As most equity investors know, we are last in line for a slice of operating profits and get whatever is left after the corporation pays its creditors, preferred shareholders and taxes. The totality of this claim is often referred to as common shareholder’s equity (assets – liabilities). Other similar terms include net asset value or book value of the corporation. Think of book value like this: if the common shareholders decide by majority to close corporate operations, they would be entitled to everything left over after settling creditor/preferred claims.

With book value representing a stockholder’s claim on the corporation, an investor would be correct in thinking the price of the stock should closely reflect book value per share (BVPS). However, BVPS only reflects an equity investor’s claim at any given time where as the stock price considers future growth prospects of the firm. A P/BVPS above 1.0 generally implies the market sees good growth prospects in front of the stock. With increasing earnings, the company will be able to buy more assets, or reduce liabilities, thus increasing the BVPS for equity holders.

A P/BVPS near or below 1.0 piques the interest of the value investor and is the focus of this 5i Filter. In theory, a P/BVPS of less than 1.0 means the stock price is trading for less than its liquidation value to common equity shareholders. The market may have incorrectly valued the stock’s growth prospects. If the company's business is not broken and its balance sheet does not send investors running for the hills, a P/BVPS less than 1.0 can be a good indicator of undervaluation. However, it could also mean something is fundamentally wrong at the company; the market may be forecasting a plunge in earnings power, asset write-downs, or the possibility of financial distress.

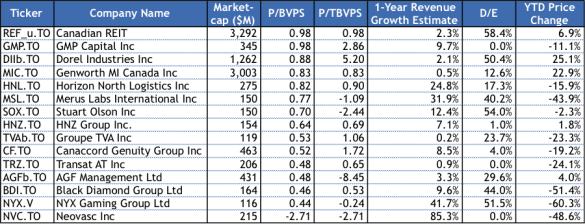

Below we show the results from our filter. We have highlighted stocks trading at a P/BVPS of less than 1.0 with a market-cap above $100 million. Of course, not all names meeting this criterion are investable, as just noted. To help avoid these land mines, we looked for a decent balance sheet with debt/equity less than 60.0% and a 1-year revenue growth estimate above 2.0%.

The astute investor will recognize that a better proxy for liquidation value is tangible book value. Many companies carry intangible assets (or liabilities) on the balance sheet; goodwill is a perfect example. Tangible book value excludes these line items. Intangible assets have value but not in the same way tangible assets do, as you cannot easily liquidate them. Tangible book value per share (TBVPS) is closer to the baseline value of the company but is less useful for technology companies. We have attached this valuation multiple to our results but did not use a TBVPS constraint. Negative TBVPS typically implies that the company’s value drivers are intangible (media rights, television program costs, R&D, patents). Less commonly, the company may have taken an impairment charge on its fixed assets due to failed assets.

It is interesting to see a concentration of financial names in the form of GMP, Canaccord, and Genworth on the list. Given the high level of liquid assets these companies typically hold, book value tends to be a good metric to consider when evaluating financial names. Those looking for a longer-term oil and gas play may be interested in Horizon North and Black Diamond Group. While there is likely still some time required for any material increase in energy company capital spending to arise, these names may be worth putting on a watch list for if/when that time comes.

As always, please remember that this should simply be viewed as an idea generator and not a commentary on the merit of any of the above stocks for investment. You can see our previous filter here. Also, don't forget to sign up to the blog below!

Comments

Login to post a comment.

Either way it would be interesting to see a filter featuring REITS where a lot of the relevant comparables are looked at.