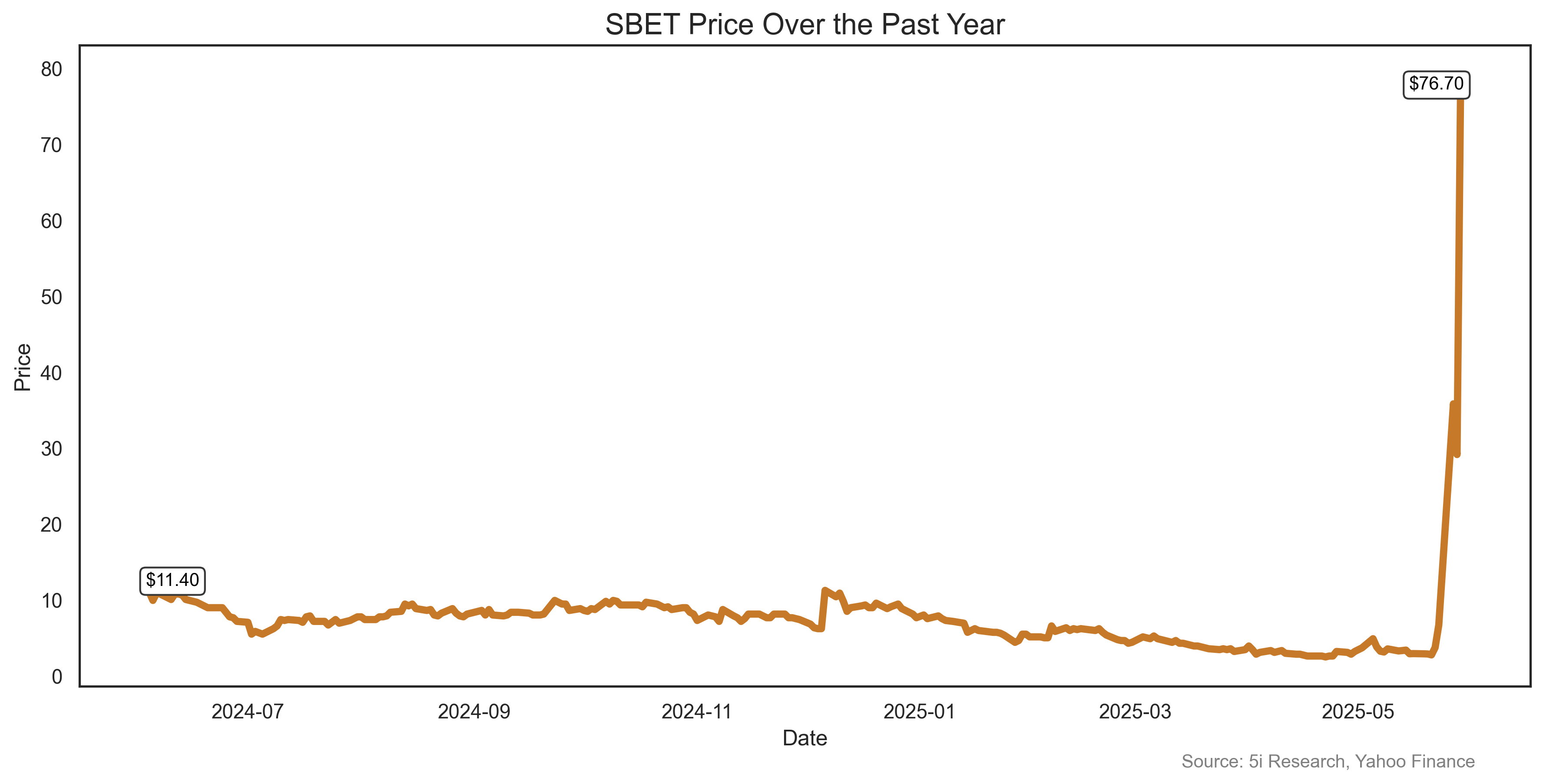

A small share float, a move to load up on Ethereum, and a promotion by a convicted fraudster. What could possibly go wrong? Sharplink rose more than 1000% last week, as it announced a $425 million financing, with plans to build an ethereum treasury, following moves by other companies such as Microstrategy to become holding companies for cryptocurrencies. Shares were also pumped higher by social media posts on the company by Martin Shkreli, aka the "Pharma Bro" who in 2017 was convicted of securities fraud and sentenced to seven years in prison. He is also permanently barred from serving as an officer of a public company. But...he can still buy stocks, and can still tweet (x) about them. Despite a market cap of $6 billion, it is estimated that the actual tradeable float of shares of the company is only $180 million or so. This one is going to end badly, we are fairly sure of that.

