New Report

We have posted a new report on the Canadian lifestyle apparel company, Aritzia (ATZ). The company has been growing its popularity among younger generations and has been able to quickly adapt its business model during the pandemic. It is entering a new frontier in its operations and we feel that management has had a good track record. A strong brand name with solid fundamentals - we think there is a lot to like here.

Read the latest updates by logging in here!

Report Updates

We have posted report updates on AIF and STN. Both company's ratings were maintained. One company has seen good growth in the US and the other is executing well on its strategy to migrate its customer base to the cloud. Margin expansions, revenue growth, and recent acquisitions encompass the main themes for these two companies. We believe these companies will continue to perform well as the global economy reopens and economic conditions act as tailwinds for business operations.

Read the latest updates by logging in here!

Market Update

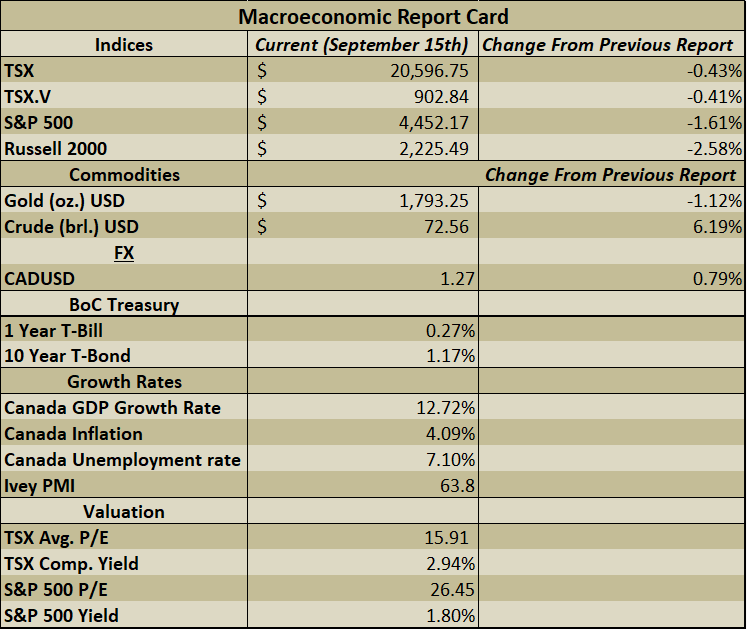

Markets have begun to slightly rollover over the past couple of weeks as the delta variant continues to weigh on the economy and concerns around inflation and tapering lingered. A recent US inflation print showed a CPI reading of 5.3% from a year ago and a 0.3% month-over-month increase. These are contrasted against expectations of a 5.4% year-over-year increase and a 0.4% increase on the month. This news has eased some concerns for investors as it appears that the rate of change for inflation has begun to subside and this brings some hope as inflation inches closer to the target rate. Consumers appear to have increased their spending, as US retail sales rose 0.7% in August against expectations of a (0.8%) decline. Commodities, in general, have continued to do well, and many investors have been hearing news of soaring uranium prices. We dive into the background and potential reasons for increasing uranium prices and uranium stocks below.

Background on the Use Case For Uranium

2021 has certainly marked an excellent year for commodities and the most recent example of this is the ongoing price evolution in the uranium markets. The primary use case for uranium is to power nuclear facilities that generate electricity around the globe. Contrary to what many may think, nuclear power is one of the most effective methods of producing clean and green energy around the world. We do not often hear of the renewable energy benefits that nuclear power has to offer, but it is the world’s second-largest source of clean energy besides hydropower. A rudimentary example of how nuclear power generates clean energy is that uranium is used by undergoing a process called fission, which is the process of splitting uranium’s atoms which then generates heat. This heat is used to spin a turbine and create electricity. The mineral, uranium, is found in seawater and is continuously renewed through geological processes, and so as uranium is extracted out of the earth, the earth is renewing the supply of uranium – in this sense, it is considered renewable.

Thesis for Nuclear Energy and Demand for Uranium

The history of nuclear energy has been fraught with anxiety over radiation exposure, nuclear power plant incidents and spills, and any byproducts that these have on the surrounding environment. Although, as the world continues to see an increased demand for achieving net-zero carbon emissions, nuclear energy is becoming an increasingly popular and viable option. This thesis is the fundamental backdrop for increased optimism and buying pressure in the uranium markets. Below we can see the past one-year performance of the spot uranium market, with a recent significant jump in price.

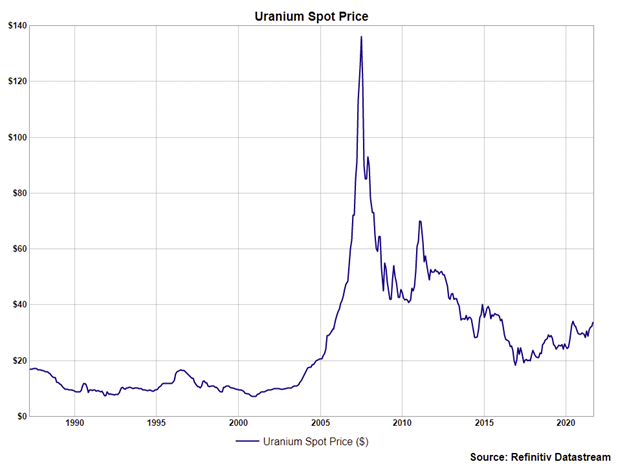

For reference, the spot price of uranium since the late 1980s is below. The ‘uranium bubble of 2007’ was fueled partly by speculation, partly due to constrained supply, and due to increasing prices across all asset classes leading up to 2008.

Reasons for the Recent Price Increase

The current economic environment that is causing the most recent wave of increasing uranium prices and uranium stock prices can partially be attributed to the underlying demand for uranium as nuclear plants are being built and more are underway. The other reason is due to a constraint in the supply of uranium. In July, a fund manager created a physically-backed uranium trust fund which has so far amassed over 24 million pounds of physical uranium out of the market. This large reduction in the supply of uranium available for purchase is known as a ‘demand shock’ and can create upward pressure in the price of uranium as the available supply becomes more scarce. The theory is that as more nuclear plants are established and the push for cleaner global energy increases, the demand for uranium grows, and the fund manager is attempting to get ahead of this. Some examples of uranium ETFs or companies are:

- North Shore ETF (URNM)

- Global X Uranium ETF (URA)

- Cameco Corp. (CCO)

- NexGen Energy (NXE)

- Denison Mines (DML)

Below we can see the effect that increased demand has had on these stocks and ETFs, and the compounding interest from investors.

Where Do We Go from Here?

With uranium stocks and ETFs hitting record highs, it does warrant some reason for caution, but on a longer timeframe, the increasing need to attain global net-zero carbon emissions coupled with nuclear energy’s high capability of producing clean energy does present an interesting case for uranium. We think that in the short term there will be volatility, and supply shocks can only last so long until the market becomes too one-sided. When we see big moves in a market such as this, we always find it worth further investigation. Caution is warranted with such a large move over the last year, and end markets will have their limits somewhere in terms of what they can pay for input costs like this. If we were to take away one key piece of wisdom from this, it is that keeping an eye on alternative solutions for green energy can be a constructive way to get ahead of the crowd, and sleeping giants can only be in slumber for so long, until they are finally awoken.

Disclosure: Please note that the author does not hold a financial or other interest in stocks or funds mentioned at the time of publishing.

Best wishes for your investing!

www.5iresearch.ca