ETF Strategy:

Hamilton Canadian Financials Yield Maximizer ETF (HMAX): HMAX is designed to provide high monthly income from Canada’s 10 largest financial services companies. The ETF uses an active covered call strategy to enhance monthly distribution income and reduce volatility. HMAX generates higher monthly income by writing at-the-money covered call options. Approximately 70% of the fund is weighted toward the ‘Big 5 banks’ (RBC, TD, CIBC, BNS, BMO). HMAX’s strategy seeks to benefit from income while also allowing for capital appreciation and protection against downside risk by only writing calls on 30-50% of holdings.

Hamilton Enhanced U.S. Covered Call ETF (HYLD): HYLD is designed for long-term investors seeking to meet monthly income needs. The fund aims to provide attractive monthly income and long-term capital appreciation from a diversified portfolio of primarily US holdings. HYLD’s holdings are strictly other Hamilton ETF products. This can be characterized as a ‘Fund of Funds’ since its holdings are all other ETFs. HYLD is available in two options being CAD-hedged (HYLD) or USD-unhedged (HYLD.U) to help investors meet their income needs in either currency. HYLD’s top five holdings are SMAX (64.7%), QMAX (27.4%), LMAX (12.3%), FMAX (8.1%), and AMAX (5.5%). HYLD uses 25% cash leverage to boost yield and growth potential.

Performance

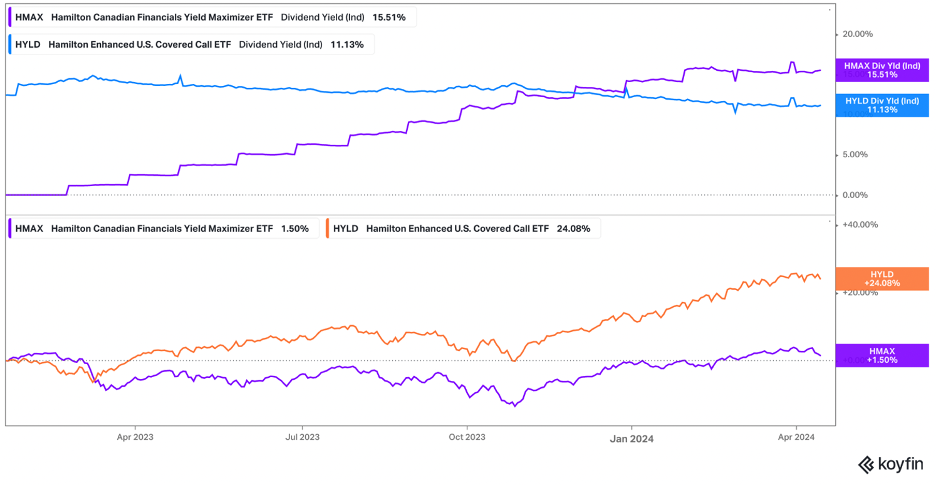

While both funds are relatively new, HMAX is particularly a newer listing with inception in January 2023. Analyzing the return and yield of both funds displays significant outperformance from HYLD. HMAX’s focus on Canadian financials are likely the main reason for the marginal gain over this time period. The big five banks have all been down year-to-date, and HMAX has actually taken a price decline over this period, with the covered calls propping up return. HYLD on the other hand has seen a nice gain and the strategy of income with potential for capital appreciation has proved beneficial.