A small share float, a move to load up on Ethereum, and a promotion by a convicted fraudster. What could possibly go wrong? Sharplink rose more than 1000% last week, as it announced a $425 million financing, with plans to build an ethereum treasury, following moves by other companies such as Microstrategy to become holding companies for cryptocurrencies. Shares were also pumped higher by social media posts on the company by Martin Shkreli, aka the "Pharma Bro" who in 2017 was convicted of securities fraud and sentenced to seven years in prison. He is also permanently barred from serving as an officer of a public company. But...he can still buy stocks, and can still tweet (x) about them. Despite a market cap of $6 billion, it is estimated that the actual tradeable float of shares of the company is only $180 million or so. This one is going to end badly, we are fairly sure of that.

Tariffs? What tariffs? ELF rose 34% last week on news that courts blocked Donald Trump's tariff plans (but they were back on pending an appeal). But ELF also bought Mrs. Bieber's beauty brand, Rhode, for $1 billion, and also reported first-quarter earnings that were better than expected, even though it was the company's lowest sales gains in five years. As they say in the market (sometimes), put some lipstick on that pig and sell it. ELF has had a tough few years after being a stellar performer. But, it is still up 561% in the past decade.

Tariffs? What tariffs? ELF rose 34% last week on news that courts blocked Donald Trump's tariff plans (but they were back on pending an appeal). But ELF also bought Mrs. Bieber's beauty brand, Rhode, for $1 billion, and also reported first-quarter earnings that were better than expected, even though it was the company's lowest sales gains in five years. As they say in the market (sometimes), put some lipstick on that pig and sell it. ELF has had a tough few years after being a stellar performer. But, it is still up 561% in the past decade.

