Knight Acquires Grupo Biotoscana

Knight Therapeutics has been a name that has tested investors' patience. While its no debt and high cash offer plenty of protection to the downside, the company does not pay a dividend and investors have been waiting for the company to spend its high cash balance to promote some sort of growth. At last, it seems like the company is finally putting that cash to use in what looks like a transformative acquisition. What does this mean for how we view and value the company? Shares saw a ~15% rise following the announcements, but are now back to pre-announcement levels. Could it be that investors were just looking for an opportunity to exit the company? Let's take a look at the new and improved Knight Therapeutics and what it means to own its shares going forward.

Deal Details

Before its third-quarter earnings release, Knight Therapeutics (GUD) announced it would acquire Group Biotoscana (GBT), a pharmaceutical company operating in over 10 countries in Latin America. The deal will be done in cash and in two phases. In the first phase GUD is expected to acquire a 51.2% ($189 million) controlling interest in GBT of the company for 10.96 BRL per share, a premium of 22.2% from its biggest shareholders Advent International and Essex Woodlands. The rest will be acquired from public shareholders on similar terms for roughly $180 million, bringing the total cost of acquisition to $369 million and a total enterprise value of $418 million when including Biotoscana debt, an enterprise value quite close to that of Knight. This represents a purchase multiple of 8.5x GBT's LTM adjusted EBITDA.

GBT’s product portfolio will provide an instant source of diversified revenues that will be complementary to GUD’s especially in the areas of Oncology (where GUD still has not marketed any products) and infectious diseases which is a wide playing field in health care. However, before we get into what kind of products GBT will add to GUD let’s take a look at GUD’s existing products.

Knight’s Product Portfolio:

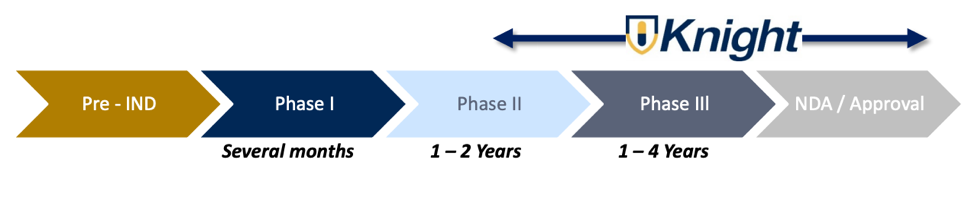

GUD takes an approach of acquiring product rights of drugs that are in the late-stage of development and this has resulted in a 90% success rate in getting drugs approved, making it easier to get its products to market.

Source: Knight IR Presentation

Knight now has 20+ prescription pharmaceutical products that are either marketed, approved, pending submission or in the late-clinical phase. The four main areas of therapy are Pain/Gastrointestinal, Ophthalmic, Women’s Health and Oncology. Five other products are in miscellaneous areas like malaria, heart, liver and tropical diseases. Out of all the company’s products, only four are marketed and generate revenue for the company. However, Knight seems to be doing a decent job in getting products lined up. Here is a list of recent approvals and submissions:

- Breast cancer drug Nerlynx approved by Health Canada in July 2019

- Iluvien (diabetic macular edema) approved in November 2018

- Both drugs were recommended not to be reimbursed by public health plans by their respective regulatory body, but Knight has appealed both and expecting responses by year-end and early next year

- Knight also secured secure public reimbursement for Probuphine (opioid dependence) for various provinces

- Approval for Netildex (ocular inflammation) and submission for Joyesta in October 2019

- Planning to submit Bijuva (menopausal vasomotor symptoms) later this year

While revenue numbers have been small in Knight’s short history, revenues have grown rapidly from $370,000 in 2014 to $12 million in 2018 and the company is expected to realize ~$20 million for 2019 from its original business. While the Canadian focused business will likely become a much smaller portion of total revenues, one should not discount the original business and its previous growth in the big picture of things. In the least, previous growth serves as a track record for the potential growth of the new company in the future (not mention the track record of Paladin pre-2013).

