This article was originally published on the Globe and Mail which you can access here.

Access the full article by signing up for the free 5i trial here.

As part of the free trial, you'll also receive access to 3 model portfolios (balanced, dividend/income, and growth), over 70 easy-to-understand research reports, and access to over 57,000 answered investment questions.

Preview:

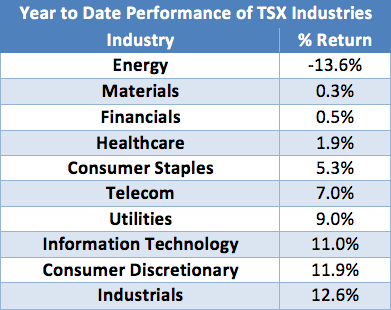

What if I told you that as of June 28, 2017, essentially half way through the calendar year, only one sector out of ten (including REITs with Financials) was negative?

What if I told you that out of those ten sectors, six of them had returned over 5% in the year-to-date period and three of those had returned in excess of 10% over the year-to-date period?

With the TSX flat to slightly negative over the same period, you would likely call shenanigans, but it’s true.

Only one sector is negative for the TSX in 2017 and due to its heavy weighting, it has been the main contributor to the lack of any returns on the TSX so far this year.

Source: Thomson Reuters Eikon

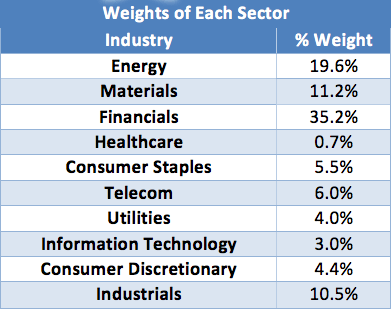

To be fair, the fact that the next two largest industries in Canada were flat for the first half of 2017 did not help either, but herein lay the problem. The TSX is a bad benchmark to use because it is too heavily weighted to a few sectors and makes it difficult for passive investors in Canada.

What’s more, being a ‘passive’ investor in the TSX could actually be an oxymoron, as an individual is really making an active tilt toward the financial and energy sectors. As can be seen in the table below, if an investor takes a passive approach to the TSX, they are putting 55% of their allocation in two sectors and 66% in three sectors.

Source: Thomson Reuters Eikon

What is perhaps more interesting is that if an investor had taken an equal weight approach, a strategy one could argue is even more passive than owning a benchmark that weights against company size, the equal weight portfolio would actually return 4.6% over the YTD period.

This is a return that is competitive on an annual basis any given year. We don’t mean to criticize passive investing, in fact, we think passive investing along with exchange traded funds are some of the best movements and innovations to develop in the finance industry in quite some time. We do, however, believe that there is a difference in being passive with ones investment style and passive with ones risk management.

An investor can be passive with their style in that they set an allocation that achieves long-term goals, does not trade often, seeks low cost solutions, and simply lets the markets do what they do.

That does not, however, mean that an individual should be passive with managing risks. This includes putting 55% of ones Canadian allocation (which is more than likely the largest part of ones portfolio for better or worse*) into two sectors just because an arbitrary benchmark does so. You could probably ask just about any financial professional about holding 55% of ones portfolio in two sectors and the uniform response would be that it is a high-risk strategy akin to speculating or trying to time the market, in other words, ‘active’ strategies.