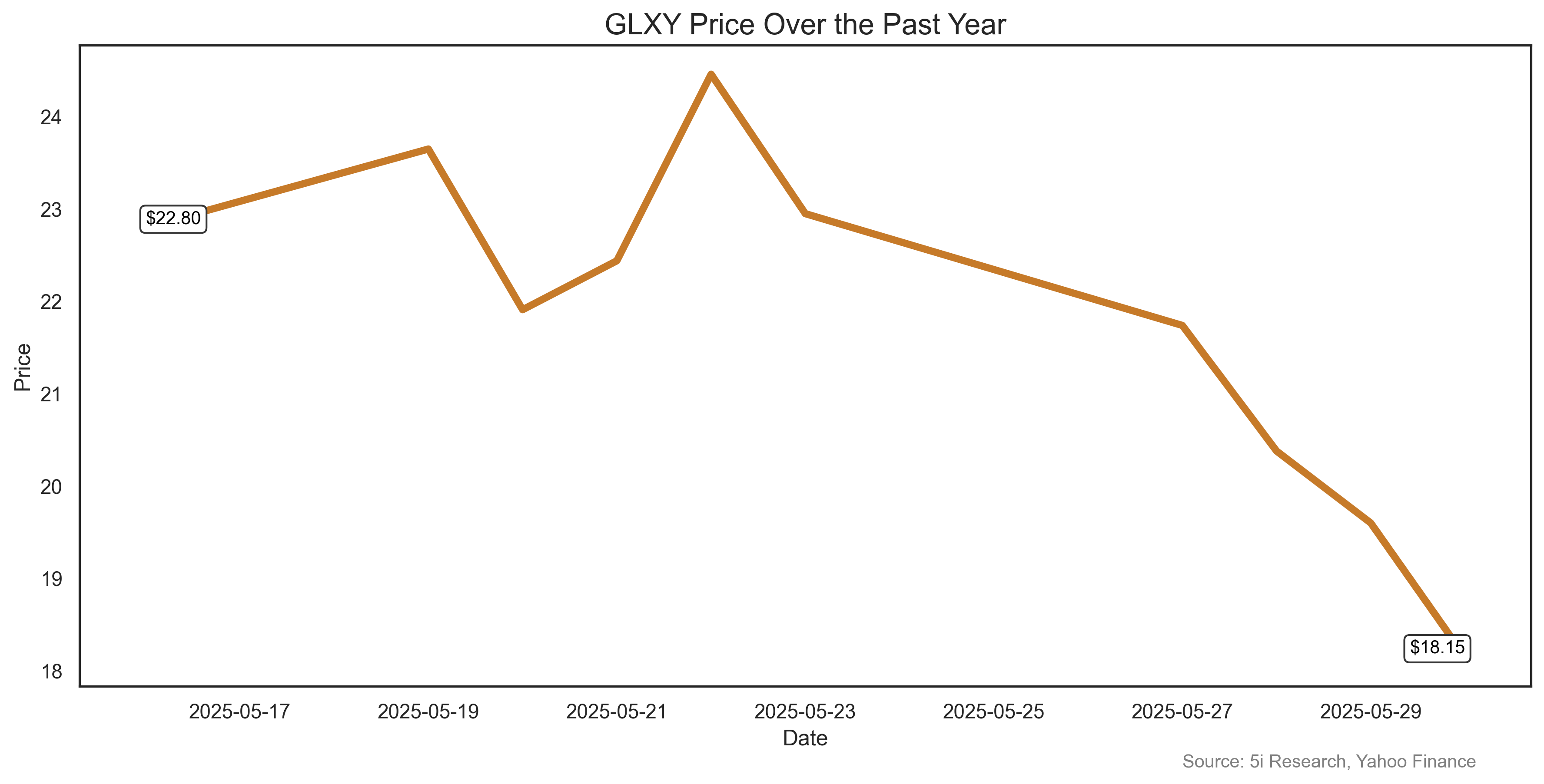

Curb your enthusiasm. Galaxy listed on the Nasdaq recently, and the stock did very well in anticipation of the listing and subsequent buying. Alas, GLXY had to go and spoil the party with an underwritten offering of 29 million shares--24.15 million from company treasury and the balance from shareholders. GLXY will use the proceeds to expand its AI and high performance computing infrastructure. But the stock fell 21% last week as the issue was discounted for a fast sale.

Curb your enthusiasm. Galaxy listed on the Nasdaq recently, and the stock did very well in anticipation of the listing and subsequent buying. Alas, GLXY had to go and spoil the party with an underwritten offering of 29 million shares--24.15 million from company treasury and the balance from shareholders. GLXY will use the proceeds to expand its AI and high performance computing infrastructure. But the stock fell 21% last week as the issue was discounted for a fast sale.

