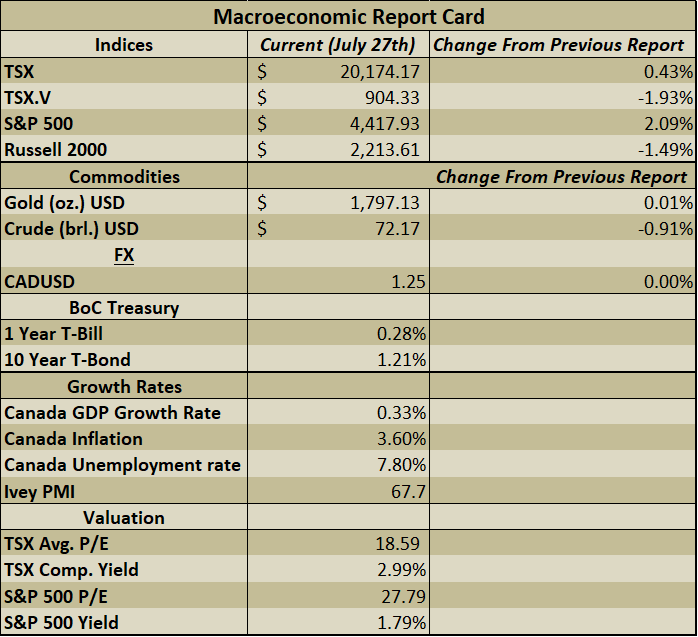

Report Updates

We have posted a report update on BEP.UN and have maintained its rating. Renewable energy companies witnessed a rapid expansion in valuation multiples over the past year as investor interest grew. The company's growth prospects and industry tailwind should continue to support the current valuations, and we think there is a lot to like here.

Read the latest updates by logging in here!

