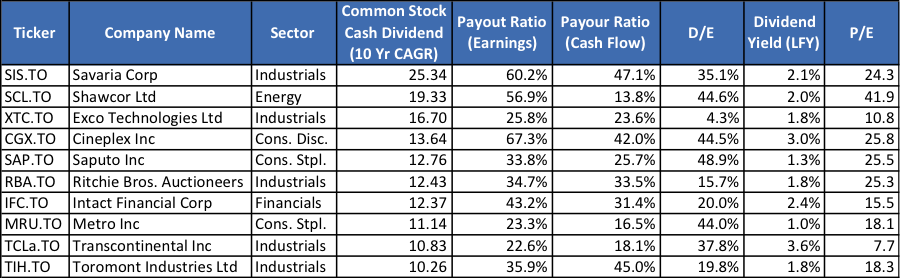

Dividends can be a great source of cash flows for investors. Whether in retirement and living off of dividends or growing a portfolio and reinvesting the cashflows in other investments, the compounding of returns from these tax advantaged funds can be powerful. What any single investor looks for in a dividend company may difer but we wanted to highlight some attributes we like to look for in dividend names. Highlighted below are companies that have aggressively grown dividends by a 10-yr annualized dividend growth rate > 10%. To evaluate dividend sustainability and the potential for continued growth, results were further filtered with a payout ratio < 75% and leverage < 50%.

The payout ratio may be the single most important statistic in evaluating a dividend's safety. Lower payout ratios are generally safer than higher payout ratios but an increased ratio of course brings a better yield. Instead of focusing on the most conservative payout ratio, look for a balanced number that represents a fair yield today but also leaves room for growth down the road. While each sector is different, a payout in the 50% - 70% range could be considered balanced. Many of our readers will be aware that we prefer to use cash flow rather than earnings when evaluating the payout, as dividends are actually paid from cash and not earnings.

Common stock shareholders collecting dividends sit on the bottom rung of a company's ladder of financial obligations. It is important to consider leverage as represented by a lower debt/equity (D/E) ratio. In times of stress, earnings and cash flow are of course put under pressure, most notably for highly leveraged companies. The dividend investor should make sure that the ‘VIP line’ of bond and preferred shareholders is not too long.

Some readers may be surprised that all results have a yield of 3% or less (except TCL.A). Quality companies that demonstrate the above characteristics often trade at a premium price, as is seen by the P/E. This has a habit of driving down the yield, as investors reward a consistent and high-growth dividend. Indeed, a growing dividend is where the true reward lies in our view compared to high yielders that often pay a dividend at the expense of future growth (reinvestment in the business) and have very little room for the dividend to weather any downturn in demand or economic activity.

We also note the absence of the telecommunication, utility and “Big Bank” stocks. This outcome reflects the required 10-yr dividend CAGR above 10%. While these stocks do have a good record of growing dividends, the filter threshold over a 10-year period is a high bar to clear for many companies, making this list an interesting one in our view.

Don't forget to subscribe to the blog below for more stock news and analysis!

Comments

Login to post a comment.

You are both correct on CNR dividend growth; however, CNR failed to meet the leverage requirement of a D/E ratio below 50%. Specifically, CNR has a D/E of 70%.

2006: $0.3250

2016: $1.50

http://www.cn.ca/en/investors/stock-information

CN announces 20 per cent increase in quarterly cash dividend

MONTREAL, Jan. 26, 2016 /CNW/ - CN (TSX: CNR) (NYSE: CNI) announced today that its Board of Directors has approved a 20 per cent increase in the Company's quarterly cash dividend. With this increase, CN's dividend on an annualized basis is C$1.50 per common share.

Luc Jobin, CN executive vice-president and chief financial officer, said: "We are pleased to uphold our track record of consistently returning cash to shareholders. This dividend increase is testimony to our confidence in the strong cash flow generation capacity of CN throughout business cycles, and reaffirms our objective of gradually increasing the dividend payout ratio toward 35 per cent."

A quarterly dividend of thirty-seven-and-one-half cents (C$0.375) per common share will be paid on March 31, 2016, to shareholders of record at the close of business on March 10, 2016.

Including today's announcement, CN has declared annual increases to its dividend 20 consecutive times, averaging 17 per cent per year, since its initial public offering of shares in 1995.