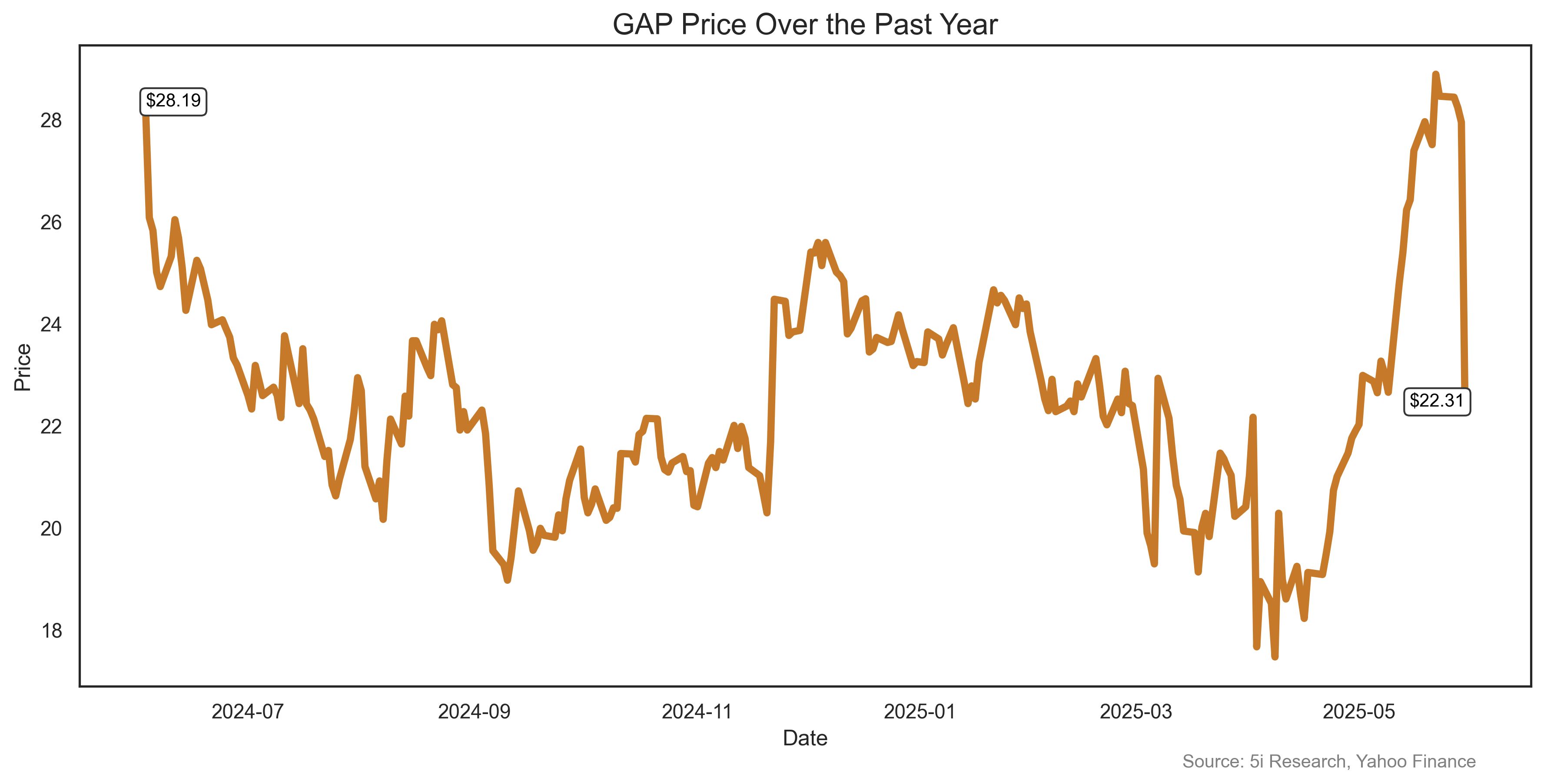

Mind the stock (gap) and look out below. GAP, that once cool--now not--clothing retailer, fell 22% last week as it warned that tariffs could cost it $300 million. The company reiterated its guidance, but said guidance did not include potential tariff hits. That's like saying you will come to the party, unless you don't. But it's all good: tariffs are supposed to be good for America, right?......Right?

Mind the stock (gap) and look out below. GAP, that once cool--now not--clothing retailer, fell 22% last week as it warned that tariffs could cost it $300 million. The company reiterated its guidance, but said guidance did not include potential tariff hits. That's like saying you will come to the party, unless you don't. But it's all good: tariffs are supposed to be good for America, right?......Right?

