One of the common refrains we are hearing is that the economy is/will be in such poor condition due to the Coronavirus, how can markets be doing so well? Corollary to this is that, ‘markets have clearly run too high and are set to crash when reality sets in’. A lot of this also hinges on the idea that the market is ‘dumb’ and the critic is ‘smart’. Time and again though, we have learned that it is dangerous ground to attack markets with the presumption that the entire market is wrong and you are right.

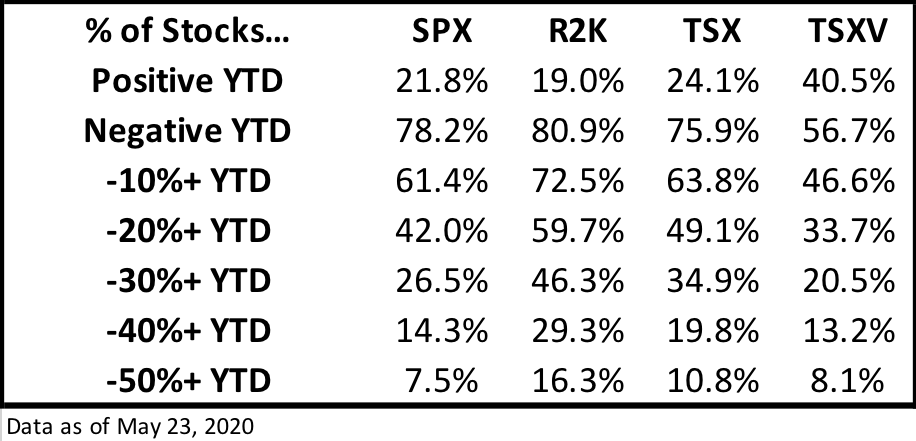

We recently discussed a number of reasons why the market is not the economy to help explain why the market can be doing well while the economy is not. The only problem is, ‘the market’ isn’t actually doing that well! A select few, very large stocks, are doing VERY well, and those are propping up the overall markets. Obviously, FANG stocks do not represent the market and are even less of a representation of the real economy, so when we look at the S&P 500 and see it down about 8.5% year-to-date, it actually gives us a false signal. The broad market is not doing nearly as well, just the largest, most dominant companies that make up the most of the index (FANG). Don’t believe me, check out the table below (R2K stands for Russell 2000 index):

While the return of the markets doesn’t look all that bad, when we look into the performance of the actual constituents, we see a very different story. In fact, in most cases, less than 25% of companies within their respective index are positive year-to-date. Perhaps more interestingly, 40% to 60% of companies are down over 20% over the year-to-date period. Depending on where you look, almost half of the companies in ‘the market’ sit in bear market territory or worse.

The SPX has some of the more resilient sets of results, with one of the lower readings of stocks below a 20% drawdown. This makes sense though, considering it is some of the largest and most formidable companies not just in North America but the world. So, we would only expect them to be impacted to a lesser degree than your average company. Using the Russell 2000, an index that is likely a far better representation of the real economy, we actually see results reflecting a lot of the pain everyone is hearing about. Just shy of half of the companies in the R2K are down 50% or more currently, after a decent run from the bottom. This does not look like an irrational or even a ‘strong market in our eyes. We could argue all day about whether the average company should be down 10%, 20% or 50%, but when you hear that the markets have disconnected from reality, it is difficult to give the argument that much credence when you actually look past the headline return number. The markets actually aren’t doing well, it’s a handful of stocks that drive the markets that are doing well.

The above is two sides of the same coin but it is worth highlighting. The larger and more dominant that a few companies become in their index, the less signal and more noise broad market performance becomes. Shopify, RBC and TD now make up 14.8% of the total market cap of the TSX composite. These three companies doing well says nothing to an investor about how the total market has actually performed and is even less of a reflection of how the economy is doing. This issue of composition of indices used to primarily be a TSX issue but it is increasingly becoming an issue in the US. This is a feature that investors are going to need to get more and more comfortable with When you hear the TSX or SPX is up ‘X%’, any signal you can take from this will become less and less helpful. And if articles or investors are telling you there are no good deals out there (whatever that means), just remember that 46% of companies in the Russell 2000 and 35% on the TSX are down over 30% this year.

Thinking about becoming a 5i Research Member? There is no better time to join but don't just take our word for it. Try it for free for the next month and experience all the benefits of the 5i Research membership. (And don't worry. We won't ask for your credit card upfront)

Disclosure: Employees, directors, officers and/or partners hold a financial or other interest in Facebook, Amazon, Google (Alphabet), and Netflix at the time of publishing.

Comments

Login to post a comment.