Flash Report Updates

We have posted a flash report on nine of our coverage companies with updates on their recent financial results in the second quarter of 2021, a reassessment of their valuations, and our overall view on their investment merit. One company received an upgrade and one a downgrade. Overall, results looked solid coming out of Q2 2021 with most companies beating estimates and showing signs of recovery from the pandemic.

Read the latest updates by logging in here!

Market Update

Markets notched new highs after experiencing some volatility over the past couple of weeks, with the Volatility Index (VIX) making large moves up and down. Recent U.S. jobless claims data came out at 340,000 against estimates of 345,000. Results for U.S. GDP displayed an annualized growth of 6.6% slightly above estimates of 6.5%. Canadian markets have been experiencing a bit of volatility as well and Canadian businesses are anticipating raising their prices due to increased inflation expectations. The Federal Reserve Chair, Jerome Powell, noted on Friday at Jackson Hole that the central bank will most likely begin the tapering process before the end of this year. Mr. Powell noted that the central bank continues to believe that inflation is transitory and will eventually decrease to the 2% target. In this market update, we take a look at how financial markets have reacted to tapering in the past and what it could mean for markets going forward.

What Does 'Tapering' Mean and Is This The Right Time?

Following the events of 2008 and the COVID-19 pandemic, central banks began to inject liquidity into the financial system. After the onset of the pandemic, the Central Bank of Canada announced that it would begin to buy $4 billion in government bonds per week (roughly $16 billion a month) to provide financial institutions with liquidity, and the U.S. Federal Reserve announced that it would begin purchasing $120 billion in government bonds per month. Measures such as these are usually enacted after a recession or large economic crash to support the financial system and eventually, those support systems need to be reversed.

Tapering is the process of a central bank gradually reducing its monthly purchase of government bonds until eventually they are no longer purchasing these assets. The typical process for unwinding economic stimulus is to begin with tapering until monthly government bond purchases reach zero, and then begin raising interest rates. The glaring signal for the Federal Reserve to begin tapering its bond-buying program is what is called ‘Reverse Repos’ which are essentially U.S. financial institutions giving back excess liquidity to the Federal Reserve, indicating a glut of cash in the system. A chart showing the rapid increase in Reverse Repos over the past several months is below.

Relationship Between Bond Prices and Yields

Bond prices and yields have an inverse relationship and so as bond prices fall, yields rise, and vice versa. The Central Bank of Canada began its bond-buying tapering in April by reducing its weekly purchases from $4 billion down to $3 billion, and then further down to $2 billion in July. The Federal Reserve is expected to reduce its bond-buying down from $120 billion per month down to $110 billion per month sometime later this year. This slowdown in government bond purchases would put downward pressure on bond prices, and thus cause bond yields to increase.

Impact of Tapering on the Stock Markets

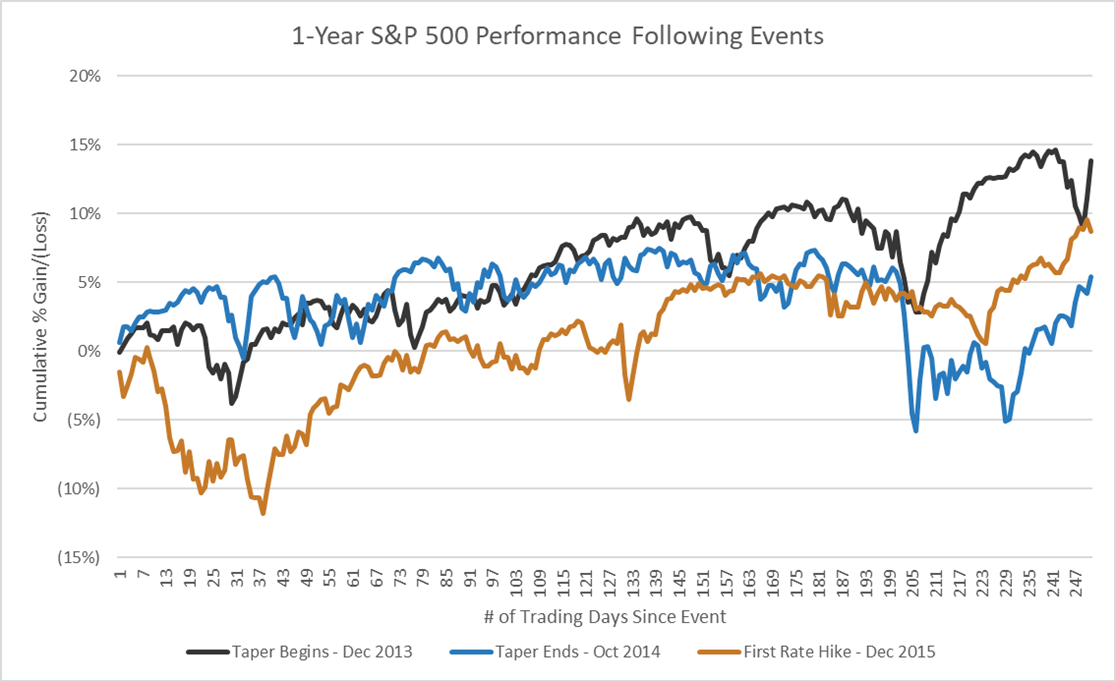

It’s clear that the central banks are beginning to assess the process of tapering (which is already underway in Canada), and this is ultimately a positive indicator, as it means that the central banks do not believe the economy needs to be supported anymore and is progressing well towards a full recovery. For a historical view on how the S&P 500 performed following the unwinding of stimulus after 2008, we have analyzed both a 1-year and 3-year cumulative return. For context, the Federal Reserve began tapering in December 2013, ended tapering in October 2014, and increased interest rates in December 2015.

Key Takeaways

Although the markets may initially react negatively or endure some volatility because of any potential announcements of tapering, it is ultimately a long-term positive signal, and it indicates that the economy is heading in the right direction. The economy is much stronger now from a GDP and unemployment point of view than when the Fed began tapering back in 2013. If there is to be news of the Federal Reserve officially beginning to taper, and if this news causes volatility or panic selling, we believe these would represent good buying opportunities. From what we know from history (albeit with limited data points), this is ultimately a positive for the financial systems and the markets have trended up on one-year and three-year timeframes. The market is anticipating interest rates to increase in the future, and bond-buying tapering is the first step in beginning this process. We believe most future interest rate increases are embedded in the current market valuations and any future interest rate hikes are beneficial to the economy.