New Revenue & Geographic Mix for GUD

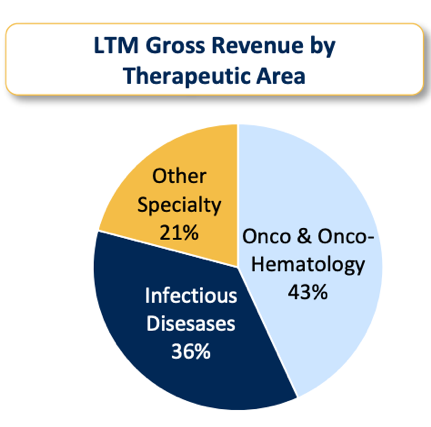

Source: Knight IR Presentation

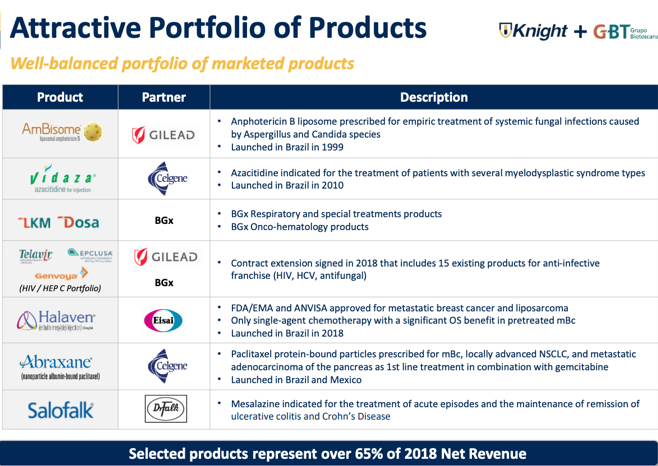

GBT is the partner of choice for big pharmaceutical companies like Gilead and BGx in Latin America and the two have a contract with GBT in place for 15 products. In addition to this, GBT has partnerships with other pharmaceuticals for 9 other products for a total product portfolio of 24 products (most generating revenue) that will be added to GUD’s own portfolio.

Source: Knight IR Presentation

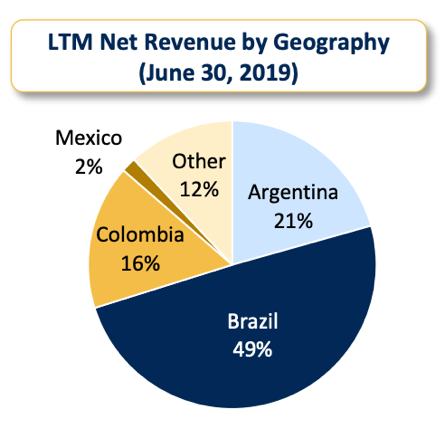

Source: Knight IR Presentation

The acquisition makes GUD well-positioned in Latin America for future in-licencing partnerships which it is planning to leverage for organic growth. After major developed markets and China, Latin America is the biggest pharmaceutical market and is expected to grow above average global growth rates (>6% vs ~4%). Biotoscana is focused on fast-growing markets such as oncology and onco-hematology and infectious diseases among others with a revenue and EBITDA CAGR of 20% and 26.9% between 2014 and 2018 and has expanded from five to ten countries since 2011. We would expect less aggressive but continued healthy growth for Biotoscana going forward since the company's more rapid expansion in the continent seemed to be taking place pre-2016.

The management team is experienced and has laid out a comprehensive infrastructure (pan-regional sales, marketing, R&D, regulatory, access and manufacturing department) in Latin America. Knight may also be able to benefit from the more relaxed regulatory framework in Latin America compared to that of Canada and the US for its current and future products. All considered, Biotoscana is looking to be an accretive acquisition for GUD.

GBT’s geographic diversification also makes sense for GUD in terms of stability. In the context of economic/social/political turmoil in Latin American countries like Argentina and Chile, we view GBT’s ~50% concentration in Brazil as a good thing as it is one of the more stable economies in the region and of the more promising emerging markets for growth towards development (think BRIC).

