In general, economists seem to be honing in on a few key issues surrounding the Brexit debate. The Economist does a great job at outlining this issue and we have tried to further summarize what is already a great summary and should be a first stop for those who want to read further about this:

1 – Impact of trade – The arguments here are that the UK could strike better deals with non-EU countries and that being part of the EU has ‘cost’ the UK many trading opportunities. As it stands, it appears that the UK did benefit from trade by being part of the EU regardless, as a great deal of goods are traded by the UK are from within the EU.

2 – Foreign investment – Markets and investors hate uncertainty and this event is about as uncertain as things can get! This causes projects and investments to be put on hold and capital to seek other geographies that offer more stability. It is hard to imagine a scenario where a Brexit would benefit foreign investment over the short to medium term.

3 – Migration policy – This impact seems to be the most uncertain as to whether it would benefit or hurt the UK. The likelihood is that stopping or impeding migration would hurt in the short-term but if the UK were able to optimize any policy, there could be a long-term benefit. A lot of ‘ifs’ exist here though.

4 – Net contribution to the EU – This is likely a nice data point for headlines, as at ~8.5 billion GBp, it sounds big and is a real, quantifiable cost. However, it seems that the size of the number pales in comparison to the potential negative impacts on areas such as trade. Unfortunately, the impact of something like trade is based on estimates and harder to communicate compared to a ‘solid number’ such as this one.

5 – Less bureaucracy – The idea of cost savings from less red tape and compliance costs is another benefit being bandied about but is likely fairly small potatoes in the scheme of the impact that the first two points would have.

So overall there are two very large factors that seem to have a negative outcome that are likely to dwarf any positive impacts and one less certain factor that in reality is probably more of a socio-politically driven argument than anything. Other reading that may be worthwhile can be found at the Financial Times and from the OECD. The more reading from balanced sources you do, the more likely you will realize that The Economist article linked at the top hits the nail on the head.

So that is what the economist’s are saying but what are the markets saying?

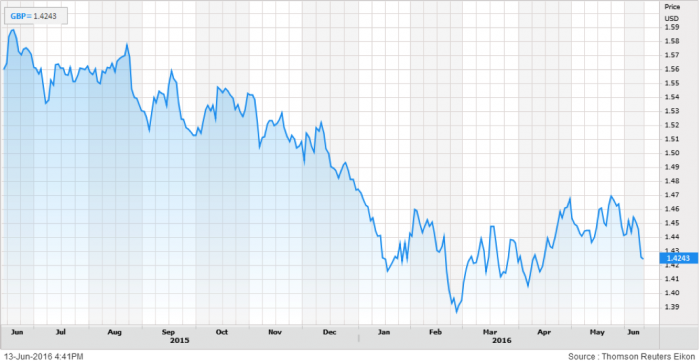

The Pound Sterling has declined 11.5% since the highs over the last year.

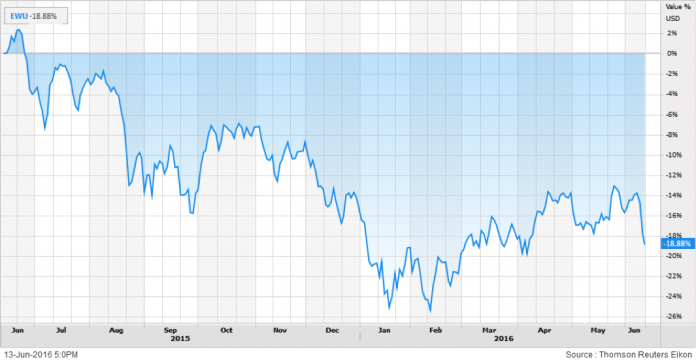

UK stocks, as represented by the iShares UK ETF ‘EWU’ are down 18.9% over the last year and down 4.4% year-to-date.

So investors seem to be showing how they feel about this debate with demand for assets falling in the UK but how does this impact North American and Canadian investors? The reality is that this probably has little impact on most Canadian investors. For right or wrong, Canadian investors are usually overexposed to their own country and rarely have a whole lot of exposure to the US, let alone to the UK specifically. So most investors are unlikely to have much exposure to the UK in the first place. Additionally, aside from companies that derive a great deal of their revenues from the UK and are sensitive to general economic growth in this area, the impact will likely be mitigated. Companies will continue to trade and buy and sell goods to and from the UK (everyone needs to eat still!). Companies will not be banned from operating in the UK all of a sudden and if anything, demand for non-EU goods and services may actually increase (regardless of whether that is good for the UK). The consensus is that GDP is expected to slow, so yes, there would look to be a negative short-term impact but from a Canadian perspective, where the majority of companies have well under 50% of revenues coming from the UK (if any), we would be reluctant to view this as an event to be too concerned about.

The above, however, is more of a fundamental consideration and this can be different from investor sentiment and psychology. We would fully expect increased volatility as the vote approaches and a lot of ‘headline risk’ as doom and gloom stories begin to surface. Couple this with the fact that markets seem to be looking for a good reason to have a sell-off and the Brexit could be a golden egg for this camp. Unfortunately, this is speculation and timing, and the statistics show time and again that it is a fool’s errand to try to time the markets. We would view increased volatility as an opportunity to add to a portfolio as the United Kingdom will still be around after any Brexit and will continue to produce and buy goods and services. The sky will not fall. There is even a chance that if the Brexit movement fails, European markets move higher on the news. These events are tough to watch though, as the UK and European economies as a whole have been struggling to find growth, and an event like this is probably something that none of the countries really need right now. For those that do have material exposure to the European economy, there may be a case for lightening up this allocation a little but we would be reluctant to sell out of this geography outright. Much of this impact has likely been priced in given the movement of the UK market over the last year. An investor only needs to look at a chart of a Russian or Brazilian ETF to see why selling when things seem worst could be a bad move. As we often say, we do not know when a given company or market will do well, so we would far prefer to hold a bit of all areas of the economy along with the best companies in them and receive the benefit when things do turn around. This is no different for European and UK markets, regardless of the result of any Brexit vote.

We have some updated thoughts on the Brexit result here.

Comments

Login to post a comment.

Some of the other observations are also knee jerk: true research into the issues dispensed with for political correct print expediency-pity.

GUY