With market uncertainty and volatility running rampant, now is a great time to focus on crowd psychology and the four psychological phases of asset bubbles.

Schiller's dictum - "Anyone taken as an individual is tolerably sensible and reasonable – as a member of a crowd, he at once becomes a blockhead."

At a time when many retail investors use tools like social media as a resource to find investment information, understanding crowd psychology becomes crucial.

My daily interactions on social media can be summed up best by Economist John Kenneth Galbraith, "We have two classes of forecasters: those who don't know and those who don't know they don't know". Those who don't know they don't know are the ones to look out for, yet I often see new investors making the mistake of falling for these self-proclaimed prophets. New investors must avoid being emotionally swept up by the excitement created by these individuals to prevent their own reality from becoming badly distorted.

What many retail investors don't realize is that crowd psychology and liquidity is inversely related. During market tops where optimism is at an extreme, cash levels (potential demand) are at a low. Not enough buying pressure to push prices any higher. Vice versa at market bottoms during times of extreme pessimism cash levels become very high. In other words, go with the crowd until psychological levels hit an extreme and begin to reverse. Then it's most likely a time to become a contrarian and bet against the herd.

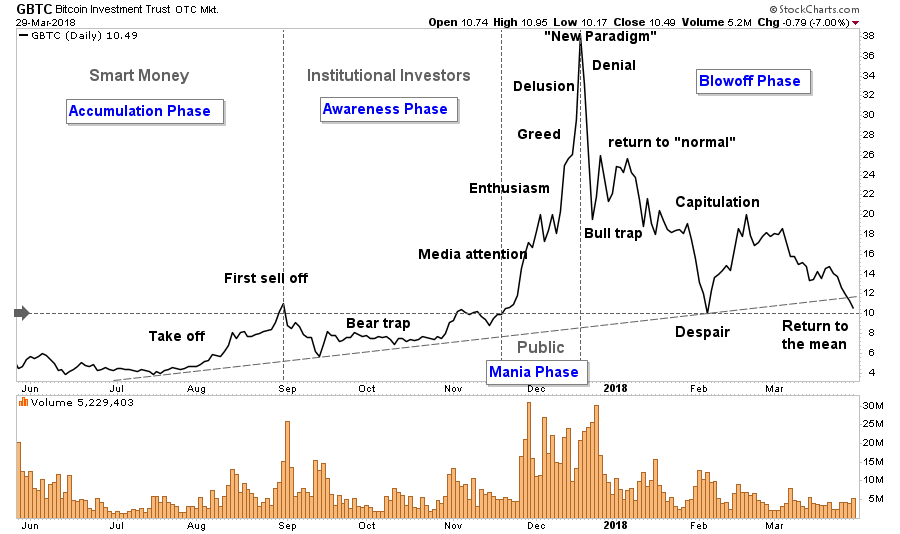

There are four psychological phases of asset bubbles: accumulation, awareness, mania and blowoff.

The accumulation or stealth phase represents informed buying by the astute investors or the so-called smart money. These investors recognize that the market has presented an opportunity.

The awareness phases or public participation phase is where most technical trend-followers including institutional investors begin to participate. This occurs when people become aware of the potential and the price of the asset begins to move higher. This phase ends when the media (including social media participants) begin to catch on.

Once this media attention attracts the everyday-Joe wanting to invest, the mania phases begins. The media hype creates a lot of speculation. This attracts enthused buyers making the price go up based on hope and expectations. Many investors at the peak of this mania phase invest solely on the belief (delusion) that the asset will keep going higher, forever.

The blowoff phase is when the asset bubble pops. The smart money that accumulated during the stealth phase (when no one else wanted to buy) begins to sell, while delusional investors are still under the impression that prices will keep going up forever. As with every asset bubble, these delusional investors think this time it is going to be different. Prices will begin to decline slowly until panic sinks in causing a huge drop. This will eventually lead to capitulation causing price to return to its historical mean.

Ned Davis sums it up best, "The degree of unprofitable anxiety in an investor's life corresponds directly to the amount of time one spends dwelling on how an investment should be acting, rather than the way it is actually acting." Beware of the crowd at extremes.

Have a question? Sign up for free to ask 5i's Research Team your top question, plus get instant access to Canada's top stocks, three model portfolios, and over 62,000 answered investments questions. Get your free 5i Research Trial here.

By Dwight Galusha from SetYourStop.com

Comments

Login to post a comment.