Source: Knight IR Presentation

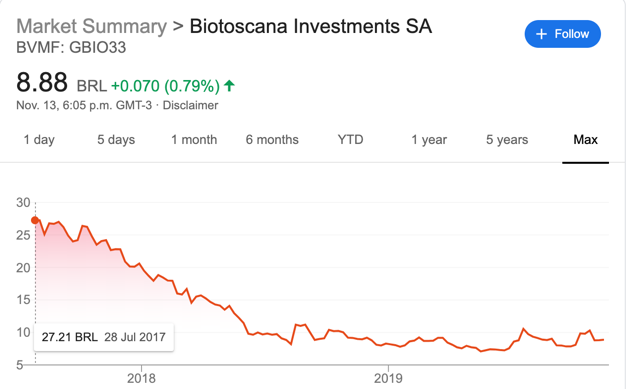

Biotoscanana was acquired at a ‘GUD’ price

Another point to keep in mind is that Biotoscana’s stock has not performed so well since IPO in 2018 and this has worked in GUD’s advantage as it was able to pick it up at a significant discount. We would not be particularly concerned with GBT’s drop in shares as the underlying business is showing decent growth and is well-established in Latin America, presenting a good growth platform for GUD. We also take into consideration that company shares are more sensitive to sell-offs soon after going public, so shares may have been corrected to more justifiable levels. More importantly, the strong sales, marketing and distribution capabilities of GUD management should carry over into GBT and we think GUD will leverage this company to realize synergies that may not have been possible before the acquisition.

Patience is still needed

While this is a positive and sizable development that many investors have been waiting for, we think the company will continue to be a name for patient investors. The possibility remains that GUD will make other acquisitions in the near future however, we think GUD will remain quite patient and methodical in its capital allocation as it has been in the past. As the company remains selective with its acquisition targets, a frothy pharmaceutical space on a valuations basis could elongate the timing of the company’s next acquisition. The company says it will continue to evaluate consolidation opportunities while growing GBT’s Latin American business. For its Canadian growth strategy, the company will continue to focus on in-licencing, acquiring “under-promoted” products from big pharmaceutical companies and developing near-term, low risk and low-cost products.

Proforma financials

To get another perspective of just how different Knight will be after the acquisition, it often helps to simulate how the balance sheet and income statement might look going forward. With many acquisitions, the impact is not always very obvious, but due to the size of this acquisition, it is easy to see a difference in the 'new Knight'.

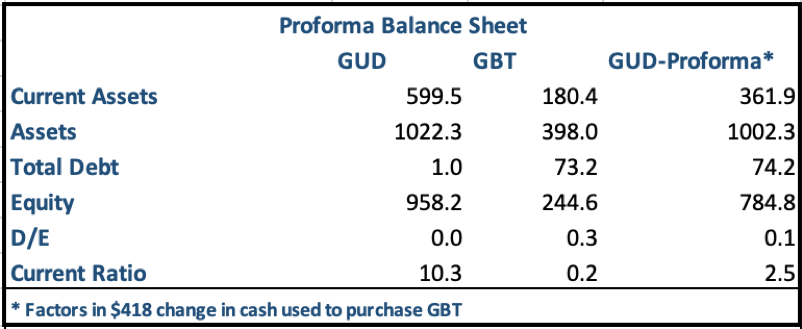

Balance Sheet

The table above shows both companies’ main balance sheet items and ratios before/after the acquisition with 'GUD proforma' representing the new entity. The new current assets, total assets and equity essentially reflect the combined figures minus the $418 million in cash GUD used to acquire Biotoscana. Debt of Biotoscana is simply added to GUD. However, the added debt is immaterial as can be seen by the debt/equity ratio and will likely be paid off soon given Goodman’s history of wiping off any debt from the balance sheet. The current ratio will likely fall significantly but still to a healthy level. This is due to the current liabilities Biotoscana brings with it as an operating business.