Market Update

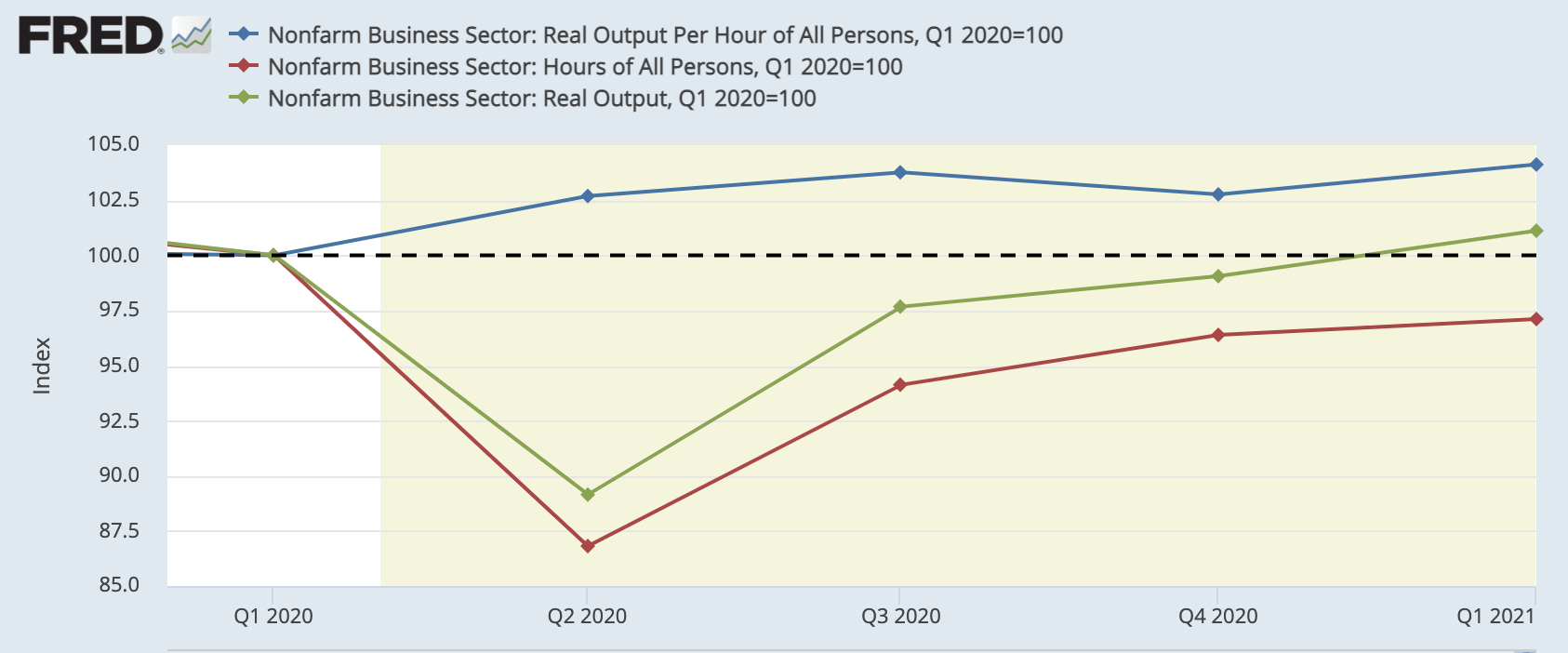

While markets have been seeing some sell-off pressure lately due to a renewed COVID scare, the underlying economic progress has been encouraging. Nonetheless, markets are re-evaluating the global economic growth thesis and most broad markets continue to be near all-time highs, so a bit of weakness is not unwarranted in our view. The main difference between today and a year ago, of course, is that we now have vaccines that appear to be working. Employment numbers have also improved and the economic output has shown healthy signs of recovery throughout the pandemic. Let’s take a look at how things have progressed through the lens of output, labour hours and productivity.

Q1 2020 (just before the pandemic effects kicked in)

The chart above reflects figures in the US. The blue line represents productivity (output per hour worked), the green represents real economic output and the red line represents the number of hours worked, all indexed to a base of 100.

The very first thing that stands out is that real output per hour worked in the US has actually increased during the pandemic. In other words, productivity has actually improved during the pandemic even though real output on an absolute basis has declined heavily.

Historically this has not been the norm as real output typically falls more than labor hours worked in a recession. This was the case for eight out of the last 11 recessions in the US.

There are many possible explanations for the initial spike in productivity in Q2 of 2020. For example, one is that employees that were laid off in Q2 may have done some work in previous quarters that was delivered in Q2.

However, what is truly impressive here is that productivity has remained above Q1 2020 levels throughout the pandemic. This could indicate that corporations as a whole adapted quite well during the pandemic and found ways to use resources (employees, capital, technology etc) more efficiently. Perhaps what is even more impressive is that real output (green line) has now crossed over pre-pandemic levels, while the total number of hours worked still remains below.

It is also worth noting that the number of hours worked (red line) has also seemed to follow suit with total real output (green line), but at a slightly slower pace. What will be interesting to see is whether productivity growth will decline as more people get back to work.

Turning to Canada (see chart below), in the first quarter of COVID, we see the same unique ‘COVID-effect’ of total productivity rising due to a sharper decline in the number of hours worked than total output. However, fast-forward to the present, productivity rates seem to reflect the ‘norm’ whereby overall output has generally shown a stronger correlation to the number of hours worked. Overall, productivity in Canada has actually fallen compared to the first quarter of 2020.

Source: Statistics Canada. Table 36-10-0206-01 Indexes of business sector labour productivity, unit labour cost and related measures, seasonally adjusted

Reflecting on this, the difference in labor productivity compared to the US could be due to Canada’s dominant sectors being more labor-intensive (energy, mining, manufacturing etc) and therefore more reliant on labor. Other reasons could also point to more intense business competition in the US and a stronger technology sector that may have enabled US companies to ‘replace’ workers with technology more efficiently.

Overall, while there are differences between Canada and the US in productivity throughout the pandemic, we think the main takeaway here is that overall, economic output and employment numbers are both improving, which is a good sign as we come out of this pandemic. Another interesting point to watch out for is whether some of the COVID-induced productivity efficiencies first realized in the US will flow over into certain Canadian sectors. In light of recent market sell-offs, we think this at least provides some comfort for long-term investors that, under the hood of the economy, things are headed in the right direction.

Model Portfolio Changes

Growth Model Portfolio

Add 0.5% to Dollarama (DOL) Position

Trade Rationale - As a historically strong cyclical name, we believe Dollarama will benefit from the broader economic re-openings. Earnings are expected to show good growth over the next few years and the valuation is within the historical average range. This name is attractive given the re-opening tailwinds, and at 3.8% of the portfolio, we would be comfortable with more exposure to this steady growth name.

Best wishes for your investing!

www.5iresearch.ca

Comments

Login to post a comment.