Markets hit the quickest bear market in history. Now they are rallying and are technically in a bull market as they have risen so far and so fast. Meanwhile, job losses are hitting levels we have never seen yet markets rally. The confusion was captured perfectly in this image that was getting shared across social media from CNBC.

It is easy to understand why the contrast here is not only confusing but also polarizing and disheartening for many, particularly the millions that are facing tenuous financial or employment situations. My goal here is to not get into philosophical debates or try to say what ‘should’ be happening. Nor am I going to discuss what we think will happen (spoiler alert: no one knows with certainty). I want to take a bit of time to explain why this is the case and while it may be a confounding image to look at, why it is not necessarily ‘irrational’. First, we need to understand a few fundamental concepts about the economy and markets:

Core concept 1: The market IS NOT the economy.

People are often surprised to hear that the economy and the markets are two related ut different things. In many cases, the companies that are publicly traded are far different from the average company out there and from companies that employ the majority of workers (i.e. small businesses). Also, the indices we look at (S&P 500 or Dow Jones for example in the US) are not necessarily reflective of the underlying economy. The Down Jones actually only contains 30 companies and is 40% technology companies. This could probably not be a further representation of the real economy.

Another important point that can often be missed is that the economic data we see in news headlines is usually lagged by at least a month. This means that the economic data we see as it is released can be far different from the reality that the companies are operating in at the time. While economies do not turn on a dime, by the time people see a bad headline, the worst could be over. This is why often times markets start improving before it looks like we are through the worst of things.

Core concept 1.1: The companies in ‘the market’ are not the same as the companies getting impacted.

I touch on this a little when mentioning the DOW but the point deserves further discussion. Companies that are publicly traded are far different than the majority of companies in existence. Also, companies that are publicly traded have far better access to capital and talent. All things that help you survive a crisis just like this. So, it makes sense that the companies that trade on a market are not a mirror image of what we see in the ‘real economy’ Of course they will feel a slowdown as well, but they have more tools to weather the slowdown.

Recently, we touched on how this current crisis might actually widen the unfortunate chasm we are seeing between large and small companies.

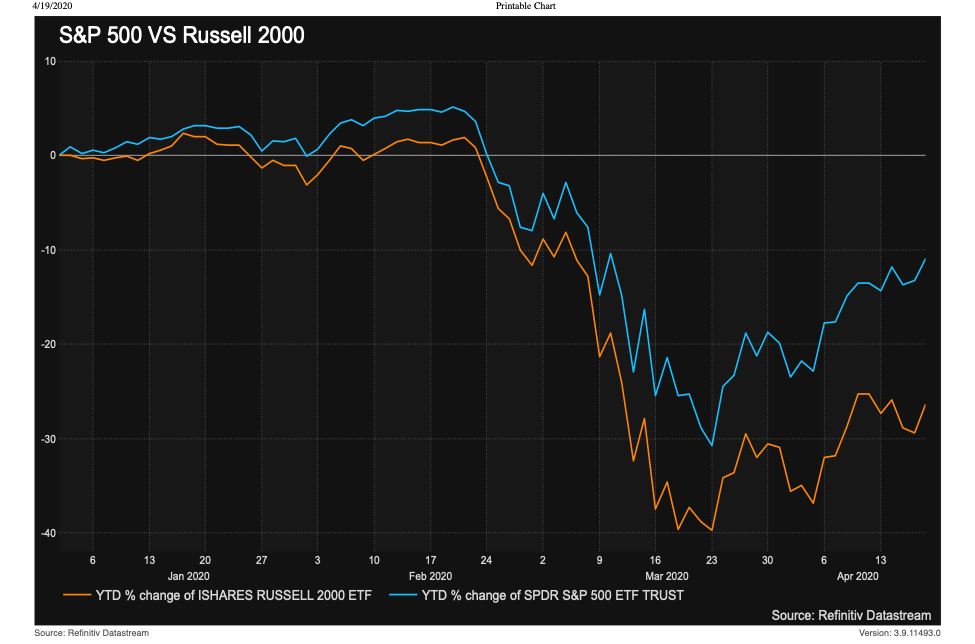

It is worth noting that while some markets that get quoted frequently in financial media do not seem to be reflecting the world we are in currently if we widen our net and use an index that is a better representation of smaller companies, we see something that is probably a bit closer to reality. The below image compares the S&P 500 (large-cap) to the Russell 2000 (small-cap) and the divergence in returns between the two is clear.