As we can see, GUD will continue to be a company with a very healthy balance sheet, in contrast to most of its other health care competitors which tend to be highly leveraged. Much of this can be attributed to Goodman’s conservative and patient methodology, however, GUD’s business model is unique in the sense that it focuses on acquiring product rights and sales. This is also in contrast to other health care companies that need to take on a lot of debt to discover, test, manufacture, distribute and then sell their drugs. Goodman prefers to exercise the patience of sitting on cash and wait for opportunities rather than the patience needed to bring new drugs to the market from scratch.

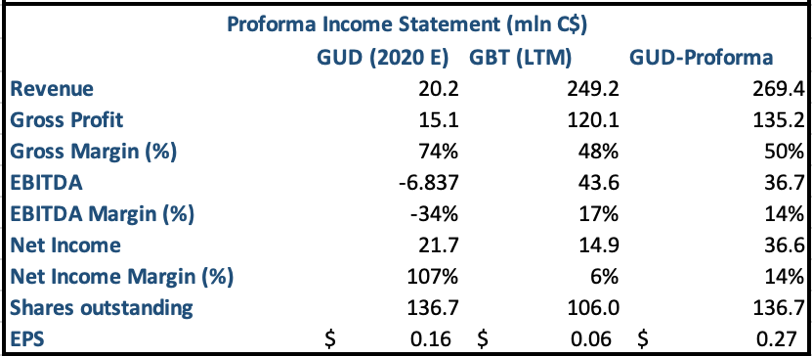

Income Statement

The income statement is where things get more interesting. We used 2020 estimates for GUD and Last Twelve Months for GBT (due limited estimates data) to get an idea of what line items and margins will look like next year. Starting with the top line, it is clear that GUD’s income statement will look a lot different going forward with the addition of GBT’s revenues. GUD will essentially have a fully operating pharma business on its side with many more products than its own ready to market. Moving on to gross profit, despite GUD’s much higher gross margin, we can see that margins will shift closer to Biotoscana’s, due to the sheer difference in revenue base it contributes and the associated cost of revenues. The case is similar for both EBITDA and Net income, however both have unique cases:

EBITDA – GUD’s EBTIDA historically has been negative even while turning a profit for one simple reason: It makes more money from interest and investment income, which is not included in EBITDA than it does from actual drug sales. Interest income is not treated as operating income except for banks (which GUD somewhat was). However, on a proforma basis, GUD will start to look more like a normal operating health care business in terms of EBITDA with margins at ~14%.

Net income – On the net income side, margins will interestingly be close to ETBIDA margins, again because interest and investment income, which GUD generates much more than your average health care business. However, unless there is a drastic shift in strategy, we expect GUD’s loan portfolio will remain an integral part of its business, generating a stable income that goes straight to its bottom line.

Shares outstanding & EPS – Lastly GUD will likely see a jump in expected EPS because shares outstanding will remain largely as they are today while net income will naturally be higher. By acquiring GBT in cash and not issuing any equity as part of the acquisition deal, the company is essentially adding profits to its books without diluting shares. This means more dollars per share for investors.

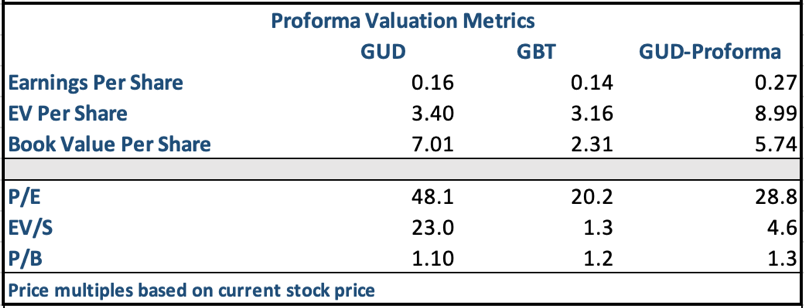

Valuation

The above table shows what multiples would look like based on today’s prices if the companies were to join based on our near-term forecasts of different per-share metrics. Understandably, P/E and EV/S should naturally contract because sales and earnings are expected to increase significantly. However, we prefer to look at book value (assets-liabilities) when valuing GUD for a few of reasons:

1) GUD has traditionally been looked at as a business mostly for its assets (namely cash) resulting in a P/B ratio of around 1.

