Here at 5i Research, it is uncommon for us to start coverage on a company and add it to one of our model portfolios after it just went public, but we found Lightspeed POS was a company hard to ignore. We recently issued a new report on LSPD which can be found here.

We have been researching LSPD since we could get our hands on its IPO prospectus, and we have to admit, it is trickier analyzing a business that has few comparisons and in a space (technology software) where the markets have not reached a real consensus on valuation multiples. In cases like this, we think it is important to establish some sort of a benchmark and make the closest possible comparisons to similar companies, but we also think it is important to go beyond that and evaluate the company based on its specific business model, growth prospects and market share potential.

Lightspeed POS (LSPD) was founded in 2005, however, our data on them is limited to 2016 and onwards based on information from its IPO prospectus. With this in mind, Lightspeed has seen truly impressive growth for a company that has only raised ~$78 million since 2016 prior to its IPO. With no debt, and IPO proceeds of $276 million the company can do a lot to grow and establish its market position.

For investors who are unfamiliar with LSPD's business, the company offers easy to use, omnichannel point-of-sale (POS) software and hardware for retail stores and restaurants. The company targets small-to-medium sized businesses (SMBs) and also provides order management, discount and loyalty features, accounting, inventory management and analytics as well as e-commerce and payment processing solutions. For smaller vendors, the market currently offers many single-function solutions (such as POS) but very few offer an end-to-end solution that Lightspeed provides. SMBs need to take different solutions and somehow configure them together, which can result in many inefficiencies from incompatibility and higher costs. Typically payment processing and POS are separate providers, whereas Lightspeed has recently introduced payment processing as part of its solutions deck. Lightspeed seems to be looking like a first-mover in this POS niche and not just domestically in Canada, but in ~100 countries, some of which LSPD already has a significant presence. The company is established yet growing rapidly. For this reason, we think Lightspeed is not a company to ignore and is even reminiscent of the early days of Shopify.

Square & Shopify

Companies like Shopify and Square are competition in the SMB space, however, Lightspeed starts its customer initiation at the store rather than online when comparing to Shopify and Square being more focused on smaller businesses. While Lightspeed is focused on retail stores and restaurants, Shopify and Square capture a market of smaller businesses that do not have a physical location and market verticals outside those of retail and restaurants. However, Lightspeed takes a different approach by leading with a comprehensive POS software as a base offering for companies with an existing physical location. Although Lightspeed’s minimum pricing of $99/month is higher than Shopify’s $29/month and Square’s transaction fee-only model, the pricing is affordable for Lightspeed customers who seek specialized retail & restaurant POS software. Lightspeed’s customers also tend to be businesses of a certain size capable of handling these software costs, compared to a starting business which Square and Shopify cater to effectively.

Paypal & Stripe

On the payment processing level, Shopify and square are also competitors along with Stripe and Paypal. Paypal is not a direct competitor with Lightspeed as Paypal’s focus is online payments between various entities such as individuals, and businesses and is a dominant player in the space. Lightspeed like Shopify and Square focus mostly on retail SMBs and provide software as a service product to help businesses receive payments, engage with clients and manage the back-end of their business. Of course, Paypal does compete with these companies by providing its own payment processing platform for businesses. The company is the dominant player in the payment processing space with about 60% market share and is about 100x the size of Lightspeed, and is at a more mature stage. Paypal’s gross margins are stable at ~46% but EBITDA and net margins have been declining in recent years. The difference in premium paid for growth can be seen in the Lightspeed and Paypal’s price to sales ratios of 23.5 and 7.4 respectively. Another major player in the payment processing space is Stripe, a private company that has about ~20% of market share. It rivals Paypal by charging the same fees of 2.9% + 0.30, but it does not charge additional fees like its rival. It has over 1 million businesses that use it for payment processing including many larger companies like Google, Uber and Salesforce.

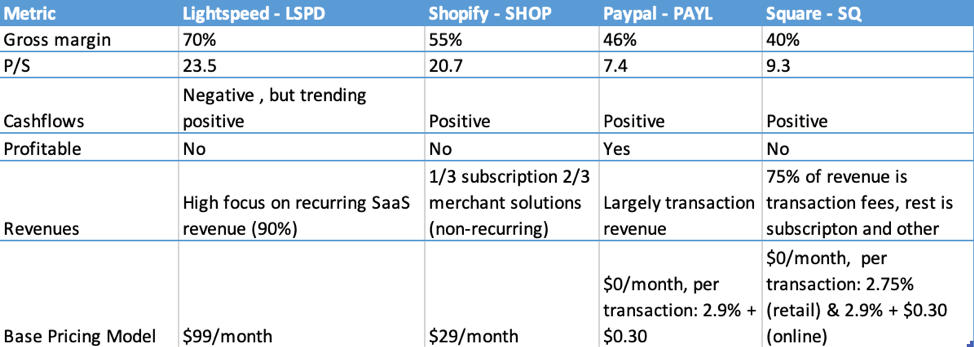

Below is a chart comparing different metrics relating margins, sales multiples, cash flows, profitability, revenue mix and pricing model of Lightspeed and its competitors:

When comparing to peers, LSPD has a higher gross margin, higher revenue per user based on their pricing model as well as more recurring revenues integrated into its core revenue streams. Another thing to keep in mind is that the LSPD is still at the earlier stages of its growth compared to peers, so shares may trade at a higher multiple. We explain our views on LSPD in further detail in our full report which members can read here: Lightspeed POS (LSPD)

Comments

Login to post a comment.