One of the common problems that young and old savers face is the issue of delaying gratification today for a reward sometime in the future. While it is difficult to see what sort of long-term impact foregoing a vacation or new toy may have, it is even tougher to understand the impact that small, seemingly inconsequential costs can have over time. So for those who think that daily dose of Timmy’s is harmless, lets look at the impact these types of purchases can actually have.

By the numbers:

Coffee – To be fair, if you are a coffee drinker, you probably cannot forego your morning coffee. So we decided to look at the difference between a Medium Tim Hortons coffee and a single serve K-Cup. With a Tim Hortons coffee at $1.70 and a coffee pod at $0.8325, the difference between the two adds up to $225 for five days a week over 52 weeks and $2,255 over ten years.

Lottery – At $3 for a single ticket, once a week, this cost adds up to $156 a year and $1,560 over ten years.

Lunches out – Here we are assuming an individual goes out twice a week and spends an average of $8 for lunch. Over a year this adds up to $832 and $8,320 over ten years.

Bottled water – Here we are assuming an individual/family will drink a 24 pack of bottled water a week at $2.97 for a pack. Over a year this amounts to $154 and $1,544 over ten years. As a side note, we couldn’t believe how low the price of bottled water has gotten over the years! It is hard to believe that there is money being made here after transportation and material costs.

Mutual fund fees – Canada is known for having some of the highest cost mutual funds in the world. So what if an investor were able to shave just 1% off of their funds’ cost. Certainly some funds charging 2.5% have reasonable competitors at the 1.5% ranges as well (not to mention lower cost ETFs). As a base portfolio amount, we have assumed an investor with a $100,000 portfolio can shift into funds that lower the total fee by 1%. Over a year, this is $1,000 in savings and $10,000 over ten years.

The damage:

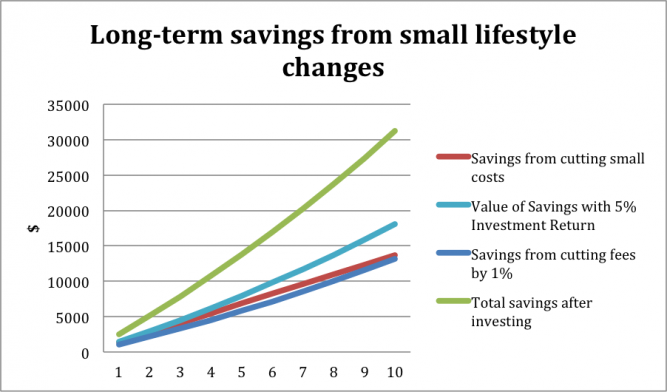

On ‘lifestyle costs’ (coffee, lunch, lottery, water) alone, an individual can save a total of $1,368 a year or $13,680 over ten years. If we add in mutual fund fees, these numbers jump to $2,368 and $23,680, respectively. However, this is only half of the story. What is even more important is what is done with those savings. The chart below outlines what an individual could save if they cut their lifestyle costs as outlined above and invested those savings. We have assumed a 5% rate of return over ten years.

The red line represents the cumulative savings if an individual were to just cut the lifestyle costs (not including fund fees) and put those savings under the mattress. The light blue line represents the amounts an individual would have if they decided to invest those savings. The dark blue line represents the invested savings from decreasing fund fees and finally, the green line represents the savings from investing the amounts garnered from lower lifestyle costs and lower fund fees. Over ten years, here is what they add up to:

Cost savings = $13,680

Cost savings invested at 5% = $18,067

Fund fee savings invested at 5% = $13,207

Total savings = $31,274

A point worth noting is that if we assumed this analysis applied to the average working individual, these savings and returns could actually compound over thirty years. This would add up to well over $90,000. That’s a big number when thinking about retirement, especially for those that may be concerned about their retirement prospects.

The big takeaway:

If you are looking for ways to cut costs, one of the best places to start is likely the area of investment fees. Looking at this analysis, fees on a relatively modest investment portfolio amount to nearly the same amount as all of the lifestyle changes combined. This becomes even more attractive when you realize you only have to cut these investment fees once and it has zero impact on your lifestyle. Whether you pay 2.5%, 1.5% or 0.5% on your fund does not matter. What matters is that it is generating returns and providing the proper risk exposures. An individual does not get more joy by paying 2.5% in fees compared to 1.5% or the joy they may get when drinking their morning coffee. If an investor can cut fees, they almost certainly will not be missed and future you will likely be rewarding yourself with some well deserved vacationing in retirement.

In most cases, we work so we can make money that we can spend on things, discretionary or not. This analysis is not trying to say that we should all be cutting out our daily coffee or those other vices that help get us through the day. If you are craving that coffee, go for it, you earned it! The point of it is to demonstrate that these things do add up and while coffee or lottery tickets may not be the things to cut out, we all have those small, unnecessary costs that add up and can be cut from our daily lives. Hopefully this illustrates that even those costs that seem small today can have a big impact for a diligent saver and investor ten, twenty or thirty years down the road.

Comments

Login to post a comment.

Thanks for the waker upper!

But point taken - after I ordered lunch and a coffee for $13.