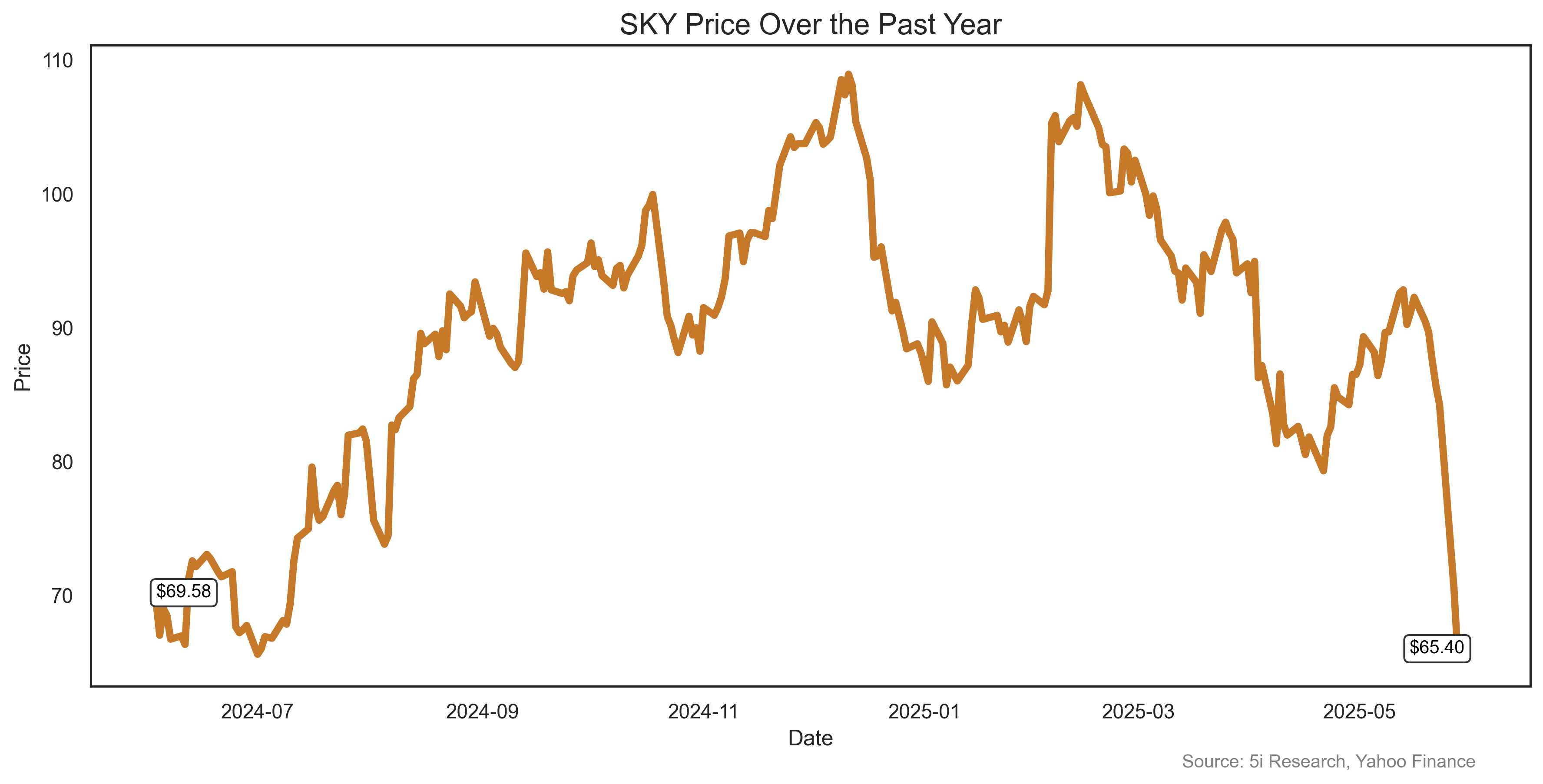

All the' good news' in the economy must mean home-builder companies are crushing it, right? Wrong. SKY, a factory-built housing company, reported results below expectations, and shares fell 22% last week. It did announce a $500 million share buyback, but its shares are clearly not going to the SKY anytime soon. We are not sure why it has the symbol SKY, frankly.

All the' good news' in the economy must mean home-builder companies are crushing it, right? Wrong. SKY, a factory-built housing company, reported results below expectations, and shares fell 22% last week. It did announce a $500 million share buyback, but its shares are clearly not going to the SKY anytime soon. We are not sure why it has the symbol SKY, frankly.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Analysts of 5i Research responsible for this report do not have a financial or other interest in securities mentioned. The i2i Fund has a financial or other interest in ELF.

Comments

Login to post a comment.