Core concept 2: Markets are forward looking.

This is potentially the more important concept when trying to wrap one’s head around the image we started with in this article. The value of a stock is determined by trying to find what the value of all of the cash flows or profits will be that a company generates into the future. So, while we can be in the middle of a really bad economy, markets are still trying to look past the current crisis and value all of those cash flows that the companies will generate for years once we are through the current crisis. No, markets and investors are not perfect at this but they do a pretty good job and is another reason why you can have a situation where the market (looking to the future) can be very different from what the economy is doing (a single point in time).

Now we need to look at how markets are viewing the COVID crisis. I will reiterate, I am not here right now to discuss whether the market view is right or wrong. I am only going to discuss what the market believes to be right or wrong.

Core concept 3: The market has already priced in some sort of recession given the past declines.

As should be clear, markets have already gone through a very fast and steep decline, falling over 30% from peak to trough. Whether it was deep or long enough remains up for debate but the point is that markets have not ignored this crisis outright as some might think. Markets fell, assessed the situation, weighed current and new developments and adjusted. Exactly what we would expect them to do.

Core concept 4: The market believes that to a large degree and on relative terms, the immediate impact of the virus will be short-lived.

In other words, markets think that this is might be a one-year story and we then move past this. Hopefully, this is the case and this crisis is shorter term. Regardless, whether it takes a year or one and a half years for things to get back to something that resembles normalcy, markets expect the direct or acute impacts to be short-lived.

Core concept 5: Governments and service providers are throwing everything they can at the problem to keep the economy afloat.

Markets think that between unprecedented government stimulus/support, positive developments on the progression of the virus and some potential news on treatments, that the probability of the ‘worst-case scenario’ from the crisis (whatever that may be) is getting lower and lower.

So, now we understand a few concepts behind the underpinnings of the market as well as how markets are viewing the current crisis. How can we have a situation where we are looking at really bad economic data and yet surging markets?

Well, markets and also the companies being impacted by COVID are not necessarily a great representation of the economy at large. SO, you can have a situation where the companies that are underlying the market do not feel a recession in the same way that the average person or company does.

Additionally, in theory, markets are looking out decades and accounting for the profit/cash flows years and years into the future. If markets believe that COVID is largely a ‘one-year story’ and that developments are confirming this idea, it becomes easier to accept the idea that even though the real-time data coming in does not look good, that markets are already accounting for this but looking forward to a world post-COVID.

Hopefully, this helps to highlight the scenario we have in the initial image. It is frustrating and confusing to see images like this. I believe memes like this also turn people away from the idea of investing, under the theme of ‘the market is rigged’, which is a shame.

Again, I am not trying to say whether this is right, wrong, or fair from a market or philosophical point of view nor am I trying to give any indication of whether the markets are justified at these levels. I am just trying to provide an understanding of what IS happening, whether you believe the market is right or not. For better or worse in investing, what does happen and what you think should happen are two very different things. Hopefully, this provides a bit of insight and alleviates some of the confusion into what IS happening in the markets and why.

By: Ryan Modesto

Never miss timely information...Sign-up for your FREE trial today! There is no better time to join but don't just take our word for it. Try it for free for the next month and experience all the benefits of the 5i Research membership. (And don't worry. We won't ask for your credit card upfront)

Comments

Login to post a comment.

Some good thoughts there. I follow the DOW a lot and I agree that those companies are certainly as far removed from Main Street as you can get. The economy is in a deep recession, but the market rebound does not really show that. It is looking ahead to when we get out of this. I agree it is always best to focus on what IS happening in the market and not worry about what you think should be happening.

Most interesting read; a few thoughts:

1. Could the market have foreseen the advent of this pandemic? Of Course not! Then how could the market foresee the timing and advent of "normal" times. I can safely say none of us, but perhaps a handful, have experienced an epidemic, let alone a pandemic of such scale.

2. Each individual investor has his/her own comfort zone. In normal times, people would seek the advice of investment advisors; in the current situation however, many of them would rather place the opinions of epidemiologists and health care specialists in the foreground and relegate the opinions of financial advisors into the background. This does not mean that they would lose sight of them.

Keep it coming; this kind of reporting stimulates the mind.

You guys at 5i are tops,

Thanks,

Antoine