The market continues to make investors nervous given the headlines such as recession, geopolitical conflicts, inverted yield curve, and rising interest rates. Sentiment indicators such as the VIX are hitting above-average levels, with a relatively strong economic backdrop.

While there is a lot to worry about in the market, and with the concept of loss aversion, wherein the thought of losing is psychologically about twice as powerful as the pleasure of gaining, investors are making shifts within their portfolios preferring to avoid losses than acquiring gains in this market. For example, the inflation expectations dramatically shifted asset allocations towards commodities and the oil price rally made the energy sector gain spotlight. While some of the shift is beneficial based on correlation and risk-return characteristics, we think it is important to distinguish between two approaches to asset allocation.

Strategic Asset Allocation VS Tactical Asset Allocation

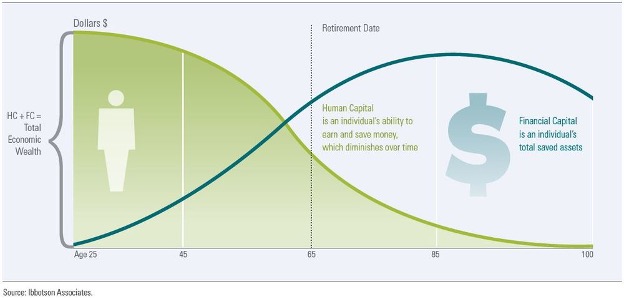

Strategic asset allocation (SAA) is a long-term asset allocation plan which considers an investor’s risk profile, financial goals, time horizon, and liquidity needs. The investor typically sets target allocations for various asset classes and rebalances the portfolio periodically. SAA considers both factors (human capital and financial capital) of capital that drive the total economic wealth of an investor. Human capital, simply put, is the present value of one’s future labor income. It is essentially a sum of predictable future income earned over one’s life. Financial capital on the other hand refers to savings and investment.

As it can be seen in the graph above, human capital is the highest in the earlier years and reduces over time as the present value of future income (beyond that age) declines as one gets closer to retirement. On the other hand, savings and investments accumulate over time, reflected in the growing financial capital over time. Both forms of capital are assessed when coming up with a SAA.

Tactical asset allocation (TAA), on the other hand, is a short-term deviation from the strategic asset allocation based on factors such as short-term sector view, a temporary hedge, economic conditions, valuations, or market cycles. TAA works by actively shifting asset allocations to take advantage of trends or perceived arbitrage opportunities in asset classes. Any deviation from SAA is a form of risk, and TAA decisions would be considered successful if the TAA generates higher risk-adjusted returns compared to SAA.

When making shifts in portfolio allocations, an investor must be mindful of whether the change is strategic or tactical in nature. SAA has a long-term focus and thus is often forgotten about, but we think it is important to revisit the strategy periodically or when someones situation has a material change. Apart from periodically, the following could be reasons why the SAA should be revisited:

- Change in investor goals or circumstances: A change in relationship status, dependent profile (age, education, addition), age, disability, career change, business, charity goals, and retirement are some of the goals that warrant a revision of portfolio goals, and strategic asset allocation.

- Change in constraints: An investor’s constraints are factors that would potentially restrict or limit investment options for an investor. The constraints can be either internal or external constraints. Internal constraints are created by investors themselves while external constraints can be caused by government or regulatory authorities. Examples of constraints include liquidity needs, time horizons, tax implications, and regulatory requirements.

- Change in capital market expectations: Capital market expectations are an important input to formulating a strategic asset allocation, so it is apparent that a permanent change in capital market expectations would mean a revaluation of SAA. In broad terms, capital market expectations are expectations regarding the risk and return profiles of asset classes with the goal of making informed investment decisions. Setting improper market expectations or ignoring market shocks (such as policy/regime change, technologies, growth rates, and financial crises) can be very costly for investors. Hence, a change in capital market expectation must be assessed and incorporated into SAA accordingly.

Having a strategic asset allocation is key for portfolio management as it can improve the chances of investment goals being met. The SAA helps set reasonable market and asset expectations and helps identify any biases such as home country, the illusion of control, and familiarity. The SAA also considers technical data such as correlations, volatility, and drawdowns helping investors make informed decisions. Given that the SAA is a blueprint for an investment portfolio, it is prudent to review a strategy periodically.

Comments

Login to post a comment.