2) Banks are often valued based on book value and GUD has often been viewed as a ‘pseudo-bank’ stock given its significant loan portfolio.

3) Other multiples like P/E and EV/S will likely be more volatile and subject to much interpretation of the denominator values (earnings and sales) in the near future, whereas book value is usually a more stable metric.

What Book Value tells us

By taking on this acquisition, GUD has become more of an operating company that actually generates significant revenue. GUD is currently trading at book value with a P/B of ~1.1 (historically closer to 1), which is essentially the company’s book value. It seems quite odd that the GUD is still trading so close to its historical P/B level which reflected low growth due to the massive pile of cash it was sitting on. It was essentially priced at no more than the value of its assets and cash, which made sense. However, it is difficult to argue that a similar P/B ratio has priced in a transformative acquisition that will almost certainly generate ongoing value/returns.

Prior to the GBT acquisition, GUD generated most of its profits from interest/investment income rather than actual pharmaceutical products and the majority of the company consisted of cash. Now it has taken on an entity similar to it in enterprise value size that is fully operational, GUD is in a sense ‘becoming’ Biotoscana, (except holds more cash). Considering that GUD is trading at P/B ratio of ~1.1 and GBT has historically traded within the 1.2x-1.3x book value range, one might even view buying GUD shares as a way to purchase GBT at a discount. Arguably, the acquisition of a large Latin American company also implies a large shift in strategic focus and risk exposure, however the new entity consisting of both GUD and GBT is de-risked in many ways. The new GUD has more cash than GBT ever did, less debt, and a North American operating framework, all very valid reasons to justify a premium in valuation even above the historic P/B of GBT. Finally, being a fully operating business with virtually no debt also makes GUD a more legitimate health care name in Canada from the few options available on the TSX, furthering the case for a premium in GUD’s valuation.

Another Perspective

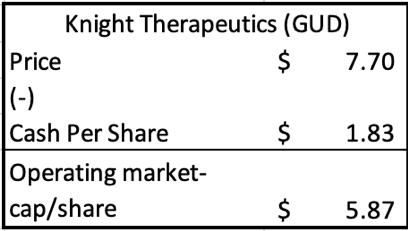

While GUD’s cash balance is expected to drop significantly after the acquisition, replacing it with an operating business that generates higher returns, GUD will still have ~25% of its market cap in cash, which is still more than average. When encountered with businesses holding a lot of cash, it sometimes makes sense to try valuing the company only in terms of its operating assets. By holding GUD’s stock, you are essentially holding ~25% cash. In other words, ¼ of your market value is not productive and might as well be cash in your portfolio. Knowing that the stock price is essentially market-cap/share, we can take cash/share and subtract it from the price to get an idea of what the price would be if we are just looking at the ‘productive’ part of the business. Doing that we get $5.87 per share which we can call “Operating market-cap/share”.

If we use that as a price to derive our multiples, we end up with a proforma P/B ratio of 1.02x which is close to GUD’s historical P/B, which may indicate that markets are pricing GUD more based on its history of being a company that holds a lot of cash and does not do much with it. By pricing a company exactly at book value, you are essentially saying that a company is not worth much more than its assets. Given that GUD is now more of an operating business that should generate healthy profits as well as see growth through international markets, it is fair to say that its value should be beyond just its assets.

It might take a quarter of results with the new Biotoscana acquisition on the books to get markets looking closely at the name again. For now, the company continues to trade around the same levels as it has in the past. However, GUD now has an operating business behind them that will overtake most of their existing business, continues to have some cash, has drugs reaching approval and an ability to grow on the Canadian and international side. Meanwhile, shares are still trading at close to book value, which may mean investors could be getting a huge bargain. We think GUD is set up well for the future at this stage and the bar for the company to meet is low in order to realize value.

*Disclosure: The author does not hold a position in shares of Knight Therapeutics (GUD).

Comments

Login to post a comment.