When searching for growth stocks, it is often useful to go back to basics and look for companies that are showing high rates of growth in revenue. Positive sales growth can indicate that a company is implementing its growth strategy effectively, gaining market share, access to new markets, acquiring companies or just selling more of their goods and services. More specifically, high revenue growth numbers can mean significant positive changes to the company that will allow them to reach new levels of expansion.

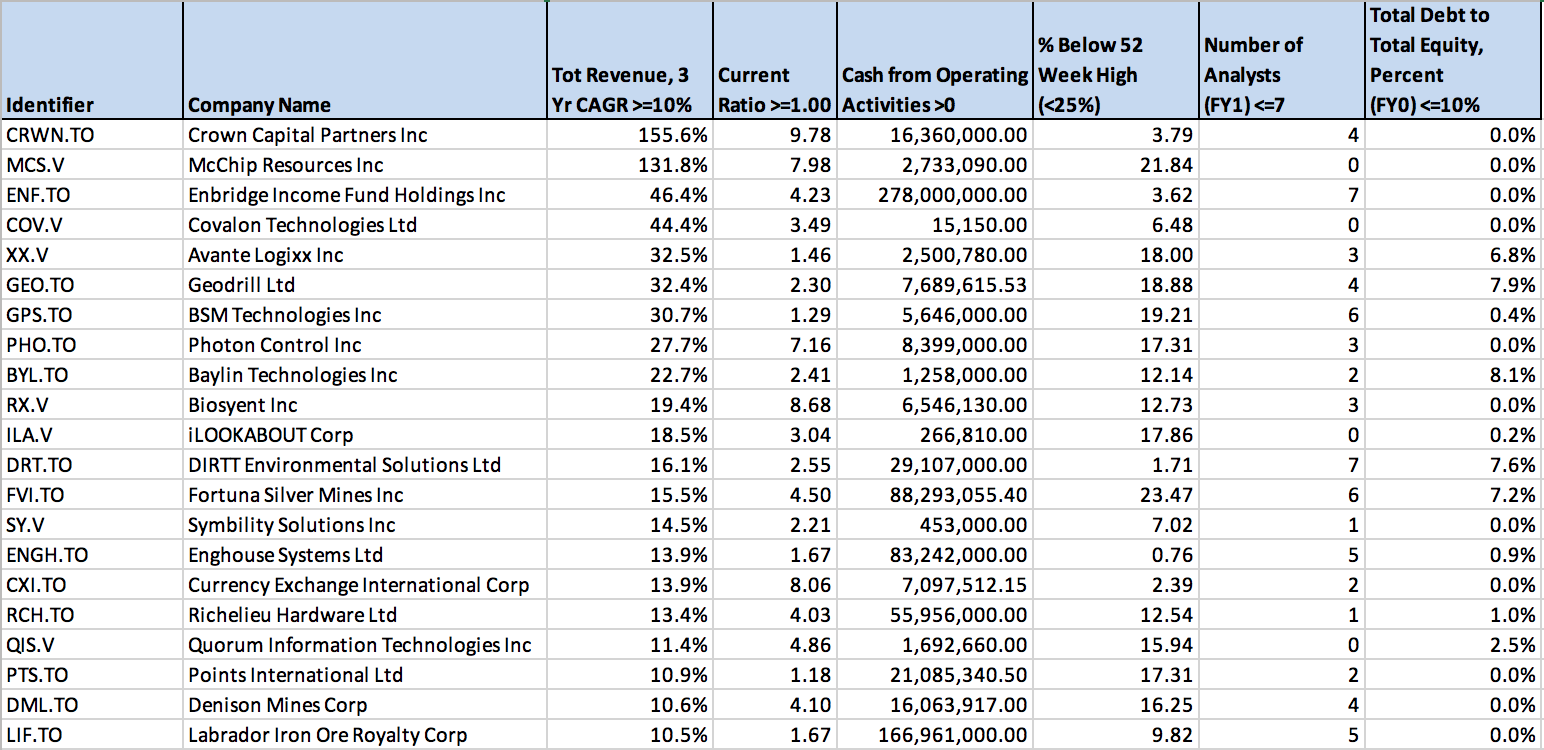

In this edition of the 5i Research stock screener, we have focused on searching for companies with a compounded annual growth rate (CAGR) of at least 10% in the last three years. We have also put in place a few secondary conditions to make sure we are pulling up quality companies. Companies must have a current ratio of at least one, positive operating cash flows, a stock price within 25% of the most recent high, a debt-to-equity ratio of less than or equal to 10% and finally, seven or fewer analysts covering the stock.

Although many companies on this list are showing far above 10% CAGR, using a three-year average means the company has been achieving consistent growth over time showing a trend may be setting in. We use the current ratio as an indicator for balance sheet health as it measures the ability to meet short-term debts. We placed a strict requirement for debt to equity at 10% or less to screen for companies that are stable and mature. This requirement also helps reduce the risks associated with highly leveraged companies. Looking at companies with fewer analysts intends to unearth names that may see less price discovery and in turn could be undervalued or overlooked.

It is important to remember that these stock screens are intended to be idea generators and not any opinion on the stocks themselves. Many of these companies listed above fall into the 5i Research coverage universe. You can use a free trial to learn more or ask questions about the stocks on this list.

Comments

Login to post a comment.

Try lighter highlight colour for column titles.