Distribution History

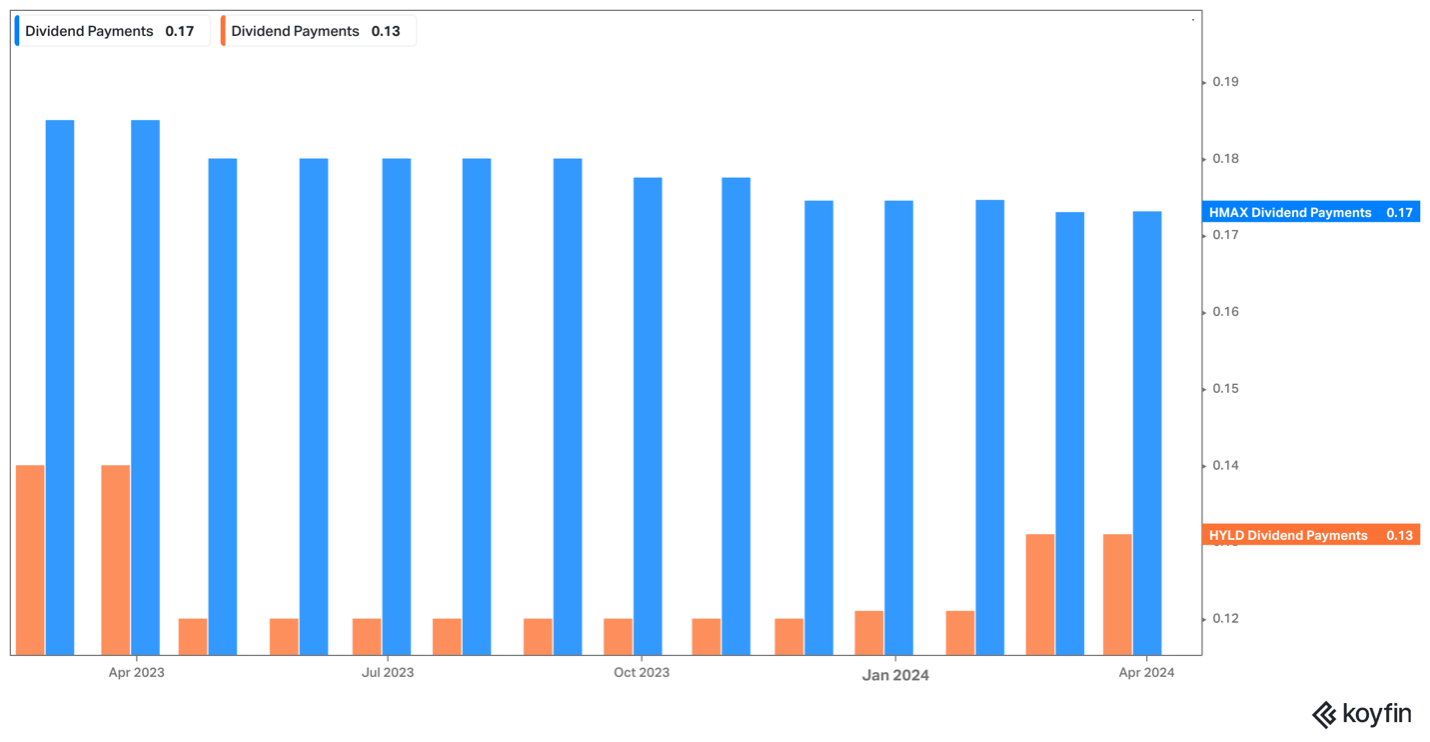

Looking at how actual distribution payments have performed can also be useful. We can see that HYLD has been nicely increasing payments over the last few months. HMAX has seen a slight decline in payments, but the aggregate payment is more than HYLD. So, while there has been some price decline propping up HMAX’s yield, it does pay higher distributions relative to HYLD.

Important Metrics

The above chart displays a few key metrics for both ETFs. HMAX is evidently the larger fund with the higher yield as explained previously. Two metrics we did want to importantly touch on for HYLD were the fee and percent of calls written. Since HYLD is a fund of funds, there is an embedded expense ratio in its holdings. So, while the fund is advertised as having a ‘0.00% expense ratio’ this is more of a marketing and regulatory feature as they are not allowed to charge an additional fee for investing in other Hamilton products. A fee is still charged on the underlying ETF holdings of HYLD. Also, on the percentage of calls written, this is per the individual holdings. For example, HYLD holds numerous Hamilton ‘Yield Maximizer’ ETFs that write calls on 30% of the portfolio while it also holds HBND which writes calls on 50% of its portfolio.

Investment Decision:

Both Hamilton products are good options for investors seeking income with the potential for growth as well. They are similar products where the main difference is sector exposure, with HYLD being more diversified, focussing on US companies, and HMAX having a focus on Canadian financials. For risk averse investors we would side with HMAX due to the focus on one of Canada’s most stable sectors and also not using leverage. HYLD is a good option for investors who are comfortable with taking on more risk and wanting US exposure.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Take Care,

Employees, directors, officers, related companies, the i2i Fund and/or partners of 5i Research do not have a financial or other interest in HMAX and HYLD at the time of publishing.

Comments

Login to post a comment.