Market Update - A Look At Renewable Energy

With the US election coming up and the markets seeing some volatility over the last couple of weeks, investors are seeking new opportunities for their portfolios that reflect the direction our world is headed. One theme of particular interest lately has been green energy, especially due to the $2.2 trillion plan for renewable energy Biden wins in the US elections. Investors have taken a particular interest in solar and wind turbine companies as they are the main target for incentives and subsidies with the proposed plan.

What If Trump Wins?

Investors should not forget about the possibility that a Trump win is very possible and with pure play green energy stocks already seeing a run-up in anticipation of a Biden win, a Trump win could result in a solar and wind sell-off in the short-term. Of course, if you believe in long-term investing as we do, whether Trump or Biden wins does not change the general direction renewable energy is heading. A large part of investing is identifying areas of future growth and investing in the right sectors. Even if a $2 trillion plan towards renewable energy does not go through, $2 trillion is a large number to see in a proposal and hints at the importance it will likely have in the future.

Long-term trends

It is quite well-known at this point that oil demand is running out of fuel (pun intended) and many studies are predicting that global demand will peak over the next few years. The oil crash we saw in March due to the pandemic has not only caused oil stocks to perform poorly in the short-term, but has likely accelerated the transition from fossil fuels to renewable energy. This is partly due to the high costs of capital of drilling and extracting oil and of course, the environmental concerns remain. Besides, oil as a commodity has already been a poor performer even prior to the pandemic (-7% annually over ten years) and oil companies have not been much different for the most part.

Big Money Shifting Away From Oil

Asset managers have begun to see the drag on performance oil companies have had on portfolios. Blackrock, with its trillions in assets under management, has committed to moving away from fossil fuels. Canadian investors in particular should pay close attention to the transition from oil to green energy as a large portion of our economy (and the TSX) has relied on oil.

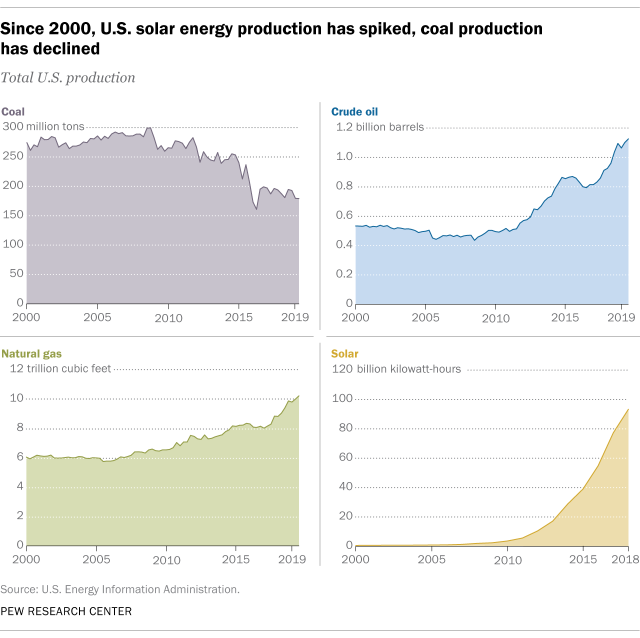

In contrast to fossil fuels, renewable energy demand and production are growing fast:

Comparing crude oil to solar since 2000, crude oil has more than doubled, but solar production is up almost 100 times.

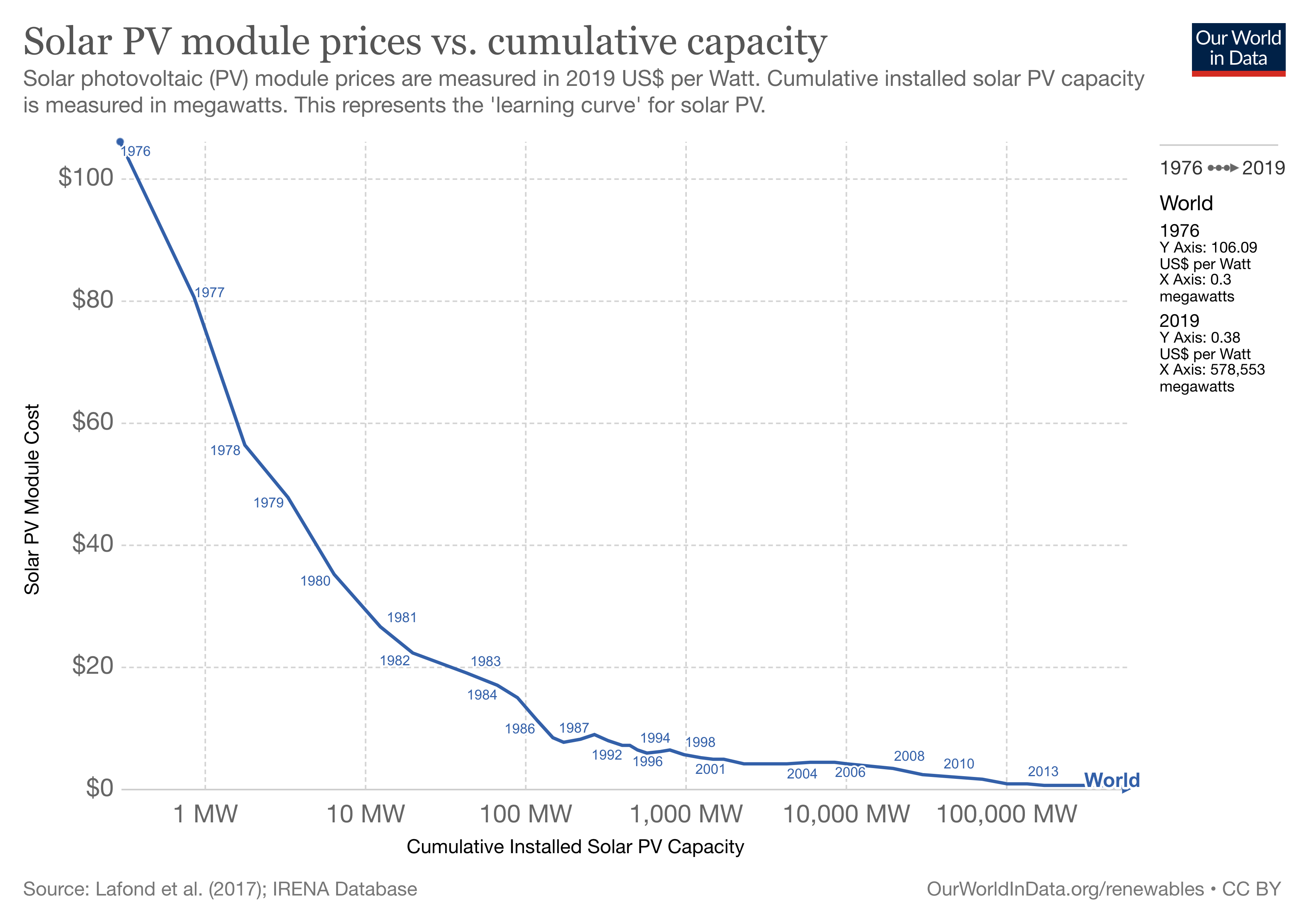

Lowered costs of capital

Taking solar as an example, the average cost of solar power has declined by 26% in the last year alone. The chart below shows the significant decline in solar panel costs over the years. Scale efficiencies from more production due to higher consumption and technological innovation has also significantly lowered the costs of capital. Lower costs and more demand means more profits and more energy companies shifting towards cleaner energy production.

Government incentives and subsidies are also likely to contribute to lower costs of capital in getting this industry on its feet. Canada is actually more encouraging on the incentives side which has resulted in 28% of our primary energy coming from renewables. The US is at about 9%.

Are There Alternatives To Oil Dividend Stocks?

While it is still too early to know how future green energy companies will allocate profits (i.e. growth or dividends), given what we know about the cash flow of electric utilities, we would imagine future renewable energy companies will arrive at a similar cash flow model. However, leading up to the point of dividend payouts being the norm with renewable energy companies may take decades and like any growing industry, we would imagine there will be plenty of stocks that will exhibit growth characteristics. Companies that manufacture and develop equipment for renewables (eg., parts for solar panels) are likely to benefit from the growth in the space.

That said, investors can still benefit from existing players in the renewable energy space like Northland Power (NPI), Algonquin Power & Utilities (AQN) and Brookfield Renewable (BEPC) that have stable cash flows through their electric utilities businesses. These are likely to continue to benefit from the growth in the renewable space as well. Ironically, we would also not rule out larger oil companies that have begun to make the shift to renewable energy. Though most of the large oil companies making an active transition to renewable energy are European majors like BP, Total and Royal Dutch Shell, this is a good signal for where things are headed.

In our view, renewable energy is no longer a 'fringe' industry as it used to be perceived and think an investor would be justified in having renewable energy making up a large portion of ones 'energy sector’ allocation. If we think of energy as the ‘blood supply’ that keeps our economy moving, it is not difficult to conclude that particular forms of renewable energy like solar and wind are worth considering in a long-term portfolio. The ‘green movement’ we think is certainly here to stay, but it will be a decades-long process. As with any industry that gets a lot of attention, investors should be careful of unjustified high valuations and if one is willing to pay for a premium valuation, one should expect higher short-term volatility.

Thinking about becoming a 5i Research Member?

There is no better time to join but don't just take our word for it. Try it for free for the next month and experience all the benefits of the 5i Research membership. (And don't worry. We won't ask for your credit card upfront)